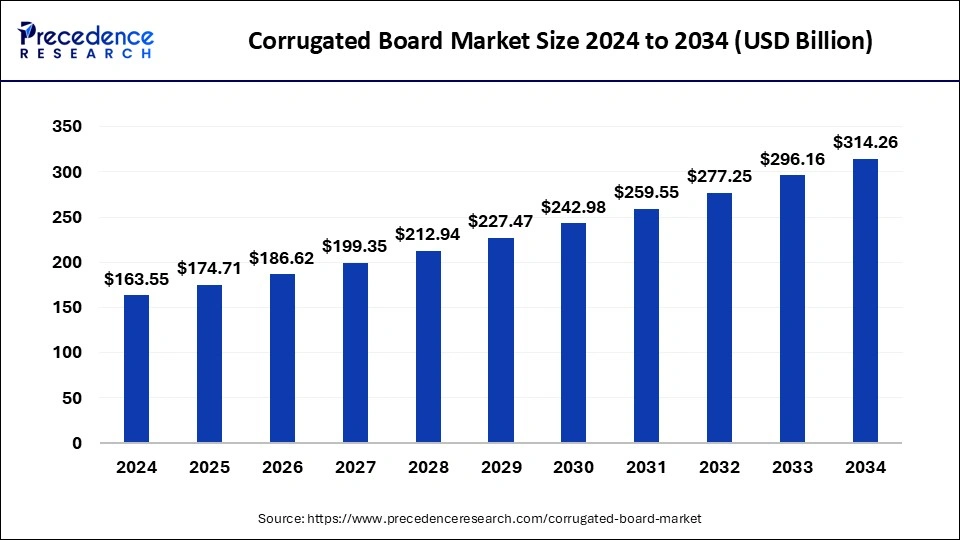

The global corrugated board market size was valued at USD 153.11 billion in 2023 and is predicted to reach around USD 296.16 billion by 2033, expanding at a CAGR of 6.82% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 42% in 2023.

- North America is expected to grow at the highest CAGR in the market during the forecast period.

- By flute type, the C-flute type segment has held a major revenue share of 27% in 2023.

- By flute type, the A-flute type segment is expected to grow at the highest CAGR of 7.72% during the forecast period.

- By board style, the single wall segment has contributed more than 36% of revenue share in 2023.

- By board style, the triple wall segment is expected to grow at the highest CAGR in the market during the forecast period.

The corrugated board market is a vital segment within the packaging industry, characterized by its versatile applications across various sectors such as food and beverage, electronics, and e-commerce. Corrugated boards are widely favored due to their lightweight nature, durability, and eco-friendly properties, making them a preferred choice for packaging solutions globally.

Get a Sample: https://www.precedenceresearch.com/sample/4492

Growth Factors

Several factors drive the growth of the corrugated board market. Increasing demand for sustainable packaging solutions, coupled with stringent regulations promoting environmentally friendly materials, has propelled the market forward. Moreover, the rise of e-commerce activities has significantly boosted the demand for corrugated boards as they are essential for safe and secure shipping of goods.

Region Insights:

The corrugated board market exhibits strong regional variations. North America and Europe are mature markets with high adoption rates of corrugated packaging, driven by established retail infrastructure and stringent environmental regulations. In contrast, Asia-Pacific is witnessing rapid growth due to industrialization, urbanization, and increasing disposable incomes driving demand across various end-user industries.

Corrugated Board Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 296.16 Billion |

| Market Size in 2023 | USD 153.11 Billion |

| Market Size in 2024 | 163.55 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 6.82% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Flute Type, Board Style, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Corrugated Board Market Dynamics

Drivers: Key drivers influencing the corrugated board market include the continuous innovation in packaging design to meet changing consumer preferences and technological advancements in manufacturing processes that enhance efficiency and product quality. Additionally, the growing awareness among consumers and businesses regarding the environmental benefits of corrugated packaging materials drives market expansion.

Opportunities: The corrugated board market presents opportunities for growth through expanding applications in new industries such as healthcare and pharmaceuticals, where packaging requirements are stringent and specialized. Furthermore, advancements in digital printing technologies offer opportunities for customization and personalization of corrugated packaging solutions, catering to the evolving demands of modern consumers.

Challenges: Despite its growth prospects, the corrugated board market faces challenges such as fluctuating raw material costs, particularly for paper and adhesives, which impact production economics. Additionally, managing supply chain complexities and ensuring compliance with diverse regulatory frameworks across different regions pose challenges for market participants.

Read Also: Micropump Market Size to Reach USD 13.61 Billion by 2033

Corrugated Board Market Companies

- International Paper

- Georgia-Pacific

- WestRock Company

- Packaging Corporation of America

- Stora Enso

- Oji Holdings Corporation

- Smurfit Kappa

- Port Townsend Paper Company

- Mondi

- DS Smith

Recent Developments

- In January 2024, Cascades Inc., a company situated in Kingsey Falls, Quebec, introduced innovative designs for producing baskets to the market. The business claims that these innovative flapped baskets, which are made from up to 100% recycled fibers, provide fruit producers with a sustainable substitute for packaging that is difficult to recycle. According to Cascades, the packaging is created using “recognized eco-design principles” and is consistent with a circular economy strategy. The firm claims that using recyclable and recycled corrugated cardboard in its design helps its clients lessen their environmental effects and satisfy customer demand for packaging that is becoming more and more eco-friendly.

- In November 2023, Kongsberg launched a digital cutting platform to boost corrugated production. Kongsberg Precision Cutting Systems has unveiled what it describes as a ‘game-changing’ new digital cutting platform, the Kongsberg Ultimate.

- In June 2022, Baumer announced its CorrBox Solution, a modular gluing system for corrugated converters featuring a sensor that can detect adhesives without the need for additives and a multi-application head for various viscosities and a smoother start-up process.

Segment Covered in the Report

By Flute Type

- A flute

- B Flute

- C Flute

- E Flute

- F Flute

- Others

By Board Style

- Single Face

- Single Wall

- Double Wall

- Triple Wall

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/