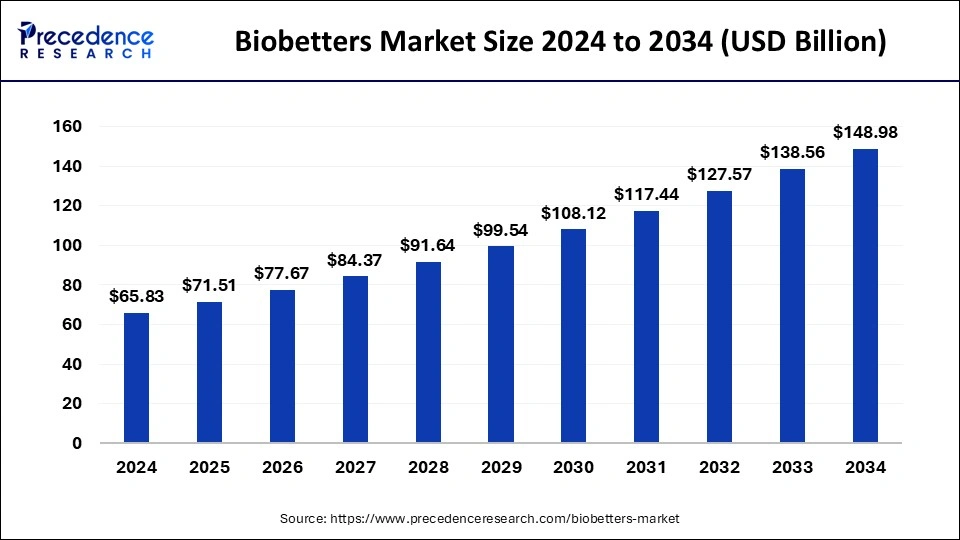

The global biobetters market size was valued at USD 60.61 billion in 2023 and is predicted to reach around USD 138.56 billion by 2033, expanding at a CAGR of 8.62% from 2024 to 2033.

Key Points

- North America dominated the biobetters market in 2023.

- Asia- Pacific shows a significant growth in the biobetters market during the forecast period.

- By molecule type, the monoclonal antibodies biobetters segment dominated the market in 2023.

- By molecule type, the insulin biobetters segment is observed to be the fastest growing in the biobetters market during the forecast period.

- By disease indication, the cancer segment dominated the market in 2023.

- By disease indication, the neurological disorders segment shows a significant growth in the biobetters market during the forecast period.

- By distribution channel, the hospital pharmacy segment dominated the market.

- By distribution channel, the online pharmacy segment shows a notable growth in the biobetters market during the forecast period.

The biobetters market is an emerging segment within the broader biopharmaceutical industry. Biobetters are modified versions of existing biologic drugs with enhanced properties such as improved efficacy, reduced side effects, extended half-life, or better patient compliance. These enhancements are achieved through advanced biotechnological methods, including protein engineering, pegylation, glycoengineering, and fusion with Fc fragments, among others. Unlike biosimilars, which are essentially generic versions of biologics, biobetters offer significant therapeutic advancements over their reference products. This market is gaining momentum due to the increasing demand for more effective and patient-friendly treatments, coupled with advancements in biotechnology and drug development processes.

Get a Sample: https://www.precedenceresearch.com/sample/4504

Growth Factors

Several factors are driving the growth of the biobetters market. Firstly, the limitations of existing biologics in terms of efficacy, safety, and patient compliance create a substantial demand for improved alternatives. Biobetters address these limitations, offering enhanced therapeutic benefits and improved patient outcomes. Secondly, advancements in biotechnology and drug development technologies enable the creation of biobetters with superior properties. Innovations in protein engineering, for instance, allow for precise modifications that enhance the stability, efficacy, and safety profile of biopharmaceuticals.

Additionally, the expiration of patents for many blockbuster biologics presents significant opportunities for the development of biobetters. As these patents expire, biopharmaceutical companies are increasingly looking to biobetters as a strategy to maintain market share and extend the commercial lifecycle of their products. Moreover, regulatory pathways for biobetters are becoming more clearly defined, facilitating their development and approval. Regulatory agencies are recognizing the distinct advantages of biobetters and are providing guidance on the evidence required to demonstrate their improved properties over reference biologics.

Region Insights

The biobetters market is witnessing growth across various regions, with North America, Europe, and Asia-Pacific being the key markets. North America holds a significant share due to the presence of a robust biopharmaceutical industry, advanced healthcare infrastructure, and strong support for biotechnological innovations. The United States, in particular, is a major contributor to the market, driven by extensive research and development activities and a favorable regulatory environment.

Europe is another prominent market for biobetters, with countries like Germany, the United Kingdom, and France leading the way. The region’s well-established healthcare systems, combined with strong governmental support for biopharmaceutical research, contribute to the growth of the market. Additionally, Europe has a significant number of biologics approaching patent expiration, providing ample opportunities for biobetters.

The Asia-Pacific region is emerging as a rapidly growing market for biobetters, driven by increasing investments in biotechnology, rising healthcare expenditures, and a growing focus on innovative therapies. Countries like China, Japan, and South Korea are at the forefront of this growth, supported by favorable government policies and a rising prevalence of chronic diseases that necessitate advanced treatment options.

Biobetters Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 138.56 Billion |

| Market Size in 2023 | USD 60.61 Billion |

| Market Size in 2024 | USD 65.83 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 8.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Molecule Type, Disease Indication, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biobetters Market Dynamics

Drivers

The primary drivers of the biobetters market include the need for improved therapeutic options, technological advancements, and the strategic advantages they offer to pharmaceutical companies. As patients and healthcare providers seek treatments that offer better efficacy, fewer side effects, and improved compliance, biobetters are becoming an attractive option. They provide substantial clinical benefits, addressing unmet medical needs and enhancing patient quality of life.

Technological advancements in the field of biotechnology play a crucial role in the development of biobetters. Innovations such as protein engineering, advanced formulation techniques, and cutting-edge delivery systems enable the creation of biobetters with superior properties. These technologies allow for the precise modification of biologic drugs, resulting in enhanced stability, prolonged half-life, and improved targeting of specific tissues or cells.

For pharmaceutical companies, biobetters represent a strategic opportunity to extend the lifecycle of their biologic products and maintain market share. With many biologics nearing patent expiration, the development of biobetters provides a pathway to retain exclusivity and generate continued revenue from existing therapeutic areas. Moreover, biobetters can differentiate a company’s product portfolio and enhance its competitive position in the market.

Opportunities

The biobetters market presents several opportunities for growth and innovation. One of the key opportunities lies in the development of biobetters for chronic and complex diseases. Conditions such as cancer, autoimmune disorders, and rare genetic diseases often require long-term treatment with biologics. Biobetters with improved efficacy, safety, and convenience can significantly enhance the management of these diseases, leading to better patient outcomes and reduced healthcare costs.

Additionally, the growing trend towards personalized medicine offers opportunities for the development of biobetters tailored to specific patient populations. Advances in genomics, proteomics, and biomarker research enable the identification of patient subgroups that are likely to benefit from particular biobetters. This targeted approach can optimize treatment efficacy and minimize adverse effects, further driving the adoption of biobetters in clinical practice.

Collaborations and partnerships between biopharmaceutical companies and research institutions also present significant opportunities for the biobetters market. By leveraging each other’s expertise and resources, these collaborations can accelerate the development of innovative biobetters and facilitate their commercialization. Academic institutions, in particular, play a crucial role in early-stage research and discovery, providing a pipeline of potential biobetters for further development.

Challenges

Despite the promising outlook, the biobetters market faces several challenges that need to be addressed to fully realize its potential. One of the primary challenges is the complexity and cost associated with the development of biobetters. The advanced biotechnological techniques required for their creation often involve significant investment in research and development, as well as extensive clinical testing to demonstrate their superiority over reference biologics. This can be a barrier for smaller companies with limited resources.

Regulatory challenges also pose a significant hurdle for the biobetters market. While regulatory pathways for biobetters are becoming more defined, there is still a need for clearer guidelines and streamlined processes to facilitate their approval. Regulatory agencies must balance the need for rigorous evaluation to ensure safety and efficacy with the need to expedite the availability of these improved therapies to patients.

Intellectual property and patent issues represent another challenge. Developing biobetters requires careful navigation of existing patents and intellectual property rights associated with the reference biologics. Companies must ensure that their biobetters do not infringe on existing patents while also securing their own intellectual property to protect their innovations.

Market acceptance and competition from both biosimilars and new biologic drugs are additional challenges. While biobetters offer distinct advantages, gaining market acceptance requires convincing healthcare providers, payers, and patients of their benefits. Furthermore, the increasing availability of biosimilars and the continuous development of new biologic drugs create a competitive landscape that biobetters must navigate to achieve commercial success.

Read Also: Heavy Construction Equipment Market Size, Share, Report by 2033

Biobetters Market Comppnies

- F. Hoffmann-La Roche AG

- Merck & Co. Inc.

- SERVIER

- Eli Lily and Company

- Biogen Inc.

- Teva Pharmaceutical Industries Ltd.

- Sanofi SA

- Porton Biopharma Limited

- Novo Nordisk A/S

- CSL Behring GmbH

Recent Developments

- In June 2024, As reported by Syngene International Ltd, a new platform for producing proteins has been launched. The platform combines Syngene’s clone selection and development procedures with in-licensed cell line and transposon-based technology from the Swiss biotech services company ExcellGene, which should result in a notable increase in accuracy and efficiency. By speeding up improved protein manufacturing, the new platform shortens the time to market by facilitating faster preclinical, clinical, and commercial launches.

- In November 2023, the most recent addition to 3M’s line of chromatographic clarifiers was revealed. Harvest RC Chromatographic Clarifier, model number BT500, is a 500 mL, single-use chromatographic clarifier for monoclonal antibodies, recombinant proteins, and biologics.

- In March 2022, ProteoGenix declared the XtenCHOTM Transient Expression System to be available. The novel patented mammalian cell-based expression host provides up to ten times greater yields with less hands-on time than previous options because of its improved metabolism and enhanced plasmid stability. The novel CHO host seeks to expedite early-phase drug screening and streamline the creation of recombinant proteins.

Segments Covered in the Report

By Molecule Type

- G-CSF Biobetters

- Insulin Biobetters

- Erythropoietin Biobetters

- Monoclonal Antibodies Biobetters

- Others

By Disease Indication

- Cancer

- Diabetes

- Genetic Disease

- Neurological Disorders

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/