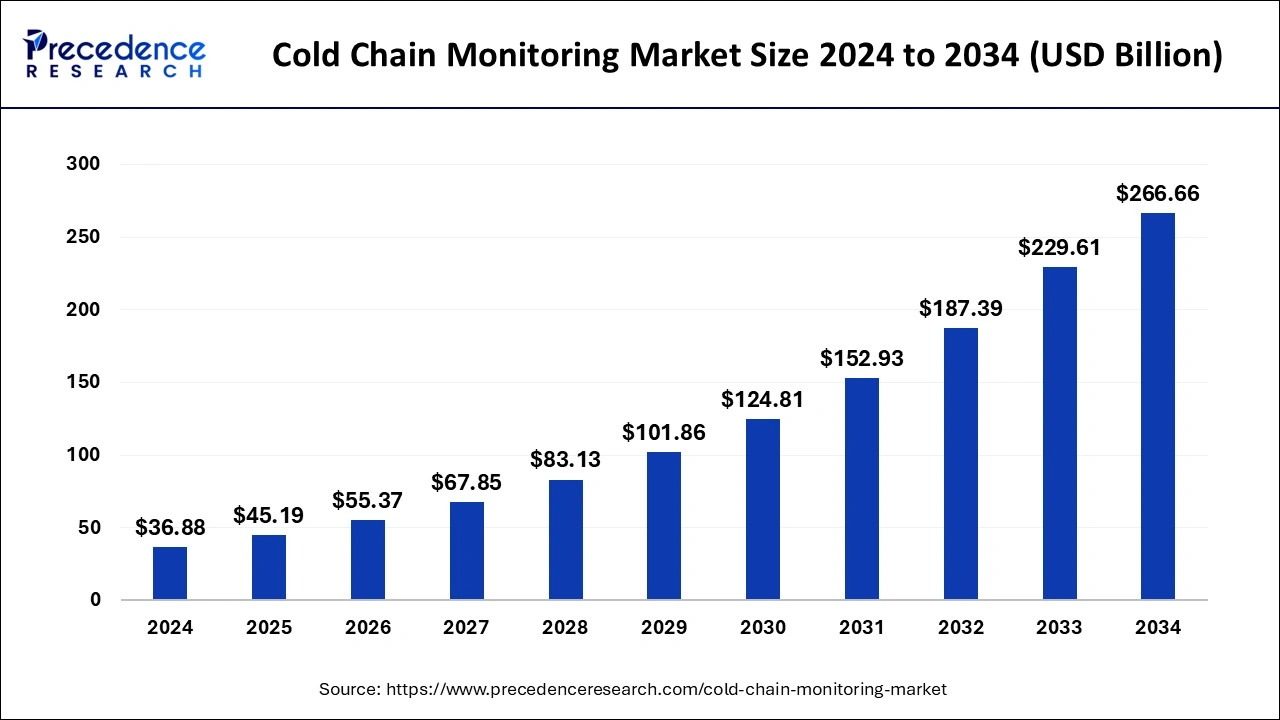

The cold chain monitoring market size is estimated to surpass USD 229.61 billion by 2033, expanding at a CAGR of 22.53% from 2024 to 2033.

Key Points

- North America led the market with a major market share of 35% in 2023.

- Asia-Pacific is expected to expand at the fastest CAGR of 25.63% between 2024 and 2033.

- By component, the hardware segment has held the largest market share of 79% in 2023.

- By component, the software segment is anticipated to grow at a remarkable CAGR of 23.72% between 2024 and 2033.

- By application, the food & beverages segment has recorded over 78% of market share in 2023.

- By application, the pharmaceuticals segment is projected to grow at the fastest CAGR of 24.52% over the projected period.

The cold chain monitoring market is witnessing rapid growth globally, driven by the increasing demand for temperature-sensitive products across various industries such as pharmaceuticals, food and beverages, and chemicals. Cold chain monitoring involves the continuous tracking and management of temperature-controlled supply chains to ensure the integrity and quality of perishable goods throughout transportation and storage. With the rising globalization of supply chains and stringent regulatory requirements for product safety and quality, the adoption of cold chain monitoring solutions is becoming indispensable for companies to maintain compliance and meet customer expectations.

Get a Sample: https://www.precedenceresearch.com/sample/3979

Growth Factors:

Several factors contribute to the growth of the cold chain monitoring market. One key driver is the expansion of the pharmaceutical and biotechnology industries, which rely heavily on cold chain logistics to transport temperature-sensitive drugs and vaccines. The increasing prevalence of chronic diseases, coupled with the development of biologics and specialty drugs, necessitates stringent temperature control measures to preserve product efficacy and safety during distribution.

Moreover, the growing demand for perishable food products, including fresh produce, dairy, and seafood, fuels the need for efficient cold chain management solutions. With consumers prioritizing food safety and quality, food manufacturers and distributors are investing in cold chain monitoring technologies to minimize spoilage, reduce waste, and ensure compliance with food safety regulations.

Furthermore, advancements in sensor technology, wireless connectivity, and data analytics have facilitated the development of sophisticated cold chain monitoring systems. Real-time monitoring capabilities, remote temperature sensing, and predictive analytics enable companies to proactively identify and mitigate temperature excursions, thereby minimizing product losses and maintaining supply chain integrity.

Region Insights:

The cold chain monitoring market exhibits a global presence, with key regions including North America, Europe, Asia-Pacific, and the rest of the world. North America dominates the market, driven by the presence of established pharmaceutical and food industries, stringent regulatory standards, and the widespread adoption of cold chain monitoring solutions. The region’s advanced infrastructure, coupled with the growing emphasis on product quality and safety, propels market growth.

In Europe, stringent regulatory requirements for pharmaceuticals and perishable goods drive the adoption of cold chain monitoring technologies. The presence of leading pharmaceutical companies, logistics providers, and cold chain solution vendors further stimulates market expansion. Additionally, initiatives to combat foodborne illnesses and ensure traceability across the food supply chain contribute to market growth in the region.

Asia-Pacific emerges as a rapidly growing market for cold chain monitoring, fueled by the expanding pharmaceutical and food industries in countries such as China, India, and Japan. Rising healthcare expenditures, increasing demand for vaccines and biologics, and government initiatives to improve healthcare infrastructure drive market growth in the region. Moreover, the proliferation of e-commerce platforms and the need for last-mile cold chain solutions present lucrative opportunities for market players.

Cold Chain Monitoring Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 22.53% |

| Global Market Size in 2023 | USD 30.10 Billion |

| Global Market Size by 2033 | USD 229.61 Billion |

| U.S. Market Size in 2023 | USD 7.90 Billion |

| U.S. Market Size by 2033 | USD 60.27 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cold Chain Monitoring Market Dynamics

Drivers:

Several drivers propel the adoption of cold chain monitoring solutions across industries. One primary driver is the increasing globalization of supply chains, which necessitates the efficient and reliable transportation of temperature-sensitive products across long distances. Cold chain monitoring technologies enable real-time tracking and temperature control, ensuring product integrity and compliance with regulatory requirements throughout the supply chain.

Moreover, the rise of e-commerce and direct-to-consumer delivery models has intensified the need for last-mile cold chain solutions. With consumers expecting fast and reliable delivery of perishable goods, companies are investing in cold chain monitoring technologies to optimize logistics operations, minimize transit times, and maintain product quality from warehouse to doorstep.

Furthermore, regulatory requirements and quality standards mandate the implementation of cold chain monitoring systems in industries such as pharmaceuticals and food. Stringent regulations governing the storage and transportation of temperature-sensitive products compel companies to invest in robust monitoring solutions to demonstrate compliance, mitigate risks, and protect brand reputation.

Opportunities:

The cold chain monitoring market presents significant opportunities for innovation and growth. One notable opportunity lies in the integration of emerging technologies such as Internet of Things (IoT), blockchain, and artificial intelligence (AI) into cold chain monitoring systems. IoT-enabled sensors and devices provide real-time visibility into temperature and humidity conditions, while blockchain technology ensures data integrity and traceability across the supply chain. AI-driven analytics enable predictive insights and proactive risk management, allowing companies to optimize cold chain operations and enhance product quality and safety.

Moreover, the expansion of cold chain infrastructure in emerging markets offers lucrative opportunities for cold chain monitoring solution providers. As developing countries invest in healthcare infrastructure and modernize their logistics networks, there is a growing demand for advanced cold chain technologies to support the storage and distribution of vaccines, biologics, and perishable goods. Strategic partnerships with local stakeholders and government agencies can facilitate market entry and drive adoption in these rapidly growing markets.

Furthermore, the increasing focus on sustainability and environmental stewardship presents opportunities for the development of eco-friendly cold chain solutions. Innovations such as passive cooling technologies, renewable energy-powered refrigeration systems, and reusable packaging materials help reduce carbon emissions, minimize waste, and lower operational costs. Companies that prioritize sustainability and environmental responsibility can gain a competitive edge and capture market share in an increasingly eco-conscious business landscape.

Challenges:

Despite the promising growth prospects, the cold chain monitoring market faces several challenges that could hinder its expansion. One significant challenge is the complexity and cost associated with implementing cold chain monitoring systems, particularly for small and medium-sized enterprises (SMEs). The upfront investment in hardware, software, and infrastructure, coupled with ongoing maintenance and operational costs, can be prohibitive for companies with limited resources.

Moreover, interoperability issues and data silos pose challenges to seamless integration and collaboration across the cold chain ecosystem. Incompatibility between different monitoring technologies, data formats, and communication protocols may hinder data sharing and visibility, leading to inefficiencies and gaps in supply chain management. Standardization efforts and industry collaboration are needed to address these challenges and enable seamless data exchange and interoperability.

Furthermore, cybersecurity threats and data privacy concerns present risks to cold chain monitoring systems. As companies increasingly rely on digital technologies and cloud-based platforms for data collection and analysis, they become vulnerable to cyberattacks, data breaches, and unauthorized access. Ensuring robust cybersecurity measures, encryption protocols, and compliance with data protection regulations is essential to safeguard sensitive information and maintain trust and integrity within the cold chain ecosystem.

Read Also: Acrylic Polymer Market Size to Reach USD 1,125.14 Mn By 2033

Recent Developments

- In May 2023, Tridentify unveiled the release of its real-time temperature monitoring system, designed to provide ongoing monitoring of pharmaceutical product shelf-life and stability.

- In August 2023, Emergent Cold Latin America (Emergent Cold LatAm) disclosed its acquisition of Frigorifico Modelo’s (Frimosa) cold storage operations in Montevideo, Uruguay. Simultaneously, Emergent Cold LatAm announced plans to promptly commence the expansion of the newly acquired Polo Oeste facility, aiming for a capacity increase of 17,000 pallets. The expansion project is expected to be completed by mid-2024.

- In 2020, Gubba Cold Storage announced the enhancement of its cold chain network to facilitate storage for coronavirus vaccines.

Cold Chain Monitoring Market Companies

- Sensitech Inc.

- Berlinger & Co. AG

- Elpro-Buchs AG

- Controlant

- Emerson Electric Co.

- Digi International Inc.

- Monnit Corporation

- ORBCOMM Inc.

- Daikin Industries Ltd.

- Zest Labs Inc.

- Infratab Inc.

- SecureRF Corporation

- TagBox Solutions Pvt. Ltd.

- FreshSurety Corporation

- BT9 Ltd.

Segments Covered in the Report

By Component

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-premise

- Cloud-based

By Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

By Geography

- North America

- Europ

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/