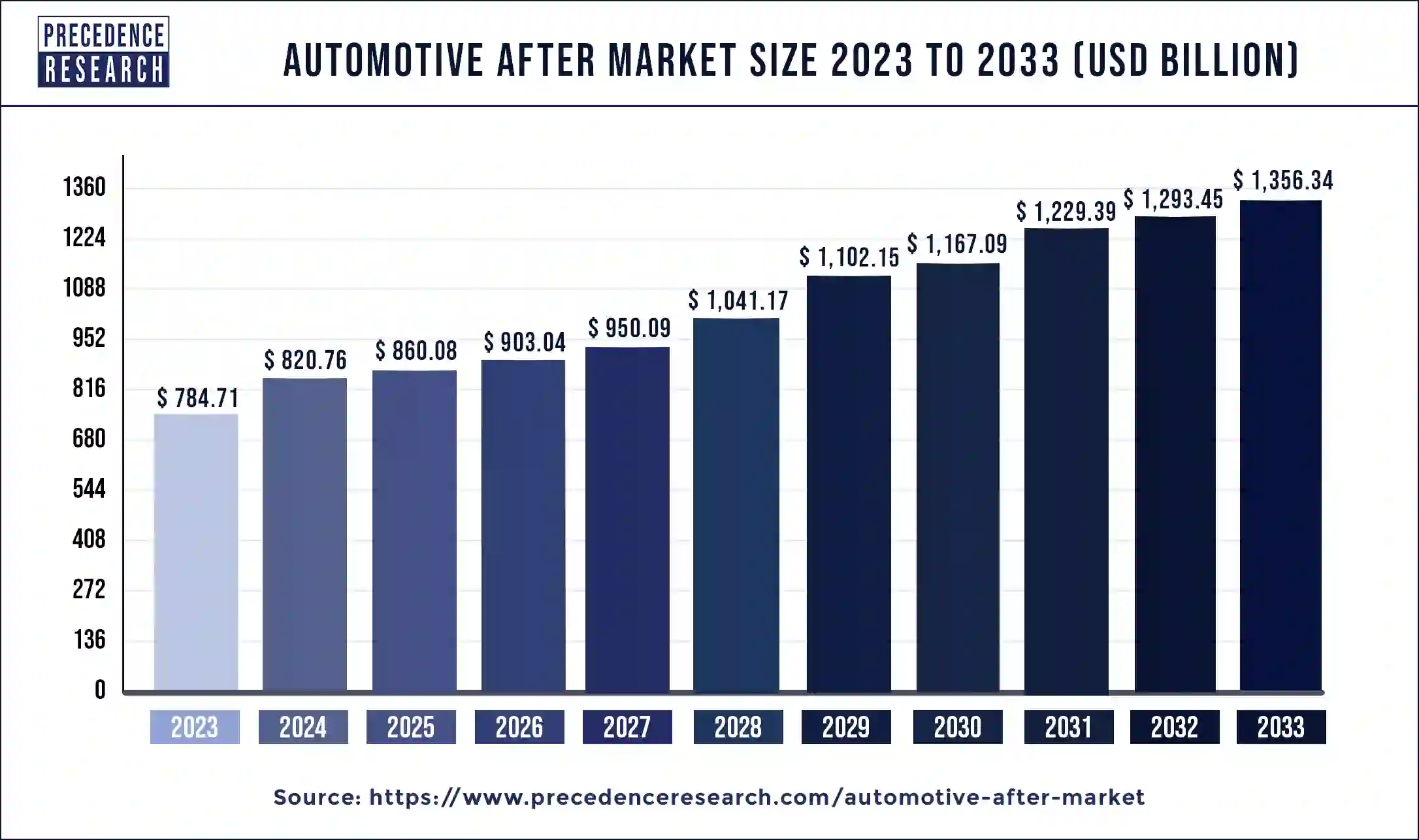

The global automotive aftermarket is projected to reach USD 1,356.34 billion by 2033, growing at a CAGR of 5.74% from 2024 to 2033.

Automotive Aftermarket Key Takeaways

- North America dominated the global market in 2023, holding the highest share of 34.95%.

- The tire segment recorded the largest market share by product in 2023.

- The DIFM (Do It For Me) segment accounted for the highest revenue share by application in 2023.

- Retailers led the market by distribution channel, securing the largest share in 2023.

- Genuine parts are estimated to hold the highest market share by technology in 2023.

Opportunities

- The growing adoption of electric vehicles (EVs) creates demand for specialized aftermarket parts and services.

- Expansion of e-commerce platforms enhances accessibility and convenience for customers.

- Rising interest in vehicle customization and performance enhancement boosts aftermarket sales.

- Advancements in AI, telematics, and IoT enable predictive maintenance and smart diagnostics.

- The increasing number of aging vehicles requires frequent repairs and part replacements.

- Emerging markets present untapped growth potential due to rising vehicle ownership.

- Sustainability trends drive demand for eco-friendly and remanufactured aftermarket parts.

Challenges

- The rise of EVs reduces demand for traditional internal combustion engine (ICE) components.

- Counterfeit and low-quality aftermarket products pose risks to brand reputation and consumer trust.

- Stringent government regulations on emissions and safety increase compliance costs.

- Supply chain disruptions and raw material shortages impact production and distribution.

- Intense competition from OEMs (Original Equipment Manufacturers) affects market share for independent aftermarket players.

- The complexity of modern vehicle technologies makes repairs more challenging, requiring specialized expertise.

- Price fluctuations in raw materials can affect profitability and cost structures.

Regional Insights

North America leads the global automotive aftermarket, holding the highest market share due to a large vehicle fleet, increasing consumer preference for vehicle customization, and a well-established repair and maintenance industry. The United States dominates this region, driven by a high demand for replacement parts and technological advancements in diagnostics and repair services. Europe follows closely, with strong contributions from countries like Germany, the UK, and France. The region benefits from a high number of aging vehicles, strict emissions regulations, and a strong presence of leading aftermarket manufacturers. The shift towards electric vehicles and sustainability trends also influence market dynamics in Europe.

The Asia-Pacific region is experiencing rapid growth, fueled by rising vehicle sales, increasing disposable incomes, and expanding automotive infrastructure in countries such as China, India, and Japan. The growing demand for affordable aftermarket parts, along with a surge in e-commerce platforms, is transforming the industry in this region. Latin America and the Middle East & Africa are also witnessing steady growth, driven by rising vehicle ownership, improving economic conditions, and an increasing focus on vehicle maintenance. However, these regions face challenges such as fluctuating raw material prices and underdeveloped distribution networks, which may hinder rapid expansion.

Don’t Miss Out: Plug-in Hybrid Electric Vehicles Market

Market Key Players

- p.A.

- 3M Company

- Continental AG

- Robert Bosch GmbH

- Federal-Mogul Corporation

- Denso Corporation

Recent News

In November 2024, Advance Auto Parts announced plans to close 700 stores nationwide, including 500 company-operated and 200 franchise locations, along with four distribution centers. This decision came after a quarterly report revealed a decline in profits, prompting the company to reduce its headcount and operational footprint. In October 2024, Genuine Parts Company lowered its 2024 earnings forecast due to underperformance in its industrial segment and challenging market conditions in Europe. The company now anticipates a decline of 1% to 2% in industrial segment sales, revising its earlier projection of up to 2% growth. This adjustment led to a significant drop in the company’s share value during pre-market trading.

In November 2024, General Motors (GM) faced criticism for removing Apple CarPlay and Android Auto functionalities from its electric vehicles (EVs). In response, aftermarket solutions emerged to restore these features, highlighting consumer demand for familiar infotainment options. In August 2024, Advance Auto Parts sold its Worldpac division to investment firm Carlyle for $1.5 billion. This strategic move aimed to streamline Advance Auto Parts’ operations and focus on its core business segments.

Market Segmentation

By Product

- Battery

- Tire

- Filters

- Brake Parts

- Turbochargers

- Lighting & Electronic Components

- Body Parts

- Exhaust Components

- Wheels

- Others

By Application

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEM’s)

By Distribution Channel

- Wholesalers & Distributors

- Retailers

- OEMs

- Repair Shops

By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts