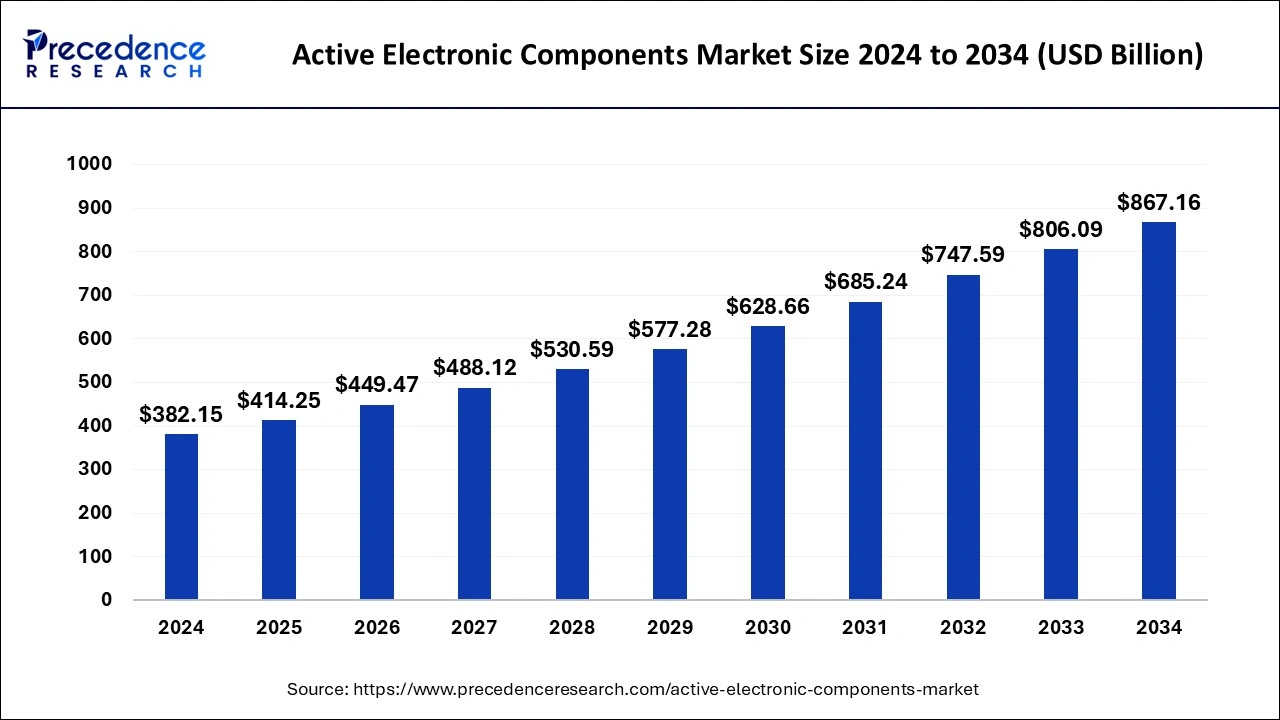

The active electronic components market, valued at 382.15Bn in 2024, is set to soar to 867.16Bn by 2034, showcasing impressive growth with an 8.53% CAGR.

Table of Contents

ToggleActive Electronic Components Market Key Takeaways

- Asia Pacific dominated the market in 2024, contributing over 38% of the total revenue.

- The semiconductor segment led the market by product, securing more than 58% of the revenue share in 2024.

- The consumer electronics sector emerged as the leading end-user segment in 2024, holding the largest market share.

- By revenue, the consumer electronics segment accounted for 32% of the market share in 2024.

Active electronic components, such as oscillators, integrated circuits, and transistors, amplify signals and enhance or generate voltage, power, or current in AC circuits. These components play a crucial role in electronic systems by influencing electrons and their associated fields. The global market for active electronic components is witnessing rapid growth, driven by the rising demand for high transfer speeds and minimal idle time. In emerging markets like India, advancements in 5G infrastructure are fueling interest in IT and telecom hardware, boosting the adoption of these components.

Sample Link: https://www.precedenceresearch.com/sample/1017

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 414.25 Billion |

| Market Size by 2034 | USD 867.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.53% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Regional |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Key Drivers

Opportunities

- Rising Smartphone and Wearable Adoption: The growing penetration of smartphones, wearable devices, and industrial automation is driving demand for active electronic components globally.

- Increased Use in Modern Vehicles: Vehicle modernization and the demand for advanced automotive technologies are accelerating the deployment of active electronic components in automobiles.

- Expansion in Renewable Energy Applications: The rising adoption of renewable energy systems, such as solar panels and turbines, is boosting the need for active electronic components.

- Vertical Integration by Automakers: Automakers are investing in the design and production of semiconductors, particularly for EVs, to reduce dependency on external suppliers and enhance efficiency.

- Global Semiconductor Collaboration: International alliances, like the IESA and U.S. Semiconductor Industry Association collaboration, are fostering market growth by promoting semiconductor innovation and cooperation.

Challenges

- Fluctuating Raw Material Costs: The volatile and unpredictable prices of raw materials significantly impact production costs and profitability.

- High Labor Costs: Labor expenses contribute to the overall cost of manufacturing, further increasing the price of finished products.

- Supply Chain Disruptions: Global supply chain issues, such as shortages or delays, can hinder the timely production and delivery of components.

- Rising Competition: Intense competition among global and regional players makes it challenging to maintain market share and profitability.

- Technological Complexity: The rapid pace of technological advancements requires constant innovation and high R&D investments, which can strain resources for smaller players.

Regional Insights

Market Key Players

- Infineon Technologies AG

- Fairchild Semiconductor International, Inc.

- Maxim Integrated Products Inc.

- Texas Instruments, Inc.

- Analog Devices, Inc.

- ST Microelectronics NV

Recent News

In January 2023, Infineon Technologies AG announced the sale of its HiRel DC-DC converter business to Micross Components, allowing Infineon to focus on core semiconductor advancements. Toshiba plans to build a new facility for automotive power semiconductors in Japan, doubling production capacity by 2025. Texas Instruments partnered with Chicony Power in December 2022 to develop a compact 65-W laptop adapter using advanced GaN technology, achieving higher efficiency. Infineon strengthened its semiconductor portfolio through acquisitions, including Cree Inc.’s RF Power division in 2016 and Cypress Semiconductor Corp. in 2019. Additionally, NXP Semiconductors launched the SR100T chipset in 2019 for precise positioning in UWB-enabled devices.

Market Segmentation

By Product

- Semiconductor Devices

- Transistors

- Diodes

- Optoelectronic Components

- Integrated Circuits

- Display Devices

- Cathode-ray Tubes

- Microwave Tubes

- X-ray Tubes

- Triodes

- Photoelectric Tubes

- Optoelectronic

- Vacuum Tubes

- Others

By End User

- Consumer electronics

- Healthcare

- Automotives

- Aerospace and defense

- Information Technology

- Others