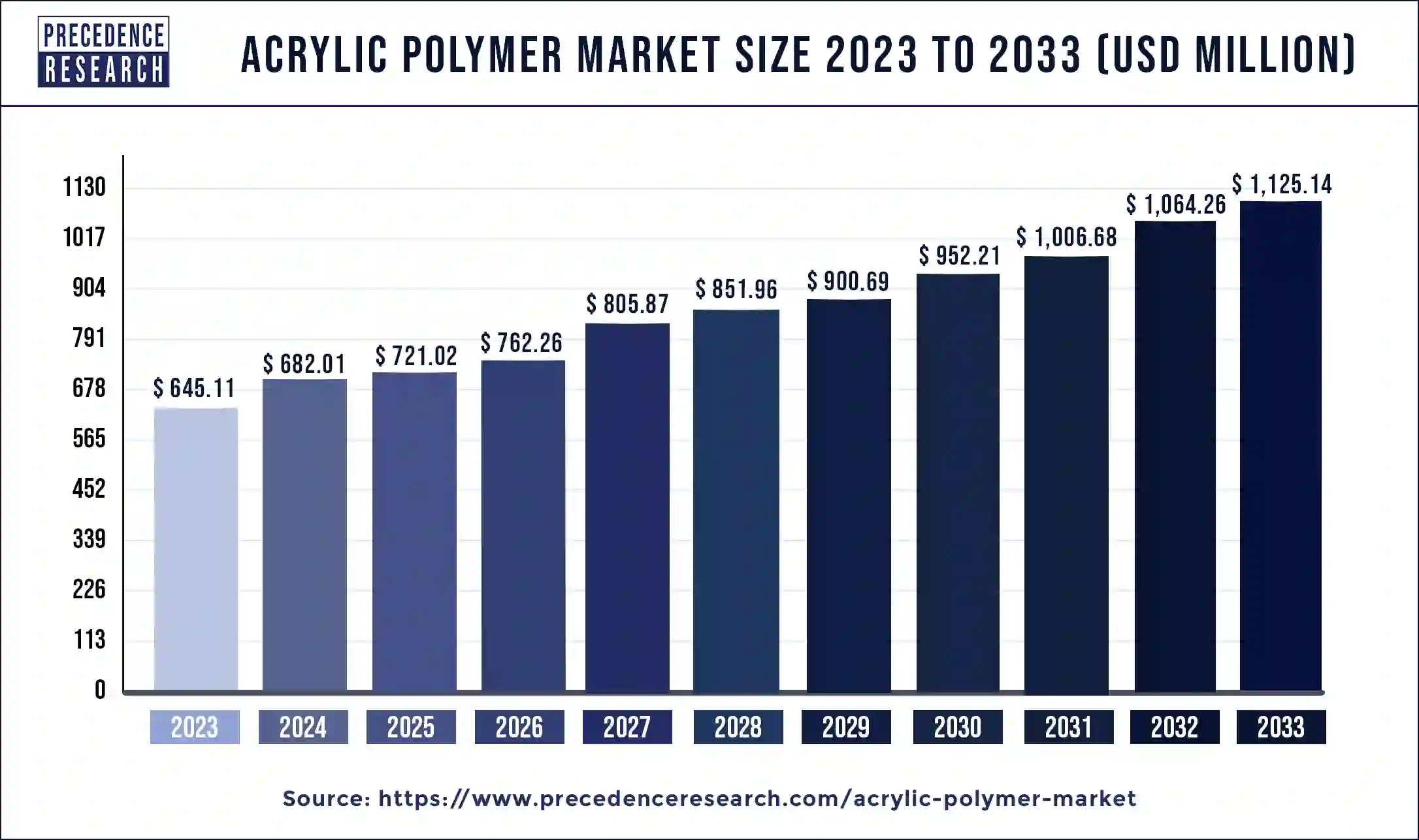

The global acrylic polymer market size is estimated to surpass around USD 1,125.14 million by 2033, growing at a CAGR of 5.72% from 2024 to 2033.

Key Points

- North America dominated the market share in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2024 and 2033.

- By type, the polymethyl methacrylate segment held the largest market share 22% in 2023.

- By type, the polyvinyl acetate segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By solution type, the water-borne segment generated the biggest market share 28% in 2023.

- By solution type, the solvent-borne segment is expected to expand at the fastest CAGR over the projected period.

- By application, the cosmetics segment has held a major market share of 31% in 2023.

- By application, the paints & coatings segment is expected to expand at the fastest CAGR over the projected period.

The acrylic polymer market is witnessing robust growth driven by its extensive applications across various industries such as paints and coatings, adhesives, textiles, and construction. Acrylic polymers, derived from acrylic acid and its derivatives, offer desirable properties including excellent weatherability, chemical resistance, and durability, making them a preferred choice for diverse end-use applications. With increasing demand for high-performance materials and sustainable solutions, the acrylic polymer market is poised for significant expansion in the foreseeable future.

Get a Sample: https://www.precedenceresearch.com/sample/3978

Growth Factors:

Several factors contribute to the growth of the acrylic polymer market. One primary driver is the booming construction industry, particularly in emerging economies, which fuels demand for acrylic-based coatings, sealants, and adhesives. Acrylic polymers provide superior adhesion, flexibility, and weather resistance, making them ideal for architectural coatings, waterproofing membranes, and structural adhesives used in building and infrastructure projects.

Moreover, the automotive sector’s growing demand for lightweight materials and enhanced aesthetics drives the adoption of acrylic-based paints and coatings for vehicle exteriors and interiors. Acrylic polymers offer advantages such as UV resistance, scratch resistance, and color retention, meeting the stringent performance requirements of automotive OEMs and aftermarket coatings manufacturers.

Additionally, the increasing popularity of water-based coatings and environmentally friendly formulations accelerates the adoption of acrylic polymers as alternatives to solvent-based coatings. With stringent regulations aimed at reducing VOC emissions and promoting sustainable practices, acrylic-based waterborne coatings emerge as viable solutions for achieving compliance while delivering superior performance and durability.

Furthermore, the rising disposable income and urbanization trends contribute to the expansion of the furniture and consumer goods markets, driving demand for acrylic-based finishes, laminates, and surface coatings. Acrylic polymers enable the production of aesthetically pleasing and durable products while offering manufacturers cost-effective and environmentally friendly alternatives to traditional materials.

Region Insights:

The acrylic polymer market exhibits a global presence, with key regions including North America, Europe, Asia-Pacific, and the rest of the world. North America and Europe represent mature markets for acrylic polymers, driven by established manufacturing industries, stringent quality standards, and robust infrastructure development. The presence of leading automotive OEMs, construction companies, and coatings manufacturers in these regions sustains demand for high-performance acrylic-based materials.

In Asia-Pacific, rapid industrialization, urbanization, and infrastructure development activities fuel market growth for acrylic polymers. Countries such as China, India, and Southeast Asian nations witness significant investments in construction, automotive manufacturing, and consumer goods production, driving demand for acrylic-based coatings, adhesives, and polymers. Moreover, favorable government policies, foreign investments, and technological advancements contribute to the region’s emergence as a key hub for acrylic polymer production and consumption.

The rest of the world, including Latin America, the Middle East, and Africa, also presents growth opportunities for the acrylic polymer market. Infrastructure development projects, expanding manufacturing sectors, and increasing investments in renewable energy drive demand for acrylic-based materials across various industries. Moreover, the region’s favorable climate conditions and growing consumer awareness of environmental sustainability drive the adoption of acrylic-based coatings and polymers in architectural, automotive, and industrial applications.

Acrylic Polymer Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.72% |

| Global Market Size in 2023 | USD 645.11 Million |

| Global Market Size by 2033 | USD 1,125.14 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Solution Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Acrylic Polymer Market Dynamics

Drivers:

Several drivers propel the growth of the acrylic polymer market. One significant driver is the increasing demand for high-performance coatings and adhesives in construction and infrastructure projects. Acrylic polymers offer exceptional durability, weather resistance, and aesthetic appeal, meeting the stringent performance requirements of architects, contractors, and building owners. The growing focus on sustainable construction practices further drives the adoption of acrylic-based materials, as they enable energy efficiency, LEED certification, and reduced environmental impact.

Moreover, the automotive industry’s shift towards lightweight materials and advanced coatings drives demand for acrylic-based solutions. Acrylic polymers provide lightweight, durable, and visually appealing finishes for automotive exteriors, interiors, and components, enhancing vehicle aesthetics, corrosion resistance, and fuel efficiency. Additionally, the growing trend towards electric and autonomous vehicles presents opportunities for acrylic-based materials in battery enclosures, thermal management systems, and lightweight structural components.

Furthermore, the increasing preference for water-based coatings and environmentally friendly formulations accelerates market growth for acrylic polymers. Stringent regulations aimed at reducing VOC emissions and promoting sustainable practices drive the transition from solvent-based to waterborne coatings, favoring acrylic-based polymers due to their low VOC content, fast drying times, and excellent adhesion properties. Additionally, technological advancements in acrylic polymer chemistry enable the development of high-performance waterborne coatings with enhanced durability, weatherability, and chemical resistance.

Opportunities:

The acrylic polymer market presents numerous opportunities for innovation and market expansion. One significant opportunity lies in the development of bio-based and renewable acrylic polymers derived from sustainable feedstocks such as biomass, bioethanol, and recycled materials. By reducing dependence on fossil fuels and minimizing environmental footprint, bio-based acrylic polymers offer environmentally friendly alternatives to conventional petroleum-based materials, meeting the growing demand for sustainable solutions across industries.

Moreover, advancements in acrylic polymer synthesis, formulation, and processing techniques present opportunities for product differentiation and performance optimization. Tailoring acrylic polymers’ molecular structure, crosslinking density, and particle morphology enables manufacturers to meet specific application requirements and address emerging market trends such as 3D printing, smart coatings, and antimicrobial surfaces. Additionally, collaboration with academia, research institutions, and technology partners facilitates the development of novel acrylic polymer-based materials with enhanced functionality, performance, and value proposition.

Furthermore, expanding market penetration in emerging economies and niche applications presents growth opportunities for acrylic polymer manufacturers. Collaborating with local distributors, manufacturers, and end-users enables companies to address regional market needs, adapt to regulatory requirements, and capture market share in industries such as electronics, healthcare, and renewable energy. Moreover, strategic partnerships, mergers, and acquisitions facilitate market expansion, technology transfer, and access to new customer segments and geographic regions.

Challenges:

Despite the favorable growth prospects, the acrylic polymer market faces several challenges that could hinder its trajectory. One such challenge is the volatility of raw material prices, particularly for key feedstocks such as acrylic acid, methacrylates, and styrene. Fluctuations in crude oil prices, supply-demand imbalances, and geopolitical uncertainties impact production costs and profit margins for acrylic polymer manufacturers, necessitating effective risk management strategies and supply chain optimization.

Additionally, environmental concerns related to acrylic polymer production and disposal pose challenges for sustainable growth. Acrylic polymer manufacturing processes typically involve energy-intensive reactions, chemical synthesis, and waste generation, leading to environmental pollution, resource depletion, and greenhouse gas emissions. Addressing these challenges requires investments in cleaner production technologies, waste minimization strategies, and circular economy initiatives to promote resource efficiency and environmental sustainability throughout the acrylic polymer lifecycle.

Moreover, regulatory compliance and product stewardship present challenges for acrylic polymer manufacturers operating in global markets. Regulatory requirements vary across regions and industries, necessitating comprehensive product testing, certification, and documentation to ensure compliance with safety, health, and environmental regulations. Keeping abreast of evolving regulations, conducting risk assessments, and engaging with regulatory authorities and stakeholders are essential for navigating compliance challenges and maintaining market access.

Furthermore, competitive pressures and market consolidation pose challenges for acrylic polymer manufacturers, particularly small and medium-sized enterprises (SMEs). Intense competition from large multinational corporations, price pressures, and market saturation in mature regions necessitate differentiation strategies, innovation, and value-added services to remain competitive and sustain growth. Additionally, market consolidation through mergers, acquisitions, and strategic alliances reshapes industry dynamics, impacting market access, pricing, and distribution channels for acrylic polymer products.

Read Also: Bispecific Antibodies Market Size, Trends, Report by 2033

Recent Developments

- On February 9, 2023, Roehm, a chemical company based in Germany, unveiled two acrylic-based copolymer compounds, Cyrolite GP-20 and MD zk6, during the 2023 MD&M West trade show. Designed for injection molding and extrusion processes, these compounds demonstrated an outstanding combination of properties ideal for medical device applications.

Acrylic Polymer Market Companies

- BASF SE

- Dow Chemical Company

- Arkema SA

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- LG Chem Ltd.

- Solvay SA

- Formosa Plastics Corporation

- Kuraray Co., Ltd.

- Nippon Shokubai Co., Ltd.

- DIC Corporation

- Celanese Corporation

- Mitsui Chemicals, Inc.

- Saudi Basic Industries Corporation (SABIC)

Segments Covered in the Report

By Type

- Polymethyl Methacrylate

- Sodium Polyacrylate

- Polyvinyl Acetate

- Polyacrylamide

- Others

By Solution Type

- Water-Borne

- Solvent-Borne

By Application

- Dentistry

- Cosmetics

- Paints & Coatings

- Cleaning

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/