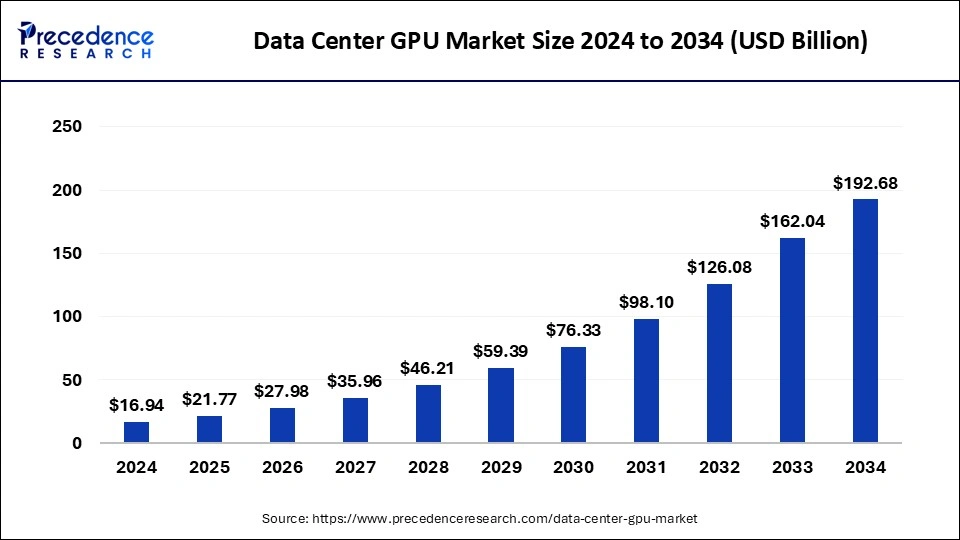

The global data center GPU market size was valued at USD 13.18 billion in 2023 and is predicted to reach around USD 162.04 billion by 2033, expanding at a CAGR of 28.52% from 2024 to 2033.

Key Points

- The North America data center GPU market size reached USD 5.01 billion in 2023 and is predicted to attain around USD 62.39 billion by 2033, at a CAGR of 28.68% from 2024 to 2033.

- North America dominated the market with the largest revenue share of 38% in 2023.

- Asia Pacific is expected to witness the fastest growth in the market over the forecast period.

- By deployment model, the on-premises segment has held a major revenue share of 59% in 2023.

- By deployment type, the cloud segment is projected to grow at the fastest rate in the market over the forecast period.

- By function, the training segment has contributed more than 66% of revenue share in 2023.

- By function, the inference segment is projected to gain a significant share of the market in the upcoming years.

The Data Center GPU market has witnessed substantial growth in recent years, driven by increasing demand for efficient data processing and parallel computing capabilities in data centers. GPUs (Graphics Processing Units) have evolved beyond their traditional role in graphics rendering to become indispensable for tasks such as AI (Artificial Intelligence) training, machine learning, and complex data analytics. This evolution has positioned GPUs as critical components in modern data centers, enabling faster computations and handling large datasets with greater efficiency.

Get a Sample: https://www.precedenceresearch.com/sample/4497

Growth Factors:

Several factors contribute to the growth of the Data Center GPU market. These include the rising adoption of AI and machine learning technologies across various industries, which require powerful GPU capabilities for training and inference tasks. Additionally, the proliferation of big data applications and the need for real-time analytics drive the demand for GPUs in data centers. Moreover, advancements in GPU technology, including higher computational power, improved energy efficiency, and specialized architectures tailored for specific workloads, further fuel market expansion.

Region Insights:

The market for Data Center GPUs exhibits strong regional dynamics. North America leads in market share, driven by the presence of major technology firms, robust infrastructure development, and early adoption of advanced computing technologies. Asia-Pacific is also a significant region, experiencing rapid growth due to increasing investments in data center infrastructure, particularly in countries like China and India. Europe follows closely, propelled by initiatives in AI research, digital transformation efforts across industries, and stringent data privacy regulations influencing data center investments.

Data Center GPU Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 162.04 Billion |

| Market Size in 2023 | USD 13.18 Billion |

| Market Size in 2024 | USD 16.94 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 28.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Deployment Model, Function, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Center GPU Market Dynamics

Drivers:

Key drivers shaping the Data Center GPU market include the growing demand for high-performance computing (HPC) applications, including scientific research, weather forecasting, and computational fluid dynamics. The expanding use of GPUs in virtualization and cloud computing environments also accelerates market growth. Furthermore, the shift towards edge computing and the Internet of Things (IoT) necessitates robust data processing capabilities, augmenting GPU adoption in edge data centers.

Opportunities:

Emerging opportunities in the market include the integration of GPUs with emerging technologies such as 5G networks and autonomous vehicles, which require advanced computing power for real-time data processing. Additionally, the increasing focus on sustainable data center solutions presents opportunities for GPU manufacturers to develop energy-efficient and environmentally friendly GPU architectures.

Challenges:

Despite its rapid growth, the Data Center GPU market faces challenges such as high initial costs associated with GPU infrastructure, including procurement and maintenance. Compatibility issues with existing data center architectures and the complexity of integrating GPUs into heterogeneous computing environments pose additional challenges. Moreover, regulatory hurdles and concerns regarding data security and privacy continue to impact market expansion.

Read Also: Integrated Systems Market Size to Reach USD 169.98 Bn By 2033

Data Center GPU Market Companies

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices, Inc

- Samsung Electronics Co., Ltd.

- Micron Technology, Inc.

- Advantech Co. Ltd.

- Alphabet Inc.

- Broadcom Inc. Fujitsu Ltd,

- Gigabyte Technology Co. Ltd.

Recent Developments

- In November 2023, the AMD Ryzen Embedded 7000 Series processor family, optimized for the high-performance demands of industrial markets, was unveiled by AMD today at Smart Production Solutions 2023. By fusing integrated Radeon graphics with “Zen 4” architecture, Ryzen Embedded 7000 Series processors offer performance and functionality that was not previously available for the embedded market.

- In November 2023, Imagination Technologies introduced IMG DXD, the first model in a new range of DirectX-compatible high-performance GPU IP. The new IMG DXD has the API coverage to run well-known PC games in addition to other Windows-based apps and mobile games, starting with a hardware-based version of DirectX 11.

- In September 2023, Cloudflare announced the deployment of Nvidia GPUs at the edge for generative AI inference in up to 300 data centers. With this deployment, Cloudflare aims to improve speed and performance while ensuring the delivery of high-quality services to its customers

- In June 2023, Intel introduced its latest data center GPU, the Max-1550, specifically designed for AI applications. This GPU offers excellent scalability, power efficiency, and impressive performance, particularly in deep learning and inference tasks. It supports various connectivity options, including PCIe 4.0 and NVLink 2.0, providing flexibility for different system configurations.

Segments Covered in the Report

By Deployment Model

- On-premises

- Cloud

By Function

- Training

- Inference

By End-user

- Cloud service providers

- Enterprises

- Government

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/