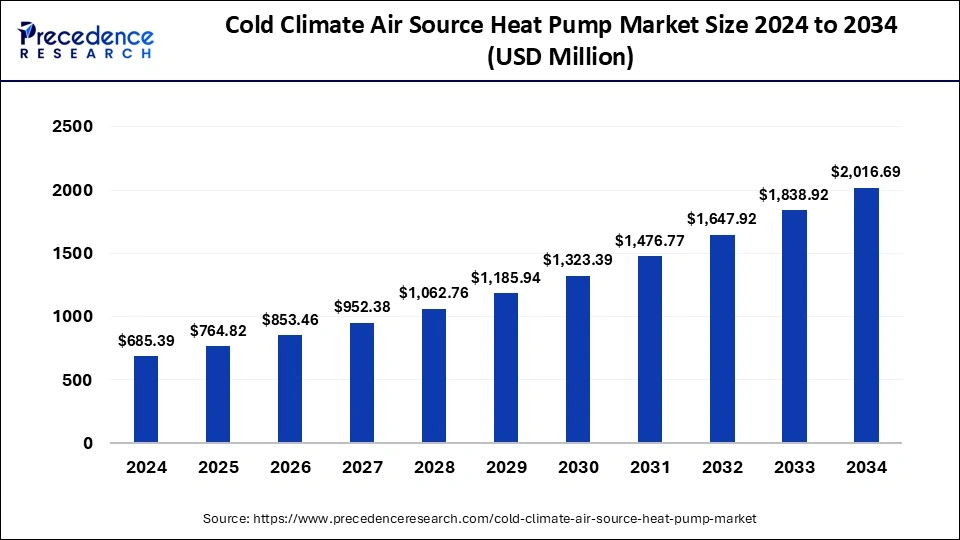

The global cold climate air source heat pump market size was valued at USD 614.20 million in 2023 and is predicted to reach around USD 1,838.92 million by 2033, expanding at a CAGR of 11.59% from 2024 to 2033.

Key Points

- The North America cold climate air source heat pump market reached USD 202.69 million in 2023 and is expected to expand around USD 616.04 million by 2033, at a CAGR of 11.72% from 2024 to 2033.

- North America dominated the cold climate air source heat pump market with the largest revenue share of 33% in 2023.

- Asia Pacific is expected to host the fastest-growing market during the forecast period.

- By product, the split system segment has held the biggest revenue share of 79% in 2023.

- By product, the single package equipment segment is expected to grow significantly in the market in the upcoming years.

- By operation, the electric operation segment has contributed more than 92% of revenue share in 2023.

- By operation, the hybrid segment is projected to expand considerably in the market over the studied years.

- By application, the residential segment has generated more than 88% of revenue share in 2023.

- By application, the commercial segment is expected to grow rapidly in the market over the forecast period.

The Cold Climate Air Source Heat Pump (CC-ASHP) market is experiencing notable growth due to increasing demand for energy-efficient heating solutions in colder regions. These systems are designed to operate effectively in low-temperature environments, making them suitable for places that experience harsh winters. The market encompasses various components, including outdoor units, indoor units, and related accessories. Technological advancements have led to the development of CC-ASHPs capable of providing reliable heating even at sub-zero temperatures, driving their adoption in residential, commercial, and industrial applications.

Get a Sample: https://www.precedenceresearch.com/sample/4638

Growth Factors

Several factors are propelling the growth of the CC-ASHP market. Firstly, rising awareness about climate change and the need for sustainable energy solutions are encouraging the adoption of heat pumps. Governments worldwide are implementing policies and offering incentives to promote energy-efficient technologies, further boosting market growth. Additionally, advancements in heat pump technology, such as improved refrigerants and enhanced performance at low temperatures, are making these systems more attractive to consumers. The increasing cost of conventional heating fuels and the need to reduce carbon footprints are also significant drivers.

Region Insights

Regionally, the market dynamics vary significantly. North America and Europe are the leading regions due to their colder climates and supportive regulatory environments. In North America, the U.S. and Canada are witnessing substantial growth in CC-ASHP installations, driven by government incentives and a strong focus on reducing energy consumption. Europe, particularly Scandinavia and other Northern European countries, has a long history of adopting heat pump technology, supported by stringent energy efficiency regulations. Asia-Pacific, although traditionally less reliant on heat pumps, is seeing increased interest, particularly in countries like China and Japan, where energy efficiency is becoming a critical concern.

Cold Climate Air Source Heat Pump Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,838.92 Million |

| Market Size in 2023 | USD 614.20 Million |

| Market Size in 2024 | USD 685.39 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 11.59% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product Type, Application, Operation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cold Climate Air Source Heat Pump Market Dynamics

Drivers

Key drivers for the CC-ASHP market include the increasing emphasis on reducing greenhouse gas emissions and the rising cost of fossil fuels. The shift towards renewable energy sources and the growing awareness of the environmental impact of traditional heating methods are pushing consumers and businesses to adopt heat pumps. Technological advancements that enhance the efficiency and reliability of heat pumps in cold climates are also significant drivers. Furthermore, government incentives, rebates, and stringent building codes promoting energy efficiency are encouraging the adoption of CC-ASHP systems.

Opportunities

The CC-ASHP market presents several opportunities for growth. The ongoing advancements in heat pump technology, such as the development of more efficient and reliable systems for extremely cold climates, are creating new market prospects. Expansion into emerging markets, particularly in Asia-Pacific and Eastern Europe, where energy efficiency is becoming a priority, offers significant growth potential. Additionally, the integration of smart home technologies with heat pump systems is opening up new avenues for innovation and consumer engagement. Collaborations between manufacturers and governments to promote the benefits of CC-ASHPs can further drive market expansion.

Challenges

Despite the positive outlook, the CC-ASHP market faces several challenges. The high initial cost of installation and the need for retrofitting existing heating systems can be a barrier to adoption for many consumers. In extremely cold regions, the performance of some heat pump models may still be inadequate, leading to reliance on supplementary heating systems. Additionally, there is a lack of awareness and understanding among consumers about the benefits and capabilities of CC-ASHPs, which can hinder market growth. Regulatory and standardization issues across different regions also pose challenges, as varying requirements can complicate product development and deployment.

Read Also: Microalgae Market Size to Reach USD 25.72 Bn By 2033

Cold Climate Air Source Heat Pump Market Companies

- Daikin Industries.

- Mitsubishi Electric Corporation.

- Panasonic Corporation.

- Fujitsu General Ltd.

- LG Electronics.

- Samsung Electronics.

- Trane Technologies (formerly Ingersoll Rand)

- Carrier Corporation.

Recent Developments

- In April 2024, Johnson Controls made the YORK YMAE 575 V air-to-water inverter scroll modular heat pump available for use in Canada. The 575-volt version of the high-efficiency heat pump complies with several provinces’ pressured equipment criteria for a Canadian Registration Number (CRN). The YMAE 575 V expands heating capacities by utilizing variable-speed electronic vapor injection (EVI) scroll technology, which builds upon the YORK Amichi platform.

- In October 2023, Panasonic introduced a new home heat pump system in Canada, where the market share of heat pumps is less than 10%. Naturally, it gets cold in Canada throughout the winter. It is, therefore, not surprising that Canadians have been a little hesitant to adopt heat pump technology; after all, if you live in below-freezing weather for months on end, it can be a little unsettling to spend thousands of dollars on a heating gadget you’re unfamiliar with.

Segment Covered in the Report

By Product Type

- Split system product

- Single-package equipment

By Application

- Residential

- Commercial

By Operation

- Electric operation type

- Hybrid heat pump

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/