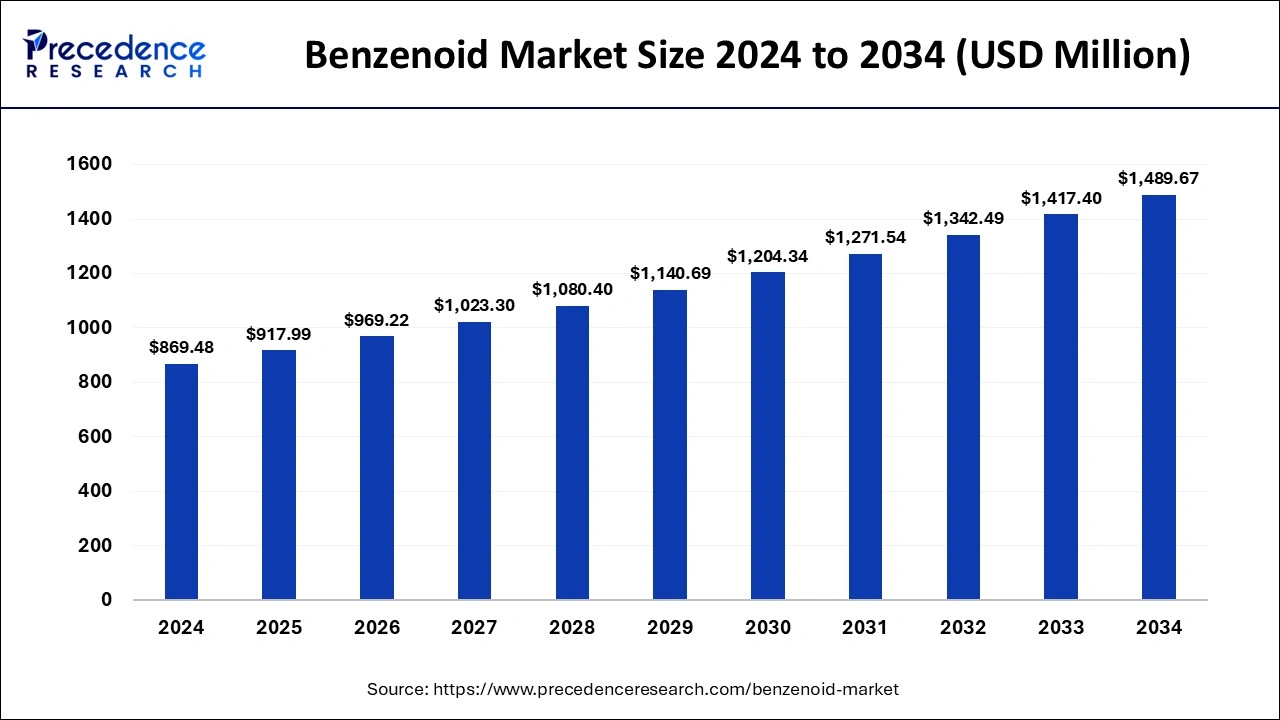

The global benzenoid market size was valued at USD 823.52 million in 2023 and is predicted to reach around USD 1,417.40 million by 2033, expanding at a CAGR of 5.58% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest share in 2023.

- By type, the benzaldehyde segment dominated the market in 2023.

- By type, the toluene segment is expected to grow significantly during the forecast period.

- By source, the natural segment dominated the market in 2023.

- By source, the synthetic segment is expected to be the fastest-growing during the forecast period.

- By application, the food and beverages segment dominated the benzenoid market in 2023 and is estimated to be the fastest-growing during the forecast period.

The Benzenoid Market encompasses a range of aromatic compounds derived from benzene, including derivatives like phenol, toluene, and xylenes. These compounds find extensive use in industries such as chemicals, pharmaceuticals, and food and beverages due to their aromatic properties and diverse applications.

Get a Sample: https://www.precedenceresearch.com/sample/4561

Growth Factors

Factors driving growth in the Benzenoid Market include increasing demand for fragrances and flavors in consumer products, expanding applications in pharmaceuticals for drug synthesis, and growth in the chemical industry for manufacturing intermediates.

Benzenoid Market Trends

- Growing Demand in Fragrance Industry: Benzenoids are widely used in the fragrance industry due to their aromatic properties. There is a continuous demand for these compounds in perfumes, colognes, and other scented products.

- Expanding Applications in Pharmaceuticals: Benzenoids are utilized in pharmaceuticals for their therapeutic properties. The market is seeing increased research and development in utilizing these compounds in drug formulations.

- Rising Popularity in Food and Beverage Industry: Certain benzenoids like vanillin and ethyl vanillin are commonly used as flavoring agents in food and beverages. There is a steady growth in their application in this sector.

- Shift towards Natural Sources: With growing consumer preference for natural ingredients, there is a trend towards sourcing benzenoids from natural extracts rather than synthetic production methods. This includes extraction from plants and fermentation processes.

- Technological Advancements: Advances in extraction technologies and synthetic biology are influencing the production and availability of benzenoids. This includes improvements in yield, purity, and cost-effectiveness.

- Regulatory Developments: Regulatory changes regarding the safety and usage of benzenoid compounds in various applications are influencing market dynamics. Compliance with regulations is becoming increasingly important for manufacturers.

Region Insights:

The market for benzenoids is global, with significant production and consumption hubs in regions like North America, Europe, and Asia-Pacific. North America and Europe are prominent due to established chemical industries and stringent regulations, while Asia-Pacific shows rapid growth driven by industrial expansion and urbanization.

Benzenoid Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,417.40 Million |

| Market Size in 2023 | USD 823.52 Million |

| Market Size in 2024 | USD 869.48 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.58% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Source, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benzenoid Market Dynamics

Drivers:

Key drivers include the rising demand for personal care and homecare products, expanding pharmaceutical manufacturing, and the use of benzenoids in agrochemicals and pesticides. Additionally, technological advancements in production methods and increasing research and development activities contribute to market growth.

Opportunities:

Opportunities lie in the development of novel applications in specialty chemicals and bio-based benzenoids, particularly in environmentally friendly formulations. Emerging markets in Latin America, the Middle East, and Africa offer untapped potential for market expansion.

Challenges:

Challenges include regulatory constraints regarding environmental impact and health concerns associated with certain benzenoid derivatives. Market volatility in raw material prices and fluctuations in demand due to economic uncertainties also pose challenges to market participants.

Read Also: Pine Derived Chemicals Market Size to Reach USD 9.06 Bn by 2033

Benzenoid Market Companies

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- SABIC (Saudi Basic Industries Corporation)

- Total S.A.

- INEOS Group Holdings S.A.

- Eastman Chemical Company

- Shell Chemical LP

- LyondellBasell Industries N.V.

- Chevron Philips Chemical Company LLC

- Lanxess AG

- Huntsman Corporation

- Dupont de Nemours, Inc.

- Exxon Mobil Corporation

- Dow Chemical Company

- BASF SE

Recent Developments

- In October 2022, LANXESS a specialty chemical company displayed its portfolio and concentrated expertise in home and personal care formulations like personal care products, cleaners, and detergents at SEPAWA. In those formulations, Purox S (sodium benzoate) and Purox B (benzoic acid) are naturally identical, fully biodegradable, and highly effective preservatives are used. They help to provide effective protection from personal care products and detergents from fungi, bacteria, etc.

- In November 2023, high SPF and effective UVA protection sunscreen ingredients were launched by Croda. The ingredients include benzyl alcohol, stearic acid, titanium oxide, titanium dioxide, etc.

- In January 2024, a global leader in high-performance polymer, Covestro, and the U.S.-based producer of ISCC PLUS-certified circular chemicals, Encina, reached a long-term supply agreement for chemically recycled, circular feedstock obtained from the post-consumer end-of-life plastic. Encina will supply benzene and toluene Covestro for the completion of the world’s world-scale production facility of Encina. The benzene and toluene raw materials are used for the manufacturing of TDI (toluene diisocyanate) and MDI (methylene diphenyl diisocyanate).

Segments Covered in the Report

By Type

- Benzaldehyde

- Benzoic Acid

- Toluene

- Xylene

- Styrene

By Source

- Natural

- Synthetic

By Application

- Flavor and Fragrance

- Food and Beverages

- Pharmaceuticals

- Polymers and Plastics

- Paints and Coatings

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/