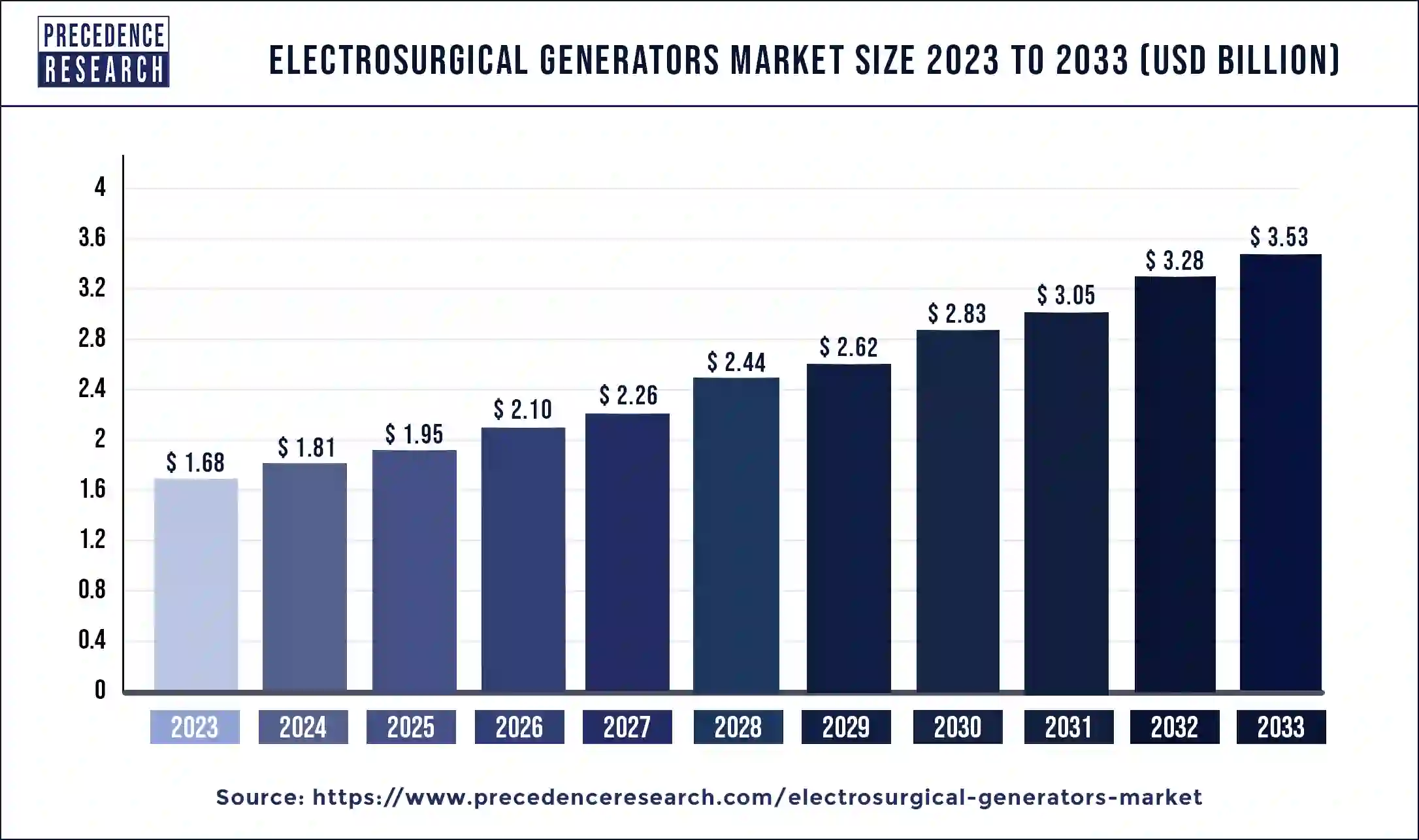

The global electrosurgical generators market size was estimated at USD 1.68 billion in 2023 and is predicted to be worth around USD 3.53 billion by 2033, growing at a CAGR of 7.72% from 2024 to 2033.

Key Points

- North America dominated the global electrosurgical generators market in 2023.

- Europe will experience notable growth in the market during the projected period.

- By type, the bipolar electrosurgical segment held a considerable share of the market in 2023.

- By type, the monopolar generator segment is expected to grow at a notable rate during the forecast period.

- By application, the dermatology segment held a significant share of the market in 2023.

- By application, the gynecology segment is projected to show notable growth in the market over the projected period.

- By end use, the hospital segment dominated the market in 2023.

- By end use, the ambulatory surgical centers segment will grow substantially in the market over the studied period.

The Electrosurgical Generators Market is a crucial segment within the broader medical devices industry, playing a vital role in modern surgical procedures. Electrosurgical generators are devices used to cut, coagulate, desiccate, or fulgurate tissue by converting electrical energy into heat. These devices are widely utilized in various surgical specialties including general surgery, gynecology, cardiology, and oncology due to their precision and efficiency. The market has witnessed substantial growth over recent years, driven by technological advancements and an increasing number of surgical procedures globally.

Get a Sample: https://www.precedenceresearch.com/sample/4408

Growth Factors

Several factors contribute to the growth of the electrosurgical generators market. Primarily, the rising prevalence of chronic diseases necessitates a higher volume of surgeries, thereby boosting demand for electrosurgical devices. Technological advancements, such as the development of advanced energy-based electrosurgical instruments, have improved surgical outcomes and patient safety, further driving market growth. Additionally, the growing adoption of minimally invasive surgical techniques, which rely heavily on electrosurgical equipment, is propelling market expansion.

Region Insights

Regionally, North America holds a significant share of the electrosurgical generators market due to the high adoption rate of advanced medical technologies, robust healthcare infrastructure, and a large base of skilled healthcare professionals. Europe follows closely, with substantial investments in healthcare and ongoing research and development activities. The Asia-Pacific region is expected to witness the fastest growth during the forecast period, attributed to increasing healthcare expenditure, improving medical infrastructure, and rising awareness about advanced surgical techniques in countries like China and India.

Electrosurgical Generator Market Scope

| Report Coverage | Details |

| Electrosurgical Generator Market Size in 2023 | USD 1.68 Billion |

| Electrosurgical Generator Market Size in 2024 | USD 1.81 Billion |

| Electrosurgical Generator Market Size by 2033 | USD 3.53 Billion |

| Electrosurgical Generator Market Growth Rate | CAGR of 7.72% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electrosurgical Generators Market Dynamics

Drivers

Key drivers of the electrosurgical generators market include the increasing global geriatric population, which is more prone to chronic diseases requiring surgical interventions. The demand for less invasive surgical procedures is also driving market growth, as these procedures often employ electrosurgical techniques. Additionally, continuous innovations in electrosurgical devices that enhance safety and efficacy, alongside favorable reimbursement policies in developed regions, are further stimulating market expansion.

Opportunities

The market presents several opportunities for growth and expansion. Emerging markets in developing countries offer significant potential due to their expanding healthcare sectors and increasing investments in medical technology. The trend towards outpatient surgeries and ambulatory surgical centers also provides opportunities for the adoption of portable and cost-effective electrosurgical generators. Moreover, the integration of advanced technologies such as robotics and AI in electrosurgery presents new avenues for innovation and market growth.

Challenges

Despite the positive outlook, the electrosurgical generators market faces certain challenges. High costs associated with advanced electrosurgical devices and stringent regulatory requirements can hinder market growth. The risk of complications and side effects associated with electrosurgical procedures may also limit adoption. Additionally, the need for skilled personnel to operate these devices effectively poses a challenge, particularly in developing regions with limited access to specialized training and education.

Read Also: Contract Research Organization (CRO) Market Size, Share, Report by 2033

Electrosurgical Generators Market Recent Developments

- In January 2023, Medtronic introduced the release of its new Monarch Electrosurgical Generator. The Monarch is a high-overall performance generator that gives quite a few capabilities, inclusive of virtual manipulation, wireless connectivity, and a touchscreen interface.

- In February 2023, Erbe Elektromedizin GmbH launched its new ViRS nine Electrosurgical Generator. The ViRS 9 is a flexible generator that can be used for quite a few surgical strategies. Its capabilities include several superior technologies, including a touch display screen interface and a Wi-Fi footswitch.

- In October 2022, Aspen Surgical Products, Inc. acquired Symmetry Surgical from RoundTable Healthcare Partners. Symmetry Surgical is a manufacturer, marketer, and distributor of reusable surgical instrumentation, electrosurgical products, and minimally invasive surgical devices.

- In March 2023, Olympus Corporation introduced the launch of its new VersaPulse Electrosurgical Generator. The VersaPulse is a compact and lightweight generator that is designed for use in quite a few settings. It functions with some features, along with a digital manipulation panel and plenty of safety functions.

Electrosurgical Generators Market Companies

- Medtronic

- Johnson & Johnson

- B. Braun Melsungen AG

- ConMed Corporation

- ERBE Elektromedizin GmbH

- Olympus Corporation

- Boston Scientific Corporation

- Ethicon Inc.

- Symmetry Surgical Inc.

- KLS Martin Group

- Megadyne Medical Products Inc.

- Bovie Medical Corporation

- Smith & Nephew plc.

- Applied Medical Resources Corporation

Segments Covered in the Report

By Type

- Bipolar

- Monopolar

By Application

- Optical

- Gynecology

- Dermatology

- Cardiac

- Dental

- ENT

- Maxillofacial

- Orthopedic

- Urology

- Neurology

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/