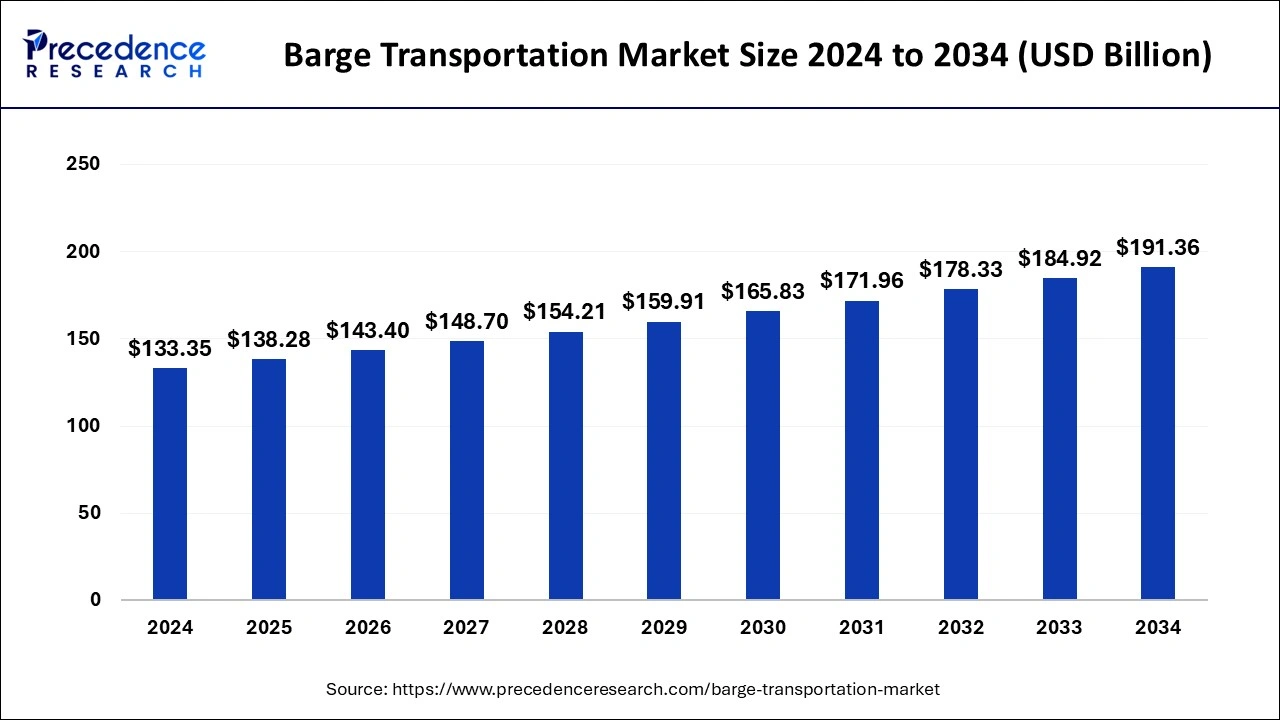

The global barge transportation market, valued at USD 133.35 billion in 2024, is expected to grow to USD 191.36 billion by 2034, with a CAGR of 3.68%.

Barge Transportation Market Key Takeaways

- Europe dominated the global market, accounting for the largest market share of 72% in 2024.

- The tank segment of the barge fleet contributed over 25% to the revenue share in 2024.

- The dry cargo product segment held the largest market share by product in 2024.

The barge transportation market is primarily driven by several key factors. First, the cost-effectiveness of barge transport systems makes them an attractive option for transporting large volumes of goods over long distances. Second, the increasing use of internal waterways for domestic trade in multiple countries enhances the efficiency of cargo movement. Third, the growing focus of companies on cost reductions leads them to prefer barge transportation due to its lower operational expenses. Fourth, the rise in new investments for the enhancement of inland water infrastructures improves the capacity and reliability of barge transport. Fifth, the immense pressure experienced by road freight transportation systems encourages a shift towards barge transport to alleviate congestion.

Opportunities

- Cost-Effectiveness: Barge transport is notably more economical than road and rail, especially for bulk commodities. This cost efficiency comes from moving large volumes of goods in a single trip, significantly reducing the per-unit transportation cost.

- High Cargo Capacity: Barges can carry much larger cargo quantities than trucks or railcars, translating to fewer trips, reduced congestion, lower costs, and a streamlined supply chain.

- Environmental Benefits: Barges are the most environmentally friendly option to ship goods by a big margin, primarily due to their lower emissions per ton-mile of cargo.

- Extensive Reach: The use of vast inland waterways allows barges to reach various regions and markets, some of which might be challenging to access via road or rail.

- Safety and Risk Mitigation: Barge transport is renowned for its safety record, with lower accident rates than road and rail transport. This aspect is vital for transporting hazardous or delicate goods, ensuring cargo integrity, and maintaining supply chain reliability.

Challenges

- Infrastructure Constraints: Waterways are not accessible everywhere and require ongoing dredging to maintain water depth for large barges. This makes expanding barge transportation networks costly and difficult.

- Seasonal Variations: Seasonal changes in water levels can impact barge load capacities at certain times of the year, affecting the reliability of barge transportation.

- Regulatory Compliance: Navigating environmental regulations, safety standards, and international shipping requirements can be complex and costly for barge operators.

- Competition from Other Modes: While barge transportation is cost-effective, competition from road and rail transport remains strong, especially in regions with well-established rail and highway networks.

- Limited Awareness: Inland transport is often overlooked in favor of more obvious modes like road and rail, hindering its broader adoption and investment.

Regional Insights

In North America, the market is projected to account for 38.9% of the global share in 2024, driven by extensive inland waterways like the Mississippi, Ohio, and Missouri rivers. Major operators such as American Commercial Barge Line and Ingram Barge Company dominate intra-regional activities, facilitating efficient domestic and import-export operations. Europe holds a significant position, with the market valued at USD 59.6 billion in 2023, representing a 42% share. The region benefits from a rich history of water transport, a robust industrial base, and a strong emphasis on reducing carbon emissions, making barge transport a cost-effective and environmentally friendly option.

Don’t Miss Out: Infant Nutrition Market

Market Key Players

- SEACOR Holdings

- American Commercial Barge Line (ACBL)

- Ingram Marine Group

- Campbell Transportation Company

- Kirby Corporation

- APL Logistics

- Crowley Maritime Corporation

Recent News

The barge transportation market is experiencing notable developments. The global market is projected to reach USD 221 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.30% from 2024 to 2033. Europe dominates the market with a 42% share, valued at USD 59.6 billion in 2023. Technological innovations are shaping the industry, with Kirby Inland Marine introducing the U.S.’s first plug-in hybrid electric inland towing vessel, the Green Diamond, aiming to reduce fuel use and emissions by approximately 80%. Infrastructure developments include the U.S. Army Corps of Engineers opening a 100-foot-wide navigation channel for commercial vessels at Monongahela River Locks and Dam 3, improving shipping efficiency. Environmental initiatives are also being pursued, with STAX Engineering launching mobile emissions capture and control technology for barges to reduce ship emissions in ports. However, the industry faces challenges, such as low water levels on the Mississippi River causing barge groundings and impacting shipping operations. These developments highlight the dynamic nature of the barge transportation industry, shaped by growth, advancements, infrastructure, environmental efforts, and operational hurdles.

Market Segmentation

By Barge Fleet

- Covered

- Open

- Tank

By Product

- Liquid Cargo

- Dry Cargo

- Gaseous Cargo

By Application

- Agricultural Products

- Coal & Crude Petroleum

- Metal Ores

- Coke & Refined Petroleum Products

- Food Products

- Secondary Raw Materials & Wastes

- Beverages & Tobacco

- Rubber & Plastic

- Chemicals

- Nuclear Fuel

-

Ready for more? Dive into the full experience on our website!