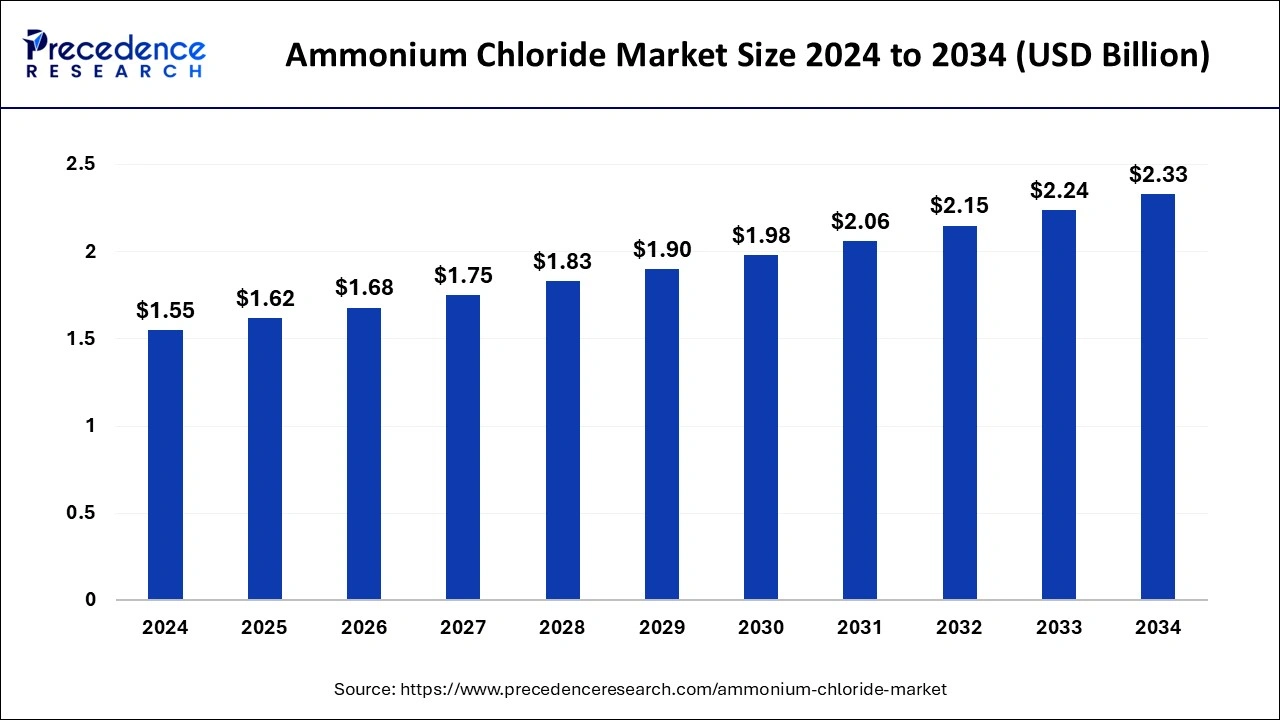

The global ammonium chloride market size is predicted to expand to around USD 2.24 billion by 2033, growing at a CAGR of 4.14% from 2024 to 2033.

Key Points

- Asia Pacific held the largest market share of 51% in 2023.

- North America is poised to be the second-largest position holder in the market over the forecast period.

- By grade, in 2023, the agriculture grade segment held the highest market share of 28%.

- By grade, the food grade segment is anticipated to witness rapid growth at a significant CAGR of 4.9% during the projected period.

- By application, the fertilizer segment has held 24% of the market share in 2023.

- By application, the medical/pharmaceutical segment is anticipated to witness rapid growth of 3.5% over the projected period.

The global ammonium chloride market has witnessed steady growth in recent years, driven by its diverse applications across various industries such as agriculture, pharmaceuticals, chemicals, and electronics. Ammonium chloride, chemically known as NH4Cl, is a white crystalline salt that is soluble in water and forms slightly acidic solutions. It is produced through the reaction of ammonia with hydrochloric acid and finds extensive use as a nitrogen fertilizer, electrolyte in dry cell batteries, flux in metal refining, and as a feed additive for livestock.

Get a Sample: https://www.precedenceresearch.com/sample/3967

Growth Factors:

Several factors have contributed to the growth of the global ammonium chloride market. Firstly, the increasing demand for nitrogen fertilizers to enhance crop yields and improve soil fertility has driven the consumption of ammonium chloride in the agriculture sector. As global population growth and urbanization continue to escalate, the need for sustainable agricultural practices and efficient nutrient management has bolstered the adoption of ammonium chloride-based fertilizers.

Moreover, the expanding electronics industry, particularly in Asia Pacific, has fueled demand for ammonium chloride as a flux in soldering operations for printed circuit boards (PCBs). Ammonium chloride serves as a fluxing agent, facilitating the removal of metal oxides and ensuring proper soldering of electronic components, thereby contributing to the production of high-quality electronic devices.

Furthermore, the pharmaceutical industry utilizes ammonium chloride in various medicinal formulations, such as cough syrups and expectorants, owing to its expectorant and diuretic properties. The growing prevalence of respiratory ailments and the increasing demand for over-the-counter (OTC) pharmaceutical products have augmented the consumption of ammonium chloride in the healthcare sector.

Additionally, the chemical industry utilizes ammonium chloride as a raw material in the production of various chemicals, including sodium carbonate (soda ash), ammonium sulfate, and methylamines. The versatility of ammonium chloride as a chemical precursor for diverse industrial processes has contributed to its steady demand and growth in the chemical manufacturing sector.

Furthermore, advancements in production technologies and the expansion of manufacturing capacities have enhanced the supply chain efficiency of ammonium chloride, ensuring a reliable and consistent availability of the product in the market. Manufacturers are investing in process optimization, energy efficiency, and environmental sustainability initiatives to meet the growing demand for high-quality ammonium chloride products.

Region Insights:

The consumption and production of ammonium chloride vary across regions, influenced by factors such as industrialization, agricultural practices, and economic development. In Asia Pacific, countries such as China, India, and Japan are among the largest consumers and producers of ammonium chloride globally. China, in particular, dominates the market due to its extensive fertilizer use in agriculture and significant presence in the electronics manufacturing industry.

In Europe, countries like Germany, the Netherlands, and France have well-established chemical and agricultural sectors, driving demand for ammonium chloride in fertilizer production and industrial applications. The region’s stringent regulations on chemical safety and environmental protection have prompted manufacturers to adopt sustainable production practices and comply with strict quality standards.

In North America, the United States and Canada are major consumers of ammonium chloride, primarily in the agriculture and chemical industries. The presence of large-scale agricultural operations and chemical manufacturing facilities in North America sustains the demand for nitrogen fertilizers and industrial chemicals, supporting the growth of the regional market.

In Latin America, countries such as Brazil and Argentina are significant consumers of nitrogen fertilizers, driving demand for ammonium chloride in the agricultural sector. The region’s fertile agricultural lands and growing population necessitate the use of fertilizers to meet food production demands, thereby fueling the consumption of ammonium chloride.

In the Middle East and Africa, the agricultural sector plays a vital role in the economy of several countries, leading to the consumption of nitrogen fertilizers like ammonium chloride. Additionally, the region’s expanding industrial base and infrastructure development projects contribute to the demand for chemicals and raw materials, including ammonium chloride.

Ammonium Chloride Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 1.49 Billion |

| Global Market Size by 2033 | USD 2.24 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.14% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Grade and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Ammonium Chloride Market Dynamics

Drivers:

Several drivers are propelling the growth of the global ammonium chloride market. One of the primary drivers is the increasing demand for nitrogen fertilizers to support agricultural productivity and food security. As the global population continues to expand, there is a growing need to enhance crop yields and improve soil fertility through the application of fertilizers, including ammonium chloride.

Moreover, the burgeoning electronics industry, driven by consumer electronics, telecommunications, and automotive sectors, is driving demand for ammonium chloride as a flux in soldering applications. The proliferation of electronic devices and the trend towards miniaturization and higher component density require efficient soldering processes, thereby boosting the consumption of ammonium chloride in electronic manufacturing.

Furthermore, the pharmaceutical industry’s focus on research and development of innovative medicines and healthcare products has increased the demand for pharmaceutical-grade ammonium chloride. As respiratory ailments and cough-related disorders remain prevalent worldwide, pharmaceutical formulations containing ammonium chloride are sought after for their expectorant and mucolytic properties.

Additionally, the chemical industry’s expansion and diversification, particularly in emerging economies, are driving demand for ammonium chloride as a raw material for various chemical processes. Ammonium chloride serves as a precursor for the production of numerous chemicals, including PVC resins, alkylamines, and quaternary ammonium compounds, thereby fueling its consumption across diverse industrial sectors.

Furthermore, technological advancements in manufacturing processes, such as the development of efficient synthesis methods and purification techniques, are enhancing the production efficiency and quality of ammonium chloride. Continuous improvements in production technologies enable manufacturers to meet evolving market demands, reduce production costs, and enhance product performance, thereby stimulating market growth.

Opportunities:

The global ammonium chloride market presents several opportunities for industry participants across the value chain. Firstly, the growing trend towards sustainable agriculture and organic farming practices creates opportunities for manufacturers to develop eco-friendly nitrogen fertilizers containing ammonium chloride. Organic-certified fertilizers and bio-based formulations appeal to environmentally conscious consumers and farmers, driving demand for sustainable agricultural inputs.

Moreover, the expansion of the electronics industry and the increasing adoption of advanced electronic devices, such as smartphones, tablets, and wearable technologies, offer opportunities for ammonium chloride suppliers. As electronic manufacturers strive to improve product performance, reliability, and energy efficiency, the demand for high-purity fluxes like ammonium chloride is expected to rise.

Furthermore, the pharmaceutical industry’s focus on respiratory health and the development of novel drug formulations present opportunities for manufacturers to innovate and diversify their product offerings. Ammonium chloride-based cough syrups, expectorants, and respiratory medicines cater to a growing consumer base seeking effective remedies for respiratory ailments and cough-related disorders.

Additionally, the expansion of chemical manufacturing activities, particularly in emerging economies, offers opportunities for ammonium chloride producers to expand their presence in key markets. Collaborations with chemical manufacturers, research institutions, and government agencies can facilitate technology transfer, market expansion, and product innovation in the chemical sector.

Furthermore, investments in research and development (R&D) aimed at improving the efficiency, performance, and sustainability of ammonium chloride production processes present opportunities for technological innovation and market differentiation. Advancements in catalytic synthesis, purification methods, and waste minimization techniques can enhance the competitiveness and environmental profile of ammonium chloride products.

Challenges:

Despite the growth prospects, the global ammonium chloride market faces several challenges that may impact market dynamics and growth potential. One of the primary challenges is the volatility of raw material prices, particularly ammonia and hydrochloric acid, which are key feedstocks for ammonium chloride production. Fluctuations in raw material costs can impact production margins and profitability for manufacturers, necessitating effective supply chain management and price hedging strategies.

Read Also: Nanosensors Market Size to Rake USD 1,712.89 Million by 2033

Recent Developments

- In March 2023, Yara Clean Ammonia and Enbridge Inc. penned a letter of intent to collaboratively develop and build a low-carbon blue ammonia production plant in Texas, USA. The facility, anticipated to have a capacity ranging from 1.2 to 1.4 million tons per annum, will employ auto-thermal reforming coupled with carbon capture technology. Its objective is to address the increasing global demand for low-carbon ammonia. Subject to approval, the project entails an investment ranging between $2.6 and $2.9 billion.

- In May 2022, BASF unveiled the expansion of its Automotive Coatings Application Center in Mangalore, India. The facility has been meticulously designed to facilitate customer-centric R&D operations and provide an authentic simulation of OEM paint shops.

Ammonium Chloride Market Companies

- BASF SE (Germany)

- The Dallas Group of America (U.S.)

- Central Glass Co., Ltd (Japan)

- Tuticorin Alkali Chemicals And Fertilizers Limited (India)

- Tinco Chemicals Private Limited (India)

- Hubei Yihua Chemical Industry Co Ltd (China)

- Jinshan Chemical (China)

- CNSG (China)

- HEBANG (China)

- Tianjin Bohua YongLi Chemical (China)

- Shannxi Xinghua (China)

- Shijiazhuang Shuanglian Chemical (China)

- Liuzhou Chemical (China)

- Hangzhou Longshan Chemical (China)

- Sichuan Guangzhou (China)

- Guangyu Chemical Co Ltd (China)

- Shanxi Yangmei Fengxi Fertilizer Industry (Group) Co., Ltd (China)

- YNCC (South Korea)

Segments Covered in the Report

By Grade

- Food Grade

- Industrial Grade

- Agriculture Grade

- Metal Works Grade

By Application

- Agrochemical

- Medical/Pharmaceutical

- Food Additives

- Leather & Textiles

- Batteries

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/