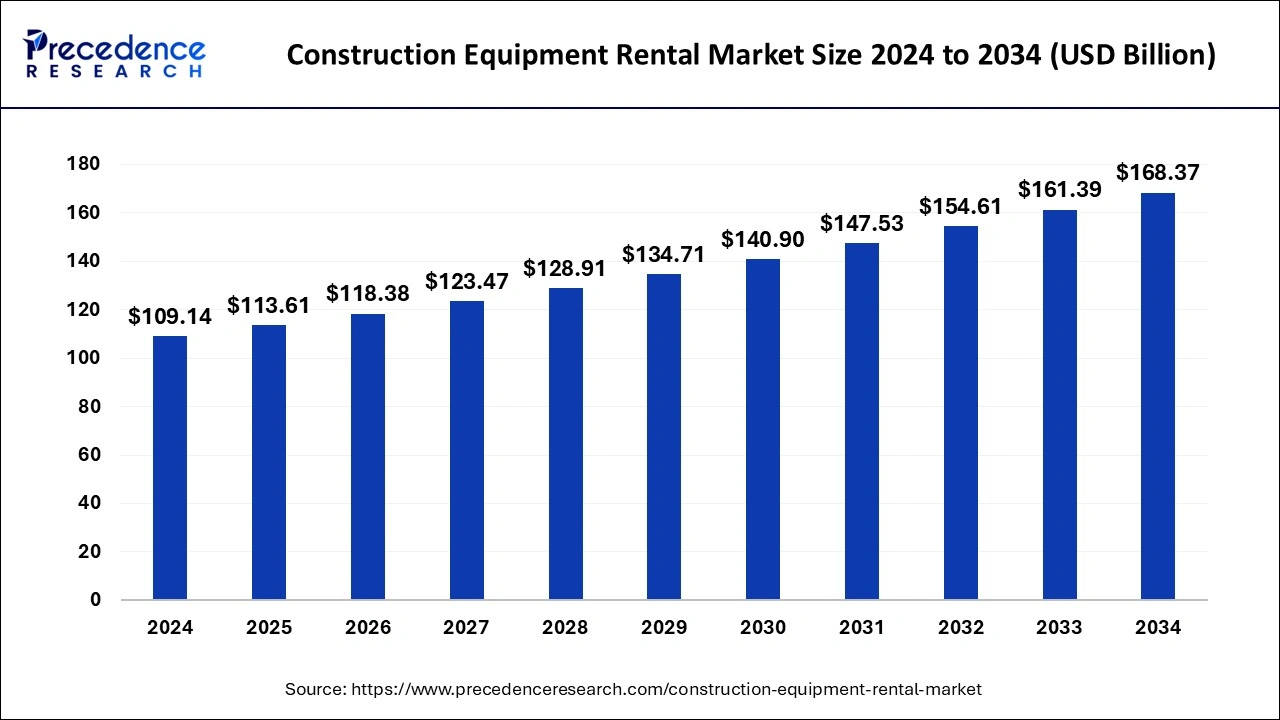

The construction equipment rental market, valued at USD 109.14B in 2024, is projected to reach USD 168.37B by 2034, growing at a CAGR of 4.43%.

Construction Equipment Rental Market Key Takeaways

- North America led the market in 2024, holding the highest share of 31.64%.

- The region is projected to grow at the highest CAGR from 2024 to 2034.

- Among products, the earthmoving machinery segment dominated the market in 2024.

The construction equipment rental market is experiencing steady growth, driven by increasing infrastructure projects and cost-effective rental solutions. Valued at USD 109.14 billion in 2024, it is projected to reach USD 168.37 billion by 2034, growing at a CAGR of 4.43%. North America dominated the market with a 31.64% share in 2024 and is expected to expand at the highest CAGR during the forecast period. The earthmoving machinery segment led the market in 2024 due to its high demand in construction activities. Rising urbanization, technological advancements, and sustainability concerns are further fueling market expansion. Key players are focusing on fleet expansion and digitalization to enhance operational efficiency.

Sample Link: https://www.precedenceresearch.com/sample/1078

Key Drivers

Opportunities

- Increasing infrastructure development and smart city projects drive demand for rental equipment.

- Growing adoption of advanced technologies like IoT and telematics enhances equipment efficiency.

- Rising preference for electric and hybrid construction equipment opens new market segments.

- Expansion in emerging economies presents lucrative growth opportunities for rental companies.

- Flexible rental models and cost-effective solutions attract small and mid-sized construction firms.

Challenges

- High competition among rental service providers leads to pricing pressures.

- Fluctuations in raw material costs and supply chain disruptions impact equipment availability.

- Strict environmental regulations and emission norms may increase operational costs.

- Equipment maintenance and repair costs can affect rental profitability.

- Seasonal demand fluctuations in the construction industry may limit revenue consistency.

Regional Insights

North America dominated the construction equipment rental market in 2024, holding the highest share of 31.64%, driven by large-scale infrastructure projects and high adoption of advanced machinery. The region is also expected to grow at the fastest CAGR between 2024 and 2034 due to increasing investments in smart cities and sustainable construction practices. Europe follows closely, supported by stringent emission regulations pushing the demand for rental over ownership.

The Asia-Pacific region is witnessing rapid growth, fueled by urbanization, industrial expansion, and government-led infrastructure development in countries like China and India. The Middle East and Africa are also emerging as key markets, driven by mega construction projects and economic diversification efforts. Latin America shows steady growth, with increasing demand for rental solutions due to budget constraints in the construction sector.

Don’t Miss Out: Laboratory Equipment Market

Market Key Players

- Ahern Equipment Rentals

- John Deere

- Caterpillar Inc.

- Gemini Equipment and Rentals (GEAR)

- Hertz Equipment

- Komatsu Equipment

- Maxim Crane Works

- Neff Rental

Recent News

In a significant move within the equipment rental industry, Herc Holdings has outbid United Rentals to acquire H&E Equipment Services for $5.3 billion. This acquisition is expected to enhance Herc’s market presence and operational capacity. In another development, Ashtead Group, a major player in industrial equipment rental, announced its decision to shift its primary listing from the London Stock Exchange to New York. This strategic move aims to align the company’s market presence with its predominantly North American operations.

Additionally, United Rentals reported a 13.5% increase in equipment rental revenue for the fourth quarter of 2023, totaling $3.119 billion. This growth reflects the robust demand in the construction sector and the company’s strategic expansions. These developments underscore the dynamic and competitive nature of the construction equipment rental market, marked by strategic acquisitions and geographic realignments.

Market Segmentation

By Product

- Material Handling Machinery

- Shelves

- Bins

- Silos

- Conveyors

- Pallet trucks

- Fork lifts

- Frames

- Sliding racks

- Bulk containers

- Platform trucks

- Hand trucks

- Cranes

- Others

- Earth Moving Machinery Concrete

- Excavators

- Loading shovels

- Site dumpers

- Dump trucks

- Others

- Concrete and Road Construction Machinery

- Pavers

- Trenchers

- Planers

- Rollers

- Hot boxes

- Others