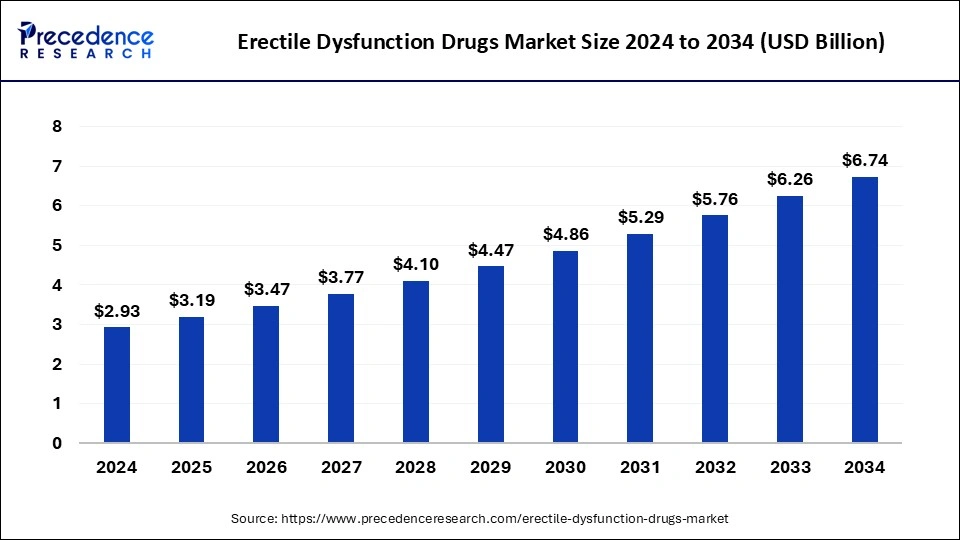

The global erectile dysfunction drugs market size was valued at USD 2.69 billion in 2023 and is expected to reach around USD 6.26 billion by 2033, expanding at a CAGR of 8.82% from 2024 to 2033.

Key Points

- The North America erectile dysfunction drugs market size reached USD 1.43 billion in 2023 and is predicted to attain around USD 3.35 billion by 2033, at a CAGR of 8.88% from 2024 to 2033.

- North America dominated the market with the largest revenue share of 53% in 2023.

- Asia Pacific is expected to grow at the fastest CAGR of 10.21% during the forecast period.

- By product, the viagra segment has held a major revenue share of 57% in 2023.

- By product, the other segment is expected to witness fast growth in the market over the forecast period.

The Erectile Dysfunction (ED) Drugs Market refers to the pharmaceutical segment dedicated to medications aimed at treating erectile dysfunction in men. This condition, characterized by the inability to achieve or maintain an erection sufficient for satisfactory sexual performance, affects a significant portion of the male population worldwide. The market encompasses various drug classes, including phosphodiesterase type 5 (PDE5) inhibitors, prostaglandins, and others, each targeting different pathways to improve erectile function.

Get a Sample: https://www.precedenceresearch.com/sample/4498

Growth Factors:

The market for erectile dysfunction drugs has experienced steady growth driven by several factors. These include an aging population globally, increasing incidences of lifestyle diseases such as diabetes and cardiovascular conditions that contribute to ED, rising awareness about available treatment options, and advancements in drug formulations that enhance efficacy and patient compliance.

Region Insights:

The market for ED drugs shows regional variations influenced by factors such as healthcare infrastructure, regulatory environments, cultural attitudes towards sexual health, and economic development. Developed regions like North America and Europe dominate in terms of market share due to higher healthcare spending and early adoption of novel therapies. Emerging markets in Asia-Pacific and Latin America are also witnessing rapid growth, driven by improving healthcare access and awareness.

Erectile Dysfunction Drugs Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 6.26 Billion |

| Market Size in 2023 | USD 2.69 Billion |

| Market Size in 2024 | USD 2.93 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 8.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Products, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Erectile Dysfunction Drugs Market Dynamics

Drivers: Key drivers of growth in the ED drugs market include increasing R&D investments by pharmaceutical companies to develop novel therapies, expanding treatment-seeking behavior among men globally, and growing acceptance of ED as a treatable medical condition rather than a taboo topic.

Opportunities: Opportunities in the market include the introduction of generic versions of popular drugs, expanding market penetration in developing regions through education and awareness programs, and leveraging telemedicine and online pharmacies to reach underserved populations.

Challenges: Challenges facing the ED drugs market include patent expiries leading to market erosion for branded medications, potential side effects associated with drug use, regulatory hurdles in some regions, and cultural barriers that inhibit open discussion and treatment-seeking behavior among men.

Read Also: Data Center GPU Market Size to Reach USD 162.04 Billion By 2033

Erectile Dysfunction Drugs Market Companies

- Pfizer Inc.

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- Bayer AG

- Petros Pharmaceuticals, Inc.

- VIVUS, Inc.

- Auxilium Pharmaceuticals, Inc.

- Adamed

- Cipla Inc.

Recent Developments

- In January 2023, Petros Pharmaceuticals, Inc. initiated two self-selection studies for its erectile dysfunction drug STENDRA (avanafil).

- In February 2023, Astellas Pharma announced the launch of Vyleesi (bremelanotide) in the United States. Vyleesi is a new injectable medication for the treatment of hypoactive sexual desire disorder (HSDD) in premenopausal women.

- In March 2022, the U.S. FDA permitted Lupin to commercialize a generic version of Revatio from Viatris Specialty LLC. Lupin’s ANDA for sildenafil (10 mg/mL oral suspension) gained this approval

- In May 2022, Aspargo Laboratories, Inc. purchased the prescription brand Bandol from the Spanish specialty pharmaceutical company Laboratorios Rubio S.A. Bandol is used to treat patients with ED problems.

- In February 2022, Tadalafil MAXON was first approved for marketing authorization by a Polish business, Adamed, under the OTC (over-the-counter) category.

Segments Covered in the Report

By Product

- Viagra

- Cialis

- Zydena

- Levitra

- Stendra

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/