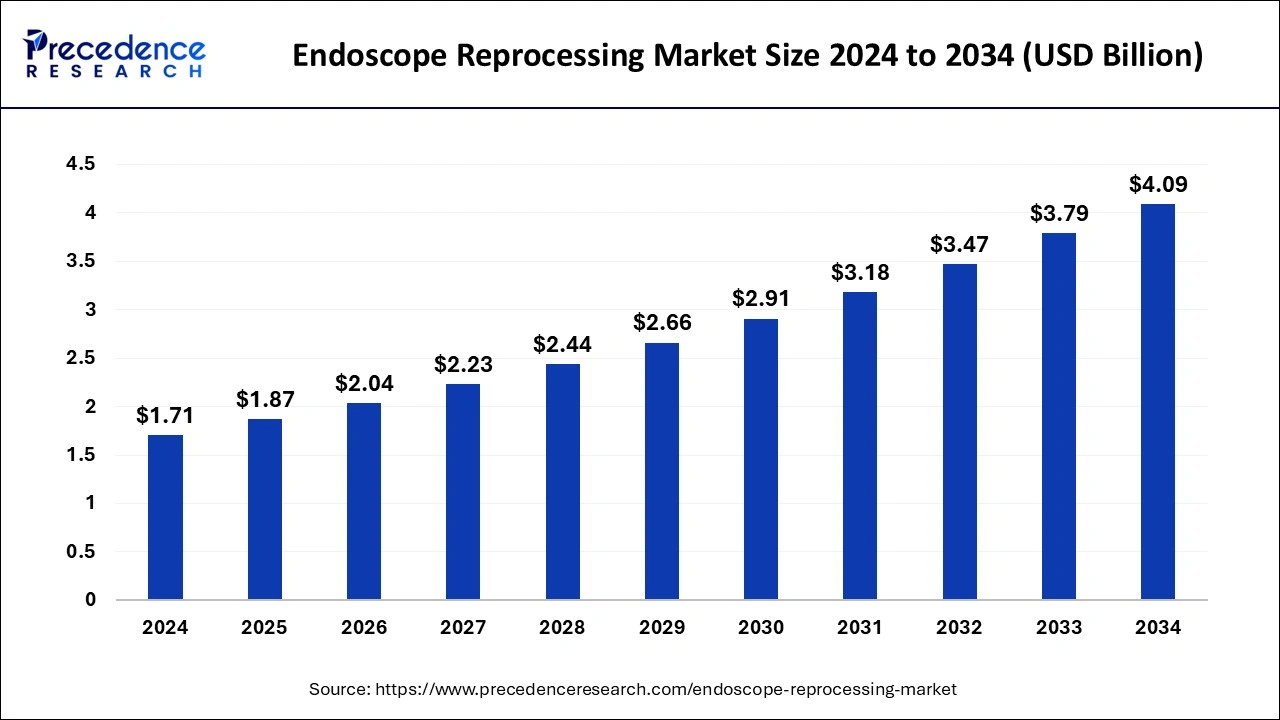

The global endoscope reprocessing market size was valued at USD 1.57 billion in 2023 and is expected to reach around USD 3.79 billion by 2033, expanding at a solid CAGR of 9.21% from 2024 to 2033.

Key Points

- The North America endoscope reprocessing market size accounted for USD 640 million in 2023 and is expected to expand around USD 1,570 million by 2033, growing at a CAGR of 9.38% from 2024 to 2033.

- North America dominated the market with the largest revenue share of 41% in 2023.

- By product type, the high-level disinfectants and test strips segment has contributed more than 31% of revenue share in 2023.

- By product type, the automated endoscope reprocessors segment is estimated to be the fastest-growing during the forecast period.

- By end-use type, the outpatient facilities segment has held a major revenue share of 57% in 2023.

- By end-use type, the hospitals segment is expected to be the fastest-growing during the forecast period.

Endoscope reprocessing is a crucial part of ensuring patient safety in medical settings. The process involves cleaning, disinfecting, and sterilizing endoscopes to prevent the risk of infection during endoscopic procedures. The market for endoscope reprocessing has witnessed significant growth over the years, driven by increasing awareness about healthcare-associated infections (HAIs), advancements in reprocessing technologies, and stringent regulatory requirements.

Endoscopes are used in various diagnostic and therapeutic procedures, making their safe reuse imperative. The reprocessing market encompasses a wide range of products, including automated endoscope reprocessors (AERs), detergents, sterilants, drying/storage cabinets, and tracking software. The continuous innovation in these products aims to enhance efficiency, reduce reprocessing time, and ensure high standards of disinfection and sterilization.

Get a Sample: https://www.precedenceresearch.com/sample/4425

Growth Factors

Several factors contribute to the growth of the endoscope reprocessing market. Firstly, the rising incidence of chronic diseases such as cancer and gastrointestinal disorders has led to an increase in endoscopic procedures, thereby boosting the demand for reprocessing solutions. Secondly, there is a growing emphasis on infection control practices in healthcare facilities, driven by both regulatory mandates and the need to protect patients from HAIs.

Technological advancements also play a significant role in market growth. Innovations such as automated endoscope reprocessors (AERs) enhance the efficiency and reliability of the reprocessing process. These devices are designed to meet stringent standards and protocols, ensuring that endoscopes are thoroughly disinfected and ready for safe use.

Furthermore, the market is propelled by the increasing adoption of single-use components and accessories, which complement the reprocessing workflow and reduce the risk of cross-contamination. As healthcare providers strive to optimize their infection control practices, the demand for advanced reprocessing solutions continues to rise.

Region Insights

The endoscope reprocessing market exhibits significant regional variation, with North America leading the market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

In North America, the market is driven by the high prevalence of chronic diseases, advanced healthcare infrastructure, and stringent regulatory requirements. The United States, in particular, has a well-established healthcare system that emphasizes infection control, contributing to the widespread adoption of endoscope reprocessing solutions.

Europe follows closely, with countries like Germany, France, and the United Kingdom leading the market. The region benefits from a strong focus on healthcare quality and patient safety, as well as supportive regulatory frameworks that mandate rigorous reprocessing standards.

The Asia-Pacific region is expected to witness the highest growth rate during the forecast period. This growth is attributed to increasing healthcare expenditure, rising awareness about HAIs, and the expanding medical tourism industry. Countries such as China, India, and Japan are investing heavily in healthcare infrastructure, which includes the adoption of advanced reprocessing technologies.

Latin America and the Middle East & Africa are also experiencing gradual market growth, driven by improving healthcare systems and increasing investments in medical facilities. However, the adoption rate of advanced reprocessing solutions in these regions remains relatively lower compared to North America and Europe, primarily due to economic constraints and limited awareness.

https://www.precedenceresearch.com/sample/4425

Drivers

The primary drivers of the endoscope reprocessing market include:

- Increasing Incidence of HAIs: The growing prevalence of healthcare-associated infections has raised significant concerns among healthcare providers and patients alike. Effective endoscope reprocessing is critical in preventing such infections, driving the demand for advanced reprocessing solutions.

- Regulatory Compliance: Stringent regulations and guidelines set by healthcare authorities and organizations, such as the Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA), mandate rigorous reprocessing practices. Compliance with these regulations necessitates the use of reliable and efficient reprocessing technologies.

- Technological Advancements: Continuous innovations in endoscope reprocessing technologies, such as the development of automated endoscope reprocessors (AERs) and high-level disinfectants, enhance the efficiency, safety, and effectiveness of the reprocessing process.

- Rising Number of Endoscopic Procedures: The increasing use of endoscopic procedures for diagnosis and treatment of various medical conditions, including gastrointestinal, respiratory, and urological disorders, drives the demand for effective reprocessing solutions to ensure patient safety.

- Growing Healthcare Expenditure: Increased healthcare spending, particularly in emerging economies, has led to the expansion of healthcare infrastructure and the adoption of advanced medical technologies, including endoscope reprocessing systems.

Opportunities

The endoscope reprocessing market presents several opportunities for growth and innovation:

- Expansion in Emerging Markets: Emerging economies, particularly in Asia-Pacific and Latin America, offer significant growth potential due to improving healthcare infrastructure, increasing awareness about infection control, and rising healthcare expenditure. Companies can capitalize on these opportunities by expanding their presence and offering cost-effective reprocessing solutions tailored to these markets.

- Development of Eco-Friendly Solutions: There is a growing demand for environmentally sustainable healthcare practices. Developing eco-friendly reprocessing solutions, such as biodegradable disinfectants and energy-efficient AERs, can attract healthcare facilities looking to reduce their environmental footprint.

- Integration with Digital Technologies: The integration of digital technologies, such as IoT and AI, into endoscope reprocessing systems can enhance the monitoring, tracking, and documentation of reprocessing activities. This can improve compliance with regulatory standards and optimize the reprocessing workflow.

- Single-Use Endoscopes: The adoption of single-use endoscopes is gaining traction as they eliminate the need for reprocessing and reduce the risk of cross-contamination. Companies can explore opportunities in this segment by developing cost-effective and high-quality single-use endoscopes.

- Training and Education Programs: Providing comprehensive training and education programs for healthcare professionals on best practices in endoscope reprocessing can enhance compliance and improve patient safety. Companies can collaborate with healthcare institutions to offer these programs, thereby fostering trust and loyalty among customers.

Challenges

Despite the promising growth prospects, the endoscope reprocessing market faces several challenges:

- High Cost of Advanced Reprocessing Systems: The initial investment and maintenance costs associated with advanced endoscope reprocessing systems, such as automated endoscope reprocessors (AERs), can be prohibitively high for some healthcare facilities, particularly in developing regions. This can limit the adoption of these technologies.

- Complexity of Reprocessing Procedures: Endoscope reprocessing involves multiple steps, including cleaning, disinfection, and sterilization, each requiring meticulous attention to detail. Ensuring compliance with all steps can be challenging for healthcare facilities, leading to potential lapses in reprocessing practices.

- Risk of Reprocessing Failures: Despite advancements in reprocessing technologies, there remains a risk of reprocessing failures, which can result in the transmission of infections. Ensuring the reliability and effectiveness of reprocessing solutions is critical to mitigating this risk.

- Regulatory Challenges: Navigating the complex regulatory landscape can be challenging for companies operating in the endoscope reprocessing market. Regulatory requirements vary by region and are subject to frequent updates, necessitating continuous adaptation and compliance efforts.

- Competition from Single-Use Endoscopes: While single-use endoscopes offer a viable alternative to reprocessed endoscopes, they also pose a competitive threat to the reprocessing market. Companies need to balance the development of reprocessing solutions with the rising demand for single-use endoscopes.

Read Also: Citizen Services AI Market Size to Reach USD 380.01 Bn by 2033

Endoscope Reprocessing Market Companies

- ARC Group of Companies Inc.

- Belimed

- Cantel Medical

- Custom Ultrasonics

- Ecolab

- Fortive Corporation (Advanced Sterilization Products)

- Getinge AB

- Metrex Research, LLC.

- Olympus Corporation

- Steelco S.p.A

- STERIS

- Shinva Medical Instrument Co. Ltd.

- Summit Imaging, Inc.

- Tuttnaur

- Wassenburg Medical

Endoscope Reprocessing Market Recent Developments

- In November 2022, the performance endoscopic ultrasound system in Canada was launched by a healthcare industry leader in diagnostic and therapeutic endoscopy solutions, PENTAX Medical.

- In May 2023, a new standard of care for endoscope safety and reprocessing was published by the Gastroenterology & Endoscopy News.

- In October 2023, a provider of endoscope reprocessing and filtration systems, the Nuova SB System, launched an award of Medical Device Network Excellence Award 2023 with category award winner in innovation and product. It includes sterilization, purification, disinfection, and treatment systems.

Segments Covered in the Report

By Product Type

- High-Level Disinfectants & Test Strips

- Detergents & Wipes

- Automated Endoscope Reprocessors

- By Type

- Single Basin

- Double Basin

- By Portability

- Standalone

- Portable

- By Type

- Endoscope Drying, Storage, and Transport Systems

- Others

By End-use

- Hospitals

- Outpatient Facilities

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/