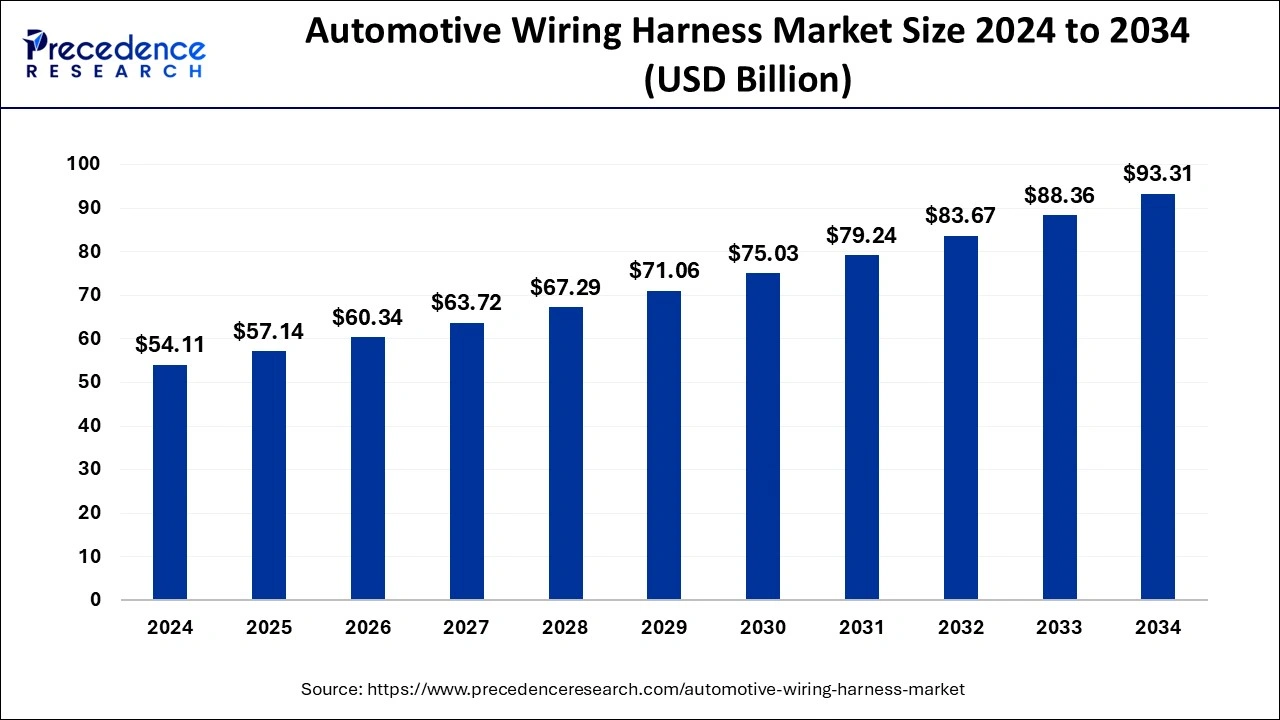

The automotive wiring harness market size was valued at USD 54.11 billion in 2024 and is projected to hit around USD 93.31 billion by 2034 with a CAGR of 5.60%.

Key Takeaways

- Asia Pacific dominated the global market with the largest market share of 48% in 2024.

- By material, the copper segment contributed the highest market share of 65% in 2024.

- By propulsion, the Ice vehicles segment captured the biggest market share of 82% in 2024.

- By vehicle type, the passenger cars segment generated a major market share of 58% in 2024.

- By voltage, the low voltage segment has held the largest market share of 85% in 2024.

The automotive wiring harness market is experiencing significant growth, driven by the increasing demand for advanced electrical systems in vehicles. These harnesses are essential for connecting various components, including automotive lighting, infotainment, and automotive active safety systems. With the rise of electric vehicles and autonomous vehicles, the need for more complex wiring solutions is expanding. The market is expected to reach USD 93.31 billion by 2034, driven by technological advancements and growing automotive production.

Sample Link: https://www.precedenceresearch.com/sample/1008

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 54.11 Billion |

| Market Size in 2025 | USD 57.14 Billion |

| Market Size by 2034 | USD 93.31 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Propulsion, Transmission, Vehicle, Sales Channel, Geography |

Key Drivers

Key drivers for the automotive wiring harness market include the growing adoption of electric vehicles (EVs) and autonomous vehicles, which require advanced wiring solutions for their electrical systems. Increasing consumer demand for in-vehicle infotainment, safety features, and comfort systems is also contributing to the need for more complex wiring. Additionally, the trend toward lightweight and energy-efficient vehicles is driving innovations in wiring harness design. Government regulations promoting vehicle safety and emissions standards further encourage the development and integration of advanced automotive wiring systems.

Opportunities

- Electric Vehicle Growth: As the adoption of electric vehicles (EVs) rises, there is a growing need for specialized wiring harnesses to support electric drivetrains, battery management, and charging systems.

- Autonomous Vehicles: The development of autonomous vehicles presents opportunities for advanced wiring solutions to support complex sensors, cameras, and communication systems.

- Lightweight Wiring Solutions: As automotive manufacturers focus on reducing vehicle weight for better fuel efficiency, there is an opportunity to develop lightweight, high-performance wiring harnesses.

- Aftermarket Services: The increasing number of vehicles on the road provides a growing market for the replacement and repair of wiring harnesses in the aftermarket sector.

- Technological Advancements: Innovations in smart wiring harnesses, such as those with integrated sensors and Internet of Things (IoT) connectivity, present new opportunities for the market.

- Sustainability Trends: Growing environmental awareness and regulations are creating demand for eco-friendly materials in the production of wiring harnesses, offering opportunities for manufacturers to develop sustainable solutions.

Challenges

- Complexity and Customization: The increasing complexity of modern vehicles, including electric and autonomous vehicles, requires highly customized wiring harnesses, which can be time-consuming and costly to design and manufacture.

- Rising Raw Material Costs: The prices of key materials like copper, aluminum, and plastics used in wiring harnesses are subject to fluctuations, which can affect production costs and margins.

- Quality Control and Reliability: Ensuring the quality and durability of wiring harnesses is crucial, as any failure can lead to safety hazards and expensive recalls, requiring stringent testing and quality assurance.

- Space Constraints in Vehicles: As vehicles become more compact and feature-rich, fitting complex wiring harnesses into limited spaces while maintaining performance and safety standards presents design and engineering challenges.

- Supply Chain Disruptions: Global supply management chain issues, including delays in the procurement of materials and components, can lead to production delays and increased lead times for manufacturers.

- Environmental Regulations: Increasing environmental regulations and the demand for eco-friendly materials present challenges for manufacturers to develop wiring harnesses that are both sustainable and cost-effective.

Regional Insights

Asia Pacific dominated the automotive wiring harness market in 2024, accounting for 48% of the global market share, driven by the region’s expanding automotive production and rising adoption of advanced technologies. The copper material segment led with a 65% share, reflecting its extensive use in wiring solutions due to its high conductivity and reliability. ICE vehicles continued to dominate propulsion with an 82% market share, while passenger cars contributed significantly, holding 58% of the market. Additionally, low-voltage wiring harnesses remained the most widely used, representing 85% of the market share.

Market Key Players

- Sumitomo Electric Industries, Ltd.

- Delphi Automotive LLP

- Furukawa Electric Co. Ltd

- Lear Corporation

- THB Group

- Yura Corporation

- Leoni Ag

- SPARK MINDA

- Yazaki Corporation

- Fujikura Ltd.

- QINGDAO SANYUAN GROUP

- SamvardhanaMotherson Group

- NexansAutoelectric

- PKC Group

Market Segmentation

By Type

- Engine Harness

- Dashboard/ Cabin Harness

- Battery Wiring Harness

- Chassis Wiring Harness

- Body & Lighting Harness

- HVAC Wiring Harness

- Seat Wiring Harness

- Door Wiring Harness

- Sunroof Wiring Harness

By Material

- Metallic

- Aluminum

- Copper

- Other Metals

- Optical Fiber

- Plastic Optical Fiber

- Glass Optical Fiber

By Propulsion

- IC Engine Vehicle

- Electric Vehicle

By Transmission

- Electric Wiring

- Data Transmission

- <150 Mbps

- 150 Mbps to 1 Gbps

- >1 Gbps

By Vehicle

By Voltage

- Low Voltage

- High Voltage

By Sales Channel

- OEM

- Aftermarket

Discover more insightful reports by visiting!

Website: https://www.precedenceresearch.com/