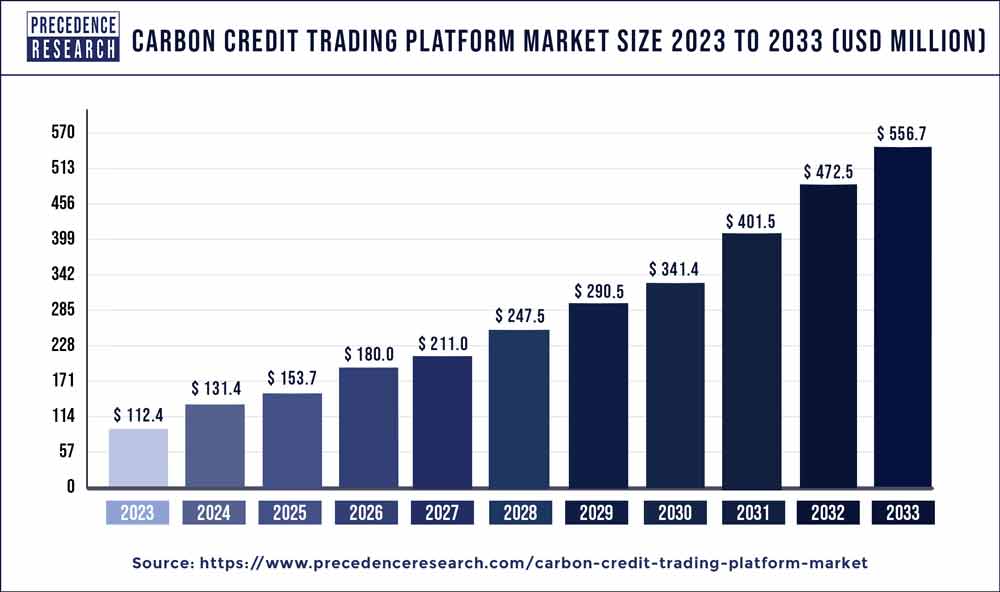

According to a recent research report titled “Carbon Credit Trading Platform Market (By Type: Voluntary, Compliance; By System Type: Cap and Trade, Baseline and Credit; By End-use: Industrial, Utilities, Energy, Petrochemical, Aviation, Others) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033″ published by Precedence Research, the global carbon credit trading platform market size is projected to touch around USD 556.7 million by 2033 and growing at a CAGR of 17.40% over the forecast period 2024 to 2033. This comprehensive study examines various factors and their impact on the growth of the carbon credit trading platform market.

Key Takeaways

- Europe contributed 40% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, the voluntary segment has held the largest market share of 55% in 2023.

- By type, the compliance segment is anticipated to grow at a remarkable CAGR of 18.7% between 2024 and 2033.

- By system type, the cap trade segment generated over 57% of market share in 2023.

- By system type, the baseline and credit segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the utilities segment generated over 26% of market share in 2023.

- By end-use, the aviation segment is expected to expand at the fastest CAGR over the projected period.

The Carbon Credit Trading Platform Market refers to the ecosystem where buyers and sellers engage in the trading of carbon credits, which represent reductions in greenhouse gas emissions. As the world intensifies efforts to combat climate change, carbon credit trading has emerged as a key mechanism to incentivize companies and organizations to reduce their carbon footprint. Carbon credit trading platforms serve as digital marketplaces facilitating the buying and selling of these credits, thereby enabling the efficient allocation of resources towards emissions reduction projects.

Download a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/3733

Growth Factors

- Increasing Environmental Awareness: Growing awareness about climate change and its impacts is driving individuals, companies, and governments to seek solutions to reduce carbon emissions, leading to a greater demand for carbon credits and trading platforms.

- Government Regulations and Initiatives: Governments worldwide are implementing regulations and initiatives to reduce greenhouse gas emissions. This includes carbon pricing mechanisms, cap-and-trade systems, and other policies that create a favorable environment for carbon credit trading platforms.

- Corporate Sustainability Goals: Many companies are setting ambitious sustainability goals, including carbon neutrality or net-zero emissions targets. To achieve these goals efficiently and cost-effectively, companies are turning to carbon credit trading platforms to offset their emissions.

- Rising Investments in Renewable Energy: The increasing investments in renewable energy projects such as wind, solar, and hydro are generating more carbon credits, thereby boosting the demand for trading platforms to facilitate the buying and selling of these credits.

- Technological Advancements: Innovations in blockchain technology, artificial intelligence, and data analytics are improving the efficiency, transparency, and security of carbon credit trading platforms, making them more attractive to investors and participants.

- Growing Investor Interest: Institutional investors, including pension funds, asset managers, and impact investors, are increasingly incorporating environmental, social, and governance (ESG) criteria into their investment decisions. This growing interest in sustainable investments is driving the demand for carbon credits and trading platforms.

Carbon Credit Trading Platform Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.40% |

| Global Market Size in 2023 | USD 112.4 Million |

| Global Market Size by 2033 | USD 556.7 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By System Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Also read: Automotive Glass Market Size to Cross USD 50.25 Billion by 2033

Region Snapshot

The carbon credit trading platform market operates globally, with significant activity in regions where environmental regulations are stringent or where there is a strong emphasis on sustainability. Key regions for carbon credit trading platforms include North America, Europe, Asia-Pacific, and increasingly, emerging markets in Latin America and Africa. Each region has its unique regulatory framework, market dynamics, and level of participation, influencing the growth and development of carbon credit trading platforms.

Opportunities

- Increasing Awareness: Growing awareness of climate change and the urgency to reduce carbon emissions present significant opportunities for carbon credit trading platforms to expand their user base and market reach.

- Policy Support: Supportive government policies, such as carbon pricing mechanisms and emissions trading schemes, create favorable conditions for the growth of the carbon credit trading market.

- Corporate Sustainability Initiatives: Rising corporate commitments to sustainability and environmental responsibility drive demand for carbon credits, providing opportunities for platform providers to offer innovative solutions and services.

Challenges:

- Regulatory Complexity: Diverse regulatory frameworks and standards across regions pose challenges for carbon credit trading platforms in ensuring compliance and interoperability.

- Verification and Monitoring: Ensuring the credibility and integrity of carbon credits require robust verification and monitoring mechanisms, which can be resource-intensive and complex.

- Market Fragmentation: Fragmentation in the carbon credit market, with varying project types, methodologies, and pricing mechanisms, complicates trading and liquidity management for platform users.

Major Key Points Covered in Report:

Executive Summary: It includes key trends of the electric vehicle fuel cell market related to products, applications, and other crucial factors. It also provides analysis of the competitive landscape and CAGR and market size of the electric vehicle fuel cell market based on production and revenue.

Production and Consumption by Region: It covers all regional markets to which the research study relates. Prices and key players in addition to production and consumption in each regional market are discussed.

Key Players: Here, the report throws light on financial ratios, pricing structure, production cost, gross profit, sales volume, revenue, and gross margin of leading and prominent companies competing in the Electric vehicle fuel cell market.

Market Segments: This part of the report discusses product, application and other segments of the electric vehicle fuel cell market based on market share, CAGR, market size, and various other factors.

Research Methodology: This section discusses the research methodology and approach used to prepare the report. It covers data triangulation, market breakdown, market size estimation, and research design and/or programs.

Market Key Players

The report incorporates company profiles of key players in the market. These profiles encompass vital information such as product portfolio, key strategies, and a comprehensive SWOT analysis for each player. Additionally, the report presents a matrix illustrating the presence of each prominent player, enabling readers to gain actionable insights. This facilitates a thoughtful assessment of the market status and aids in predicting the level of competition in the carbon credit trading platform market.

Carbon Credit Trading Platform Market Companies

- AirCarbon Exchange (ACX)

- CarbonX

- CTX (Climate Trade)

- CBL Markets

- Markit (now IHS Markit)

- APX, Inc.

- Climex

- Carbon Trade Exchange (CTX)

- Karbone

- Redshaw Advisors

- EEX Group

- ClearBlue Markets

- ClimateCare

- South Pole

- Bluesource

Segments Covered in the Report

By Type

- Voluntary

- Compliance

By System Type

- Cap and Trade

- Baseline and Credit

By End-use

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Carbon Credit Trading Platform Market

5.1. COVID-19 Landscape: Carbon Credit Trading Platform Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Carbon Credit Trading Platform Market, By Type

8.1. Carbon Credit Trading Platform Market, by Type, 2024-2033

8.1.1 Voluntary

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Compliance

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Carbon Credit Trading Platform Market, By System Type

9.1. Carbon Credit Trading Platform Market, by System Type, 2024-2033

9.1.1. Cap and Trade

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Baseline and Credit

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Carbon Credit Trading Platform Market, By End-use

10.1. Carbon Credit Trading Platform Market, by End-use, 2024-2033

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Utilities

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Energy

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Petrochemical

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Aviation

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Carbon Credit Trading Platform Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by System Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by System Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by System Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by System Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by System Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by System Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. AirCarbon Exchange (ACX)

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. CarbonX

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CTX (Climate Trade)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CBL Markets

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Markit (now IHS Markit)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. APX, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Climex

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Carbon Trade Exchange (CTX)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Karbone

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Redshaw Advisors

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Why should you invest in this report?

This report presents a compelling investment opportunity for those interested in the global carbon credit trading platform market. It serves as an extensive and informative guide, offering clear insights into this niche market. By delving into the report, you will gain a comprehensive understanding of the various major application areas for carbon credit trading platform. Furthermore, it provides crucial information about the key regions worldwide that are expected to experience substantial growth within the forecast period of 2023-2030. Armed with this knowledge, you can strategically plan your market entry approaches.

Moreover, this report offers a deep analysis of the competitive landscape, equipping you with valuable insights into the level of competition prevalent in this highly competitive market. If you are already an established player, it will enable you to assess the strategies employed by your competitors, allowing you to stay ahead as market leaders. For newcomers entering this market, the extensive data provided in this report is invaluable, providing a solid foundation for informed decision-making.

Some of the key questions answered in this report:

- What is the size of the overall Carbon credit trading platform market and its segments?

- What are the key segments and sub-segments in the market?

- What are the key drivers, restraints, opportunities and challenges of the Carbon credit trading platform market and how they are expected to impact the market?

- What are the attractive investment opportunities within the Carbon credit trading platform market?

- What is the Carbon credit trading platform market size at the regional and country-level?

- Who are the key market players and their key competitors?

- What are the strategies for growth adopted by the key players in Carbon credit trading platform market?

- What are the recent trends in Carbon credit trading platform market? (M&A, partnerships, new product developments, expansions)?

- What are the challenges to the Carbon credit trading platform market growth?

- What are the key market trends impacting the growth of Carbon credit trading platform market?

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com