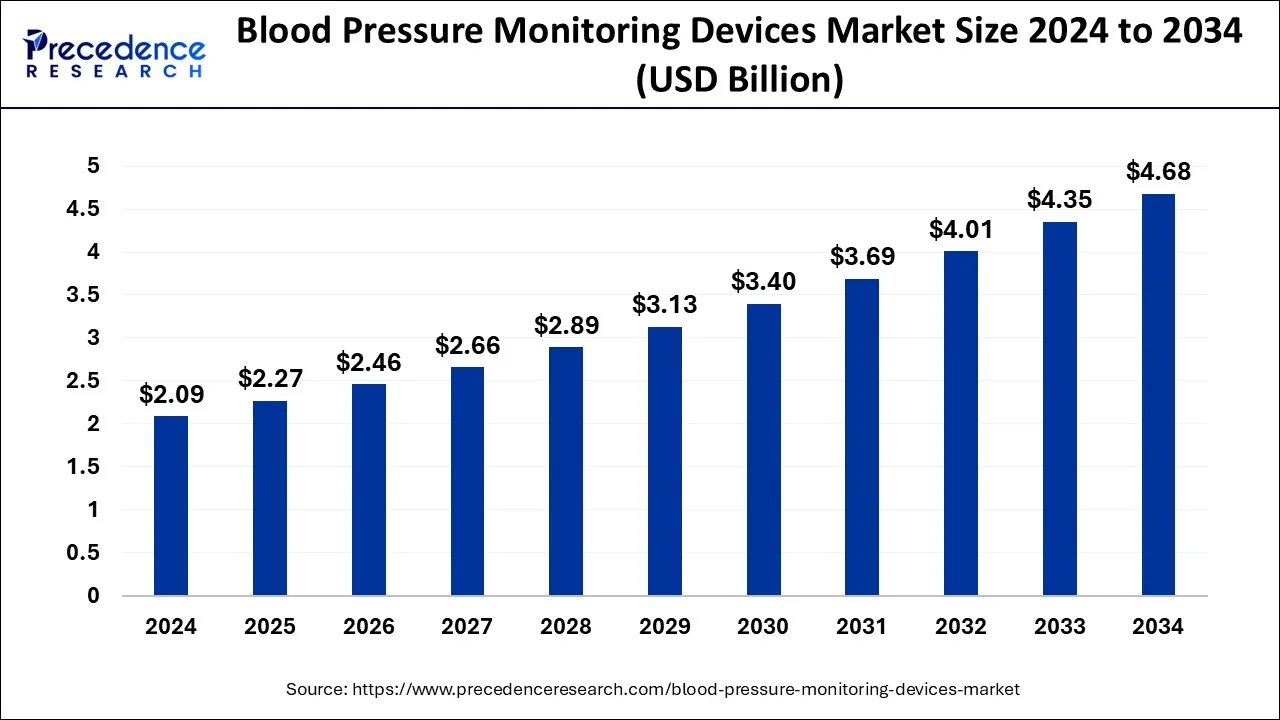

The blood pressure monitoring devices market to surge from USD 2.09 Bn in 2024 to USD 4.35 Bn by 2034, witnessing a CAGR of 8.49%.

Blood Pressure Monitoring Devices Market Key Takeaways

- North America dominated the global market in 2024, holding the largest share of 37.44%.

- The digital blood pressure monitor segment accounted for the highest market share of 35.80% in 2024.

- Among end-users, hospitals led the market with a significant revenue share of 59.34% in 2024.

The blood pressure monitoring devices market is experiencing significant growth, driven by the increasing prevalence of hypertension and cardiovascular diseases worldwide. In 2024, the market was valued at USD 2.09 billion and is projected to reach USD 4.35 billion by 2034, expanding at a CAGR of 8.49%. North America led the market with the highest share of 37.44% in 2024, reflecting strong demand and advanced healthcare infrastructure.

Among product segments, digital blood pressure monitors dominated with a market share of 35.80%, highlighting the growing preference for easy-to-use and accurate monitoring solutions. In terms of end-users, hospitals generated the highest revenue share of 59.34%, driven by the rising number of patient admissions and the need for reliable blood pressure monitoring in clinical settings.

Sample Link: https://www.precedenceresearch.com/sample/1090

Key Drivers

Opportunities

- Growing demand for wearable and smart blood pressure monitors with real-time data tracking and integration with mobile apps.

- Expansion of telemedicine and remote patient monitoring, driving the need for connected blood pressure monitoring devices.

- Increasing awareness of preventive healthcare and self-monitoring, leading to higher adoption of home-use devices.

- Growth in emerging markets due to improving healthcare infrastructure and rising disposable incomes.

- Advancements in AI and machine learning for more accurate and predictive blood pressure monitoring solutions.

Challenges

- High costs of advanced blood pressure monitoring devices, limiting accessibility in low-income regions.

- Accuracy concerns and calibration issues in some digital and wearable monitors, affect reliability.

- Regulatory challenges and strict compliance requirements for medical device approvals.

- Reimbursement limitations in some countries, affect affordability for patients.

- Competition from alternative diagnostic methods and multifunctional health monitoring devices.

Regional Insights

North America dominated the blood pressure monitoring devices market in 2024, holding the largest share of 37.44%, driven by advanced healthcare infrastructure, high awareness, and increasing cases of hypertension. Europe follows closely, supported by strong government healthcare policies and a growing elderly population. The Asia-Pacific region is witnessing rapid growth due to rising healthcare investments, expanding medical facilities, and increasing adoption of digital health technologies.

Countries like China, India, and Japan are leading this expansion with a surge in demand for home monitoring devices. Latin America is also experiencing steady growth, fueled by improving healthcare accessibility and rising health consciousness. Meanwhile, the Middle East and Africa are gradually expanding, driven by government initiatives to enhance healthcare services and increase the adoption of modern medical technologies.

Don’t Miss Out: Solid Tumor Cancer Treatment Market

Market Key Players

- Welch Allyn

- American Diagnostic Corporation

- Briggs Healthcare

- Withings

- Spacelabs Healthcare

- GF HEALTH PRODUCTS, INC.

- Kaz, A Helen of Troy Company

- Rossmax International Limited

- Microlife Corporation

Recent News

The blood pressure monitoring devices market is experiencing significant growth, driven by technological advancements and increasing health awareness. In November 2024, OMRON Healthcare received FDA De Novo authorization for home blood pressure monitors equipped with AI-powered atrial fibrillation detection, enhancing early diagnosis and management of heart conditions.

Similarly, Withings introduced the BPM Vision in January 2025, a home blood pressure monitor featuring an integrated screen for real-time readings and health insights, aiming to improve user engagement and compliance. These developments reflect a broader trend of integrating advanced technologies into personal health devices, making monitoring more accessible and effective for consumers.

Market Segmentation

By Product

- Digital Blood Pressure Monitor

- Wrist

- Arm

- Finger

- Sphygmomanometer

- Ambulatory Blood Pressure Monitor

- Instruments & Accessories

- Blood pressure cuffs

- Reusable

- Disposable

- Others

- Blood pressure cuffs

- Transducers

- Reusable

- Disposable

By End-User

- Ambulatory Surgical Centers & Clinics

- Hospitals

- Home Healthcare