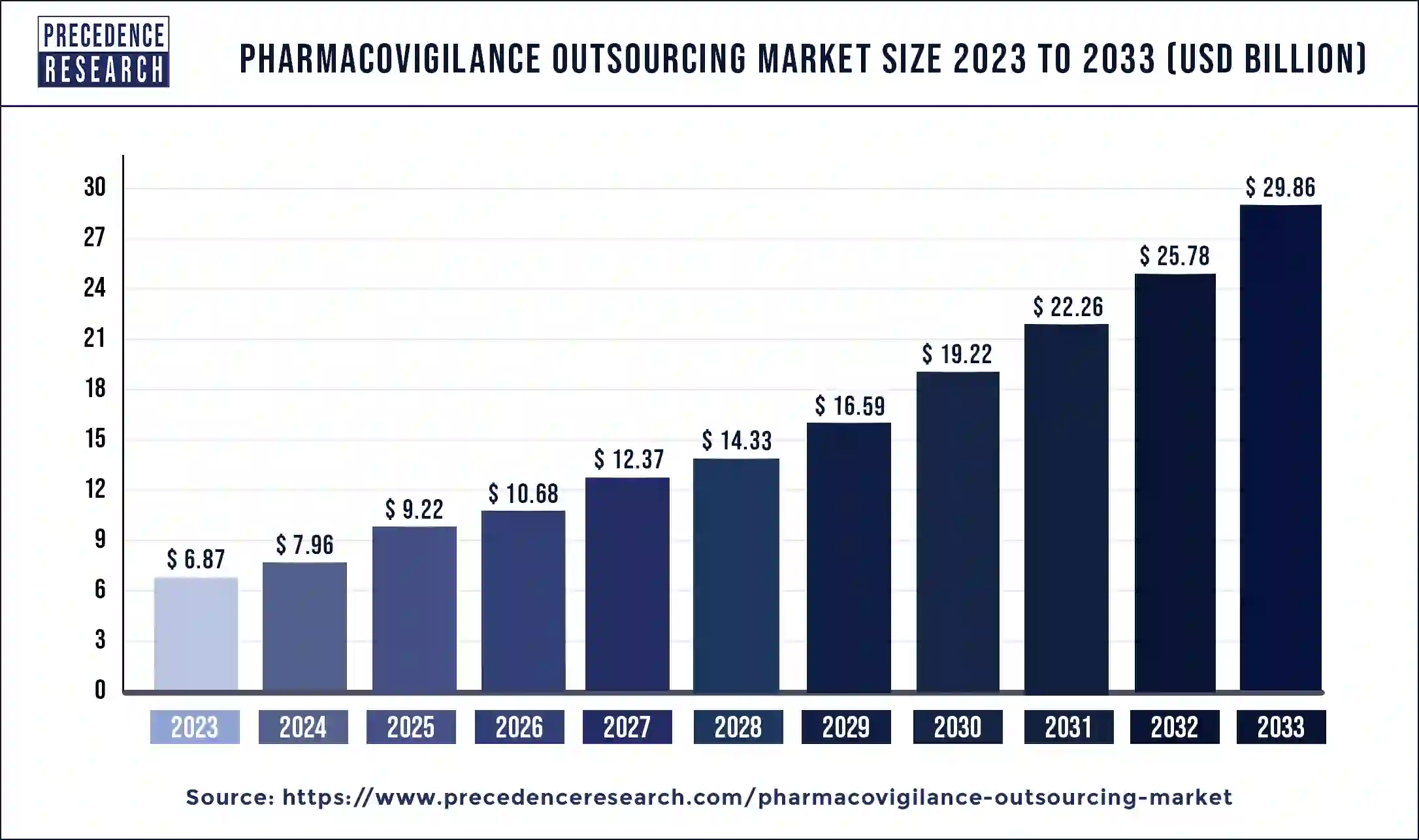

The global pharmacovigilance outsourcing market size was valued at USD 6.87 billion in 2023 and is expected to reach around USD 29.86 billion by 2033. at a solid CAGR of 15.82% from 2024 to 2033.

Key Points

- North America dominated the pharmacovigilance outsourcing market in 2023.

- Asia Pacific is expected to grow at the highest CAGR during the forecast period.

- By service, the pre-marketing pharmacovigilance services segment dominated the market in 2023.

- By service, the post-marketing pharmacovigilance services segment is expected to grow at the highest CAGR during the forecast period.

- By service provider, the contract research organizations (CRO) segment dominated the market in 2023.

- By service provider, the business processing outsourcing (BPO) segment is expected to grow at the highest CAGR during the forecast period.

Pharmacovigilance outsourcing involves the delegation of drug safety monitoring activities to third-party service providers. This practice is increasingly adopted by pharmaceutical companies to manage the complexities and regulatory requirements associated with pharmacovigilance. The market for pharmacovigilance outsourcing is driven by the need for cost-effective solutions, expertise in regulatory compliance, and the growing volume of adverse drug reactions (ADRs) reported globally. It encompasses a range of services including case processing, regulatory reporting, signal detection, risk management, and aggregate reporting.

Get a Sample: https://www.precedenceresearch.com/sample/4449

Growth Factors

The pharmacovigilance outsourcing market is poised for substantial growth due to several key factors. Firstly, pharmaceutical companies are under increasing pressure to streamline operations and reduce costs while maintaining regulatory compliance. Outsourcing pharmacovigilance activities allows them to focus on core competencies such as drug development and commercialization. Secondly, the rise in global healthcare expenditure and the expanding pharmaceutical industry in emerging markets contribute to the demand for pharmacovigilance services. Thirdly, advancements in technology, particularly in data analytics and artificial intelligence (AI), are enhancing pharmacovigilance capabilities, thereby driving the market forward.

Regional Insights

The pharmacovigilance outsourcing market exhibits regional variations influenced by regulatory frameworks, healthcare infrastructure, and economic factors. North America dominates the market owing to stringent regulatory requirements and a high concentration of pharmaceutical companies. Europe follows closely, with strong regulatory oversight and a well-established pharmaceutical industry. In Asia-Pacific, rapid market growth is fueled by increasing outsourcing activities from Western pharmaceutical companies seeking cost advantages and regulatory expertise in countries like India and China.

Pharmacovigilance Outsourcing Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 6.87 Billion |

| Market Size in 2024 | USD 7.96 Billion |

| Market Size by 2033 | USD 29.86 Billion |

| Pharmacovigilance Outsourcing Market Growth Rate | CAGR of 15.82% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Service, Service Providers, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmacovigilance Outsourcing Market Dynamics

Drivers

Several drivers underpin the growth of pharmacovigilance outsourcing. Firstly, stringent regulatory mandates worldwide compel pharmaceutical companies to ensure comprehensive drug safety monitoring, which is efficiently managed by specialized outsourcing providers. Secondly, the complexity of pharmacovigilance operations, including data management and regulatory reporting, necessitates specialized skills and resources that outsourcing firms can provide. Thirdly, the increasing volume of adverse event reports due to expanding global drug consumption and regulatory scrutiny drives the demand for scalable pharmacovigilance solutions offered by outsourcing partners.

Opportunities

The pharmacovigilance outsourcing market presents significant opportunities for growth and innovation. Expansion into emerging markets such as Latin America and the Middle East offers new avenues for outsourcing providers to establish regional presence and tap into growing pharmaceutical sectors. Moreover, the integration of advanced technologies such as AI and machine learning into pharmacovigilance processes presents opportunities to enhance efficiency in adverse event detection and signal management. Additionally, collaborations between outsourcing vendors and pharmaceutical companies for real-world data analytics and proactive risk management are poised to drive market expansion.

Challenges

Despite its growth prospects, the pharmacovigilance outsourcing market faces several challenges. One major challenge is the complexity of global regulatory landscapes, which necessitates adherence to diverse and evolving requirements across different regions. Ensuring data privacy and security in pharmacovigilance operations is another critical concern, particularly with the increasing volume and sensitivity of patient data involved. Furthermore, maintaining effective communication and collaboration between pharmaceutical companies and outsourcing partners remains essential for ensuring seamless pharmacovigilance operations and regulatory compliance.

Read Also: Medical Marijuana Market Size to Hit USD 120.15 Bn by 2033

Pharmacovigilance Outsourcing Market Companies

- Labcorp Drug Development

- Icon Plc

- Cognizant Technology Solutions Corporation

- Ergomed Plc.

- Capgemini

- Genpact Limited

- Accenture Plc.

- Iqvia Holdings Inc.

- International Business Machines Corporation

- Bioclinica Inc.

Recent Developments

- In April 2024, Charles River Laboratories is launching its Alternative Methods Advancement Project (AMAP), an initiative to develop alternatives to reduce animal testing and to drive a new standard for drug discovery and development. The company’s initial investment was $200 million over the past four years, and its five-year goal is to invest an additional $300 million. This investment spans a portfolio of technology innovations, partnerships, and advocacy efforts to reduce the use of animal testing.

- In December 2023, Thermo Fisher Scientific Inc. launched CorEvidence, a cloud-based data lake platform designed to optimize pharmacovigilance case processing and safety data management processes. The new platform aims to enhance CorEvitas clinical research registries offered by Thermo Fisher’s PPD clinical research business.

- In September 2022, AmerisourceBergen announced its plan to acquire PharmaLex for $1.42 bn, the deal which was subsequently confirmed at the beginning of the year. At the time, the company said that the addition of PharmaLex Business would be complementary to its European presence.

Segment Covered in the Report

By Service

- Pre-marketing Pharmacovigilance Services

- Clinical Pharmacovigilance Services

- Case-Processing Services

- Safety Data Management Services

- Medical Review

- Post-marketing Pharmacovigilance Services

- Pharmacovigilance Knowledge Process Outsourcing Services

- IT Solutions and Services

- Others

By Service Providers

- Contract Research Organizations (CROs)

- Business Processing Outsourcing (BPO)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/