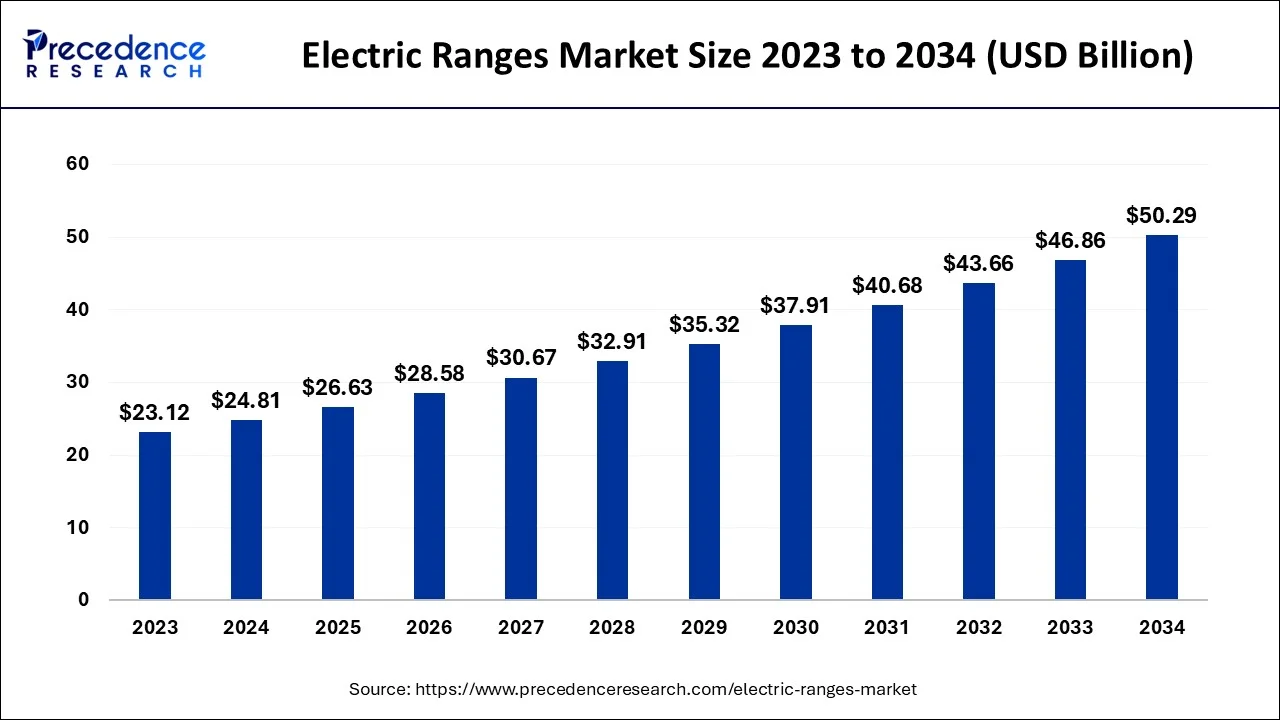

The global electric ranges market size reached USD 24.81 billion in 2024 and is predicted to be attain around USD 50.29 billion by 2034, growing at a CAGR of 7.32% from 2024 to 2034

Key Points

- North America dominated the electric ranges market with the largest market share of 38% in 2023.

- Asia Pacific is expected to grow at a fastest CAGR of 8.21% during the studied period.

- By product, the freestanding electric ranges segment accounted for the highest market share of 63% in 2023.

- By product, the slide-in electric ranges segment is expected to grow at the fastest CAGR of 8.21% over the forecast period.

- By application, the residential segment contributed the biggest market share of 81% in 2023.

- By application, the commercial segment is predicted to grow at a solid CAGR of 8.12% over the projected period.

- By distribution channel, the mass retailer-driven sales segment generated the biggest market share of 47% in 2023.

- By distribution channel, the online sales segment is anticipated to expand at the fastest CAGR of 9.03% during the forecast period.

The global electric ranges market is undergoing significant growth, driven by increasing consumer preference for energy-efficient and technologically advanced kitchen appliances. These ranges offer precise temperature control, safety features, and versatile cooking options, making them popular among both residential and commercial users. The market is segmented by type (freestanding, slide-in, and drop-in), price points (economy, mid-range, premium), and distribution channels (supermarkets, specialty stores, online retail, etc.)

Sample: https://www.precedenceresearch.com/sample/5218

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 50.29 Billion |

| Market Size in 2024 | USD 24.81 Billion |

| Market Size in 2025 | USD 26.63 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Key Drivers

Several factors propel market growth. The shift towards energy-efficient and sustainable appliances is a primary driver, with induction technology becoming particularly popular for its energy-saving and precision benefits. The integration of smart features, such as Wi-Fi connectivity and voice control, also enhances consumer appeal. Additionally, rising urbanization and disposable income, especially in emerging economies, are boosting the demand for modern kitchen solutions.

Opportunities

The electric ranges market offers substantial growth opportunities, particularly through technological advancements like smart kitchen integration and enhanced energy efficiency. Emerging markets in the Asia-Pacific and Latin America are key growth regions due to increasing urbanization and changing consumer lifestyles. Expanding e-commerce platforms further provide new avenues for market penetration.

Challenges

Despite its growth potential, the market faces challenges. Supply chain disruptions, driven by material shortages and logistical issues, can hinder production and delivery. The high initial cost of electric ranges compared to gas alternatives and economic uncertainties also pose barriers, potentially slowing consumer adoption in certain regions.

Regional Insights

North America and Europe lead the market, driven by advanced technology adoption and sustainability initiatives. The Asia-Pacific region is poised for the fastest growth due to rapid urbanization, rising incomes, and government support for energy-efficient appliances. These regional dynamics highlight a competitive and diverse market landscape

Read Also: Liquid Packaging Carton Market Size to Hit USD 49.17 Bn By 2034

Electric Ranges Market Companies

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- General Electric (GE Appliances)

- Bosch (BSH Hausgerte GmbH)

- Frigidaire

- Haier Group Corporation

- Miele & Cie. KG

- Brown Stove Works, INC.

- Rangaire

Recent News

- In March 2024, GE Appliances launched a new range lineup featuring 36 models, including the top-tier GE 30″ Slide-In Electric Convection Range with No Preheat Air Fry and the EasyWash Oven Tray, created for faster cooking and easier cleaning.

- In January 2023, Sharp Home Electronics showcased new 30″ slide-in electric ranges and smart combi appliances at the 2023 Kitchen & Bath Industry Show (KBIS) in Las Vegas.

- In October 2023, Usha International, a prominent player in the consumer durables segment in India, launched a selection of five innovative kitchen appliances as part of its latest premium iChef range.

Segments Covered in the Report

By Product

- Freestanding electric ranges

- Slide-in electric ranges

- Drop-in electric ranges

By Application

- Residential

- Commercial

By Distribution Channel

- Mass retailers

- Electronic & appliance stores

- Online/e-commerce

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa