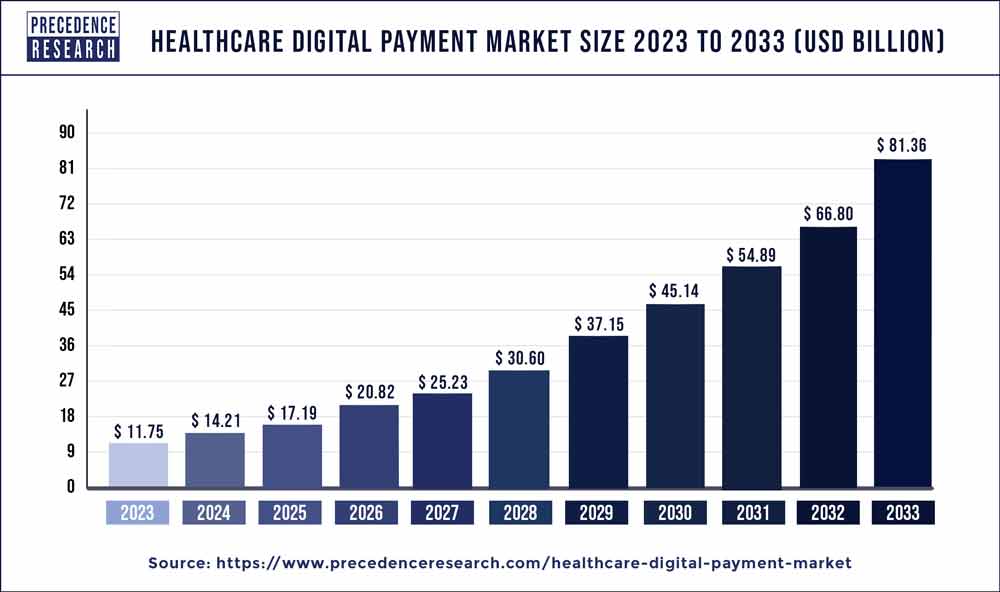

According to a recent research report titled “Healthcare Digital Payment Market (By Solution: Application Program Interface, Payment Gateway, Payment Processing, Payment Security & Fraud Management, Transaction Risk Management, Others; By Deployment: Cloud, On-premise; By Mode of Payment: Bank Cards, Digital Wallets, Net Banking, Others) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033″ published by Precedence Research, the global U.S. healthcare digital payment market size is projected to touch around USD 81.36 billion by 2033 and growing at a CAGR of 21.40% over the forecast period 2024 to 2033. This comprehensive study examines various factors and their impact on the growth of the U.S. healthcare digital payment market.

Key Takeaways

- North America contributed 40% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By solution, the payment processing segment has held the largest market share of 23% in 2023.

- By solution, the payment gateway segment is anticipated to grow at a remarkable CAGR of 23.5% between 2024 and 2033.

- By deployment, the cloud segment generated over 53% of the market share in 2023.

- By deployment, the on-premise segment is expected to expand at the fastest CAGR over the projected period.

- By mode of payment, the bank cards segment generated over 34% of the market share in 2023.

- By mode of payment, the digital wallet segment is expected to expand at the fastest CAGR over the projected period.

The report primarily focuses on the volume and value of the U.S. healthcare digital payment market at the global, regional, and company levels. At the global level, the report analyzes historical data and prospects to present an overview of the overall market size. Regionally, the study emphasizes key regions such as North America, Europe, the Middle East & Africa, Latin America, and others.

Furthermore, the research report provides specific segmentations based on regions (countries), companies, and all market segments. This analysis offers insights into the growth and revenue trends during the historical period of 2017 to 2032, as well as the projected period. By understanding these segments, it becomes possible to identify the significance of different factors that contribute to market growth.

Download a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/3718

The research also highlights significant progressions in both organic and inorganic growth strategies within the global U.S. healthcare digital payment market. Numerous companies are placing emphasis on new product launches, gaining product approvals, and implementing various business expansion tactics. Moreover, the report presents detailed profiles of firms operating in the U.S. healthcare digital payment market, along with their respective market strategies. Additionally, the study concentrates on prominent industry participants, furnishing details such as company profiles, product offerings, financial updates, and noteworthy advancements.

Healthcare Digital Payment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 21.40% |

| Global Market Size in 2023 | USD 11.75 Billion |

| Global Market Size by 2033 | USD 81.36 Billion |

| U.S. Market Size in 2023 | USD 3.29 Billion |

| U.S. Market Size by 2033 | USD 23.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Solution, By Deployment, and By Mode of Payment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Also read: U.S. In Vitro Diagnostics Market Size to Worth USD 41.62 Bn By 2033

Major Key Points Covered in Report:

Executive Summary: It includes key trends of the electric vehicle fuel cell market related to products, applications, and other crucial factors. It also provides analysis of the competitive landscape and CAGR and market size of the electric vehicle fuel cell market based on production and revenue.

Production and Consumption by Region: It covers all regional markets to which the research study relates. Prices and key players in addition to production and consumption in each regional market are discussed.

Key Players: Here, the report throws light on financial ratios, pricing structure, production cost, gross profit, sales volume, revenue, and gross margin of leading and prominent companies competing in the Electric vehicle fuel cell market.

Market Segments: This part of the report discusses product, application and other segments of the electric vehicle fuel cell market based on market share, CAGR, market size, and various other factors.

Research Methodology: This section discusses the research methodology and approach used to prepare the report. It covers data triangulation, market breakdown, market size estimation, and research design and/or programs.

Market Key Players

The report incorporates company profiles of key players in the market. These profiles encompass vital information such as product portfolio, key strategies, and a comprehensive SWOT analysis for each player. Additionally, the report presents a matrix illustrating the presence of each prominent player, enabling readers to gain actionable insights. This facilitates a thoughtful assessment of the market status and aids in predicting the level of competition in the U.S. healthcare digital payment market.

Healthcare Digital Payment Market Companies

- JPMorgan Chase & Co.

- InstaMed

- Zelis

- Rectangle Health

- PayPal Holdings, Inc.

- KKR (Kohlberg Kravis Roberts & Co.)

- HDFC Bank

- Crunchfish

- Mastercard

- Arab African International Bank (AAIB)

- Visa Inc.

- Cerner Corporation

- Fiserv, Inc.

- Allscripts Healthcare Solutions, Inc.

- Optum, Inc.

Segments Covered in the Report

By Solution

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security & Fraud Management

- Transaction Risk Management

- Others

By Deployment

- Cloud

- On-premise

By Mode of Payment

- Bank Cards

- Digital Wallets

- Net Banking

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Digital Payment Market

5.1. COVID-19 Landscape: Healthcare Digital Payment Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Digital Payment Market, By Solution

8.1. Healthcare Digital Payment Market, by Solution, 2024-2033

8.1.1 Application Program Interface

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Payment Gateway

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Payment Processing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Payment Security & Fraud Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Transaction Risk Management

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Healthcare Digital Payment Market, By Deployment

9.1. Healthcare Digital Payment Market, by Deployment, 2024-2033

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premise

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Healthcare Digital Payment Market, By Mode of Payment

10.1. Healthcare Digital Payment Market, by Mode of Payment, 2024-2033

10.1.1. Bank Cards

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Digital Wallets

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Net Banking

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

hapter 11. Global Healthcare Digital Payment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Mode of Payment (2021-2033)

Chapter 12. Company Profiles

12.1. JPMorgan Chase & Co.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. InstaMed

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Zelis

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rectangle Health

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PayPal Holdings, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. KKR (Kohlberg Kravis Roberts & Co.)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. HDFC Bank

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Crunchfish

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mastercard

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Arab African International Bank (AAIB)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Why should you invest in this report?

This report presents a compelling investment opportunity for those interested in the global U.S. healthcare digital payment market. It serves as an extensive and informative guide, offering clear insights into this niche market. By delving into the report, you will gain a comprehensive understanding of the various major application areas for U.S. healthcare digital payment. Furthermore, it provides crucial information about the key regions worldwide that are expected to experience substantial growth within the forecast period of 2023-2030. Armed with this knowledge, you can strategically plan your market entry approaches.

Moreover, this report offers a deep analysis of the competitive landscape, equipping you with valuable insights into the level of competition prevalent in this highly competitive market. If you are already an established player, it will enable you to assess the strategies employed by your competitors, allowing you to stay ahead as market leaders. For newcomers entering this market, the extensive data provided in this report is invaluable, providing a solid foundation for informed decision-making.

Some of the key questions answered in this report:

- What is the size of the overall U.S. healthcare digital payment market and its segments?

- What are the key segments and sub-segments in the market?

- What are the key drivers, restraints, opportunities and challenges of the U.S. healthcare digital payment market and how they are expected to impact the market?

- What are the attractive investment opportunities within the U.S. healthcare digital payment market?

- What is the U.S. healthcare digital payment market size at the regional and country-level?

- Who are the key market players and their key competitors?

- What are the strategies for growth adopted by the key players in U.S. healthcare digital payment market?

- What are the recent trends in U.S. healthcare digital payment market? (M&A, partnerships, new product developments, expansions)?

- What are the challenges to the U.S. healthcare digital payment market growth?

- What are the key market trends impacting the growth of U.S. healthcare digital payment market?

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com