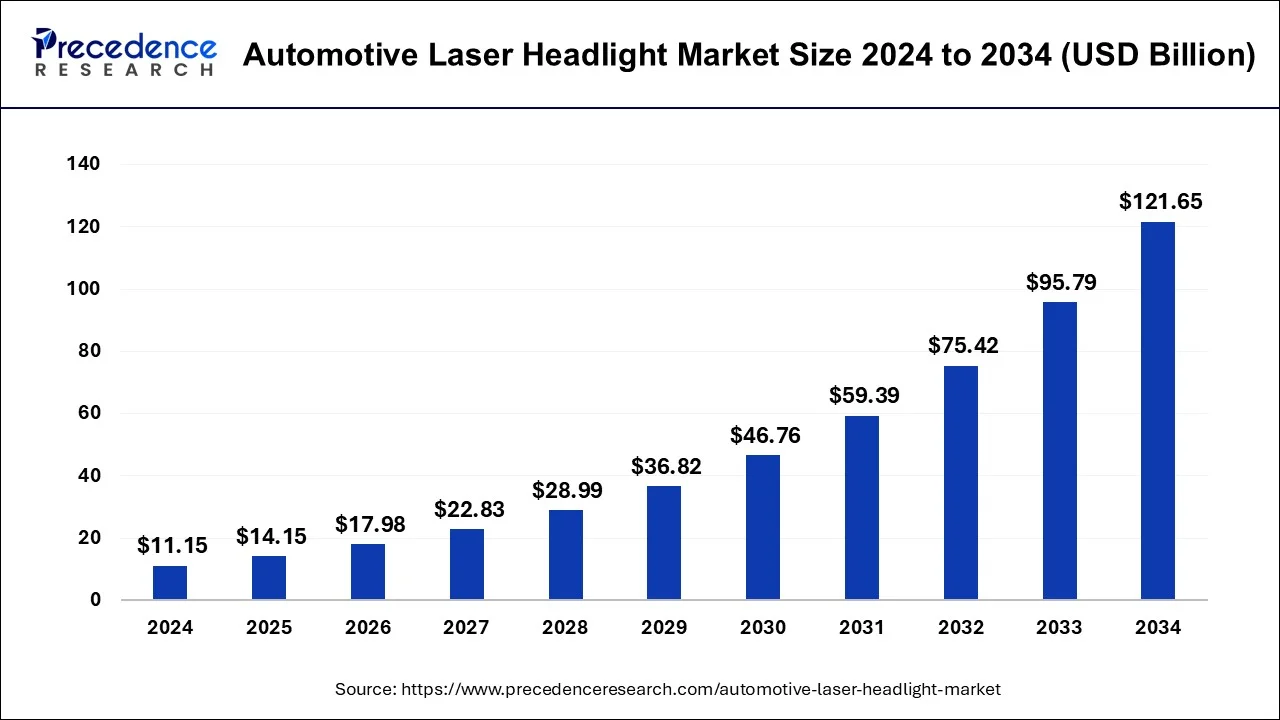

The automotive laser headlight market is projected to reach USD 121.65 billion by 2034, growing from USD 11.15 billion in 2024 at a 26.8% CAGR

Automotive Laser Headlight Market Key Takeaways

- Europe dominated the global market in 2023, holding the highest share of 40%.

- Passenger vehicles led the market by vehicle type, securing the largest share in 2023.

- Intelligent laser headlights held the largest market share by technology in 2023.

The automotive laser headlight market is witnessing significant growth, driven by advancements in lighting technology and the rising demand for high-performance, energy-efficient vehicle lighting. Valued at USD 11.15 billion in 2024, the market is expected to reach USD 121.65 billion by 2034, growing at a CAGR of 26.8%. Europe held the largest market share at 40% in 2023, with the passenger vehicle segment leading by vehicle type and intelligent laser headlights dominating by technology. Increasing adoption of ADAS (Advanced Driver Assistance Systems), the rise in luxury vehicle sales, and strict safety regulations are key factors driving market expansion worldwide.

Sample Link: https://www.precedenceresearch.com/sample/1049

Key Drivers

The automotive laser headlight market is driven by several key factors, including the growing demand for energy-efficient and high-performance lighting solutions in modern vehicles. The increasing adoption of ADAS (Advanced Driver Assistance Systems) has accelerated the need for advanced lighting technologies that enhance visibility and safety. The rising production and sales of luxury and high-end vehicles, which often feature laser headlights for superior illumination, are also fueling market growth. Additionally, stringent government regulations on vehicle lighting standards and the push for improved road safety are encouraging automakers to adopt laser headlight technology. Ongoing advancements in laser and adaptive lighting technologies, along with increasing consumer preference for premium automotive features, are further contributing to market expansion.

Opportunities

- Rising demand for luxury and high-performance vehicles with advanced lighting systems.

- Technological advancements in laser and adaptive lighting, enhance safety and energy efficiency.

- Growing adoption of electric and autonomous vehicles, driving the need for innovative lighting solutions.

- Expanding automotive markets in developing regions, creating new growth avenues.

- Customization and personalization trends, boosting demand for premium, futuristic lighting designs.

Challenges

- High manufacturing and installation costs, limiting widespread adoption in mid-range vehicles.

- Heat management and safety concerns related to high-intensity laser lights.

- Complex regulatory requirements and varying lighting standards across regions.

- Limited consumer awareness about laser headlights and their benefits compared to LED options.

- Supply chain disruptions and raw material shortages, impacting production timelines and costs.

Don’t Miss Out: Hydrogen Fuel Cell Vehicle Market

Market Key Players

- ZKW Group

- LASER Component

- Koito Manufacturing Co. Ltd

- Palomar Technologies

- Hella GmbH & Co. KGaA

- Marelli Holdings Co. Ltd.

- Koninklijke Philips N.V.

Recent News

The automotive laser headlight market is experiencing significant growth, driven by technological advancements and increasing demand for energy-efficient lighting solutions. In January 2023, a leading company introduced the world’s first laser light headlight modules featuring dual illumination in white and infrared, enhancing safety and visibility in automotive applications. Additionally, the market is projected to expand from USD 11.15 billion in 2024 to approximately USD 121.65 billion by 2034, reflecting a compound annual growth rate (CAGR) of 27%. Europe maintained a leading position with a 40% market share in 2023, while the passenger vehicle segment dominated by vehicle type, and intelligent laser headlights led in technology adoption.

Market Segmentation

By Technology

- Intelligent

- Conventional

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

By Sales Channel

- Aftermarket

- OEM