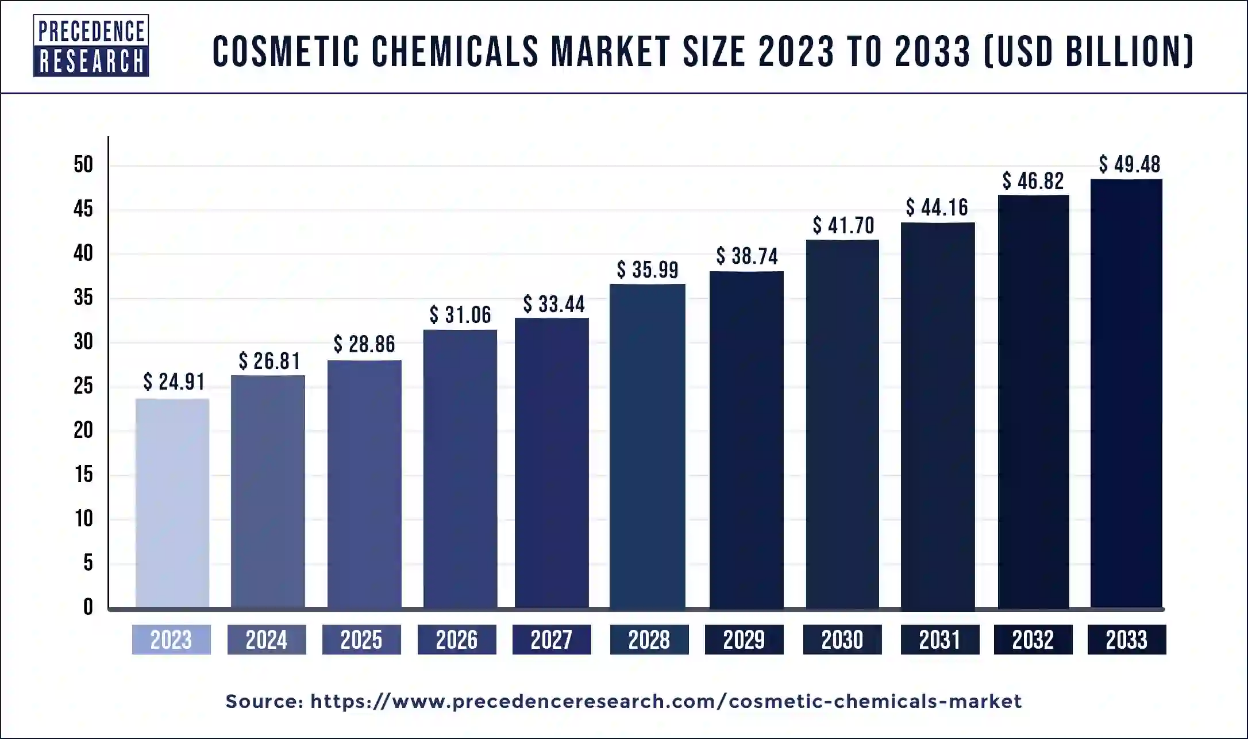

Ottawa, July 02, 2024 (GLOBE NEWSWIRE) — The global cosmetic chemicals market size is predicted to increase from USD 24.91 billion in 2023 to approximately USD 49.48 billion by 2033, growing at a solid CAGR of 7.10% between 2024 and 2033. The cosmetic chemicals market is driven by increasing use of cosmetics, changing consumer preference and R&D projects.

The cosmetic chemicals market encompasses the global industry involved in the production, distribution, and application of chemicals used in the formulation of cosmetic products. Cosmetic chemicals have been used by humans for generations to improve appearance and self-esteem. The use of chemicals in cosmetics has increased due to industrialization and mass production.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2000

Surfactants, emollients, preservatives, colorants, sunscreens, and emulsifiers are among the most often used cosmetic compounds. Surfactants remove debris and oil from the skin and hair, whereas emollients moisturize and soften the skin. Preservatives inhibit bacterial growth, whereas colorants offer color to cosmetics. Sunscreens protect the skin from damaging UV rays, whilst emulsifiers provide lotions and creams with a smooth texture. Parabens, a kind of preservatives used in cosmetic, are considered safe by the FDA but may alter hormonal balance.

Global Cosmetic Chemicals Market (USD Million), By Product Type, 2020 to 2023

| Product Type | 2020 | 2021 | 2022 | 2023 |

| Surfactants | 5,735.2 | 6,185.6 | 6,668.2 | 7,194.8 |

| Emollients & Moisturizers | 5,797.1 | 6,285.3 | 6,812.6 | 7,391.3 |

| Film-Formers | 2,307.1 | 2,485.5 | 2,676.4 | 2,884.6 |

| Colorants & Pigments | 1,127.1 | 1,203.2 | 1,283.8 | 1,371.0 |

| Preservatives | 782.7 | 840.7 | 902.5 | 969.7 |

| Emulsifying & Thickening Agents | 978.1 | 1,052.9 | 1,132.9 | 1,220.0 |

| Single-Use Additives | 607.1 | 652.2 | 700.3 | 752.6 |

| Others | 2,660.0 | 2,810.4 | 2,964.8 | 3,127.8 |

Global Cosmetic Chemicals Market (USD Million), By Application, 2020 to 2023

| Application | 2020 | 2021 | 2022 | 2023 |

| Skin Care | 6,887.0 | 7,448.8 | 8,052.6 | 8,713.1 |

| Hair Care | 5,207.0 | 5,617.4 | 6,057.4 | 6,537.7 |

| Makeup | 2,895.8 | 3,102.9 | 3,323.0 | 3,561.5 |

| Oral Care | 2,253.9 | 2,404.9 | 2,564.6 | 2,737.1 |

| Fragrances | 1,654.0 | 1,775.7 | 1,905.5 | 2,046.5 |

| Others | 1,096.6 | 1,166.2 | 1,238.7 | 1,315.9 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2000

Cosmetic Chemicals Market Key Insights

- North America dominated the cosmetic chemicals market with the largest revenue share of 36.65% in 2023.

- Europe is expected to grow at the fastest CAGR of 5.28% during the forecast period.

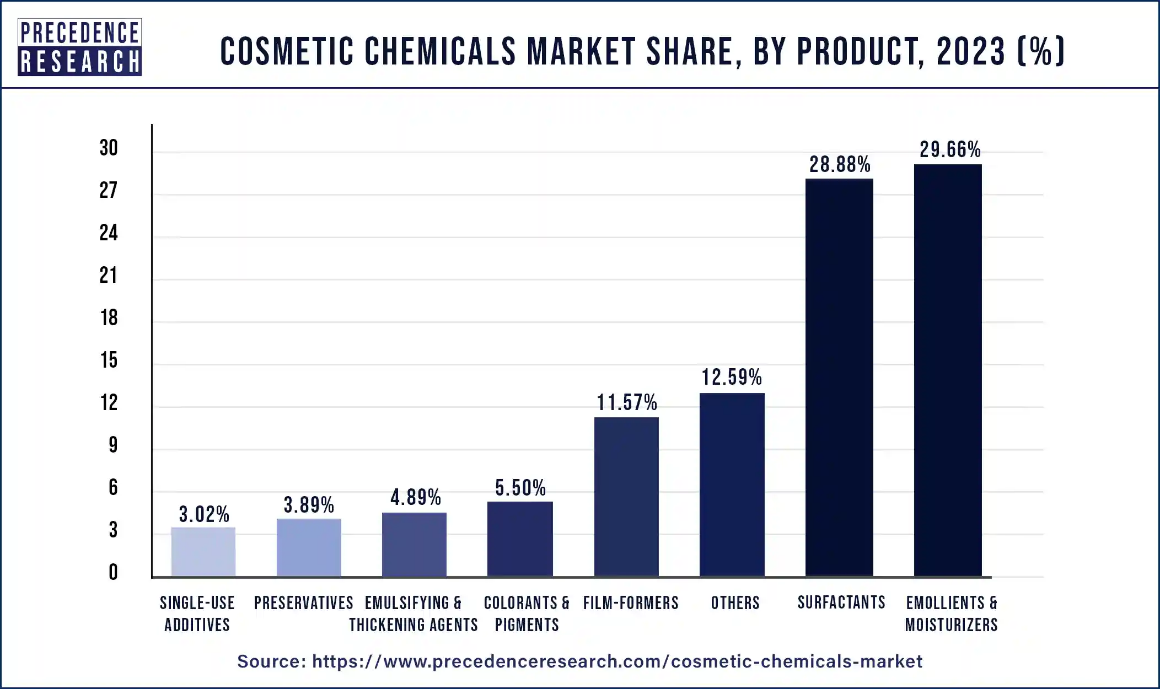

- By product type, the emollients & moisturizers segment has contributed more than 29.66% of revenue share in 2023.

- By application insight, the skin care segment has held the largest revenue share of 34.97% in 2023.

U.S. Cosmetic Chemicals Market Size and Forecast

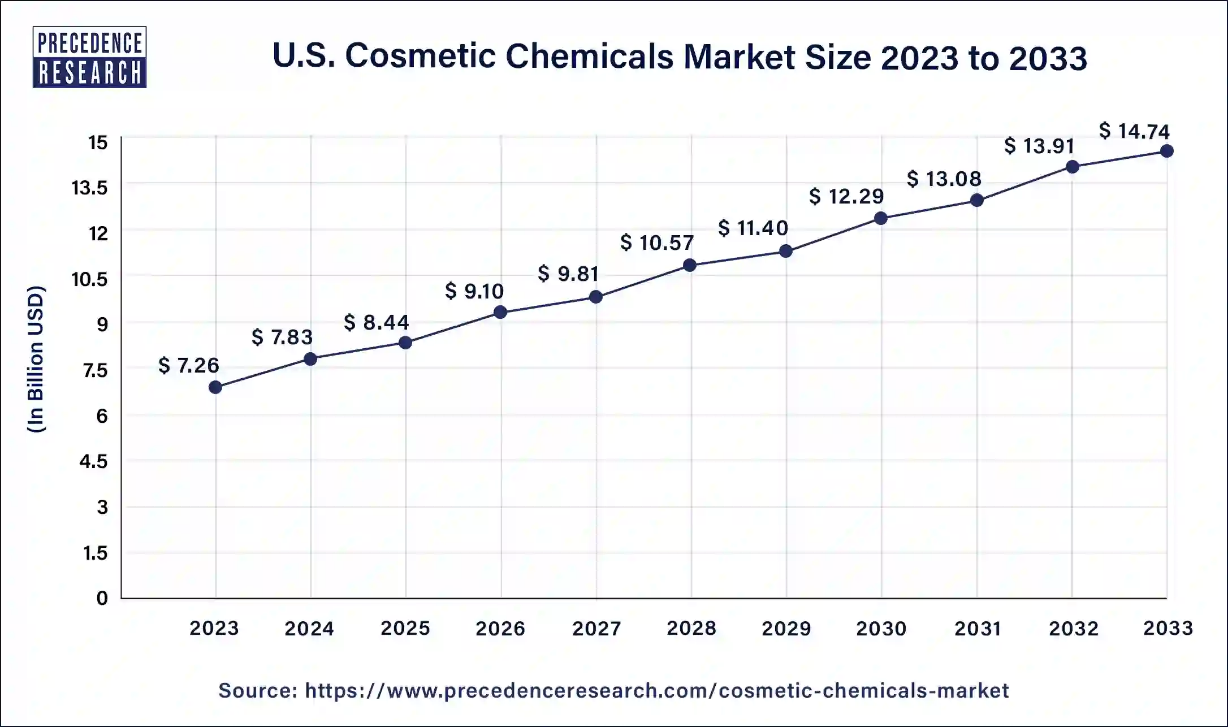

The U.S. cosmetic chemicals market size was estimated at USD 7.26 billion in 2023 and is expected to be worth around USD 14.74 billion by 2033 with a CAGR of 6.88% from 2024 to 2033.

North America dominated the cosmetic chemicals market in 2023. Large multinational cosmetic chemical makers are gaining a competitive advantage as the need for high-performance, high-purity products, as well as safety and efficacy data, grows. They have additional resources for R&D, technical support, and health and safety testing, which they may employ to serve global cosmetic firms throughout the world. Population growth, more disposable wealth in emerging nations, increasing wellness consciousness, market segmentation, and tighter regulation governing cosmetic chemical safety are all expected to raise formulation development costs.

- For instance, Sophim, a cosmetic ingredient supplier has selected Essential Ingredients as its distribution channel partner for olive squalane and other natural ingredients in the United States and Canada. This move enables Sophim to focus on quality-driven development while also expanding its network. Essential Ingredients, a leading provider of natural, high-performance, functional ingredients, is proud to service customers in the U.S. and Canada.

The Asia Pacific region has a large and youthful population that is increasingly adopting modern lifestyles and trends. Young consumers are more inclined to experiment with new cosmetic products and are highly influenced by social media and beauty influencers. This dynamic demographic drives the demand for innovative and trendy cosmetic products, thereby boosting the need for cosmetic chemicals.

South Korea (K-Beauty) and Japan (J-Beauty) are influential markets in the global beauty industry. The trends and innovations from these countries often set the standard for beauty products worldwide. The popularity of K-Beauty and J-Beauty products, known for their innovative formulations and unique ingredients, drives the demand for specialized cosmetic chemicals in the region.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Sope of Cosmetic Chemicals Market

| Report Attribute | Key Statistics |

| Cosmetic Chemicals Market Size in 2033 | USD 49.48 Billion |

| Cosmetic Chemicals Market Size in 2024 | USD 26.81 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.10% |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product Type, Application, and Regions |

| Regional Scope | North America, APAC, Europe, Latin America, and Middle East & Africa |

Cosmetic Chemicals Market Report Highlights

Product Type Insight

The emollients & moisturizers segment dominated the cosmetic chemicals market in 2023. Emollients and moisturizers can help soothe and treat dry skin caused by a variety of disorders, like atopic dermatitis, eczema, psoriasis, diabetes, hypothyroidism, and renal disease. They can also cure radiation-related burns and diapers rash. Emollients are classed as oily and greasy based on the cause and severity of the illness.

Emollients are categorized into three types: creams, ointments and lotion. Lotions are water-based and less hydrating, making them ideal from daytime usage, although they must be reapplied often owing to skin absorption. Creams are less greasy and simpler to apply than ointments, which are both oily and hydrating.

Application Insight

The skin care segment dominated the cosmetic chemicals market in 2023. Customized skin care products can help prevent acne, reduce outbreaks, and increase suppleness. High-quality components, which are commonly found in natural products, can help combat wrinkles, loss of elasticity, and prevent and repair skin discoloration.

These products also assist in preventing and treating skin aging by increasing collagen levels. Patients who use tailored skin care can get better and longer-lasting effects from medical aesthetic Anti-aging treatments, resulting in a healthier and more youthful appearance.

Cosmetic Chemicals Market Dynamics

Driver: Rise in cosmetic usage dur to social media

Rise in cosmetic usage is key driver for cosmetic chemicals market. Influencers and beauty gurus are the new lords of style, influencing the cosmetic business with lessons, product reviews, and beauty tips. This has resulted in more individualized and diversified cosmetic options, emphasizing individual trends and inclusive beauty standards. The real-time nature of social media has sped trend cycles, allowing Cosmetic to remain ahead of the curve by incorporating new designs into their Collections pages.

Platforms such as Facebook, Instagram, and Pinterest function as interactive catalogs, allowing customers to engage with firms and provide quick feedback on their items. The visibility given by social media emphasizes the importance of sustainability and ethical standards in the beauty industry, leading firms to prioritize these factors in their business models. User-generated content, including customer reviews and before-and-after photos, enhances the online beauty community, fostering trust and authenticity.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/2000

Restraint: Strict regulations

Strict regulations regarding the usage of ingredients in products is a major challenge for the cosmetic chemicals market. Cosmetic, which are goods applied to the exterior areas of the human body, have received less regulatory attention than other chemicals since it is assumed that absorption from external surfaces is insignificant. However, formulas are growing more complex, and skin exposure is increasing. Many of the EDCs found in cosmetic goods (PCPs) have been detected in human body tissues, and many of these compounds are often employed in PCPs.

The conventional framework of advice has shifted toward regulation. The EU Cosmetic Products Regulation (EC No1223/2009) applies to all EU member nations, as well as Iceland, Norway, and Switzerland. Cosmetic manufacturers, retailers, and importers in the EU are assigned “Responsible Person” status, which requires them to comply with legislation and maintain product safety dossiers. Cosmetic are controlled by the FDA in the United States and the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) in Australia.

Opportunity: Green cosmetic

Green Beauty is a cosmetic concept that attempts to give body care with natural and ecologically friendly components. It originated in the United States and has grown in popularity across the world as people seek safe, nutritious, and environmentally friendly products. Green beauty products frequently feature 100% recycled paper packaging, eco-friendly inks, or biodegradable packaging.

Green beauty products contain natural, organic substances such as plant extracts, oils, herbs, waxes, flowers, and butters. These ingredients come from sustainable or wild plantations and have been certified natural and ecological. Green beauty products often include at least 95% natural ingredients, which are more easily absorbed by the skin and have a higher concentration of potent active substances.

Cosmetic Chemicals Market Leaders

- SOLVAY SA

- Givaudan

- Symrise

- Croda International PLC

- P&G Chemicals

- Cargill Incorporated

- Evonik Industries AG

- Eastman Chemical Company

- Stepan Company

- Dow

- Lanxess

- Ashland Inc

- The Dow Chemical Company

- Lonza Group

- BASF SE

- Bayer AG.

Recent Developments

- In May 2024, The China Beauty Expo, Asia’s largest beauty show, had over 3,200 exhibitors from 40 nations. SK Chemicals demonstrated their sustainable plastic products, including the high-performance Circular Recycle copolyester ECOTRIA CR and ECOTRIA CLARO, which are readily recycled into PET. Their products, including the Circular Recycle copolyester ECOTRIA CR and ECOTRIA CLARO, attracted a lot of attention.

- In April 2024, Clariant, a sustainable chemical firm, purchased Lucas Meyer Cosmetic, a leading distributor of high-value ingredients for the cosmetic and personal care market, from IFF for USD 810 million (~CHF 720 million). The acquisition price will be adjusted based on net debt and working capital.

Segments Covered in the Report

By Product Type

- Surfactants

- Emollients & Moisturizers

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Others

By Application

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Fragrances

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2000

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com