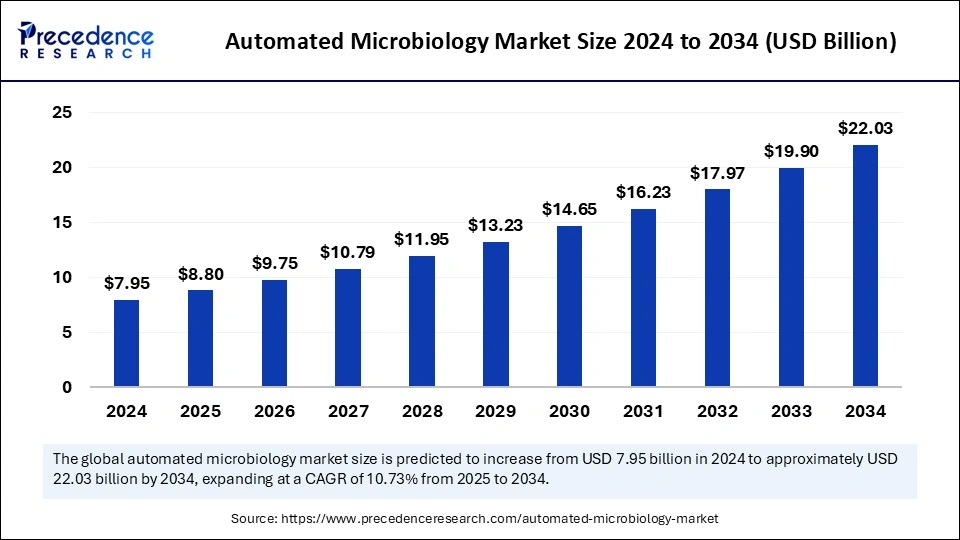

The global automated microbiology market was valued at USD 7.95 billion in 2024 and is projected to reach approximately USD 22.03 billion by 2034, growing at a CAGR of 10.73%.

Automated Microbiology Market Key Takeaways

- North America led the market by holding more than 41% of the market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the studied period.

- By product, the reagents and kits segment held the biggest market share of 49% in 2024.

- By product, the instruments segment is anticipated to grow at the fastest CAGR over the forecast period.

- By automation type, the fully automated segment led the market in 2024.

- By application, the clinical diagnostics segment dominated the market in 2024.

- By application, the biopharmaceutical production segment is anticipated to grow at the fastest CAGR over the forecast period.

- By end use, the hospitals and diagnostic laboratories segment held the biggest market share of 45% in 2024.

- By end use, the pharmaceutical and biotechnology companies segment is anticipated to grow at the fastest rate during the projected period.

The automated microbiology market is experiencing significant growth due to the increasing demand for faster, more accurate, and cost-effective diagnostic solutions. Automation in microbiology has transformed traditional laboratory workflows, reducing human errors and improving efficiency in detecting and analyzing microbial infections. This technology is widely used in clinical diagnostics, pharmaceutical research, food safety, and environmental monitoring, making it an essential component of modern microbiological testing. The rising prevalence of infectious diseases, antimicrobial resistance, and hospital-acquired infections has heightened the need for advanced diagnostic tools, further driving the adoption of automation in microbiology.

The shift toward high-throughput testing, coupled with advancements in artificial intelligence and machine learning, has further propelled market expansion. Automated microbiology systems allow for real-time monitoring, rapid pathogen detection, and streamlined laboratory operations. As laboratories worldwide continue to adopt automated solutions to meet the growing demand for faster diagnostic turnaround times, the market is expected to see sustained growth over the coming years. Additionally, stringent regulations regarding food safety, water quality, and pharmaceutical manufacturing have accelerated the deployment of automated microbiology solutions across multiple industries.

Sample Link: https://www.precedenceresearch.com/sample/5722

Key Drivers

The increasing incidence of infectious diseases, including respiratory infections, gastrointestinal diseases, and hospital-acquired infections, has driven the demand for automated microbiology solutions. With growing global health concerns and the need for rapid diagnosis, automated microbiology systems offer accurate and efficient pathogen identification, leading to timely treatment and containment of infectious outbreaks. The rise of antimicrobial resistance has also necessitated advanced microbiological testing to determine the most effective treatment options for patients.

Technological advancements in microbiological testing, such as automated culture systems, molecular diagnostics, and mass spectrometry-based microbial identification, have enhanced the accuracy and speed of diagnostic processes. These innovations allow laboratories to process large volumes of samples efficiently while maintaining high levels of precision. The integration of artificial intelligence and digitalization in microbiology labs has further improved workflow automation, data management, and predictive analytics, making diagnostics more efficient.

Government initiatives and regulatory policies promoting laboratory automation in healthcare, food safety, and pharmaceutical manufacturing have played a crucial role in market growth. Compliance with stringent regulations, such as those set by the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the World Health Organization (WHO), has encouraged laboratories to adopt automated microbiology solutions to meet industry standards and improve overall efficiency.

Opportunities

The expansion of diagnostic laboratories, particularly in developing regions, presents a significant opportunity for automated microbiology market growth. With increasing investments in healthcare infrastructure and laboratory automation, emerging economies are expected to contribute substantially to market expansion. The growing demand for point-of-care testing and decentralized diagnostic solutions has also created new opportunities for portable and compact automated microbiology systems.

The pharmaceutical and biotechnology sectors are witnessing a surge in microbiology testing for drug development and quality control. Automated microbiology solutions play a crucial role in ensuring the safety and efficacy of pharmaceutical products by detecting microbial contamination. As research and development in the pharmaceutical industry continue to expand, the need for advanced microbiological testing solutions is expected to rise.

The food and beverage industry is another promising sector for automated microbiology market growth. Foodborne illnesses and contamination incidents have raised awareness about the importance of rapid and reliable microbial testing. Automated microbiology systems help food manufacturers comply with regulatory standards, minimize product recalls, and ensure consumer safety. The increasing focus on food safety and quality control is likely to drive market demand in this segment.

Challenges

Despite its numerous advantages, the adoption of automated microbiology systems comes with certain challenges. High initial investment costs and maintenance expenses can hinder the widespread adoption of these systems, particularly in small and medium-sized laboratories with budget constraints. The need for specialized personnel to operate and maintain automated microbiology systems also poses a challenge, as trained professionals are required to handle advanced diagnostic technologies.

Interoperability issues between automated microbiology systems and existing laboratory information management systems (LIMS) can create integration challenges. Laboratories must ensure seamless connectivity between different diagnostic platforms to achieve efficient workflow automation and data management. Addressing these integration challenges requires additional investment in IT infrastructure and software solutions.

Regulatory compliance and standardization issues also present challenges for the market. The development and approval of automated microbiology systems must adhere to strict regulatory guidelines, which can delay product launches and market entry. Additionally, variations in regulatory requirements across different countries can create complexities for manufacturers looking to expand their global presence.

Regional Insights

North America dominates the automated microbiology market due to the presence of well-established healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong government initiatives supporting laboratory automation. The United States, in particular, has a significant market share, driven by increasing investments in research and development, a rising burden of infectious diseases, and stringent regulatory requirements for microbiological testing.

Europe is another key market, with countries such as Germany, the United Kingdom, and France leading in technological advancements and healthcare automation. The region’s focus on improving diagnostic capabilities, increasing investments in life sciences research, and stringent food safety regulations contribute to market growth. The European Union’s regulatory framework for microbial testing in pharmaceuticals and food production has further boosted demand for automated microbiology solutions.

The Asia-Pacific region is expected to witness the fastest growth in the automated microbiology market due to rapid industrialization, expanding healthcare infrastructure, and rising awareness about the benefits of laboratory automation. Countries like China, India, and Japan are investing heavily in medical diagnostics, biotechnology, and pharmaceutical research, driving the demand for advanced microbiology testing solutions. The growing prevalence of infectious diseases and government initiatives to strengthen healthcare systems are also contributing to market expansion.

Latin America and the Middle East & Africa are gradually adopting automated microbiology solutions, particularly in the healthcare and food safety sectors. While these regions face challenges such as limited access to advanced diagnostic technologies and budget constraints, increasing investments in laboratory automation and healthcare modernization are expected to create growth opportunities in the coming years.

Don’t Miss Out: Solid Tumor Cancer Treatment Market

Market Key Players

- BD

- QIAGEN

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Danaher

- Merck KGaA

- bioMérieux

- Abbott

- DiaSorin S.p.A.

- BioRad Laboratories, Inc.

Recent News

Recent advancements in automated microbiology have focused on enhancing diagnostic speed, accuracy, and efficiency. The introduction of AI-powered microbiology systems has improved the ability to identify and analyze microbial pathogens with higher precision. Leading companies in the market are investing in research and development to develop next-generation microbiology automation platforms with enhanced data analytics and cloud-based connectivity.

The COVID-19 pandemic accelerated the adoption of automated microbiology solutions as laboratories faced increased testing demands. The need for high-throughput diagnostic solutions led to greater investment in automation technologies to streamline workflows and reduce turnaround times. This trend has continued post-pandemic, with laboratories prioritizing automation to improve efficiency and preparedness for future outbreaks.

Pharmaceutical and biotechnology companies are increasingly integrating automated microbiology solutions into drug discovery and production processes. Recent collaborations between diagnostic companies and pharmaceutical firms have focused on developing rapid microbiological testing methods to ensure product safety and regulatory compliance. Innovations in automated microbial identification and susceptibility testing have also contributed to improving the efficacy of antimicrobial treatments.

The food and beverage industry has witnessed increased adoption of automated microbiology solutions to prevent contamination and ensure food safety. Leading manufacturers are implementing advanced microbiological testing technologies to meet regulatory requirements and enhance quality control. The integration of blockchain and digital tracking systems in microbiological testing is also gaining traction, allowing for better traceability and transparency in the food supply chain.

With continuous advancements in diagnostic technology, increasing demand for rapid microbiological testing, and expanding applications in healthcare, pharmaceuticals, and food safety, the automated microbiology market is poised for sustained growth in the coming years.

Market Segmentation

By Product

- Instruments

- Automated Microbial Identification Systems

- Automated Blood Culture Systems

- Automated Colony Counters

- Automated Sample Preparation Systems

- Automated Antibiotic Susceptibility Testing (AST) Systems

- Other Instruments

- Reagents and Kits

- Culture Media

- Stains and Dyes

- Assay Kits and Panels

- Others

- Software

By Automation Type

- Fully Automated

- Semi-Automated

By Application

- Biopharmaceutical Production

- Clinical Diagnostics

- Environmental and Water Testing

- Food and Beverage Testing

- Other Applications

By End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Academic and Research Institutes

- Other End Use

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa