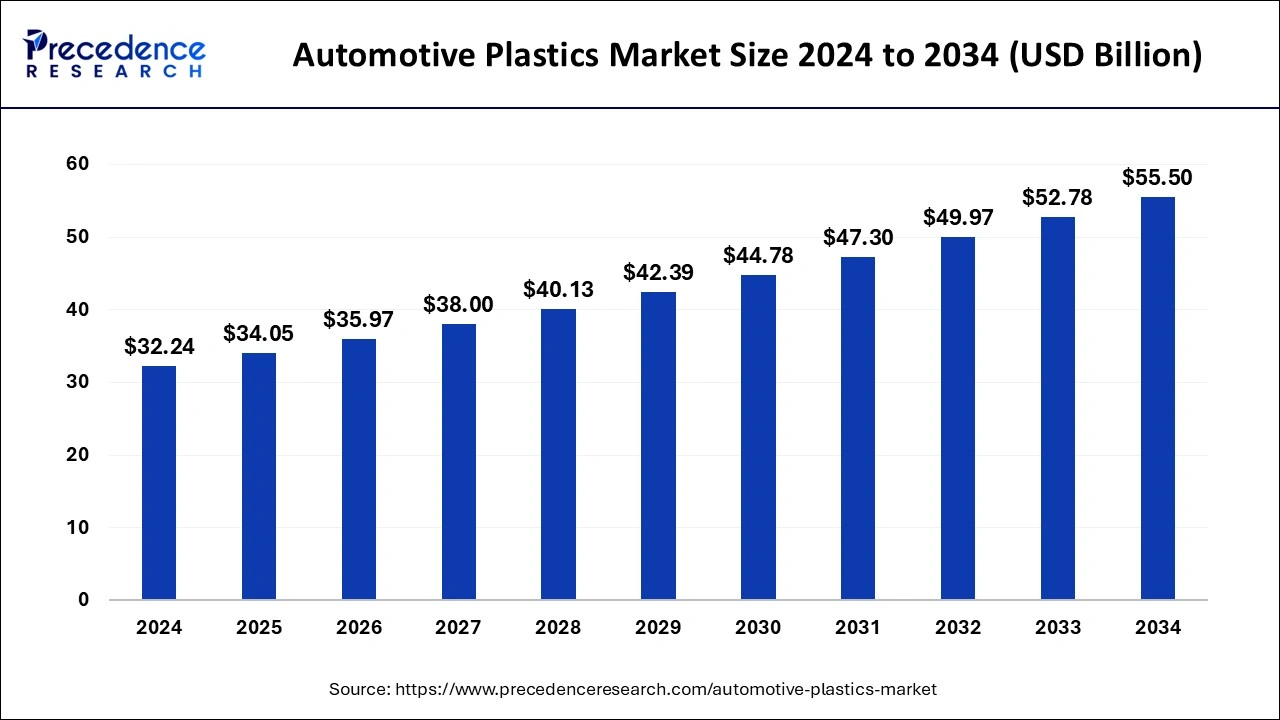

The global automotive plastics market size was valued at USD 30.52 billion in 2023 and is expected to reach around USD 52.78 billion by 2033, expanding at a CAGR of 5.63% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 47% in 2023.

- Europe is projected to host the fastest-growing market during the forecast period of 2024–2033.

- By product, the polypropylene (PP) segment has held a major revenue share of 33% in 2023.

- By product, the polyvinyl chloride (PVC) segment is projected to grow at the fastest CAGR of 18.02% during the forecast period.

- By process, the injection molding segment has contributed more than 57% of revenue share in 2023.

- By application, the interior furnishing segment has held a largest revenue share of 45% in 2023.

- By application, the electrical components segment will grow at the fastest rate in the market during the forecast period.

- By application, the exterior furnishing segment will grow significantly during the forecast period.

- By vehicle, the passenger cars segment dominated the market in 2023.

The automotive plastics market has experienced significant growth in recent years, driven by the increasing demand for lightweight materials in vehicle manufacturing. Plastics have become essential in the automotive industry due to their versatility, durability, and ability to contribute to fuel efficiency and emission reduction. These materials are used in various applications within vehicles, including interior components, exterior panels, under-the-hood parts, and electrical components. As automakers strive to meet stringent regulatory standards and consumer preferences for more efficient and environmentally friendly vehicles, the demand for automotive plastics continues to rise.

Get a Sample: https://www.precedenceresearch.com/sample/4444

Growth Factors

Several key factors contribute to the growth of the automotive plastics market. One of the primary drivers is the emphasis on reducing vehicle weight to improve fuel efficiency and meet regulatory standards for emissions. Plastics offer a lightweight alternative to traditional materials such as metal, helping automakers achieve these goals without compromising on safety or performance. Moreover, advancements in plastic technologies have enhanced their strength, heat resistance, and recyclability, further boosting their adoption in automotive applications.

Another significant growth factor is the expanding electric and hybrid vehicle (EV/HEV) market. These vehicles require lightweight materials to maximize battery efficiency and range. Plastics play a crucial role in EV/HEV manufacturing by reducing overall vehicle weight and supporting the development of aerodynamic designs that enhance energy efficiency. As the global automotive industry shifts towards electrification, the demand for advanced plastics is expected to increase substantially.

Regional Insights

The automotive plastics market exhibits regional variations influenced by factors such as manufacturing capabilities, regulatory frameworks, and consumer preferences. North America and Europe are prominent regions in the market, driven by stringent emission regulations and a strong presence of automotive manufacturers investing in lightweight materials. These regions also prioritize innovations in automotive technology, including the integration of plastics for enhanced vehicle performance and sustainability.

Asia-Pacific stands out as a key growth region due to the rapid expansion of the automotive sector in countries like China, India, and Japan. The increasing production of passenger and commercial vehicles in Asia-Pacific, coupled with rising disposable incomes and urbanization, fuels the demand for lightweight materials like plastics. Additionally, government initiatives to promote electric mobility and reduce carbon emissions are expected to accelerate the adoption of automotive plastics across the region.

Automotive Plastics Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 30.52 Billion |

| Market Size in 2024 | USD 32.24 Billion |

| Market Size By 2033 | USD 52.78 Billion |

| Market Growth Rate | CAGR of 5.63% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Process, Application, Vehicle and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive Plastics Market Dynamics

Drivers

Several drivers propel the growth of the automotive plastics market globally. Cost-effectiveness is a significant factor, as plastics are often cheaper to manufacture and mold compared to traditional materials like metal. This cost advantage encourages automakers to utilize plastics in various vehicle components, thereby reducing overall production costs while maintaining quality and performance standards.

Furthermore, technological advancements in polymer science and engineering have expanded the application capabilities of automotive plastics. Innovations such as reinforced plastics, thermoplastic composites, and biodegradable polymers offer superior mechanical properties, durability, and environmental benefits. These advancements cater to the evolving needs of automotive manufacturers seeking materials that enhance vehicle aesthetics, durability, and sustainability.

Opportunities

The automotive plastics market presents several opportunities for growth and innovation. One notable opportunity lies in the development of sustainable plastics derived from renewable sources or recycled materials. As environmental concerns mount globally, automakers and suppliers are increasingly focusing on eco-friendly solutions to reduce the carbon footprint of vehicle production and disposal. Sustainable plastics not only meet regulatory requirements but also appeal to environmentally conscious consumers.

Additionally, the integration of smart technologies in automotive plastics presents a promising opportunity. Smart plastics embedded with sensors and electronics can enhance vehicle functionality, monitor performance, and improve safety features. Applications such as smart surfaces, adaptive interiors, and integrated connectivity solutions are poised to revolutionize the automotive industry, creating new avenues for market expansion and differentiation.

Challenges

Despite its growth prospects, the automotive plastics market faces several challenges that could impact its trajectory. One significant challenge is the complexity of recycling and disposing of plastic waste generated from end-of-life vehicles. Unlike metals, plastics can be more challenging to recycle efficiently due to their diverse compositions and the presence of additives. Addressing these challenges requires investment in advanced recycling technologies and collaborative efforts across the automotive value chain.

Furthermore, concerns regarding the mechanical strength and durability of plastics compared to metals remain a barrier in certain automotive applications, especially in critical components such as chassis and structural parts. While advancements in material science have improved the performance of automotive plastics, achieving parity with metals in terms of strength and reliability remains a persistent challenge for manufacturers.

Lastly, fluctuating raw material prices and supply chain disruptions can impact the cost competitiveness and availability of automotive plastics. The industry’s reliance on petrochemical feedstocks makes it susceptible to market volatility and geopolitical factors. Mitigating these risks requires strategic sourcing strategies, diversification of material suppliers, and proactive management of inventory to ensure continuity of production and supply.

Read Also: Hemodialysis Catheters Market Size, Share, Report by 2033

Automotive Plastics Market Companies

- AkzoNobel N.V.

- Adient plc

- Borealis AG

- BASF SE

- Dow Inc

- Covestro AG

- TEIJIN Limited

- Royal DSM N.V.

- Quadrant AG

- Owens Corning

- Lear Corporation

- Grupo Antolin

- Hanwha Azdel Inc

- SABIC

- Momentive Performance Materials, Inc.

- Evonik Industries AG

- Magna International, Inc

- Saudi Basic Industries Corporation (SABIC)

Recent Developments

- In December 2023, a new recycled ocean plastic or resin made from recovered maritime plastics for automotive applications was launched by LyondellBesell.

- In January 2024, Sonichem launched a project to transform the automotive industry with bio-based plastics. These are used in the production of composites, resins, and plastics.

- In February 2024, a new multi-substrate primer for the plastic automotive exterior was launched by the AkzoNobel. A new 2k solvent-borne primer in conductive and dark grey for automotive OEM exterior plastic parts was developed by AkzoNobel.

- In February 2024, a new range of recycling content thermoplastic elastomer (TPE) products was launched by the KRAIBURG TPE for the automotive series.

Segments Covered in the Report

By Product

- Acrylonitrile Butadiene Styrene (ABS)

- Polypropylene (PP)

- PP LGF 20

- PP LGF 30

- PP LGF 40

- Others

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Polyethylene (PE)

- High-density Polyethylene (HDPE)

- Other PE Grades

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyamide (Nylon 6, Nylon 66)

- Others

By Process

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Application

- Powertrains

- Electrical Components

- Interior Furnishing

- IMD or IML

- Others

- Exterior Furnishing

- Under the Hood

- Chassis

By Vehicle

- Passenger Cars

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel cell Electric Vehicles (FCEV)

- Light Commercial Vehicles

- Medium & heavy Commercial Vehicles

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/