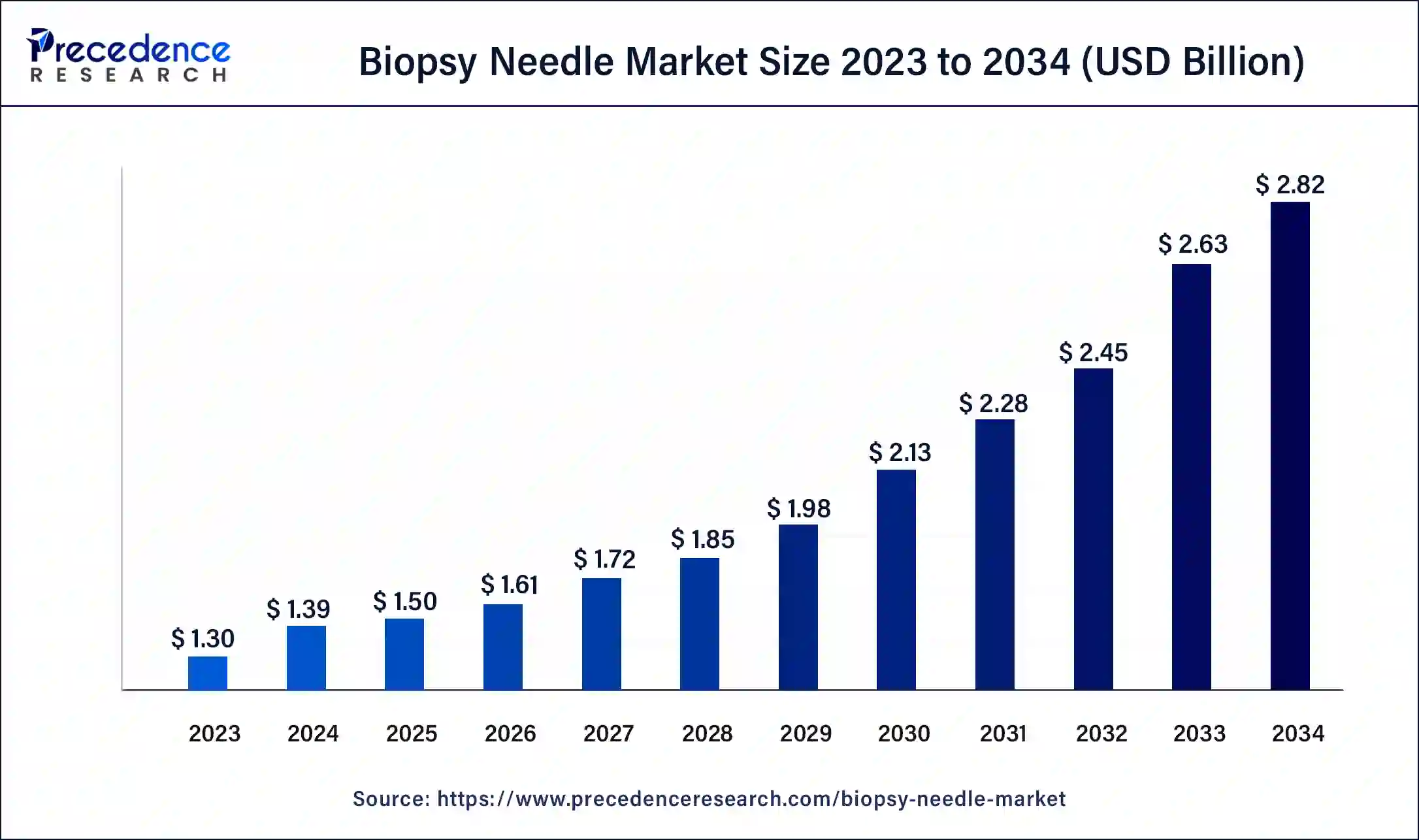

The global biopsy needle market size is anticipated to grow around USD 2.60 billion by 2033, growing at a CAGR of 7.17% from 2024 to 2033.

Key Points

- The North America biopsy needle market size surpassed USD 520 million in 2023 and is predicted to hit around USD 1,030 million by 2033.

- North America dominated the global biopsy needle market with the largest market share of 39.7% in 2023.

- Asia Pacific is considered to register the fastest growth with a significant CAGR during the forecast period.

- By-product, the biopsy needle guns segment has held the largest share of 62% in 2023.

- By application, the cancer segment has accounted largest market share of 46% in 2023.

- By end-user, the hospitals segment has registered the largest market share of 58% in 2023.

The biopsy needle market is a significant segment within the global medical devices industry, focusing on the development, production, and distribution of needles used in biopsy procedures. Biopsy is a critical medical procedure that involves the extraction of tissue samples from various organs or sites in the body for diagnostic purposes. Biopsy needles are designed to efficiently and safely obtain these samples with minimal invasiveness and patient discomfort. They are used in a wide range of medical fields, including oncology, cardiology, pulmonology, and radiology, among others.

The biopsy needle market is witnessing substantial growth due to an increase in the prevalence of various chronic diseases such as cancer and other conditions that require diagnostic testing. Additionally, technological advancements in biopsy needle design, such as the development of more precise and minimally invasive needles, are contributing to the market’s expansion. These innovations help improve the accuracy of diagnoses and the patient experience during biopsy procedures.

The global biopsy needle market is highly competitive, with several established players operating at a global and regional level. These companies are focused on developing innovative biopsy needle products and expanding their market presence through strategic partnerships, mergers, and acquisitions.

Get a Sample: https://www.precedenceresearch.com/sample/4085

Growth Factors:

- Rising Incidence of Chronic Diseases: The growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and respiratory disorders is driving the demand for biopsy needles. These diseases often require diagnostic testing using biopsy procedures.

- Technological Advancements: Innovations in biopsy needle design, including the development of fine needle aspiration and core needle biopsy techniques, are improving the precision and safety of biopsy procedures. These advancements are enhancing the diagnostic capabilities of medical practitioners.

- Increasing Awareness and Early Detection: Greater awareness of early detection and screening for diseases such as cancer has led to more frequent use of biopsy procedures. Early diagnosis can significantly improve patient outcomes, driving demand for biopsy needles.

- Growing Geriatric Population: The aging population is more susceptible to chronic diseases, leading to an increased need for diagnostic testing and biopsy procedures.

- Rising Healthcare Expenditure: Governments and private healthcare organizations are investing in advanced medical equipment and devices, including biopsy needles, to improve healthcare infrastructure and services.

Regional Insights:

- North America: North America dominates the biopsy needle market due to its advanced healthcare infrastructure, high healthcare expenditure, and prevalence of chronic diseases such as cancer. The region also benefits from the presence of major medical device manufacturers and ongoing research and development activities.

- Europe: Europe is another key market for biopsy needles, with countries such as Germany, the UK, and France leading the way. The region’s strong healthcare system and emphasis on early diagnosis contribute to the demand for biopsy needles.

- Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in the biopsy needle market, driven by an expanding healthcare infrastructure, rising awareness of early disease detection, and increasing healthcare expenditure. Countries such as China and India are major contributors to the region’s growth.

- Latin America and Middle East & Africa: These regions are also witnessing growth in the biopsy needle market due to improving healthcare infrastructure and increasing investments in medical technology. However, challenges such as limited access to advanced healthcare services in certain areas may affect market growth.

Biopsy Needle Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.17% |

| Global Market Size in 2023 | USD 1.30 Billion |

| Global Market Size in 2024 | USD 1.39 Billion |

| Global Market Size by 2033 | USD 2.60 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biopsy Needle Market Dynamics

Drivers:

- Technological Innovation: Ongoing advancements in biopsy needle design, such as the development of minimally invasive and image-guided biopsy techniques, are driving the market forward.

- Increasing Healthcare Expenditure: Rising healthcare budgets in both developed and emerging economies are fueling demand for biopsy needles and other diagnostic tools.

- Focus on Early Diagnosis: The emphasis on early diagnosis of diseases such as cancer has increased the use of biopsy procedures, thereby boosting the demand for biopsy needles.

- Growing Awareness: Public awareness campaigns on the importance of early disease detection and screening are contributing to the adoption of biopsy procedures and, consequently, biopsy needles.

- Rising Geriatric Population: The increasing number of older individuals in the global population is leading to a higher prevalence of age-related diseases, which often require biopsy procedures.

Challenges:

- High Costs: Biopsy procedures, particularly those involving advanced technologies, can be expensive, which may limit accessibility for some patients.

- Risk of Complications: Although biopsy needles are designed to be safe, there is always a risk of complications such as bleeding, infection, or damage to surrounding tissues.

- Regulatory Compliance: Medical devices, including biopsy needles, must adhere to stringent regulatory standards, which can be challenging for manufacturers.

- Limited Access in Developing Regions: In some developing regions, access to advanced medical technology and healthcare services may be limited, hindering market growth.

- Ethical and Legal Concerns: The use of biopsy procedures may raise ethical and legal questions, particularly in cases involving vulnerable populations or sensitive medical issues.

Opportunities:

- Emerging Markets: Developing regions such as Asia-Pacific, Latin America, and Africa present significant growth opportunities for the biopsy needle market as healthcare infrastructure improves and awareness of early diagnosis increases.

- Product Innovation: Continuous research and development in biopsy needle design, such as the development of new materials and technologies, can open up new market opportunities.

- Partnerships and Collaborations: Collaborations between medical device manufacturers and research institutions or healthcare providers can lead to the development of innovative biopsy needle solutions.

- Expansion into New Applications: Biopsy needles can find applications in various medical fields beyond oncology, such as cardiology and gastroenterology, creating new market opportunities.

- Telemedicine Integration: The rise of telemedicine can offer opportunities for remote diagnostic procedures, including image-guided biopsies, which may increase the demand for advanced biopsy needles.

Read Also: Agricultural Biologicals Market Size to Grow USD 39.59 Bn by 2033

Recent Developments

- In 2022, Cambridge Enterprise introduced their biopsy device named ‘CamPROBE’. The prostate biopsy device aims to reduce the risks related to conventional transrectal biopsies.

- In 2022, Mammatome introduced their dual-core biopsy system which marked their first step in the core biopsy market. The device reduces the vibrations and needle movements and helps to enhance the patient experience.

- In 2022, Limaca Medical received its breakthrough device through the FDA for its Precision-GI endoscopic ultrasound biopsy needle. The invention aims to reduce issues like blood contamination, tissue fragmentation, and less collection of sample quantity during the entire procedure.

- In 2021, Hologic Inc. acquired a company named Somatex Technologies for 64 million, aiming to increase the treatment offerings for breast cancer.

Biopsy Needle Market Companies

- Becton

- Medtronic Plc

- Cardinal Health

- Hologic Inc

- Olympus Corporation

- Argon Medical Devices Inc

- Devicor Medical Products, Inc

- B. Braun Melsungen AG

- Cook Group Incorporated

- Boston Scientific Corporation

- FUJIFILM Holdings Corporation

- Dickinson and Company

- Stryker Corporation

- INRAD, Inc

Segments Covered in the Report

By Product

- Biopsy Needle Guns

- Vacuum-assisted Biopsy Devices

- Fine Needle Aspiration Biopsy

- Core Needle Biopsy Devices

- Biopsy Needles

- Disposable

- Reusable

By Application

- Cancer

- Breast

- Lung

- Prostate

- Colon

- Stomach

- Liver

- Other cancer

- Autoimmune Disorder

- Infectious Diseases

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/