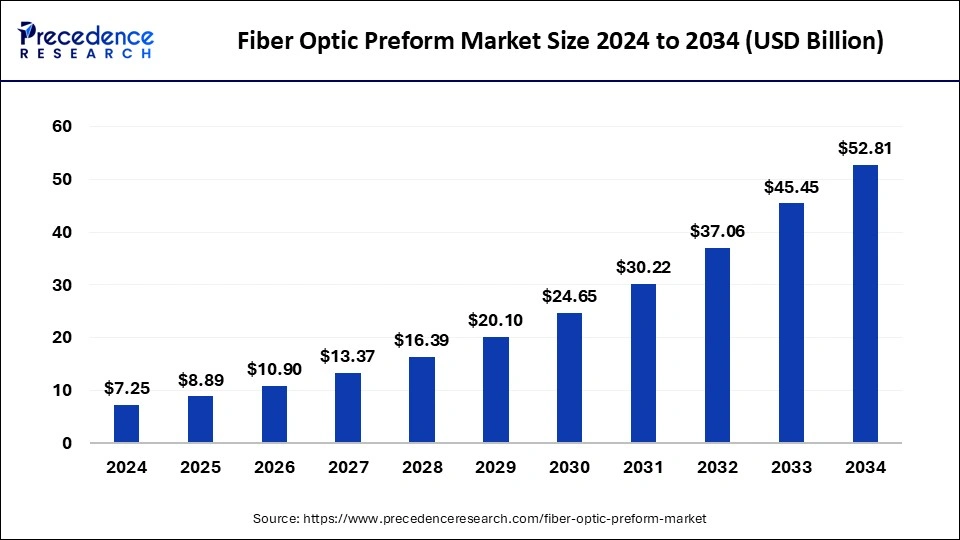

The global fiber optic preform market size was valued at USD 5.91 billion in 2023 and is predicted to reach around USD 45.45 billion by 2033, expanding at a CAGR of 22.63% from 2024 to 2033.

Key Points

- Asia Pacific has held a major revenue share of 70% in 2023.

- North America is expected to witness the fastest rate of growth in the market during the forecast period.

- By process, the VAD segment has contributed more than 41% of revenue share in 2023.

- By process, the OVD segment is expected to grow at the fastest CAGR of 23.83% during the forecast period.

- By product type, the multi-mode segment has held the largest revenue share of 53% in 2023.

- By end-user, the telecom segment has generated more than 42% of revenue share in 2023.

- By end-user, the automotive segment is expected to grow at a notable growth rate.

The fiber optic preform market is integral to the telecommunications and data transmission industries, providing the foundational material for manufacturing optical fibers. These preforms are essentially rods of high-purity glass or plastic, from which optical fibers are drawn. The global demand for fiber optic preforms has witnessed significant growth owing to the expanding telecommunications infrastructure, increasing data traffic, and the adoption of high-speed internet services worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4510

Growth Factors

Several factors contribute to the growth of the fiber optic preform market. Firstly, the proliferation of smartphones, IoT devices, and cloud computing has fueled the demand for higher bandwidth and faster data transmission rates, necessitating the deployment of advanced optical fiber networks. Secondly, government initiatives and investments in digital infrastructure, particularly in developing economies, are driving the expansion of fiber optic networks. Moreover, advancements in fiber optic technology, such as the development of bend-resistant fibers and enhanced data transmission capabilities, are further stimulating market growth.

Regional Insights

The market for fiber optic preforms exhibits regional variations influenced by factors such as economic development, technological adoption rates, and regulatory frameworks. North America and Europe are mature markets with established telecommunications infrastructures, where upgrades and expansions continue to drive demand for fiber optic preforms. Asia-Pacific, led by countries like China, Japan, and South Korea, represents a significant growth opportunity due to rapid urbanization, increasing internet penetration, and investments in 5G networks. Latin America, the Middle East, and Africa are also emerging markets, witnessing growing investments in telecommunications infrastructure.

Fiber Optic Preform Market Size Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 45.45 Billion |

| Market Size in 2023 | USD 5.91 Billion |

| Market Size in 2024 | USD 7.25 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 22.63% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Process, Product Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fiber Optic Preform Market Dynamics

Drivers

Key drivers of the fiber optic preform market include the growing demand for high-speed internet services, driven by video streaming, online gaming, and cloud computing. The shift towards 5G technology, which requires denser networks and higher data transmission rates, is another major driver. Additionally, the scalability and reliability of fiber optic networks compared to traditional copper cables are compelling factors driving their adoption across various sectors, including telecommunications, healthcare, and transportation.

Opportunities

The fiber optic preform market presents several opportunities for growth and innovation. Investments in research and development aimed at enhancing fiber optic performance, such as reducing signal loss and increasing bandwidth capacity, offer substantial growth prospects. Furthermore, the expansion of fiber optic networks into rural and underserved areas presents untapped market opportunities. Innovations in manufacturing processes, such as the development of novel materials and advanced manufacturing techniques, also open doors for market expansion and cost reduction.

Challenges

Despite its promising growth trajectory, the fiber optic preform market faces challenges that could hinder its expansion. One such challenge is the high initial investment required for deploying fiber optic networks, particularly in less economically developed regions. Regulatory hurdles and environmental concerns related to fiber optic cable installation and maintenance can also pose challenges. Moreover, competition from alternative technologies, such as wireless communication systems, and potential supply chain disruptions due to geopolitical tensions or raw material shortages are additional factors that could impact market dynamics.

Read Also: Micro-LED Display Market Size to Reach USD 325.96 Bn by 2033

Fiber Optic Preform Market Companies

- Corning Incorporated

- Optical Cable Corporation

- Jiangsu Zhongtian Technology Co., Ltd.

- Sterlite Technologies Limited

- OFS Fitel, LLC

- Prysmian Group

- AFL

- Furukawa Electric Co., Ltd.

- Sumitomo Electric Industries, Ltd

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

- HENGTONG GROUP CO., LTD

- Fujikura Ltd.

- Shin-Etsu Chemical Co., Ltd

- Jiangsu Zhongtian Technology Co., Ltd.

Recent Developments

- In July 2022, Light Brigade opened a new fiber-optic skills training facility in Dallas, Texas. The first of several new facilities the company plans to open across the U.S. focused on advanced fiber-optic skills training. With the support of parent company Hexatronic, Light Brigade and Data Center Systems (DCS) have announced the opening of a new Light Brigade Training Academy in Dallas, Texas. The courses at the new Dallas site will focus on advanced fiber-optic skills training and fiber-optics skills training for data centers and enterprise networks.

- On September 08, 2022, Corning Incorporated formally opened a new optical fiber manufacturing facility in Mszczonów, Poland, to meet growing demand for high-speed connectivity in the European Union and surrounding regions. The facility, one of the largest optical fiber plants in the European Union, is Corning’s latest in a series of global investments in fiber and cable manufacturing totaling more than $500 million since 2020, supported by growing demand and strong customer commitments.

- In August 2022, Furukawa Electric LatAm entered into a partnership with Nokia, a Finnish telecommunication, information technology, and consumer electronics corporation. Through this collaboration, the company aimed to bring innovative solutions to the clients and provide a reliable and secure technological platform.

Segments Covered in the Report:

By Process

- OVD

- VAD

- PCVD

- MCVD

By Product Type

- Single-Mode

- Multi-Mode

- Plastic Optical Fiber

By End-user

- Telecom

- Oil & Gas

- Automotive

- Military & Aerospace

- BFSI

- Medical

- Railway

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/