Table of Contents

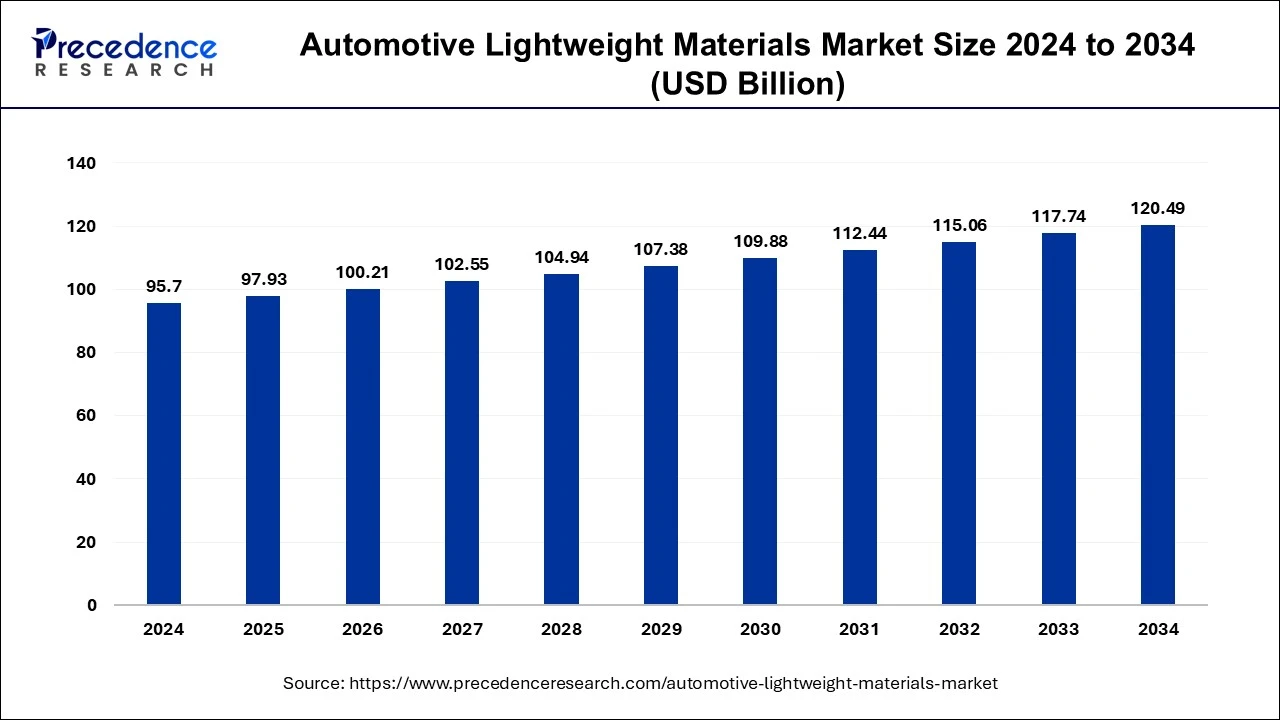

ToggleThe automotive lightweight materials market is set to grow from USD 95.7B in 2024 to USD 120.49B by 2034, with a CAGR of 2.33%.

Automotive Lightweight Materials Market Key Takeaways

- Europe led the global automotive lightweight materials market in 2024, holding the largest share of 36.52%.

- Germany is witnessing a notable CAGR of 6.99% in the automotive lightweight materials market during the forecast period.

- North America is projected to grow at a solid CAGR of 4.96% throughout the forecast period.

- Composites dominated by material type, contributing 66% of the market share in 2024.

- Plastics in the materials category are expected to grow at a CAGR of 3.83% over the forecast period.

- Body in White (BiW) was the leading application segment, holding 26% of the market share in 2024.

- The closures segment is projected to expand at a CAGR of 2.6% during the forecast period.

- Passenger cars dominated the end-use segment with an 83% market share in 2024.

- The LCVs (Light Commercial Vehicles) segment is growing at a CAGR of 3.3% over the forecast period.

The automotive lightweight materials market is experiencing steady growth, driven by the increasing demand for fuel efficiency, reduced emissions, and enhanced vehicle performance. In 2024, Europe led the market with a 36.52% share, while Germany showed notable expansion with a CAGR of 6.99%. North America is also set to grow at a strong CAGR of 4.96% during the forecast period. Among materials, composites dominated with a 66% market share in 2024, while plastics are projected to grow at a CAGR of 3.83%.

In terms of application, the Body in White (BiW) segment accounted for the highest share at 26%, while the closures segment is expected to expand at a 2.6% CAGR. By end-use, passenger cars held the majority share at 83% in 2024, with the LCV segment growing at a 3.3% CAGR over the forecast period. The market’s expansion is fueled by advancements in material technology and the rising adoption of lightweight components to meet stringent regulatory standards.

Sample Link: https://www.precedenceresearch.com/sample/1087

Key Drivers

Opportunities

- Growing EV Market – The rise of electric vehicles is increasing demand for lightweight materials to enhance battery efficiency and driving range.

- Advancements in Material Technology – Innovations in composites, carbon fiber, and high-strength plastics offer new opportunities for manufacturers to improve performance.

- Stringent Emission Regulations – Governments worldwide are enforcing strict CO₂ emission standards, driving the adoption of lightweight materials in vehicles.

- Expansion in Emerging Markets – Developing economies are witnessing rapid automotive industry growth, creating a demand for cost-effective and lightweight solutions.

- Sustainability Initiatives – The shift towards eco-friendly and recyclable materials is opening new avenues for sustainable lightweight material development.

Challenges

- High Production Costs – Advanced lightweight materials, such as carbon fiber and composites, are expensive, making large-scale adoption challenging.

- Manufacturing Complexities – Integrating lightweight materials into existing production processes requires advanced technologies and infrastructure investment.

- Limited Recycling Options – Some lightweight materials, like certain composites, face difficulties in recycling, posing sustainability concerns.

- Performance Trade-offs – While reducing weight improves efficiency, some materials may compromise durability, safety, or overall vehicle performance.

- Supply Chain Disruptions – The availability and cost fluctuations of raw materials like aluminum and rare metals can impact market stability.

Regional Insights

The automotive lightweight materials market exhibits strong regional variations, with Europe leading the industry, holding a 36.52% market share in 2024. The region benefits from stringent emission regulations, advanced automotive manufacturing, and high adoption of electric vehicles, with Germany experiencing significant growth at a CAGR of 6.99%. North America is another key region, projected to expand at a solid CAGR of 4.96% due to increasing government regulations on fuel efficiency and the rising production of high-performance vehicles.

The Asia-Pacific region is witnessing rapid growth, driven by expanding automotive manufacturing in China, India, and Japan, along with strong demand for lightweight materials in both internal combustion engine (ICE) and electric vehicles. China remains the largest automotive market, heavily investing in lightweight technologies to support EV development. Latin America and the Middle East & Africa are experiencing steady growth, primarily fueled by rising vehicle production, urbanization, and increasing consumer preference for fuel-efficient vehicles. However, these regions face challenges related to raw material availability and infrastructure development, which may impact market expansion.

Don’t Miss Out: Automotive Heads-up Display Market

Market Key Players

- KGaA

- Intrinsiq Materials, Inc.

- Creative Materials Inc.

- Vorbeck Materials Corporation, Inc

- Johnson Matthey PLC

- Heraeus Holding GmbH

- Applied Ink Solutions

Recent News

The automotive lightweight materials market is witnessing significant developments. Recent analyses suggest that the market is expected to grow from USD 95.7 billion in 2024 to approximately USD 120.49 billion by 2034, with a CAGR of 2.33%. Europe continues to dominate the industry, holding a 36.52% market share in 2024, with Germany showing impressive growth at a CAGR of 6.99%. The composites segment leads the material category, contributing 66% of the total market share in 2024. However, industry challenges persist, as companies like Porsche AG report declines in sales and operating profits due to market slowdowns, particularly in China and the EV sector.

In response to evolving market conditions, next-generation material startups are shifting their focus beyond fashion to automotive and furniture sectors, aiming for faster adoption and scalability. Supply chain constraints are also affecting the market, with companies like Northvolt selling surplus battery-making materials to raise funds, highlighting financial and logistical challenges within the industry. These ongoing shifts emphasize the evolving nature of the automotive lightweight materials market, driven by regional demand, material advancements, and strategic industry adjustments.

Market Segmentation

By Vehicle

- Passenger Vehicles

- Heavy Commercial Vehicles [HCVs]

- Light Commercial Vehicles [LCVs]

By Material

- High-strength Steel [HSS]

- Metal Alloys

- Polymers

- Composites

By Application

- Exterior

- Interior

- Powertrain

- Structural

- Others