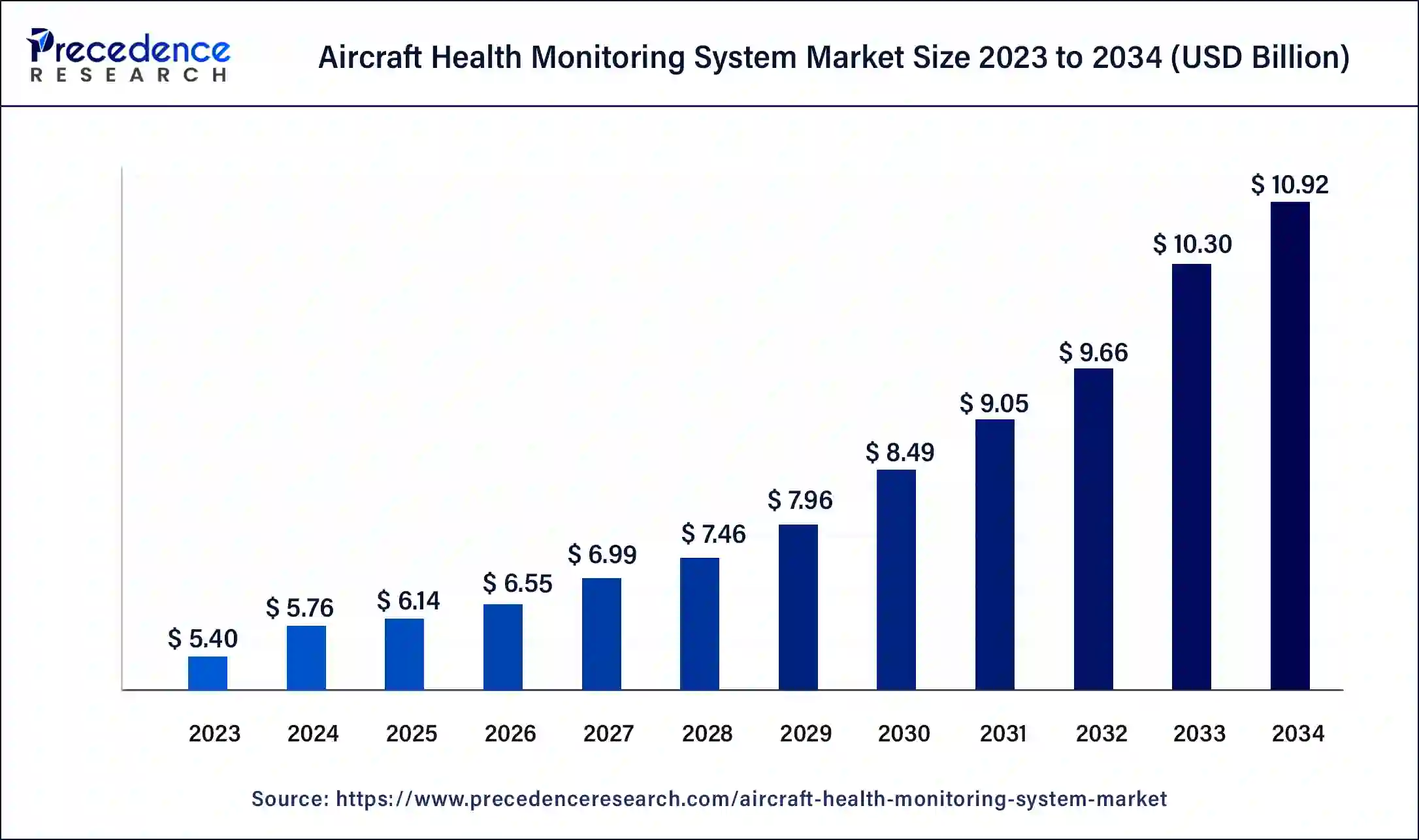

The global aircraft health monitoring system market size is projected to grow around USD 10.30 billion by 2033, growing at a CAGR of 6.67% from 2024 to 2033.

Key Points

- North America is expected to lead the global aircraft health monitoring system market in 2023 with revenue share of 34%.

- Asia Pacific is witnessing notable growth during the forecast period 2024 to 2033.

- By Fit, the line fit segment has captured highest revenue share of around 85% in 2023.

- By system, the software segment has dominated the market in 2023 with revenue share of 51% in 2023.

- By platform, the narrow body aircraft segment has dominated the market in 2023 with revenue share of 33.8%.

The Aircraft Health Monitoring System (AHMS) market is witnessing significant growth due to increasing demand for enhanced safety, reliability, and operational efficiency in the aviation sector. AHMS comprises a suite of technologies and sensors that monitor and analyze the health and performance of aircraft systems in real-time. These systems enable proactive maintenance, early fault detection, and predictive analytics, thereby reducing downtime, minimizing maintenance costs, and improving flight safety.

Get a Sample: https://www.precedenceresearch.com/sample/4060

Growth Factors:

Several factors drive the growth of the Aircraft Health Monitoring System market. One key factor is the rising emphasis on aviation safety and regulatory compliance. Aviation authorities worldwide are mandating the implementation of advanced monitoring and diagnostic systems to enhance safety standards and prevent in-flight incidents.

Moreover, the growing adoption of predictive maintenance strategies by airlines and aircraft operators is fueling the demand for AHMS solutions. Predictive maintenance allows operators to address potential issues before they escalate, leading to reduced maintenance costs, increased aircraft availability, and enhanced operational efficiency.

Furthermore, advancements in sensor technology, data analytics, and connectivity solutions are driving innovation in AHMS offerings. Integrated sensor networks, cloud-based analytics platforms, and real-time data transmission capabilities enable seamless monitoring of aircraft health and performance across fleets, facilitating more informed decision-making and optimization of maintenance processes.

Region Insights:

The Aircraft Health Monitoring System market exhibits varying dynamics across different regions. In North America, the presence of major aircraft manufacturers, technology vendors, and aviation service providers drives market growth. The region’s stringent regulatory environment and emphasis on safety standards contribute to the widespread adoption of AHMS solutions by airlines and maintenance organizations.

In Europe, the AHMS market benefits from strong aerospace and defense industries, as well as a robust ecosystem of research institutions and technology innovators. European airlines and OEMs prioritize efficiency and reliability, driving investments in advanced monitoring and diagnostic technologies to optimize fleet operations and maintenance practices.

In the Asia-Pacific region, rapid growth in air travel, rising demand for new aircraft, and increasing focus on fleet modernization are driving market expansion. Countries like China, India, and Singapore are investing in AHMS capabilities to enhance safety, reliability, and cost-effectiveness of their aviation fleets, presenting lucrative opportunities for AHMS vendors and service providers.

Aircraft Health Monitoring System Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.67% |

| Global Market Size in 2023 | USD 5.40 Billion |

| Global Market Size in 2024 | USD 5.76 Billion |

| Global Market Size by 2033 | USD 10.30 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Platform, By Fit, By System, and By Operation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Aircraft Health Monitoring System Market Dynamics

Drivers:

Several drivers contribute to the growth of the Aircraft Health Monitoring System market. One of the primary drivers is the need for proactive maintenance and operational optimization. AHMS enables continuous monitoring of aircraft systems and components, allowing operators to identify potential issues early and schedule maintenance activities more efficiently, thereby reducing downtime and improving aircraft availability.

Furthermore, the growing complexity of modern aircraft systems and the increasing volume of data generated during flight operations necessitate advanced monitoring and diagnostic capabilities. AHMS leverages technologies such as machine learning, artificial intelligence, and big data analytics to process and analyze vast amounts of data in real-time, enabling more accurate fault detection, diagnosis, and prognosis.

Moreover, the shift towards condition-based and predictive maintenance strategies is driving adoption of AHMS solutions among airlines, OEMs, and MRO providers. By transitioning from traditional calendar-based maintenance to data-driven, condition-based approaches, operators can optimize maintenance schedules, extend component life, and reduce overall maintenance costs.

Opportunities:

The Aircraft Health Monitoring System market presents numerous opportunities for growth and innovation. One such opportunity lies in the integration of AHMS with emerging technologies such as Internet of Things (IoT), edge computing, and digital twins. By leveraging IoT sensors and connectivity solutions, aircraft can transmit real-time health and performance data to ground-based monitoring systems, enabling remote diagnostics, prognostics, and maintenance planning.

Additionally, AHMS vendors can capitalize on the growing demand for data analytics and predictive maintenance services. By offering advanced analytics platforms, predictive modeling tools, and consulting services, vendors can help airlines and operators unlock the full potential of their data assets, optimize maintenance processes, and improve operational efficiency.

Furthermore, the expansion of AHMS capabilities beyond aircraft systems to include components such as engines, avionics, and structures presents new avenues for market growth. Integrated health monitoring solutions that provide holistic insights into the overall health and performance of aircraft systems offer added value to operators seeking comprehensive maintenance solutions.

Challenges:

Despite the opportunities, the Aircraft Health Monitoring System market faces several challenges that must be addressed to ensure sustained growth. One challenge is the complexity of integrating AHMS solutions with existing aircraft systems and maintenance workflows. Compatibility issues, data interoperability, and cybersecurity concerns pose hurdles to seamless implementation and adoption of AHMS technologies.

Moreover, the high upfront costs associated with AHMS deployment and integration can be prohibitive for some airlines and operators, particularly smaller carriers and fleet owners. Achieving a favorable return on investment requires careful planning, resource allocation, and alignment with business objectives, which may pose challenges for organizations with limited financial resources or competing priorities.

Furthermore, regulatory barriers and certification requirements add complexity to the deployment and operation of AHMS solutions. Compliance with aviation safety standards, data privacy regulations, and airworthiness directives necessitates thorough testing, validation, and documentation, which can prolong implementation timelines and increase project costs.

Read Also: Space Technology Market Size to Grow USD 916.85 Bn by 2033

Recent Developments

- In June 2023, GE Engine Services LLC (General Electric Company) was selected by Korea Aerospace Industries (KAI) to supply health and usage monitoring systems (HUMS).

- In July 2022, Curtiss-Wright Corporation was awarded a contract by Airbus to provide custom actuation technology. This technology offers improved reliability over legacy systems and incorporates health monitoring functions.

- In April 2022, Lufthansa Technik announced that it had recently enhanced its AVIATAR digital platform with various new digital fleet management applications for the Boeing 737 NG (Next Generation), which are now available to 737 operators around the world.

- In March 2022, Indigo announced that it had become the 55th airline to adopt Skywise Health Monitoring (SHM) as its future fleet performance tool.

Aircraft Health Monitoring System Market Companies

- Airbus SE

- Curtiss-Wright Corporation

- FLYHT Aerospace Solutions Ltd.

- GE Engine Services LLC (General Electric Company)

- Honeywell Aerospace

- Meggitt Plc

- Rolls-Royce Plc

- Safran

- SITA N.V.

- The Boeing Company

Segments Covered in the Report

By Platform

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Business Jet

- Helicopter

- Fighter Jet

By Fit

- Line Fit

- Retrofit

By System

- Hardware

- Software

- Services

By Operation

- Real-time

- Non-real-time

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/