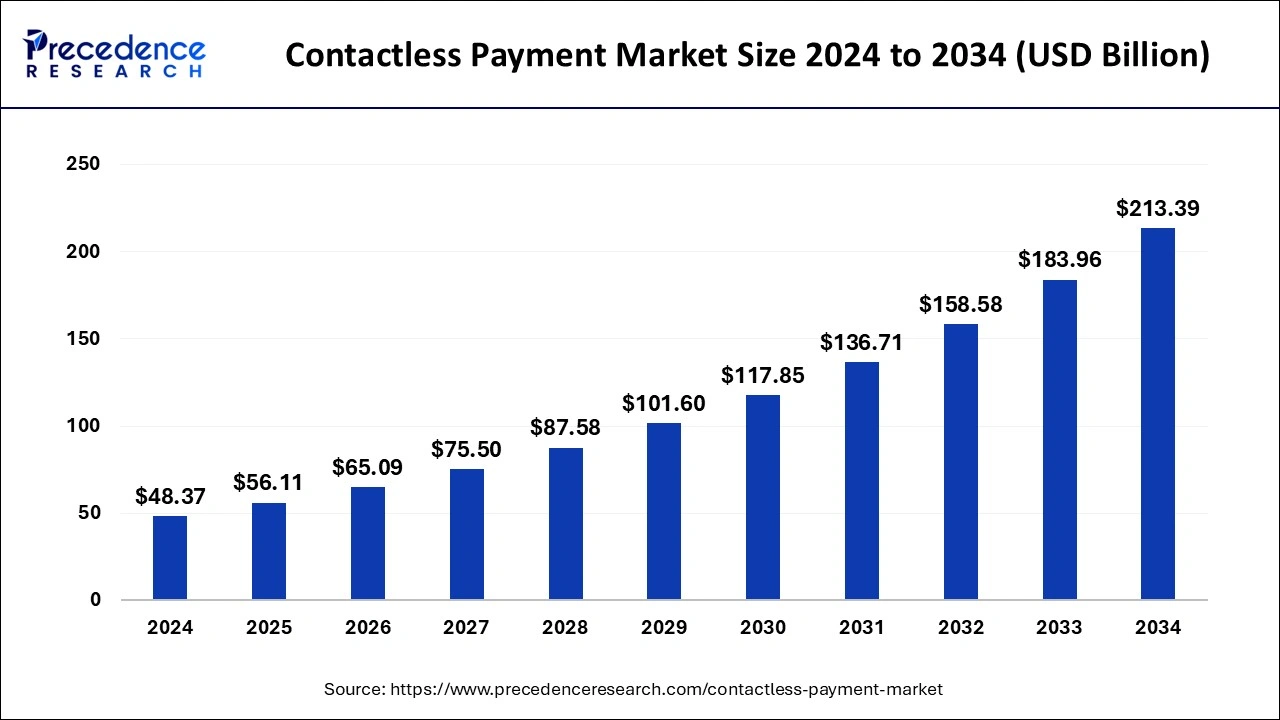

The contactless payment market is valued at USD 48.37B in 2024 and is set to reach USD 213.39B by 2034, growing at a 16% CAGR.

Contactless Payment Market Key Takeaways

- North America dominated the global contactless payment market in 2024 with the highest market share.

- The payment terminal solution segment accounted for over 40% of total revenue in 2024.

- The retail sector contributed more than 60% of the market’s revenue share in 2024.

- Smartphones and wearables led the market, generating over 60% of revenue in 2024.

The contactless payment market is witnessing significant growth, driven by increasing consumer demand for fast and secure transactions. In 2024, the market was valued at USD 48.37 billion and is projected to reach USD 213.39 billion by 2034, growing at a CAGR of 16%. North America holds the largest market share, with payment terminal solutions, retail applications, and smartphones & wearables being the key revenue contributors. The expansion of e-commerce, advancements in NFC technology, and rising digital adoption are major factors fueling this growth.

Sample Link: https://www.precedenceresearch.com/sample/1044

Key Drivers

The key drivers of the contactless payment market include the increasing adoption of digital payment solutions, the growing demand for fast and secure transactions, and the widespread use of NFC-enabled devices such as smartphones and wearables. The expansion of e-commerce, rising consumer preference for cashless payments, and government initiatives promoting digital transactions are also fueling market growth. Additionally, advancements in payment technologies, the integration of AI and blockchain for enhanced security, and the surge in contactless payments due to hygiene concerns post-pandemic are further accelerating the market’s expansion.

Opportunities

- Growing adoption of digital wallets and mobile payment solutions worldwide.

- Expansion of contactless payment infrastructure in emerging markets.

- Increasing integration of AI and blockchain to enhance security and fraud prevention.

- Rising demand for seamless and frictionless payment experiences in retail and e-commerce.

- Government initiatives and policies promoting cashless transactions.

- Advancements in NFC, RFID, and biometric authentication technologies.

Challenges

- High initial investment costs for upgrading payment infrastructure.

- Security concerns related to data breaches and fraudulent transactions.

- Limited adoption in rural and underbanked regions due to lack of awareness.

- Compatibility issues between different payment systems and devices.

- Regulatory compliance challenges across different countries.

- Consumer resistance due to trust issues with digital payment security.

Regional Insights

North America leads the contactless payment market, driven by high smartphone penetration, widespread adoption of digital wallets, and strong regulatory support for cashless transactions. Europe follows closely, with countries like the UK, Germany, and France embracing contactless payments in retail and public transport. The Asia-Pacific region is witnessing rapid growth due to increasing smartphone usage, rising fintech investments, and government initiatives promoting digital payments in countries like China, India, and Japan. Latin America is gradually expanding its contactless payment ecosystem, supported by growing e-commerce and fintech innovations. Meanwhile, the Middle East and Africa are experiencing steady adoption, fueled by banking sector modernization and digital transformation efforts.

Don’t Miss Out: 3D Imaging Market

Market Key Players

- Gemalto

- Visa Inc.

- Giesecke & Devrient GmbH

- Heartland Payment Systems, Inc.

- Thales Group

- Wirecard AG

- On Track Innovations Ltd.

- IDEMIA

Recent News

The contactless payment market is experiencing rapid growth, with projections indicating an increase from $22.40 billion in 2022 to $29.30 billion in 2024. The wearable payments market is also expanding, expected to reach $393.4 billion globally by 2031, driven by rising adoption and supportive government policies. Public transit systems are integrating contactless payment solutions, such as VIA Metropolitan Transit upgrading its fleet to support Apple Pay, Google Pay, and contactless cards to improve boarding efficiency. In Europe, seven French banking groups have introduced Wero, a European electronic wallet designed to compete with Visa and Mastercard, starting with peer-to-peer payments before expanding to e-commerce and in-store transactions by 2026. Consumer behavior is also shaping the market, with a study revealing that 54% of shoppers abandon purchases if their preferred payment method isn’t available, prompting retailers to enhance in-store payment solutions. Regulatory changes are under discussion in the UK, where the Financial Conduct Authority is considering removing the £100 contactless payment limit to boost economic activity, though concerns remain over potential fraud risks. These developments highlight the evolving landscape of contactless payments, shaped by technological advancements, consumer preferences, and regulatory shifts.

Market Segmentation

By Solution

- Security and Fraud Management

- Payment Terminal Solution

- Transaction Management

- Hosted Point-of-Sales

- Analytics

By Application

- Government

- Healthcare

- Retail

- Transportation

- Hospitality

By Device

- Point-of-Sales Terminals

- Smartphones & Wearables

- Smart Cards

Ready for more? Dive into the full experience on our website!