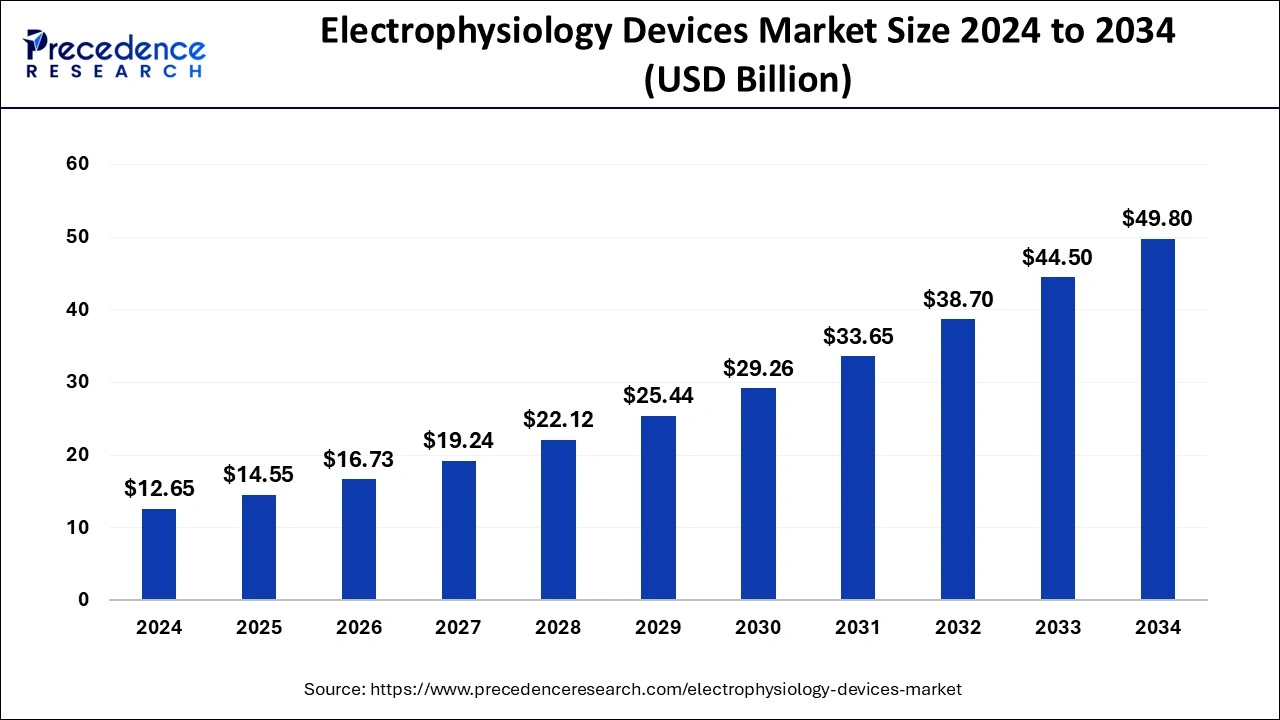

The electrophysiology devices market, valued at USD 12.65B in 2024, is projected to reach USD 49.80B by 2034, growing at a CAGR of 14.69%.

Electrophysiology Devices Market Key Takeaways

- North America led the market with the biggest market share of 49% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR during the forecast period.

- By Indication, the atrial fibrillation segment registered the maximum market share in 2024.

- By Application, the diagnostic devices segment has held a major revenue share in 2024.

The electrophysiology devices market is experiencing significant growth, driven by the rising prevalence of cardiac arrhythmias and advancements in minimally invasive procedures. In 2024, the market was valued at USD 12.65 billion and is projected to reach USD 49.80 billion by 2034, growing at a CAGR of 14.69%. Increasing adoption of advanced diagnostic and ablation technologies, along with a growing geriatric population, is fueling demand. North America holds the largest market share due to well-established healthcare infrastructure, while Asia-Pacific is expected to witness the fastest growth due to rising healthcare investments and increasing awareness of electrophysiology procedures.

Sample Link: https://www.precedenceresearch.com/sample/1100

Key Drivers

Opportunities

- Increasing prevalence of cardiac arrhythmias and rising demand for minimally invasive procedures.

- Advancements in electrophysiology technologies, including 3D mapping and AI-powered diagnostics.

- Growing adoption of catheter-based ablation procedures for treating atrial fibrillation.

- Expanding healthcare infrastructure and rising investments in emerging markets.

- Increasing awareness and early diagnosis of heart rhythm disorders, driving the market growth.

Challenges

- High costs associated with electrophysiology devices and procedures, limiting accessibility.

- Shortage of skilled electrophysiologists and specialized training required for complex procedures.

- Stringent regulatory approvals and compliance requirements delaying product launches.

- Risk of complications and safety concerns related to electrophysiology procedures.

- Limited reimbursement policies in developing regions, restrict widespread adoption.

Regional Insights

North America dominates the electrophysiology devices market, driven by advanced healthcare infrastructure, high adoption rates of minimally invasive procedures, and strong reimbursement policies. Europe follows closely, supported by increasing investments in medical technology and a rising geriatric population prone to cardiac disorders. The Asia-Pacific region is expected to witness the fastest growth due to expanding healthcare infrastructure, increasing prevalence of arrhythmias, and growing awareness of electrophysiology procedures.

Countries like China, India, and Japan are leading this growth, benefiting from rising healthcare investments and technological advancements. Latin America and the Middle East & Africa are also experiencing steady expansion, driven by improving access to healthcare and rising demand for cardiac treatment, although challenges such as high device costs and limited specialist availability remain.

Don’t Miss Out: High Potency Active Pharmaceutical Ingredients Market

Market Key Players

- Biotronik SE & CO. KG

- Biosense Webster, Inc.

- Nihon Kohden Corporation

- GE Healthcare

- Microport Scientific Corporation

- Siemens AG

- Koninklijke Philips N.V.

Recent News

In February 2025, Johnson & Johnson paused U.S. sales of its Varipulse heart-rhythm device after reports of neurovascular events, including strokes, in several patients. An investigation confirmed the device operated correctly, but improper use could increase risks. Consequently, J&J resumed its limited U.S. rollout and plans to update global usage guidelines. In the same month, Boston Scientific’s stock experienced a slight decline after pausing enrollment in the Avant Guard study of its pulsed field ablation technology.

Despite this, the company’s electrophysiology segment reported a 131% sales increase in the third quarter of 2024, contributing to an 18.2% overall revenue growth. Additionally, Abbott Laboratories raised its full-year earnings outlook in October 2024, driven by an 11.7% rise in medical device sales, notably in electrophysiology products.

Market Segmentation

By Indication

- Atrial Fibrillation (AF)

- Atrioventricular Nodal Re-entry Tachycardia (AVNRT)

- Supraventricular Tachycardia

- Bradycardia

- Wolff-Parkinson-White Syndrome (WPW)

- Others

By Application

- Diagnostic Devices

- Diagnostic Electrophysiology Catheters

- Holter Monitoring Devices

- EP Mapping & Imaging Systems

- Electrocardiograph (ECG)

- Insertable Cardiac Monitors (ICM)

- Others

- Treatment Devices

- Automated external defibrillators (AEDs)

- Implantable Cardioverter Defibrillators (ICDs)

- CRT-D

- CRT-P

- Catheters

- Pacemakers

- Others

By End-User

- Ambulatory Surgical Centers

- Hospitals

- Others