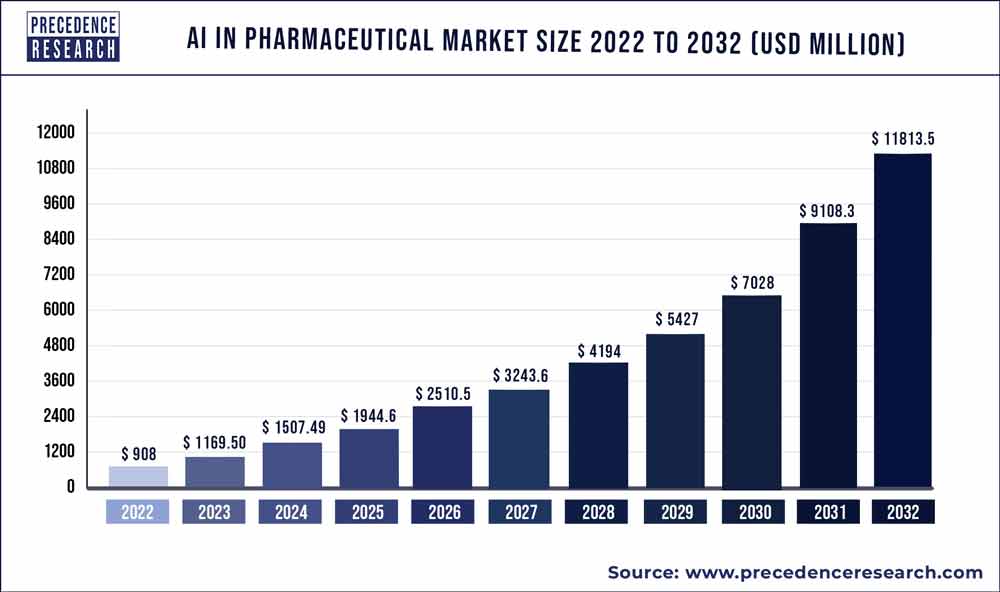

The global AI in pharmaceutical market size is forecasted to reach from US$ 905.91 million in 2021 to US$ 9,241.34 million by 2030, growing at a CAGR of 3% from 2021 to 2030, as per reports by market research and consulting organization Precedence Research.

The report contains 150+ pages with detailed analysis. The base year for the study has been considered 2021, the historic year 2017 to 2020, the forecast period considered is from 2021 to 2030. The AI in pharmaceutical market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit). The report offers exclusive insights to help companies make informed decisions to sustain growth through the assessment period.

Download Free Sample Copy with TOC, Graphs & List of Figures @ https://www.precedenceresearch.com/sample/1485

Scope of the AI in Pharmaceutical Market

| Report Coverage | Details |

| Market Size in 2020 | USD 701.6 Million |

| Growth Rate from 2021 to 2030 | 29.4% |

| Revenue Projection by 2030 | USD 9,241.34 Million |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

The rapid adoption of the AI technologies in the pharmaceutical industry across the globe is the primary driver of the AI in the pharmaceutical market. The rising investments in the biopharmaceutical industry to cater the burgeoning demand for the innovative drugs that cures various chronic diseases such as cancer, diabetes, and CVDs is exponentially driving the adoption of AI in the pharmaceutical market.

The use of AI technologies can enhance the research & development, clinical trials, and the drug manufacturing processes allowing the pharmaceutical companies to significantly reduce cost and time. Majority of the global pharmaceutical players are increasing investments in the adoption of the AI technologies. For instance, in April 2021, Abbott introduced its new coronary imaging platform, powered by artificial intelligence, in Europe. It has also received CE mark by the concerned authorities in Europe. Therefore, the demand for AI technologies in the pharmaceutical industry is expected to grow at a significant rate.

Report Highlights of the AI in Pharmaceutical Market

- Based on the technology, deep learning dominated the market with more than 33% of the market share in 2020. This is attributable to the increased adoption of the deep learning technology in the diagnosis and monitoring of the health conditions. It is extensively used in the monitoring of the health conditions and predicting the subsequent conditions in the near future. The rising adoption of this technology for monitoring the conditions related to various diseases such as sepsis and cardiovascular diseases is further fueling the growth of this segment.

- Based on the drug type, the large molecule is estimated to be the most opportunistic segment. The growing demand for the biologics for the treatment of various chronic diseases coupled with the rising prevalence of diseases, rising healthcare expenditure, and growing awareness regarding the biologic drugs is expected to foster the market growth.

- Based on the application, the drug discovery segment accounted for around 80% of the market share in 2020. The AI technologies facilitate cost reduction, savings of time, and increased operational efficiency in the drug discovery process, which has augmented the growth of this segment.

AI in Pharmaceutical Market Dynamics

Driver

Increasing usage of AI in drug discovery

The adoption of the AI and the machine learning technologies is growing rapidly in the drug discovery. The drug discovery has become extremely expensive and highly competitive in the past few years. Therefore, the rising demand for controlling cost and reducing time along with increasing the efficiency in the process related to the drug discovery is expected to drive the growth of the

AI in the pharmaceutical market during the forecast period. Moreover, the AI and ML technologies assists in the research and developmental activities by reducing the errors and inefficiencies.

Restraints

High capital investments in AI technologies

A huge capital investment is involved in the implementation of the AI and ML technologies in the pharmaceutical sector. The financial restrictions of the small and medium size pharmaceutical companies and drug manufacturers may restrict the adoption of AI and can hinder the market growth during the forecast period.

Opportunities

Rising investments in the drug discovery for chronic diseases

It is estimated that by 2025, around 50% of global pharmaceutical companies will deploy AI technologies. This will result in the increased investments in the development of the drugs for curing various oncology and chronic diseases. Therefore, the increased demand for the innovative drugs across the globe owing to the rising prevalence of various chronic diseases is expected to offer lucrative growth opportunities to the market players in the upcoming future.

Challenges

Challenges of maintaining data security and data privacy

The data privacy and security are the most important factor for any big pharmaceutical organization. With the growing adoption of the digital technologies, the threat of cyberattacks is growing rapidly. The cyberattacks can adversely impact the organizations and can result in financial losses. Therefore, the maintenance of data security and privacy are the major challenges.

Regional Snapshot of AI in Pharmaceutical

North America garnered a market share of around 43% in 2020. North America is characterized by the higher demand for the biopharmaceutical and biologics medications owing to the increased prevalence of various chronic diseases and increased healthcare expenditure. This creates a huge pressure on the biopharma companies to manufacture innovative drugs and at a rapid pace.

The AI technologies can significantly boost the research, drug discovery, and drug manufacturing process by reducing the time consumption and costs involved in the drug development. Moreover, the regulatory framework in the US is encouraging the healthcare and the pharmaceutical industries to increasingly adopt the AI powered technologies to increase operational efficiency and reduce costs. These factors had resulted in the dominance of the region in AI in the pharmaceutical market.

On the other hand, Asia Pacific is estimated to be the most opportunistic segment during the forecast period. This is attributed to the increasing presence of the CROs and the CMOs in countries like China, India, South Korea, and Singapore. The government policies to attract FDIs is fueling the adoption of the AI technologies in the research and manufacturing of the pharmaceutical drugs. The presence of the several top pharmaceutical manufacturing facilities in the Asia Pacific region is expected to boost the demand for the AI technologies in the forthcoming years.

Read Also: Materials Informatics Market Size is Forecasted to Reach US$ 782.2 Million by 2027

Competitive Intelligence

The report provides an understanding of the market composition and explains the role of established players and regional contributors. It is essential for the market players to make calculative moves and focus on client acquisition and retention. The detailed company profiles will provide the necessary intelligence to the reader. In order to maintain their share, the market players are focusing on strategies such as cross-border expansion, product differentiation and so on.

Some of the prominent players in the global AI in pharmaceutical market are listed as below:

- IBM Corporation

- Exscientia

- Deep Genomics

- Cloud Pharmaceuticals, Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Insilico Medicine

- Alphabet Inc.

- Atomwise, Inc.

- Biosymetrics

- Euretos

- BenevolentAI

Segments Covered in the Report

By Technology

- Natural Language Processing

- Context-Aware Processing

- Deep Learning

- Querying Method

By Drug Type

- Large Molecules

- Small Molecules

By Application

- Drug Discovery

- Clinical Trial

- Research & Development

- Others

Regional Segmentation

– North America (U.S. and Canada)

– Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

– Asia-Pacific (China, Japan, India, Southeast Asia and Rest of APAC)

– Latin America (Brazil and Rest of Latin America)

– Middle East and Africa (GCC, North Africa, South Africa, Rest of MEA)

Why should you invest in this report?

If you are aiming to enter the global AI in pharmaceutical market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for AI in pharmaceutical are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2021-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI in Pharmaceutical Market

5.1. COVID-19 Landscape: AI in Pharmaceutical Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI in Pharmaceutical Market, By Technology

8.1. AI in Pharmaceutical Market, by Technology Type, 2021-2030

8.1.1. Natural Language Processing

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Context-Aware Processing

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Deep Learning

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Querying Method

8.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global AI in Pharmaceutical Market, By Application

9.1. AI in Pharmaceutical Market, by Application, 2021-2030

9.1.1. Drug Discovery

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Clinical Trial

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Research & Development

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global AI in Pharmaceutical Market, By Drug

10.1. AI in Pharmaceutical Market, by Drug, 2021-2030

10.1.1. Large Molecules

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Small Molecules

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global AI in Pharmaceutical Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2019-2030)

11.1.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.3. Market Revenue and Forecast, by Drug (2019-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2019-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.4.3. Market Revenue and Forecast, by Drug (2019-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Drug (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2019-2030)

11.2.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.3. Market Revenue and Forecast, by Drug (2019-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2019-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.4.3. Market Revenue and Forecast, by Drug (2019-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Drug (2019-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Drug (2019-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Drug (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2019-2030)

11.3.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.3. Market Revenue and Forecast, by Drug (2019-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2019-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.4.3. Market Revenue and Forecast, by Drug (2019-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Drug (2019-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Drug (2019-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Drug (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2019-2030)

11.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.3. Market Revenue and Forecast, by Drug (2019-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2019-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.4.3. Market Revenue and Forecast, by Drug (2019-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Drug (2019-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Drug (2019-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Drug (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2019-2030)

11.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.3. Market Revenue and Forecast, by Drug (2019-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2019-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.4.3. Market Revenue and Forecast, by Drug (2019-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Drug (2019-2030)

Chapter 12. Company Profiles

12.1. IBM Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Exscientia

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Deep Genomics

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Cloud Pharmaceuticals, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Microsoft Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. NVIDIA Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Insilico Medicine

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Alphabet Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Atomwise, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Biosymetrics

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Euretos

12.11.1. Company Overview

12.11.2. Product Offerings

12.11.3. Financial Performance

12.11.4. Recent Initiatives

12.12. BenevolentAI

12.12.1. Company Overview

12.12.2. Product Offerings

12.12.3. Financial Performance

12.12.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Purchase Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1485

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com