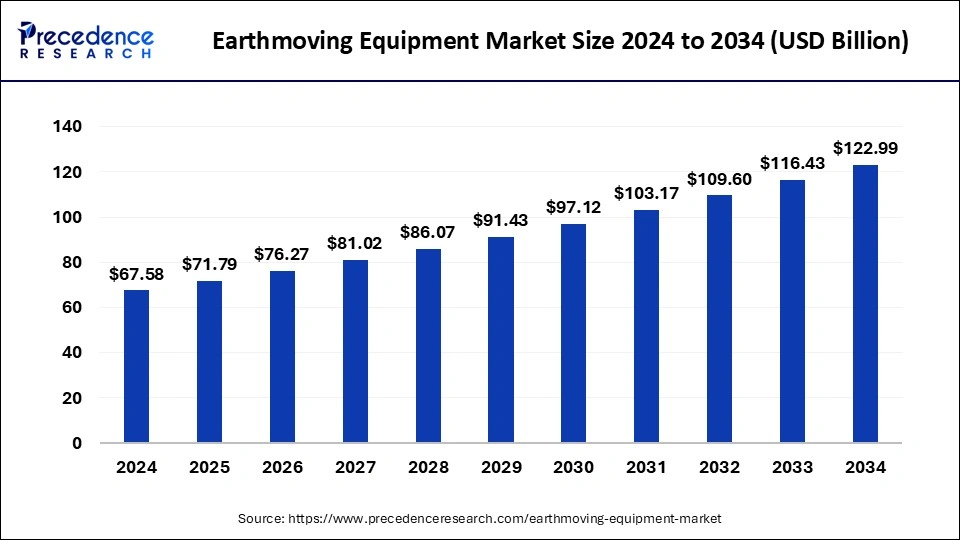

The global earthmoving equipment market size was valued at USD 63.62 billion in 2023 and is predicted to reach around USD 116.43 billion by 2033, expanding at a CAGR of 6.23% from 2024 to 2033.

Key Points

- Asia Pacific led the earthmoving equipment market with the largest market share in 2023.

- North America is expected to witness the fastest growth in the market during the forecast period.

- By product, the excavators segment dominated the market with the largest market share in 2023.

- By application, the construction segment projected largest revenue in the market in 2023.

The global earthmoving equipment market encompasses machinery used in various construction and mining activities, including excavators, loaders, bulldozers, and others. These machines are essential for digging, lifting, and moving earth and other materials, making them indispensable in infrastructure development, residential and commercial construction, and mining operations worldwide. The market is characterized by a diverse range of equipment types and is influenced by technological advancements, regulatory policies, and economic conditions globally.

Get a Sample: https://www.precedenceresearch.com/sample/4508

Growth Factors

Several key factors drive the growth of the earthmoving equipment market. Firstly, rapid urbanization and industrialization across emerging economies necessitate extensive infrastructure development, boosting demand for construction equipment. Secondly, ongoing investments in transportation infrastructure projects, such as roads, highways, and railways, further propel market growth. Thirdly, the expansion of mining activities to meet global demand for minerals and metals contributes significantly to the market’s expansion.

Moreover, technological advancements play a crucial role in market growth. Innovations in earthmoving equipment, such as enhanced fuel efficiency, GPS tracking, and automated operations, improve productivity and operational efficiency, thereby driving adoption among end-users. Additionally, increasing environmental awareness has led to the development of eco-friendly equipment with reduced emissions and noise levels, appealing to environmentally conscious buyers and governments promoting sustainable practices.

Regional Insights

Regionally, the earthmoving equipment market exhibits varying dynamics influenced by economic conditions, infrastructure development, and regulatory frameworks. Asia-Pacific dominates the market, driven by rapid urbanization in countries like China and India, extensive investments in construction projects, and government initiatives to upgrade infrastructure. North America and Europe also hold significant market shares, characterized by ongoing infrastructure renewal and expansion projects.

In emerging markets of Latin America, Africa, and the Middle East, the market is growing steadily, supported by increasing construction activities and investments in mining and oil exploration. However, market growth in these regions can be constrained by political instability, fluctuating commodity prices, and regulatory challenges.

Earthmoving Equipment Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 116.43 Billion |

| Market Size in 2023 | USD 63.62 Billion |

| Market Size in 2024 | USD 67.58 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 6.23% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Earthmoving Equipment Market Dynamics

Drivers

Several drivers underpin the growth of the earthmoving equipment market. Firstly, the need for infrastructure development, driven by population growth and urbanization, fuels demand for construction equipment. Secondly, technological advancements in equipment design, automation, and connectivity enhance efficiency and reduce operational costs, stimulating market growth. Thirdly, government initiatives and public-private partnerships (PPPs) aimed at infrastructure development and modernization projects provide a significant boost to market expansion.

Furthermore, the increasing adoption of rental and leasing options for earthmoving equipment offers flexibility to end-users, especially small and medium-sized enterprises (SMEs), by reducing upfront costs and maintenance responsibilities. Additionally, the rising trend towards sustainable construction practices drives demand for energy-efficient and environmentally friendly equipment, promoting innovation and market growth.

Opportunities

The earthmoving equipment market presents several opportunities for manufacturers, suppliers, and service providers. Firstly, the expansion of smart cities and sustainable infrastructure projects creates a demand for advanced equipment with IoT capabilities and real-time monitoring systems. Secondly, the replacement and upgrading of aging equipment fleets in developed markets provide opportunities for equipment suppliers to introduce newer, more efficient models.

Moreover, emerging markets offer growth opportunities due to increasing investments in infrastructure and mining sectors. Strategic partnerships and collaborations between equipment manufacturers and technology firms can accelerate product development and innovation, addressing evolving customer needs and regulatory requirements. Furthermore, the growing trend towards equipment rental and leasing models presents a lucrative business opportunity for rental companies and equipment financiers.

Challenges

Despite growth prospects, the earthmoving equipment market faces several challenges. Firstly, the high initial cost of equipment and ongoing maintenance expenses pose financial barriers, particularly for small contractors and enterprises. Secondly, economic volatility and fluctuating raw material prices impact manufacturing costs and profit margins for equipment suppliers.

Additionally, stringent environmental regulations and emissions standards necessitate continuous investment in research and development (R&D) to develop eco-friendly equipment, increasing manufacturing complexities and costs. Moreover, geopolitical tensions and trade disputes can disrupt supply chains and market stability, affecting equipment availability and pricing globally.

Furthermore, the industry’s dependency on the construction and mining sectors exposes it to cyclical downturns and market uncertainties, influencing equipment demand and sales. Lastly, skilled labor shortages and the need for specialized training in operating advanced equipment pose operational challenges for end-users, affecting productivity and efficiency.

Read Also: Anti-Inflammatory Biologics Market Size, Share, Report by 2033

Earthmoving Equipment Market Companies

- AB Volvo

- BEML LIMITED.

- Bobcat Company

- Caterpillar

- CNH Industrial N.V.

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd

- Komatsu Ltd.

- LIEBHERR

- SANY Group

- Sumitomo Heavy Industries, Ltd.

- Terex Corporation

- XCMG Group

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

Recent Developments

- In June 2024, Volvo CE launched L120 Electric heavy-duty electric earthmoving machines with the lifting capacity of 6 tonnes. With featuring mobile charging units that used to charge the equipments in the construction site with insufficient power grid connection.

- In May 2024, FuelPro Trailers, a leading player of diesel fuel, and service trailers added the new member in its fuel trailers portfolio like the economical 500-gallon FuelPro 500. These fuel trailers allow farmers, contractors, and farmers to refuel equipments on site effectively.

- In May 2024, Volvo CE launched the range of new excavators EC210, EC230, EC370, EC400 and EC500, and ECR145 short swing crawler excavators with enhanced performance, safety, and operator features.

Segment Covered in the Report

By Product

- Excavators

- Loaders

- Backhoes

- Compaction Equipment

- Others

By Application

- Construction

- Underground Mining

- Surface Mining

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/