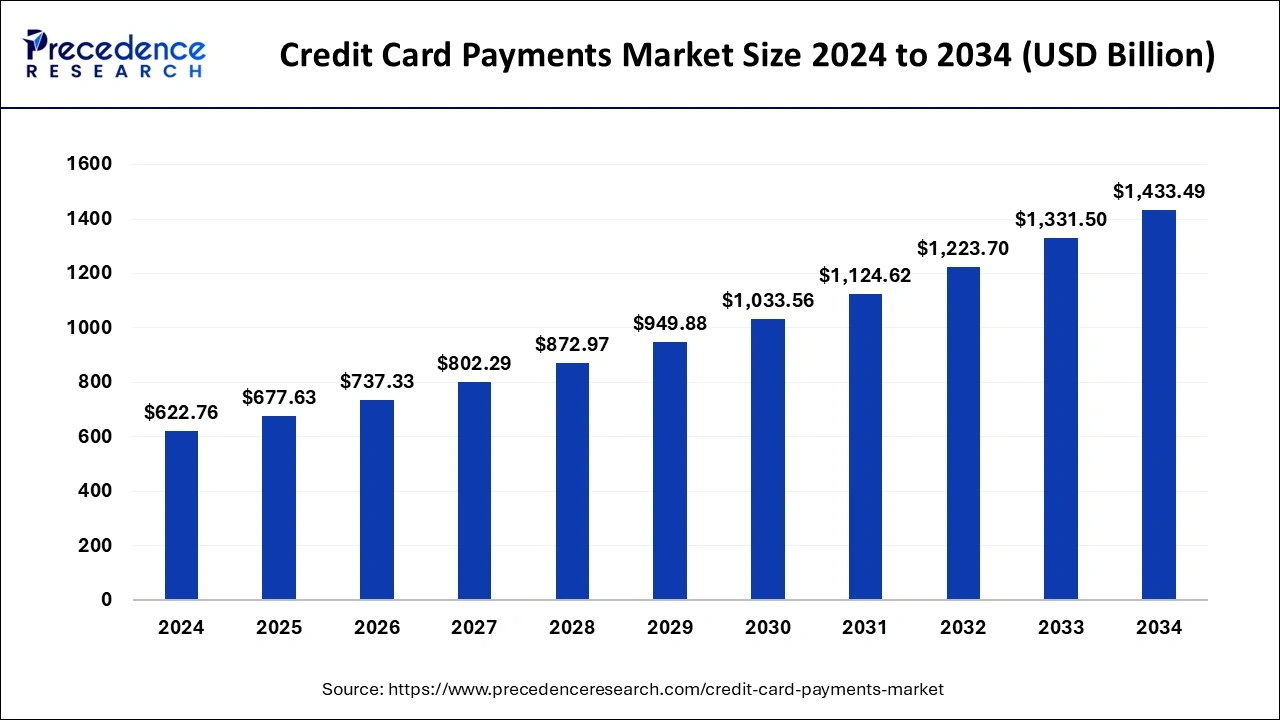

The global credit card payments market size was valued at USD 572.34 billion in 2023 and is expected to reach around USD 1,331.50 billion by 2033, expanding at a CAGR of 8.81% from 2024 to 2033.

Key Points

- The North America credit card payments market size reached USD 246.11 billion in 2023 and is expected to expand around USD 579.20 billion by 2033, at a CAGR of 8.93% from 2024 to 2033.

- North America held the dominant share of the credit card payments market in 2023.

- Europe is expected to expand at a rapid pace in the market during the forecast period.

- By card type, the general purpose credit cards segment accounted for the largest share of the market in 2023 and is projected to continue its dominance over the forecast period.

- By card type, the specialty & other credit cards segment is expected to witness considerable growth in the market over the forecast period.

- By application, the food & groceries segment held the largest share of the market in 2023.

- By application, the health & pharmacy segment is expected to grow significantly in the market during the forecast period.

- By provider, the Mastercard segment is estimated to hold the dominating share of the market during the forecast period.

- By provider, the Visa segment is expected to grow notably in the market over the studied period.

The credit card payments market is a critical component of the global financial ecosystem, facilitating transactions between consumers, merchants, and financial institutions. It encompasses the infrastructure and processes that enable individuals and businesses to use credit cards for purchases, bill payments, and other financial transactions. Over the years, this market has experienced significant growth driven by technological advancements, changing consumer behaviors, and the expansion of digital payment solutions.

Get a Sample: https://www.precedenceresearch.com/sample/4460

Growth Factors in the Credit Card Payments Market

Several key factors contribute to the growth of the credit card payments market. Firstly, technological innovations such as contactless payments, mobile wallets, and blockchain-based solutions have enhanced convenience and security, driving adoption among consumers and merchants alike. Moreover, the proliferation of e-commerce and online shopping has fueled the demand for credit card transactions, as consumers increasingly prefer the ease of making digital payments over traditional methods.

Furthermore, the globalization of businesses and the increasing number of international transactions have boosted the usage of credit cards as a preferred payment method. This trend is supported by the widespread acceptance of credit cards across various sectors including retail, hospitality, healthcare, and entertainment. Additionally, regulatory initiatives aimed at promoting electronic payments and consumer protection have also played a crucial role in shaping the growth trajectory of the market.

Regional Insights

The credit card payments market exhibits regional variations influenced by economic development, consumer preferences, regulatory frameworks, and technological infrastructure. In developed regions such as North America and Western Europe, credit card penetration is high, with a significant portion of transactions conducted electronically. These regions also lead in terms of technological adoption, with advanced payment processing systems and robust security measures in place.

In contrast, emerging markets in Asia-Pacific, Latin America, and Africa are experiencing rapid growth in credit card usage driven by urbanization, rising disposable incomes, and increasing access to financial services. Governments in these regions are actively promoting financial inclusion initiatives, which include expanding access to credit cards and improving payment infrastructure to support digital transactions.

Credit Card Payments Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 572.34 Billion |

| Market Size in 2024 | USD 622.76 Billion |

| Market Size by 2033 | USD 1,331.50 Billion |

| Market Growth Rate | CAGR of 8.81% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Card Type, Application, Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Credit Card Payments Market Dynamics

Drivers

Several drivers propel the expansion of the credit card payments market. Firstly, the shift towards a cashless economy driven by digital transformation initiatives and changing consumer preferences favors the adoption of credit cards. Moreover, the integration of artificial intelligence and machine learning technologies into payment systems enhances fraud detection capabilities and improves transaction security, thereby increasing consumer confidence in using credit cards.

Additionally, partnerships between financial institutions, technology companies, and merchants facilitate the development of innovative payment solutions, such as loyalty programs, rewards schemes, and personalized offers, which attract and retain cardholders. Furthermore, the convenience of credit cards for international travel and online shopping further stimulates demand, especially among millennial and Gen Z consumers who value seamless and efficient payment experiences.

Opportunities

The credit card payments market presents numerous opportunities for stakeholders across the value chain. Expansion into underserved markets, particularly in developing regions, represents a significant growth opportunity for financial institutions and payment processors. Moreover, advancements in payment technologies such as biometric authentication, tokenization, and real-time transaction processing are poised to enhance the efficiency and security of credit card payments, thereby driving adoption among businesses and consumers.

Furthermore, the integration of credit card functionalities into mobile devices and wearables presents new avenues for innovation and customer engagement. As consumer preferences continue to evolve towards digital and contactless payment methods, there is a growing opportunity to develop user-friendly interfaces and seamless omnichannel experiences that cater to diverse demographics and purchasing behaviors.

Challenges

Despite its growth prospects, the credit card payments market faces several challenges. One of the primary concerns is cybersecurity risks, including data breaches, identity theft, and fraudulent transactions, which undermine consumer trust and confidence in using credit cards. Mitigating these risks requires continuous investment in robust cybersecurity infrastructure and adherence to stringent regulatory standards.

Moreover, regulatory compliance poses challenges for financial institutions operating across multiple jurisdictions, as regulatory requirements related to data privacy, anti-money laundering, and consumer protection vary significantly. Adapting to these regulations while maintaining operational efficiency and cost-effectiveness remains a complex task for industry participants.

Furthermore, competition from alternative payment methods such as digital wallets, peer-to-peer payment apps, and cryptocurrency platforms presents a competitive threat to traditional credit card issuers and payment processors. These alternative solutions offer greater convenience, lower transaction fees, and faster settlement times, thereby challenging the dominance of credit cards in the payments landscape.

Read Also: Blood Testing Market Size to Reach USD 198.19 Billion by 2033

Credit Card Payments Market Companies

- American Express

- Bank of America

- Barclays

- Capital One

- Chase

- Citibank

- Discover

- HSBC

- ICICI Bank

- JPMorgan

- Mastercard

- MUFG

- Santander

- SBI Cards

- State Farm

- U.S. Bancorp

- Visa

- Wells Fargo

- Westpac

- Worldpay

Recent Developments

- In February 2024, American Express and Delta Air Lines unveiled upgraded Delta SkyMiles American Express Cards, intended to improve the travel experience and provide everyday value to consumers and business owners.

- In March 2024, SBI Card, in partnership with Titan Company Ltd, announced the launch of Titan SBI Card. Titan SBI Card offers features that include cashback, titan gift vouchers, and reward points. The cardholders can avail benefits worth over Rs. 2,00,000 per annum.

- In June 2024, Adani One and ICICI Bank announced the launch of India’s first co-branded credit cards with airport-linked benefits in collaboration with Visa. Available in two variants – Adani One ICICI Bank Signature Credit Card and Adani One ICICI Bank Platinum Credit Card – the cards offer a substantial reward program.Companies

Segments Covered in the Report

By Card Type

- General Purpose Credit Cards

- Specialty and Other Credit Cards

By Application

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Other Applications

By Provider

- Visa

- Mastercard

- Other Providers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/