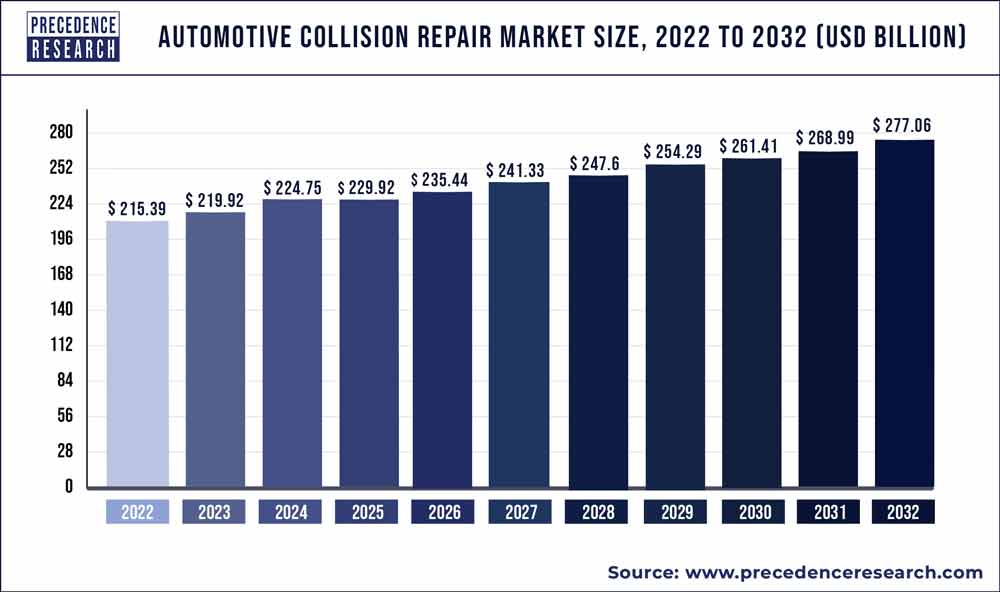

According to Precedence Research, the global automotive collision repair market size is expected to surpass the US$ 220.1 billion mark by 2030 and is forecast to grow 2.5 percent annually through 2030.

The release notes that rising international trade activities are likely to propel the number of heavy commercial fleet across the world, which in turn will help drive the growth of the auto collision repair market. This also increases the availability of the state-of-the-art service garages and automotive repair shops equipped with advanced technologies for repairing, painting, body repair, and denting of the vehicle.

The paints and coatings product segment is expected to grow at the fastest clip, with increased environmental concerns for the use of synthetic coating materials and other refinishing products. Further, tech advancements in the segment that can do a better job of preventing scratches and other harm to the automobile are some of the prime factors that are expected to push the surge in pricing.

Somewhat surprisingly, the news release says do-it-yourself (DIY) work is anticipated to experience the fastest growth in the next decade.The release cites the increasing trend for customers self-servicing their vehicles for minor repair and painting. In addition, various companies also offer DIY kits along with the vehicles to attract large volume of customers.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1268

Market Scope of Automotive Collision Repair Market

| Report Highlights | Details |

| Market Size | USD 220.1 Billion by 2030 |

| Growth Rate | CAGR of 2.5% between 2021 and 2030 |

| Base Year | 2020 |

| Historic Data | 2017 to 2020 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Product, Vehicle, Service Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Some of the prominent market players profiled in the global automotive collision repair market include Automotive Technology Products LLC (ATP), 3M, Continental AG, Denso Corporation, Federal-Mogul LLC, Faurecia, Honeywell International Inc., Johnson Controls Inc., International Automotive Components Group, Magna International Inc., Martinrea International Inc., Mann+Hummel Group, Mitsuba Corporation, Takata Corporation, and Robert Bosch GmbH among others.

Automotive manufacturers focus prominently on the product differentiation along with collaboration with other globally renowned players to expand their customer reach. Further, rising international trade activities are likely to propel the number of heavy commercial fleet across the world that in turn prospers the growth of automotive collision repair market. This also increases the availability of the state-of-art service garages & automotive repair shops equipped with advanced technologies for repairing, painting, body repair, and denting of the vehicle.

On the other hand, introduction to advanced driver assistance systems (ADAS), anti-lock braking technology, collision detection systems, and sensors have prominently reduced the rate of road fatalities and accidents that hampers the market growth for automotive collision repair market. Further, the government bodies of various regions also support the integration of such advanced technologies in the upcoming models of vehicles, this also likely to restrict the market growth significantly during the forthcoming years.

The automotive industry is amongst the most exposed sectors to the coronavirus outbreak and is currently facing unprecedented uncertainties in the market. The COVID-19 has significantly impacted the supply chain as well as the product delivery system on the global scale in the automotive industry. Apart from this, changes in the buying behavior of consumers have created more uncertainty to the vehicle sale and have serious implications on the growth of automotive industry in the near future. This all factors also negatively impact the growth of automotive collision repair market.

The paints & coatings product segment expected to register the fastest growth over the forecast period owing to rising environmental concern for the use of synthetic coating materials and other refinishing products used in the automobiles. Further, technological advancements in the paints & coating products that meets the rising aesthetic demand as well as better protective material that prevent scratches and other harm to the outer body parts of the automobile are some of the prime factors that excels the market growth for automotive collision repair during the forecast period.

Based on service channel, Do-it-yourself (DIY) exhibits the highest growth rate of approximately 3% during the analysis time frame because of increasing trend for self-servicing the vehicles for minor repair and painting. In addition, various companies also offer DIY kits to their customers along with the vehicles to attract large volume of customers. The Asia Pacific region exhibits the fastest growth for the DIY segment followed by Latin America. Moreover, the trend for DIY kits is more popular in the European and North American countries owing to larger volume of population favoring DIY services.

On the basis of vehicle type the global automotive collision repair market has been bifurcated into light-duty vehicle and heavy-duty vehicle. Light-duty vehicle captured the largest revenue share of nearly 70% in the year 2020 and anticipated to register the fastest growth over the forthcoming years. The prominent growth of the region is majorly attributed to the increasing sale of light-duty vehicles such as passenger cars and recreational vehicles.

Besides this, electric vehicles and green mobility solutions have revolutionized the light-duty vehicles market and spur the rate of sales to a greater extent. Governments of various regions are also favoring the adoption of green mobility for curbing the rate of pollution and in accordance to the same they are designing near future plans for transforming their mobility into green mobility. Hence, the aforementioned factors are likely to prosper the market growth for automotive collision repair in the coming years.

The Asia Pacific region predicted to witness the highest CAGR of about 4% during the analysis period due to higher rate of road traffic crashes along with high sale of passenger cars in the region. Apart from this, the region also accounted significant share in the global trade that again increases the risk for vehicle crashes particularly on the highways and other connecting roadways. However, Europe being an automotive hub occupied the largest share of revenue in the year 2020.

Related Reports

- Automotive Communication Technology Market – The global market size was valued at USD 7.63 billion in 2020 and expected to hit around US$ 36.30 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.4% from 2021 to 2030.

- Intelligent Transportation System (ITS) Market – The global market size was valued at USD 29.69 billion in 2020 and is expected to reach US$ 47.89 Bn by 2030, growing at a compound annual growth rate (CAGR) of 6.3% from 2020 to 2030.

- Automotive Electronics Market – The global market size was valued at US$ 255.98 billion in 2020 and is predicted to reach US$ 640.56 billion by the end of 2030, representing impressive CAGR of 7.64% during the forecast period 2021 to 2030.

The industry players in the global automotive collision repair market experience heavy competition from their competitor players owing to large number product differentiation and development in the market. For instance, in July 2018, 3M division for automotive aftermarket launched an application for cost-free collision repair.

Market Segmentation:

By Product

- Consumables

- Paints & Coatings

- Spare Parts

By Service Channel

- DIFM

- DIY

- OE

By Vehicle Type

- Heavy-duty Vehicle

- Light-duty Vehicle

By Regional Outlook

- North America

- US

- Rest of North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Read Also: $23.9 Bn of Potential Opportunity Is Opening Up In Robotic Process Automation Market

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Automotive Collision Repair Market, By Product

7.1. Automotive Collision Repair Market, by Product, 2020-2027

7.1.1. Consumables

7.1.1.1. Market Revenue and Forecast (2016-2027)

7.1.2. Paints & Coatings

7.1.2.1. Market Revenue and Forecast (2016-2027)

7.1.3. Spare Parts

7.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 8. Global Automotive Collision Repair Market, By Service Channel

8.1. Automotive Collision Repair Market, by Service Channel, 2020-2027

8.1.1. DIFM

8.1.1.1. Market Revenue and Forecast (2016-2027)

8.1.2. DIY

8.1.2.1. Market Revenue and Forecast (2016-2027)

8.1.3. OE

8.1.3.1. Market Revenue and Forecast (2016-2027)

Chapter 9. Global Automotive Collision Repair Market, By Vehicle Type

9.1. Automotive Collision Repair Market, by Vehicle Type, 2020-2027

9.1.1. Heavy-duty Vehicle

9.1.1.1. Market Revenue and Forecast (2016-2027)

9.1.2. Light-duty Vehicle

9.1.2.1. Market Revenue and Forecast (2016-2027)

Chapter 10. Global Automotive Collision Repair Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2016-2027)

10.1.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.1.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Product(2016-2027)

10.1.4.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.1.4.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Product (2016-2027)

10.1.5.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.1.5.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2016-2027)

10.2.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.2.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Product (2016-2027)

10.2.4.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.2.4.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Product (2016-2027)

10.2.5.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.2.5.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Product (2016-2027)

10.2.6.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.2.6.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Product (2016-2027)

10.2.7.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.2.7.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2016-2027)

10.3.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.3.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Product (2016-2027)

10.3.4.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.3.4.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Product (2016-2027)

10.3.5.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.3.5.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Product (2016-2027)

10.3.6.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.3.6.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Product (2016-2027)

10.3.7.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.3.7.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2016-2027)

10.4.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.4.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Product (2016-2027)

10.4.4.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.4.4.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Product (2016-2027)

10.4.5.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.4.5.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Product (2016-2027)

10.4.6.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.4.6.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Product (2016-2027)

10.4.7.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.4.7.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2016-2027)

10.5.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.5.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Product (2016-2027)

10.5.4.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.5.4.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Product (2016-2027)

10.5.5.2. Market Revenue and Forecast, by Service Channel (2016-2027)

10.5.5.3. Market Revenue and Forecast, by Vehicle Type (2016-2027)

Chapter 11. Company Profiles

11.1. Automotive Technology Products LLC (ATP)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. 3M

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Continental AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Denso Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Federal-Mogul LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Faurecia

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Honeywell International, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Johnson Controls, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. International Automotive Components Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Magna International Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

11.11. Martinrea International Inc.

11.11.1. Company Overview

11.11.2. Product Offerings

11.11.3. Financial Performance

11.11.4. Recent Initiatives

11.12. Mann+Hummel Group

11.12.1. Company Overview

11.12.2. Product Offerings

11.12.3. Financial Performance

11.12.4. Recent Initiatives

11.13. Mitsuba Corporation

11.13.1. Company Overview

11.13.2. Product Offerings

11.13.3. Financial Performance

11.13.4. Recent Initiatives

11.14. Takata Corporation

11.14.1. Company Overview

11.14.2. Product Offerings

11.14.3. Financial Performance

11.14.4. Recent Initiatives

11.15. Robert Bosch GmbH

11.15.1. Company Overview

11.15.2. Product Offerings

11.15.3. Financial Performance

11.15.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1268

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333