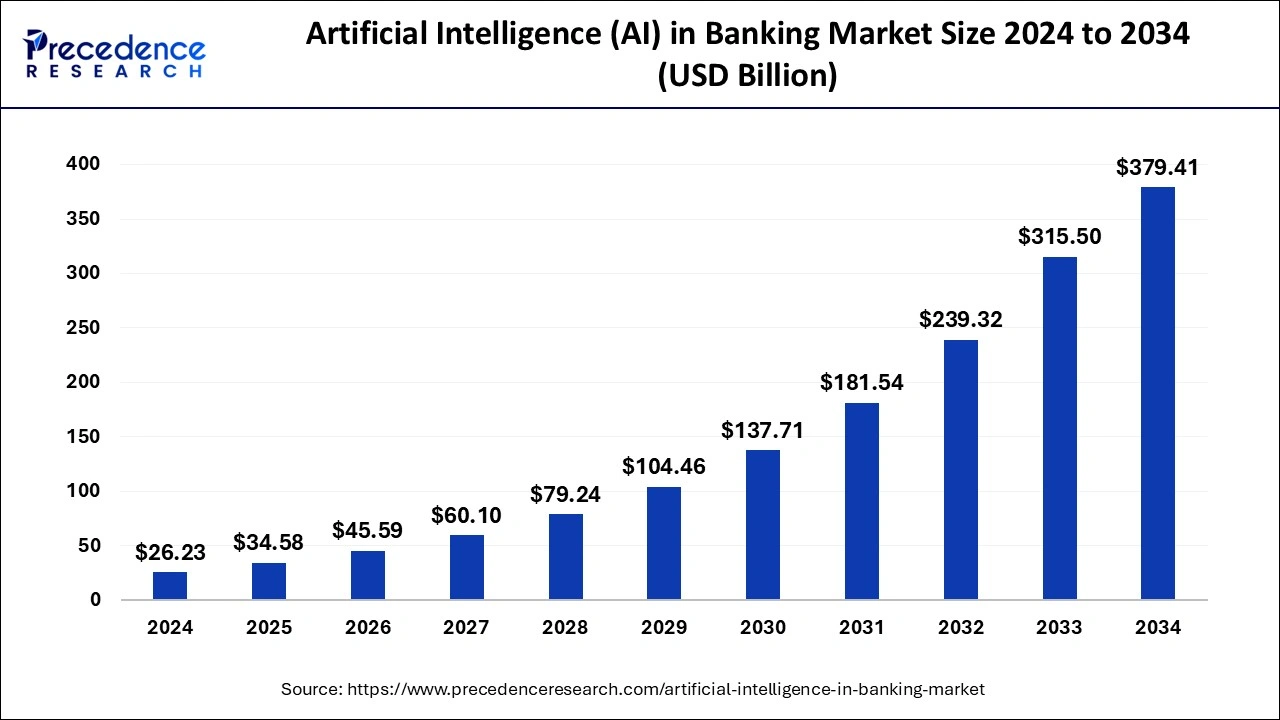

The global artificial intelligence (AI) in banking market size was USD 19.90 billion in 2023 and is expected to reach around USD 315.50 billion by 2033. The market is expanding at a solid CAGR of 31.83% over the forecast period 2024 to 2033.

Key Points

- North America led the artificial intelligence (AI) in banking market in 2023.

- Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

- By component, the solution segment dominated the market in 2023.

- By component, the service segment is expected to gain a significant share of the market during the forecast period.

- By application, the risk management segment held the largest share of the market in 2023.

- By application, the customer service segment is expected to increase its CAGR over the forecast period.

- By technology, the natural language processing (NPL) segment accounted for the largest of the market in 2023.

- By technology, the computer vision segment will grow rapidly in the market during the forecast period.

- By enterprise size, the large enterprise segment accounted for the largest share of the market in 2023.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to register significant growth in the market during the forecast period.

Artificial Intelligence (AI) has revolutionized the banking sector, introducing unprecedented efficiencies and transforming customer experiences. AI applications in banking encompass a wide range of functionalities, including customer service chatbots, fraud detection systems, personalized financial advice, credit scoring models, and risk management tools. These technologies leverage machine learning algorithms to analyze vast amounts of data swiftly and accurately, enabling banks to make data-driven decisions in real-time. The AI in banking market is poised for significant growth globally, driven by the increasing adoption of digital transformation strategies and the need for enhanced operational efficiency and customer satisfaction.

Get a Sample: https://www.precedenceresearch.com/sample/4445

Growth Factors

The growth of AI in banking is fueled by several key factors. Firstly, banks are increasingly investing in AI to streamline operations and reduce costs through automation. AI-powered systems can handle routine tasks such as transaction processing and customer inquiries, freeing up human resources for more complex and strategic roles. Secondly, the explosion of data availability has prompted banks to leverage AI for data analytics, enabling them to derive valuable insights for better decision-making and personalized customer experiences. Thirdly, regulatory pressures and the need for stringent compliance have pushed banks to adopt AI-driven solutions for fraud detection, anti-money laundering (AML) efforts, and risk management.

Regional Insights

The adoption of AI in banking varies across regions, influenced by regulatory environments, technological infrastructure, and market maturity. In North America, particularly in the United States, leading banks have been early adopters of AI technologies, integrating them into their core operations to improve efficiency and customer service. In Europe, countries like the UK and Germany have seen significant AI adoption in banking, driven by regulatory reforms and the push towards digital transformation. In Asia-Pacific, countries such as China and India are witnessing rapid AI adoption in banking, supported by robust digital ecosystems and a growing middle-class population demanding sophisticated financial services.

Artificial Intelligence (AI) in Banking Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 19.90 Billion |

| Market Size in 2024 | USD 26.23 Billion |

| Market Size by 2033 | USD 315.50 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 31.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Application, Technology, Enterprise Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial Intelligence (AI) in Banking Market Dynamics

Drivers

Several drivers propel the adoption of AI in the banking sector. Firstly, the quest for operational excellence and cost efficiency drives banks to automate processes using AI, reducing manual errors and operational costs. Secondly, the demand for personalized customer experiences prompts banks to deploy AI-powered chatbots and recommendation engines, enhancing customer engagement and satisfaction. Thirdly, regulatory requirements for enhanced security and compliance push banks to invest in AI-driven solutions for fraud detection, KYC (Know Your Customer) procedures, and regulatory reporting.

Opportunities

The AI in banking market presents numerous opportunities for growth and innovation. One significant opportunity lies in the development of AI-powered predictive analytics and real-time decision-making tools, enabling banks to offer proactive financial advice and risk management solutions to customers. Moreover, the integration of AI with blockchain technology holds promise for secure and transparent banking transactions, reducing fraud and enhancing trust among customers. Furthermore, partnerships between banks and fintech startups specializing in AI offer opportunities for collaboration and co-creation of innovative solutions tailored to evolving customer needs.

Challenges

Despite its promising prospects, AI adoption in banking faces several challenges. Firstly, concerns about data privacy and cybersecurity remain paramount, requiring banks to invest in robust data protection measures and comply with stringent regulatory requirements. Secondly, the shortage of skilled AI talent poses a challenge, as banks compete for data scientists and AI engineers capable of developing and maintaining sophisticated AI systems. Thirdly, the complexity of integrating AI with legacy banking systems and ensuring interoperability across different platforms can hinder seamless adoption and implementation.

Read Also: Automotive Plastics Market Size to Reach USD 52.78 Bn By 2033

Artificial Intelligence (AI) in Banking Market Companies

- Amazon Web Services, Inc.

- Capital One

- Cisco Systems, Inc.

- FAIR ISAAC CORPORATION (FICO)

- Goldman Sachs

- International Business Machines Corporation

- JPMorgan Chase & Co.

- NVIDIA Corporation

- RapidMiner

- SAP SE

Recent Developments

- In May 2024, The Ministry of Industry and Advanced Technology (MoIAT) announced the collaboration with the Emirates Development Bank (EDB), a major financial engine of industrial advancements and economic development in the UAE, for providing AED 370 million in financing solutions for the development of new AI Innovation Program.

- In May 2024, Sterling Bank collaborated with AI in Nigeria to introduce the ‘Nigeria AI Landscape and Startup Report’, providing a diversified view of Nigeria’s ecosystem and startup scene.

Segments Covered in the Report

By Component

- Service

- Solution

By Application

- Risk Management

- Customer Service

- Virtual Assistant

- Financial Advisory

- Others

By Technology

- Natural Language Processing (NLP)

- Machine Learning & Deep Learning

- Computer Vision

- Other

By Enterprise Size

- Large Enterprise

- SMEs

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/