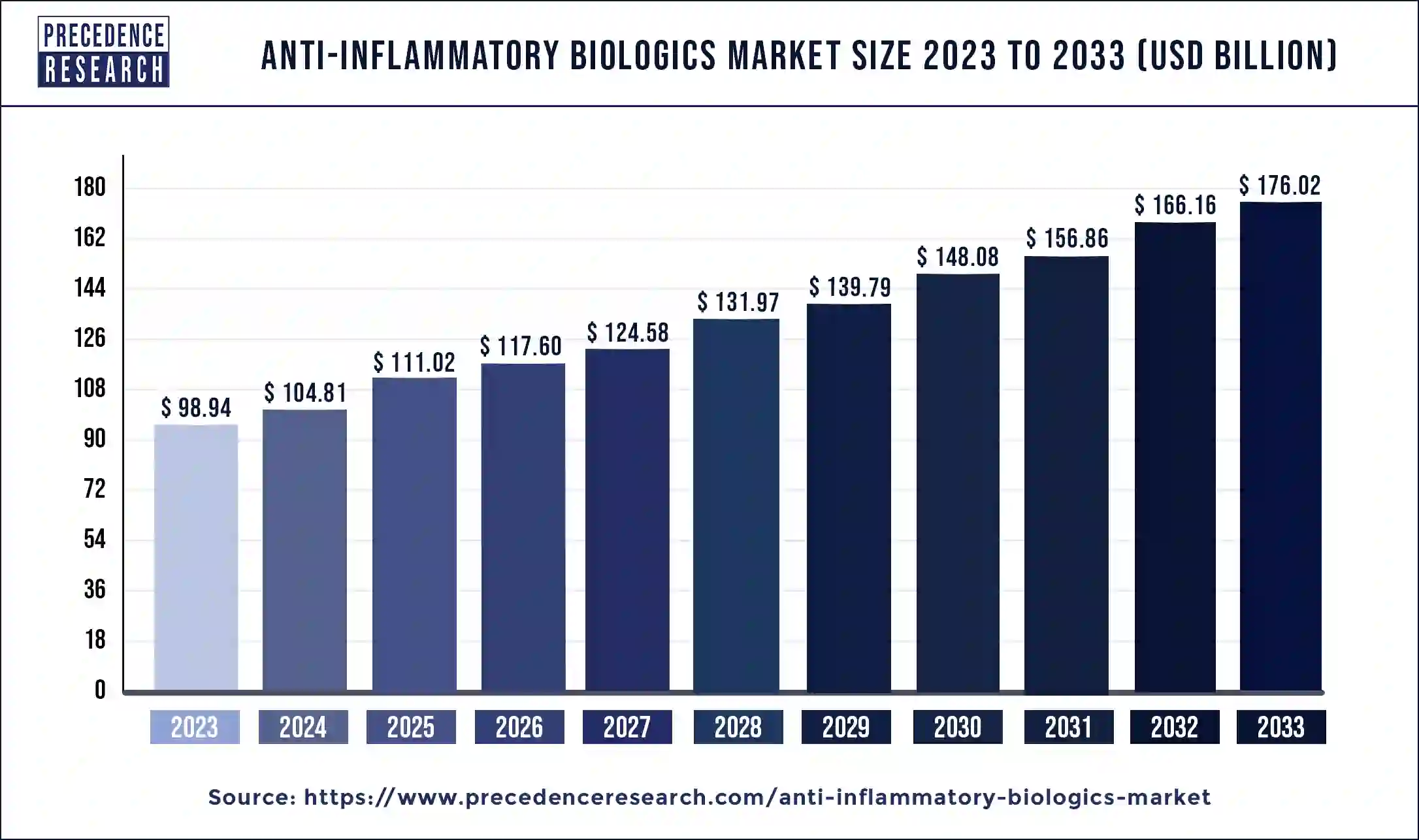

The global anti-Inflammatory biologics market size was valued at USD 98.94 billion in 2023 and is predicted to reach around USD 176.02 billion by 2033, expanding at a CAGR of 5.93% from 2024 to 2033.

Key Points

- The North America anti-inflammatory biologics market size is exhibited at USD 60.35 billion in 2023 and is expected to attain around USD 108.25 billion by 2033, poised to grow at a CAGR of 6.01% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 61% in 2023.

- Europe is expected to host the fastest-growing market during the forecast period.

- By drug class, the anti-tumor necrosis factor (TNF) segment has contributed more than 45% of revenue share in 2023.

- By drug class, the interleukin antagonists segment is expected to grow at the highest CAGR in the market during the forecast period.

- By application, the rheumatoid arthritis segment dominated the market in 2023.

- By application, the psoriasis segment is expected to grow at the highest CAGR in the market during the forecast period.

- By route of administration, the injection segment dominated the market in 2023.

- By route of administration, the oral segment is expected to grow rapidly in the market in the upcoming years.

- By distributional channel, the hospital pharmacy segment dominated the market in 2023.

- By distributional channel, the retail pharmacy segment is expected to grow at the fastest rate in the market during the forecast period.

The global anti-inflammatory biologics market has been experiencing significant growth due to rising incidences of chronic inflammatory diseases such as rheumatoid arthritis, inflammatory bowel disease, psoriasis, and others. Anti-inflammatory biologics are advanced therapies derived from biological sources that target specific molecules involved in the inflammatory process, providing more targeted and effective treatment options compared to traditional therapies. These biologics include monoclonal antibodies, interleukin inhibitors, TNF inhibitors, and others, which have revolutionized the management of inflammatory conditions by modulating immune responses.

Get a Sample: https://www.precedenceresearch.com/sample/4507

Growth Factors

Several key factors are driving the growth of the anti-inflammatory biologics market. Firstly, increasing prevalence of chronic inflammatory diseases globally is a major driver. Lifestyle changes, aging populations, and environmental factors contribute to the rising incidence rates, necessitating effective treatment options like biologics. Secondly, advancements in biotechnology and pharmacology have enabled the development of more potent and specific biologic therapies, enhancing treatment outcomes and patient quality of life. Additionally, growing healthcare expenditure, improving healthcare infrastructure, and rising awareness among patients and healthcare providers about biologics’ benefits further propel market expansion.

Region Insights

Geographically, North America and Europe dominate the anti-inflammatory biologics market. These regions have well-established healthcare systems, higher adoption rates of advanced therapies, and substantial investments in research and development. In North America, the U.S. accounts for the largest share due to a large patient pool, supportive reimbursement policies, and strong presence of biopharmaceutical companies. Europe follows closely, with countries like Germany, France, and the UK leading in market size and research activities. Asia-Pacific is witnessing rapid growth driven by increasing healthcare expenditure, rising chronic disease burden, and improving access to biologic therapies.

Anti-Inflammatory Biologics Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 176.02 Billion |

| Market Size in 2023 | USD 98.94 Billion |

| Market Size in 2024 | USD 104.81 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Drug Class, Application, Route of Administration, Distributional Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Anti-Inflammatory Biologics Market Dynamics

Drivers

Several drivers contribute to the robust growth of the anti-inflammatory biologics market. Technological advancements in biopharmaceutical manufacturing and drug delivery systems enhance product efficacy and patient compliance. Regulatory approvals for new indications and expanded use of existing biologics broaden market opportunities. Moreover, strategic collaborations and partnerships between pharmaceutical companies, academic institutions, and research organizations accelerate innovation and market penetration. Additionally, patient preference for biologics over conventional therapies due to superior efficacy and fewer side effects further boosts market demand.

Opportunities

The anti-inflammatory biologics market presents numerous opportunities for growth and innovation. Expanding indications for existing biologics into new therapeutic areas such as neurology, dermatology, and ophthalmology broaden market potential. Personalized medicine approaches, including biomarker-based therapies, offer customized treatment options and improve patient outcomes. Furthermore, increasing investments in biotechnology research and development, particularly in emerging markets, create opportunities for novel biologic drug development and market expansion. The shift towards value-based healthcare models and emphasis on cost-effectiveness drive demand for biologics that reduce long-term healthcare costs through disease management and prevention.

Challenges

Despite significant growth prospects, the anti-inflammatory biologics market faces several challenges. High costs associated with biologic therapies limit accessibility, particularly in developing regions with constrained healthcare budgets. Manufacturing complexities and stringent regulatory requirements for biologics production pose challenges for market players. Additionally, concerns about long-term safety profiles and potential adverse effects of biologics require continuous monitoring and pharmacovigilance. Competition from biosimilars, which offer lower-cost alternatives to branded biologics, intensifies market competition and pricing pressures, impacting profit margins for original manufacturers.

Read Also: Data Center Networking Market Size to Reach USD 98.57 Bn by 2033

Anti-Inflammatory Biologics Market Companies

- Amgen Inc

- Novartis AG

- AstraZeneca PLC.

- Johnson & Johnson

- PFIZER INC.

- GlaxoSmithKline plc

- F.Hoffmann-La Roche AG

- Merck & Co., Inc.

- Eli Lily and Company

Recent Developments

- In May 2024, Eisai Co., Ltd. and Biogen Inc. announced that, following the FDA’s Fast Track designation, Eisai had started rolling submission of a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) for lecanemab-irmb (U.S. brand name: LEQEMBI®) subcutaneous autoinjector for weekly maintenance dosing.

- In February 2024, the global pharmaceutical giant Hikma Pharmaceuticals PLC (Hikma) announced the U.S. launch of COMBOGESIC® IV (acetaminophen and ibuprofen) injection. COMBOGESIC® IV is an opioid-free intravenous pain reliever that combines 300 mg of nonsteroidal anti-inflammatory medication (NSAID) ibuprofen with 1,000 mg of acetaminophen.

- In June 2023, Lodoco (colchicine) was authorized by the FDA to lower the risk of cardiovascular mortality, myocardial infarction (MI), stroke, and coronary revascularization in adult patients. Lodoco, created by Agepha Pharma, is the first medication authorized to address inflammation, which is a fundamental factor in atherosclerotic cardiovascular disease.

- In January 2023, Sun Pharmaceutical Industries Limited declared that it had acquired three brands from Aksigen Hospital Care, a Mumbai-based company that treats post-operative inflammation in patients having minor surgery and dental work done. The Drugs Controller General of India (DCGI) has authorized the Disperzyme, Disperzyme-CD, and Phlogam brands.

Segment Covered in the Report

By Drug Class

- Anti-tumor Necrosis Factor (TNF)

- Interleukins Antagonists

- Janus Kinase (JAK) Inhibitor

- Others

By Application

- Rheumatoid Arthritis

- Psoriasis

- Others

By Route of Administration

- Oral

- Injection

- Intravenous

- Subcutaneous

By Distributional Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/