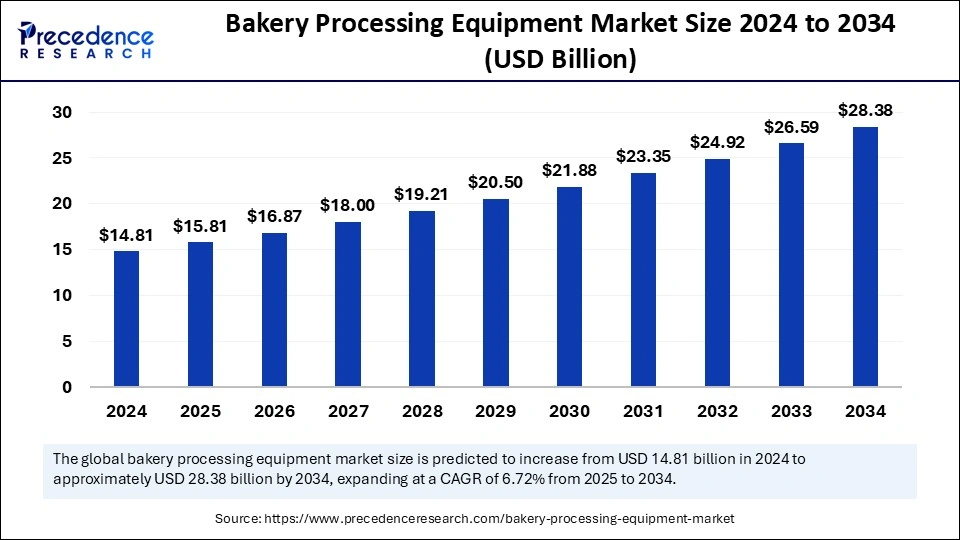

The global bakery processing equipment market is projected to grow from USD 14.81 billion in 2024 to approximately USD 28.38 billion by 2034, registering a CAGR of 6.72%.

Bakery Processing Equipment Market Key Takeaways

- Asia Pacific led the global bakery processing equipment market with the largest share of 40% in 2024.

- The China accounted for the highest market share of 39% in 2024.

- By equipment, the oven and proofers segment held the biggest market share of 35% in 2024.

- By equipment, the molders and sheeters segment is anticipated to expand at the highest CAGR between 2025 and 2034.

- By application, the bread segment contributed the highest market share of 35% in 2024.

- By application, the pizza crust segment is expected to expand at a notable CAGR over the projected period.

The global bakery processing equipment market has been witnessing significant growth due to the increasing demand for bakery products such as bread, cakes, cookies, and pastries. The market, valued at USD 14.81 billion in 2024, is projected to reach approximately USD 28.38 billion by 2034, expanding at a CAGR of 6.72%. This growth is fueled by rising consumer preferences for convenience foods, changing dietary habits, and the increasing adoption of automated solutions in the food processing industry. The market is driven by technological advancements, improving efficiency in baking processes, and the integration of smart automation systems that enhance production capacity.

The demand for bakery processing equipment is rising due to the surge in industrial bakeries and food service outlets worldwide. Equipment such as mixers, ovens, proofers, molders, and slicers are crucial for large-scale production, helping manufacturers meet increasing consumer demand. Additionally, the growing influence of Western eating habits in emerging economies, coupled with urbanization and rising disposable income, is fueling market expansion. Manufacturers are also focusing on sustainability, developing energy-efficient equipment and incorporating eco-friendly production techniques to reduce carbon footprints.

Sample Link: https://www.precedenceresearch.com/sample/5675

Key Drivers

One of the primary drivers of the bakery processing equipment market is the growing demand for bakery products globally. Changing consumer lifestyles and the rising popularity of ready-to-eat food have led to increased consumption of packaged bakery products, propelling the need for advanced processing equipment. Additionally, the expansion of quick-service restaurants (QSRs), cafés, and supermarket bakeries is further boosting equipment demand.

The technological evolution in bakery machinery is another key driver, with manufacturers investing in automation, artificial intelligence, and robotics to enhance efficiency. Automation not only reduces human intervention but also improves product consistency and minimizes wastage. Advanced processing technologies, such as precision temperature control in ovens and energy-efficient baking systems, are gaining traction, enabling manufacturers to optimize production while reducing costs.

Health-conscious consumers are increasingly seeking gluten-free, organic, and whole-grain bakery products, prompting manufacturers to invest in specialized processing equipment that can handle alternative ingredients. The increasing focus on hygiene and food safety regulations has also encouraged bakery manufacturers to upgrade their machinery to meet stringent industry standards. Additionally, government support and incentives for food processing industries in countries like India, China, and Brazil are fostering market growth.

Opportunities

The rapid expansion of the e-commerce sector presents a significant opportunity for the bakery processing equipment market. Online food delivery services and cloud kitchens are experiencing exponential growth, driving demand for high-capacity bakery processing machines that cater to bulk orders efficiently. The increasing trend of home baking, fueled by social media influence and the growing popularity of artisanal bakery products, is creating new opportunities for small-scale bakery equipment manufacturers.

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer lucrative growth opportunities due to urbanization, rising disposable incomes, and changing dietary habits. Many international bakery chains are expanding into these regions, necessitating advanced bakery processing solutions. Additionally, the introduction of energy-efficient and eco-friendly bakery equipment aligns with the global sustainability movement, encouraging manufacturers to develop innovative solutions that minimize environmental impact.

Advancements in IoT and smart manufacturing technologies provide another opportunity for growth. Integrating bakery equipment with cloud-based monitoring systems and predictive maintenance solutions can improve operational efficiency and reduce downtime, making production more cost-effective. As the demand for premium and customized bakery products grows, manufacturers can capitalize on the development of modular and flexible processing systems that cater to varied production needs.

Challenges

Despite the promising growth, the bakery processing equipment market faces several challenges. High initial investment costs associated with advanced automated equipment can be a barrier for small and medium-sized bakeries. The significant capital required for procurement, installation, and maintenance may limit adoption, particularly in developing regions where traditional baking methods still dominate.

Fluctuating raw material prices and supply chain disruptions pose challenges for manufacturers, affecting production costs and profit margins. The bakery industry is heavily dependent on raw materials such as flour, sugar, and dairy products, which are subject to price volatility due to changing climatic conditions, trade policies, and global supply chain constraints.

Stringent food safety regulations and compliance requirements are another hurdle. Bakery processing equipment must adhere to hygiene and safety standards set by regulatory bodies like the FDA, EFSA, and FSSAI. Compliance with these regulations often involves additional costs for manufacturers in terms of testing, certification, and equipment modifications.

Labor shortages in the food processing industry are also a growing concern, making it difficult for bakeries to maintain consistent production. While automation can address this issue, the lack of skilled workforce to operate and maintain advanced bakery machinery remains a challenge. Additionally, competition from local and unorganized bakery manufacturers in emerging markets limits the growth potential of established players.

Regional Insights

The bakery processing equipment market exhibits strong regional growth patterns, with North America, Europe, and Asia-Pacific leading the industry. North America holds a significant market share, driven by the high consumption of bakery products, advanced food processing technology, and the presence of key market players. The U.S. and Canada are major contributors to regional growth, with increasing demand for artisanal and premium bakery products fueling equipment sales.

Europe is another dominant market, supported by a well-established bakery industry and strict food safety regulations that push manufacturers to invest in high-quality processing equipment. Countries like Germany, France, and the UK have a strong bakery culture, with consumers preferring fresh, organic, and gluten-free bakery products, driving innovation in bakery processing equipment.

The Asia-Pacific region is expected to witness the fastest growth, with rising urbanization, changing dietary preferences, and increasing disposable income levels. Countries like China, India, and Japan are experiencing a surge in demand for bakery products, leading to higher investments in automation and advanced processing technologies. The expansion of global bakery chains and local bakery startups in these markets is further propelling equipment sales. Additionally, government initiatives supporting food processing industries in India and China are fostering the adoption of modern bakery machinery.

Latin America and the Middle East & Africa are emerging as potential markets, with increasing bakery consumption driven by Western influences and rapid economic development. The growing popularity of fast food and ready-to-eat products in countries like Brazil, Mexico, the UAE, and Saudi Arabia is contributing to market growth. However, limited access to advanced technology and high equipment costs may hinder rapid adoption in these regions.

Don’t Miss Out: Seafood Market

Market Key Players

- Gemini Bakery Equipment Company

- Global Bakery Solutions

- Heat & Control, Inc.

- JBT Corporation

- Koenig Maschinen GmbH

- Markel Food Group

- RHEON Automatic Machinery Co., Ltd.

- The Middleby Corporation

Recent News

The bakery processing equipment market has witnessed several noteworthy developments in recent years. Leading manufacturers are focusing on expanding their product portfolios by launching innovative equipment with enhanced automation and energy efficiency. For instance, major players like Bühler, GEA Group, and Ali Group have introduced AI-driven bakery processing solutions that optimize production processes and reduce operational costs.

Strategic partnerships and mergers & acquisitions are shaping the competitive landscape. In 2023, Middleby Corporation acquired Turkington USA to strengthen its presence in the industrial bakery equipment sector. Similarly, Rondo and WP Bakery Group have been investing in R&D to develop sustainable and high-performance bakery solutions.

The increasing adoption of Industry 4.0 in bakery processing has led to the integration of smart sensors and data analytics in equipment, allowing real-time monitoring and predictive maintenance. This trend is expected to continue, with manufacturers focusing on IoT-enabled systems that enhance efficiency and minimize downtime.

Sustainability remains a key focus area, with many companies developing eco-friendly bakery processing equipment that reduces energy and water consumption. Equipment manufacturers are investing in technologies that align with global sustainability goals, such as using recycled materials in machine construction and optimizing energy usage through heat recovery systems.

Additionally, the COVID-19 pandemic accelerated the shift toward automation, with bakery manufacturers investing in contactless and robotic solutions to maintain hygiene and reduce labor dependency. The growing preference for frozen and pre-packaged bakery products post-pandemic has further boosted demand for high-performance processing equipment.

As the market continues to evolve, key players are expected to invest in technological advancements, strategic collaborations, and sustainability initiatives to maintain a competitive edge. The bakery processing equipment industry is poised for substantial growth, driven by automation, consumer trends, and expanding bakery businesses worldwide.

Market Segmentation

By Equipment

- Mixer & Blenders

- Dividers & Rounder

- Molders & Sheeters

- Oven & Proofers

- Others

By Application

- Bread

- Cakes & Pastries

- Cookies & Biscuits

- Pizza Crusts

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa