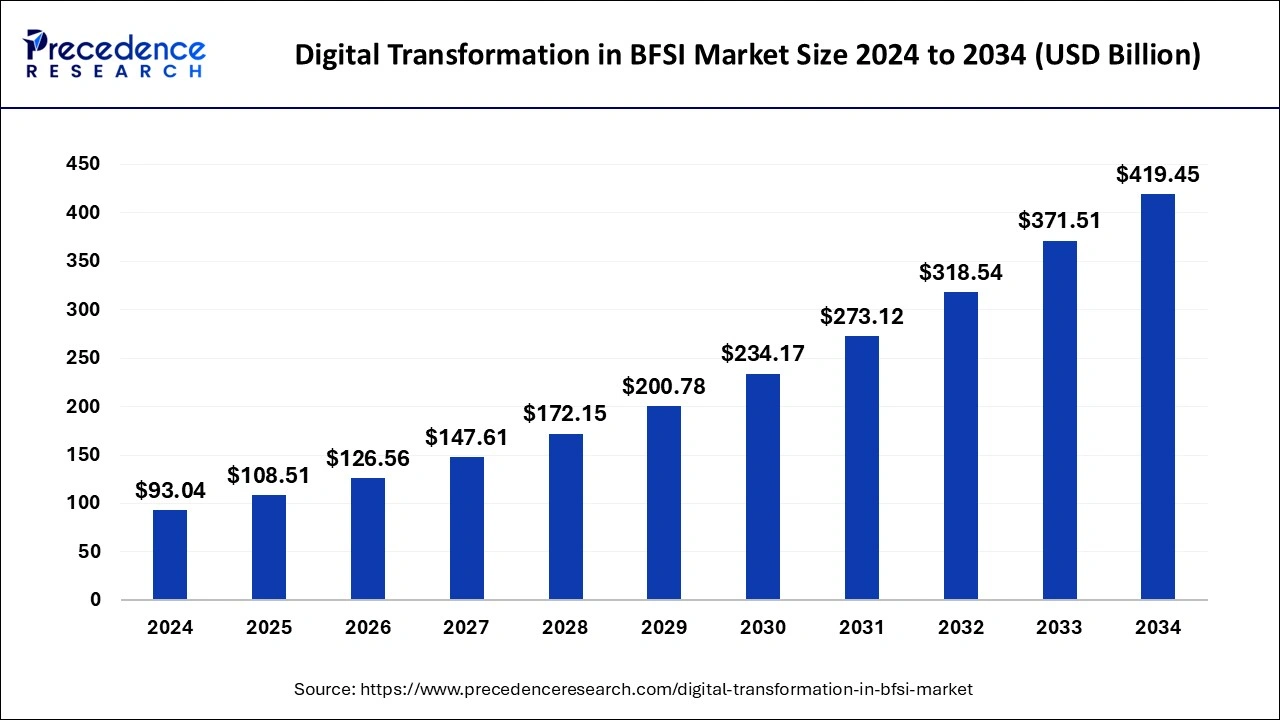

The global digital transformation in BFSI market size was valued at USD 79.77 billion in 2023 and is predicted to reach around USD 371.51 billion by 2033, expanding at a CAGR of 16.63% from 2024 to 2033.

Key Points

- North America led the digital transformation in BFSI market with the largest market size in 2023.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By component, the solution segment dominated the market with the highest growth in 2023.

- By deployment, the on-premise segment projected the highest growth in 2023.

- By deployment, the cloud segment is estimated to grow at the fastest rate during the forecast period.

- By enterprise, large enterprise segment dominated the market with the largest market share in 2023.

- By technology, the artificial intelligence segment dominated the market with the largest revenue in 2023.

- By end-user, the banks segment dominated the digital transformation in BFSI market in 2023.

Digital transformation in the Banking, Financial Services, and Insurance (BFSI) sector is reshaping how these industries operate, deliver services, and interact with customers. The integration of digital technologies into every aspect of BFSI is not just a technological trend but a strategic imperative for competitiveness and growth. This transformation encompasses the adoption of technologies such as artificial intelligence (AI), machine learning (ML), blockchain, cloud computing, and big data analytics to streamline operations, enhance customer experiences, and drive innovation.

Get a Sample: https://www.precedenceresearch.com/sample/4466

Growth Factors

Several factors are driving the digital transformation in the BFSI sector. One of the primary growth factors is the increasing demand for personalized and seamless customer experiences. Customers today expect faster, more efficient, and personalized services, which traditional banking methods struggle to provide. Digital platforms allow BFSI companies to offer tailored services based on individual customer data, enhancing customer satisfaction and loyalty.

Another significant growth driver is the advancement in technology. The rapid development of AI and ML enables BFSI companies to analyze large volumes of data and gain actionable insights, which can be used for risk management, fraud detection, and improving customer services. Blockchain technology is revolutionizing the way transactions are conducted, providing increased security, transparency, and efficiency.

Regulatory compliance and the need for robust security measures also play a critical role in driving digital transformation. With the rise in cyber threats, BFSI institutions are investing heavily in advanced cybersecurity solutions to protect sensitive customer data and maintain regulatory compliance.

Trends

Several key trends are shaping the digital transformation landscape in the BFSI sector. One major trend is the adoption of AI and ML. These technologies are being used to enhance customer service through chatbots and virtual assistants, automate routine tasks, and improve decision-making processes through predictive analytics.

Another significant trend is the shift towards mobile banking. With the proliferation of smartphones, customers are increasingly using mobile apps for their banking needs. Mobile banking apps offer convenience and accessibility, allowing customers to perform transactions, check balances, and access other banking services anytime and anywhere.

The adoption of blockchain technology is also a notable trend. Blockchain provides a secure and transparent way to conduct transactions, which is particularly beneficial in the areas of payments, trade finance, and identity verification. Financial institutions are exploring various blockchain-based solutions to improve efficiency and reduce costs.

Open banking is another trend gaining traction. By enabling third-party developers to build applications and services around financial institutions, open banking fosters innovation and provides customers with more choices. It also promotes competition and can lead to better financial products and services.

Region Insights

The digital transformation in the BFSI sector varies significantly across different regions. In North America, the adoption of digital technologies is highly advanced, driven by significant investments in technology and a strong focus on innovation. The United States, in particular, is a leader in fintech innovation, with numerous startups and established financial institutions leveraging advanced technologies to enhance their services.

Europe is also witnessing substantial digital transformation in the BFSI sector. The region’s strong regulatory framework, particularly the General Data Protection Regulation (GDPR), is pushing financial institutions to adopt advanced data management and security solutions. The United Kingdom, Germany, and France are leading the way in digital banking and fintech adoption.

In the Asia-Pacific region, countries like China, India, and Singapore are at the forefront of digital transformation in BFSI. The rapid economic growth, increasing internet penetration, and a large population of tech-savvy consumers are driving the adoption of digital banking and fintech solutions. China, with its highly developed mobile payment ecosystem, and India, with its push towards a cashless economy, are notable examples.

Latin America and the Middle East & Africa regions are also embracing digital transformation in BFSI, albeit at a slower pace compared to North America, Europe, and Asia-Pacific. In Latin America, countries like Brazil and Mexico are leading the way, with increasing investments in fintech and digital banking solutions. In the Middle East & Africa, the focus is on enhancing financial inclusion and leveraging digital technologies to reach the unbanked population.

Digital Transformation in BFSI Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 79.77 Billion |

| Market Size in 2024 | USD 93.04 Billion |

| Market Size by 2033 | USD 371.51 Billion |

| Market Growth Rate | CAGR of 16.63% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Deployment, Enterprise, Technology, End-User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital Transformation in BFSI Market Dynamics

Drivers

Several drivers are propelling the digital transformation in the BFSI sector. Customer expectations are a primary driver, as modern consumers demand faster, more personalized, and accessible financial services. The proliferation of smartphones and internet connectivity has enabled customers to access banking services on-the-go, driving the need for mobile and digital banking solutions.

The competitive landscape is another crucial driver. Traditional banks are facing stiff competition from fintech startups and technology giants entering the financial services space. To stay competitive, banks and financial institutions must adopt digital technologies to enhance their services and offer innovative solutions.

Regulatory pressure and the need for compliance are also significant drivers. Financial institutions must adhere to stringent regulations to protect customer data and ensure secure transactions. Advanced digital solutions help these institutions comply with regulatory requirements and mitigate risks associated with data breaches and cyber threats.

The operational efficiency gained through digital transformation is another key driver. Automation of routine tasks, enhanced data analytics, and improved decision-making processes lead to significant cost savings and operational efficiencies. Financial institutions can allocate resources more effectively and focus on strategic initiatives by leveraging digital technologies.

Opportunities

The digital transformation in the BFSI sector presents numerous opportunities for financial institutions. One of the most significant opportunities is the ability to reach underserved and unbanked populations. Digital banking solutions, mobile wallets, and fintech innovations can provide financial services to individuals who lack access to traditional banking, thereby promoting financial inclusion.

Another opportunity lies in the potential for new revenue streams. Financial institutions can leverage customer data to offer personalized financial products and services, such as tailored investment advice, insurance plans, and lending solutions. The use of advanced analytics and AI can also lead to the development of new financial products that meet the evolving needs of customers.

Collaboration with fintech startups is another area of opportunity. By partnering with fintech companies, traditional banks can leverage innovative technologies and agile methodologies to enhance their services and compete more effectively. Such collaborations can lead to the development of new products, improved customer experiences, and increased market share.

The implementation of blockchain technology offers opportunities for increased security, transparency, and efficiency in financial transactions. Blockchain can be used for various applications, including cross-border payments, smart contracts, and identity verification, providing financial institutions with a competitive edge.

Challenges

Despite the numerous benefits and opportunities, digital transformation in the BFSI sector also presents several challenges. One of the primary challenges is the integration of new technologies with legacy systems. Many financial institutions still rely on outdated systems, making it difficult to implement new digital solutions seamlessly. The integration process can be complex, time-consuming, and costly.

Cybersecurity is another significant challenge. As financial institutions adopt digital technologies, they become more vulnerable to cyber threats and data breaches. Ensuring robust cybersecurity measures to protect sensitive customer data and maintain trust is a critical challenge for the BFSI sector.

Regulatory compliance is also a major challenge. Financial institutions must navigate a complex and ever-changing regulatory landscape to ensure compliance with data protection, anti-money laundering (AML), and other regulations. The cost and effort required to maintain compliance can be substantial, particularly for smaller institutions.

The need for cultural and organizational change is another challenge. Digital transformation requires a shift in mindset and culture within financial institutions. Employees must be trained to adopt new technologies and processes, and there must be a willingness to embrace change at all levels of the organization. Resistance to change can hinder the successful implementation of digital transformation initiatives.

Additionally, the rapid pace of technological advancement poses a challenge. Financial institutions must continuously monitor and adopt emerging technologies to stay ahead of the competition. Keeping up with the latest technological trends and ensuring that the organization is equipped to leverage these technologies effectively can be a daunting task.

Read Also: Sheet Metal Market Size to Reach USD 524.27 Bn by 2033

Digital Transformation in BFSI Market Companies

- Oracle

- Fujitsu

- Accenture

- HID Global Corporation.

- SAP SE

- Google LLC

- AlphaSense Inc.

- Cognizant

- Microsoft Corporation

- International Business Machines Corporation

Recent Development

- In May 2024, Infosys, Tata Consulting Services, Tech Mahindra, and Wipro, all the IT companies, are winning the digital transformation deals in banking, financial services, and Insurance) industry. The organizations see the potential opportunities in core banking, payment, and other applications.

- In June 2024, InfoAxon comes into a strategic collaboration with Liferay to help boost the digital transformation for Reliance Digital Insurance (RGI). The collaboration is set to enhance RGI’s digital landscape and deliver a revolutionary journey to the consumer and prospects.

- In May 2024, ModernFi, an API-driven and fully integrated deposit network, announced the partnership with the Q2’s Digital Banking Platform through the Q2 Partner Accelerator Program. The collaboration brings a reciprocal program into digital banking.

- In May 2024, Decentro, India’s leading Fintech infrastructure platform, launched the next-generation Payment Stack. The platform is designed to cater to businesses delivering high performance, expansive payment needs, compliance, and security.

Segments Covered in the Report

By Component

- Solution

- Service

By Deployment

- On-Premise

- Cloud

By Enterprise

- Large Enterprises

- Small and Medium-sized Enterprises

By Technology

- Artificial Intelligence

- Cloud Computing

- Blockchain

- Big Data and Business Analytics

- Cybersecurity

- Others

By End-User

- Banks

- Insurance Companies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/