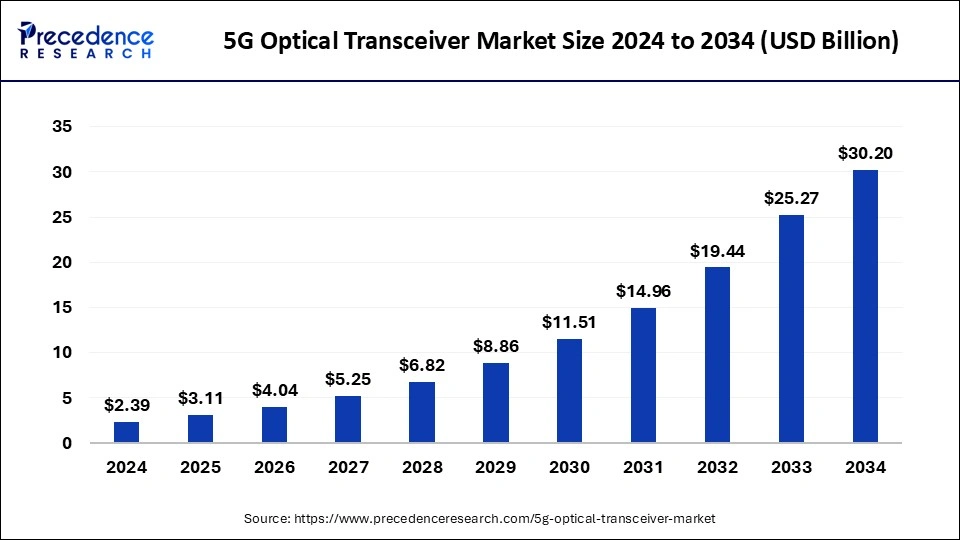

The global 5G optical transceiver market size was valued at USD 1.84 billion in 2023 and is expected to reach around USD 25.27 billion by 2033. at a solid CAGR of 29.95% from 2024 to 2033.

Key Points

- The North America 5G optical transceiver market size reached USD 660 million in 2023 and is expected to attain around USD 9.22 million by 2033, poised to grow at a CAGR of 30.17% between 2024 and 2033.

- North America has held a largest revenue share of 36% in 2023.

- Asia Pacific is anticipated to showcase significant growth with the highest CAGR in the market in the upcoming period.

- By type, the 25G transceivers segment has contributed more than 32% of revenue share in 2023.

- By type, the 400G transceivers segment is expected to grow significantly in the market over the forecast period.

- By form factor, the SFP56 form factor segment has recorded the highest revenue share of 30% in 2023.

- By form factor, the QSFP28 segment is anticipated to grow significantly during the forecast period in the market.

- By wavelength, the 1310 nm band segment has generated more than 45% of revenue share in 2023.

- By wavelength, the 850 nm band segment is estimated to grow significantly over the forecast period.

- By 5G infrastructure, the 5G fronthaul segment dominated the market with a major revenue share of 74% in 2023.

- By 5G infrastructure, the 5G midhaul/backhaul segment is projected to show substantial growth in the market during the projected period.

The 5G optical transceiver market is witnessing rapid growth as it plays a crucial role in enabling high-speed, low-latency communication networks essential for 5G technology. Optical transceivers are key components that facilitate the transmission of data over optical fibers, offering superior bandwidth and efficiency compared to traditional copper-based systems.

Get a Sample: https://www.precedenceresearch.com/sample/4551

Growth Factors

The market for 5G optical transceivers is driven by increasing demand for high-speed data transmission and the deployment of 5G networks worldwide. These transceivers support the high bandwidth requirements of 5G applications such as ultra-high-definition video streaming, augmented reality (AR), and Internet of Things (IoT) devices.

Region Insights

Geographically, North America and Asia-Pacific are key regions driving growth in the 5G optical transceiver market. North America, particularly the United States, leads in early 5G deployments and infrastructure investments. Meanwhile, Asia-Pacific, including countries like China, Japan, and South Korea, is experiencing significant adoption due to large-scale 5G network rollouts.

Trends

A notable trend in the 5G optical transceiver market is the shift towards higher data rates and increased integration of advanced technologies such as coherent optics. Manufacturers are focusing on developing compact, energy-efficient transceivers capable of handling the stringent demands of 5G networks.

5G Optical Transceiver Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 25.27 Billion |

| Market Size in 2023 | USD 1.84 Billion |

| Market Size in 2024 | USD 2.39 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 29.95% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Form Factor, Wavelength, Distance, 5G Infrastructure, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

5G Optical Transceiver Market Dynamics

Drivers

Key drivers include the escalating demand for faster data connectivity, driven by increasing mobile data traffic and the proliferation of connected devices. Additionally, government initiatives and investments aimed at enhancing digital infrastructure and achieving broader 5G coverage are fueling market growth.

Opportunities

Opportunities in the market include advancements in optical communication technologies, such as the development of 400G and beyond transceivers, which promise even higher speeds and improved efficiency. Moreover, the expansion of 5G networks into industries like automotive, healthcare, and smart cities presents new avenues for transceiver deployment.

Challenges

Despite the promising growth prospects, the 5G optical transceiver market faces challenges such as the high cost of deployment and maintenance of optical networks. Additionally, interoperability issues between different generations of optical transceivers and compatibility concerns with existing infrastructure pose challenges to seamless 5G integration.

Read Also: Smart Home Appliances Market Size to Reach USD 75.20 Bn by 2033

5G Optical Transceiver Market Companies

- II-VI Coherent Corp.

- INNOLIGHT

- HiSilicon Optoelectronics Co., Ltd.

- Cisco Acacia Communications, Inc.

- Hisense Broadband, Inc.

- Broadcom.

- Source Photonics

- Juniper Networks, Inc.

- Eoptolink Technology Inc.

- Molex, LLC

- Accelink Technology Co. Ltd

- Fujitsu Optical Components Limited

Recent Developments

- In March 2024, Nokia is introducing a new line of optical transport solutions specifically designed for metro edge deployments, catering to Communication Service Providers (CSPs), webscale companies, and Enterprise customers.

- In March 2022, Lumentum, a global optical transceiver company headquartered in the U.S., established a strategic collaboration agreement with Ayar Labs Inc. The collaboration aimed to deliver high-volume continuous-wave wavelength division multiplexing multi-source agreement (CW-WDM MSA)-compliant external laser sources.

- In October 2023, Aker Solutions and Subsea7 reported the completion of their joint venture, officially closing the deal. The newly formed entity is operating under the name OneSubsea and intends to revolutionize subsea production by fostering innovation and enhancing efficiency

Segments Covered in the Report

By Type

- 25G Transceivers

- 50G Transceivers

- 100G Transceivers

- 200G Transceivers

- 400G Transceivers

By Form Factor

- SFP28

- SFP56

- QSFP28

- Others (QSFP56, CFP2, CFP8)

By Wavelength

- 850 nm Band

- 1310 nm Band

- Others (CWDM, DWDM, LWDM, 1270nm, 1330 nm)

By Distance

- 1 to 10 Km

- 10 to 100 Km

- More than 100 Km

By 5G Infrastructure

- 5G Fronthaul

- 5G Midhaul/Backhaul

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/