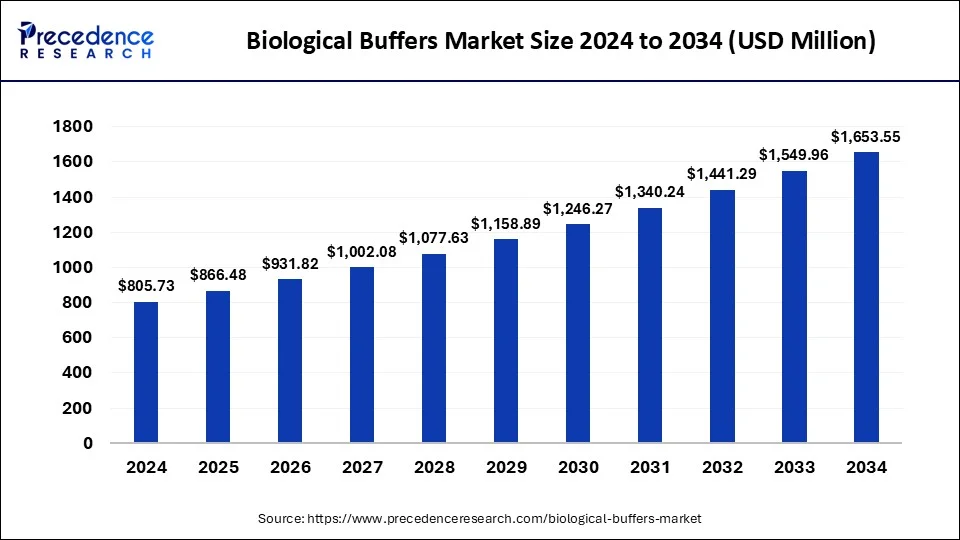

The global biological buffers market size was estimated at USD 749.24 million in 2023 and is predicted to be worth around USD 1,549.96 million by 2033, expanding at a CAGR of 7.54% from 2024 to 2033.

Biological Buffers Market Key Points

- Europe led the global biological buffers market in 2023.

- Asia Pacific is expected to show significant growth in the market during the forecast period.

- By type, the phosphate type segment dominated the market in 2023 and is anticipated to experience rapid growth during the forecast period.

- By application, in 2023, the research institution segment dominated the market and is expected to experience the fastest growth during the projected period.

The biological buffers market plays a critical role in various life science applications, providing essential pH stability to maintain biochemical processes and cell viability. These buffers are extensively used in molecular biology, cell culture, protein biochemistry, and other biotechnological applications. The market is driven by the increasing demand for biopharmaceuticals, diagnostic assays, and research reagents that require precise pH control to ensure reproducibility and accuracy.

Get a Sample: https://www.precedenceresearch.com/sample/4660

Biological Buffers Market Trends

- Increasing Biopharmaceutical Research: As biopharmaceutical research continues to expand, there is a growing demand for biological buffers in various applications such as protein purification, cell culture, and enzyme assays. This trend is driven by the need for precise pH control and maintenance of biological samples.

- Rising Demand in Diagnostic Applications: Biological buffers are crucial in diagnostic applications such as immunoassays and molecular diagnostics. With advancements in healthcare diagnostics and increasing prevalence of chronic diseases, the demand for high-quality buffers that ensure accurate test results is on the rise.

- Growing Biotechnology and Life Sciences Sector: The biotechnology and life sciences sectors rely heavily on biological buffers for research, development, and manufacturing of biologics and biosimilars. As these sectors continue to grow globally, the demand for buffers suitable for biotechnological applications is increasing.

- Focus on Quality and Purity: There is a significant emphasis on the quality and purity of biological buffers, especially in pharmaceutical and biotechnological applications where stringent regulatory requirements must be met. Manufacturers are focusing on developing buffers with high stability, low toxicity, and minimal interference with biological processes.

- Technological Advancements in Buffer Formulations: Innovations in buffer formulations, including new chemistries and compositions that enhance stability and performance, are driving market growth. Manufacturers are investing in research and development to create buffers that offer improved shelf life, compatibility with sensitive biological molecules, and ease of use.

Regional Insights

The market for biological buffers is globally distributed, with North America and Europe holding significant shares due to their advanced biotechnology and pharmaceutical sectors. These regions benefit from extensive research activities and robust healthcare infrastructure, driving consistent demand for buffers. Asia-Pacific is emerging as a lucrative market, fueled by expanding biopharmaceutical manufacturing capabilities, increasing R&D investments, and growing healthcare expenditure in countries like China, India, and Japan.

Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,549.96 Million |

| Market Size in 2023 | USD 749.24 Million |

| Market Size in 2024 | USD 805.73 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 7.54% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers of Growth

Several factors contribute to the growth of the biological buffers market. One primary driver is the expanding biopharmaceutical industry, which relies heavily on buffers for drug formulation and stability testing. Additionally, the rise in chronic diseases and the subsequent increase in diagnostic procedures propel demand for buffers used in diagnostic kits and assays. Technological advancements in buffer formulations, such as improved stability and compatibility with sensitive biomolecules, also drive market growth.

Opportunities

The market presents various opportunities driven by technological innovations and expanding applications. Advancements in buffer chemistry, including the development of new formulations and eco-friendly alternatives, open doors for product innovation and differentiation. The increasing adoption of personalized medicine and genetic research further expands the application scope of biological buffers, creating new avenues for market players to explore.

Challenges

Despite its growth prospects, the biological buffers market faces challenges such as stringent regulatory requirements for buffer components and formulations. Ensuring compatibility with diverse biological samples and maintaining batch-to-batch consistency are ongoing challenges for manufacturers. Economic uncertainties and fluctuating raw material costs also impact market dynamics, requiring companies to implement effective cost management strategies.

Read Also: Neurology Clinical Trials Market Size to Worth USD 9.64 Bn by 2033

Recent Developments

- In October 2023, Nijhuis Saur Industries (NSI) found the finishing touch of the acquisition of Pall Aria containerized devices, which constitutes a subset of Pall Water’s cell water commercial enterprise in Europe.

- In February 2023, WuXi AppTec launched a new biological safety testing facility in Suzhou, China. This facility is equipped with the latest technology and will provide a wide range of biological safety testing services to clients in the Asia-Pacific region.

- In January 2023, Charles River Laboratories announced the acquisition of Eurofins Scientific’s biological safety testing business. This acquisition will expand Charles River’s capabilities in biological safety testing and help the company meet the growing demand for these services.

- In June 2023, CellTech Innovations unveiled “LysoBoost Plus,” an enhanced cell lysis reagent with improved efficiency and compatibility across a wide range of cell types. The product incorporates a unique enzyme blend and optimized formulation to achieve higher yields of intracellular components, benefiting applications such as proteomics, genomics, and drug discovery.

- In January 2023, BioLysis Inc. introduced a breakthrough cell lysis technology, “CytoBreaker,” which allows for faster and more efficient cell disruption. The technology utilizes advanced nanoparticle-based reagents for targeted cell lysis in various sample types.

Biological Buffers Market Companies

- Merck KGaA

- Thermo Fisher Scientific Inc

- Avantor

- GE Healthcare

- Santa Cruz Biotechnology, Inc.

- Lonza Group Ltd.

- Bio-Rad Laboratories, Inc

- F. Hoffmann-La Roche Ltd.

- Hamilton Company

- BASF SE

Segments covered in the report

By Type

- Phosphate Type

- Acetate Type

- TRIS Type

- Other Types

By End-User

- Research Institution

- Pharmaceutical Industry

- Other End-Users

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/