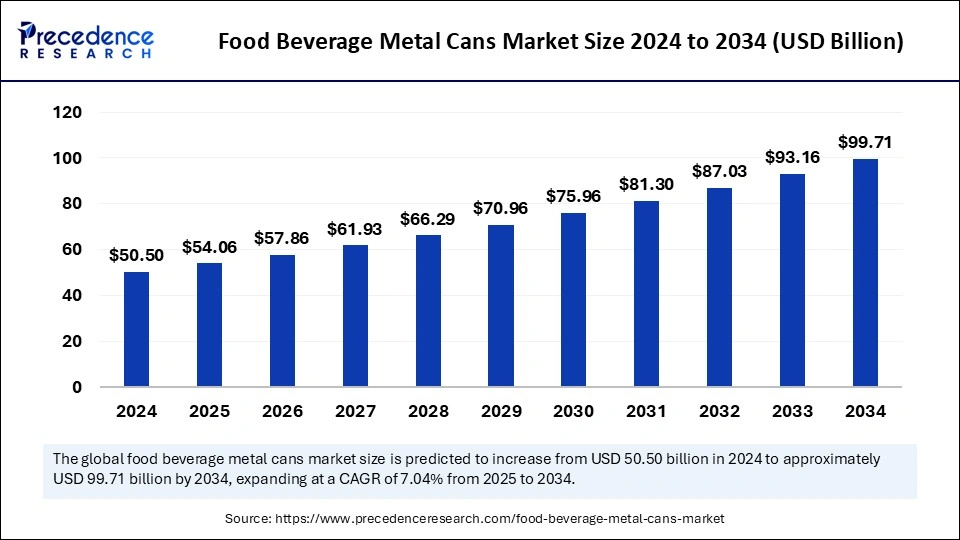

The global food & beverage metal cans market is projected to grow from USD 50.50 billion in 2024 to approximately USD 99.71 billion by 2034, registering a CAGR of 7.04%.

Food & Beverage Metal Cans Market Key Takeaways

- North America accounted for the largest share of the food beverage metal cans market in 2024.

- Asia Pacific is anticipated to witness the fastest growth in the market during the forecasted years.

- Europe is observed to grow at a considerable in the upcoming period.

- By type, the two-piece cans segment contributed the largest share of the market in 2024.

- By type, the three-piece cans segment is expected to show considerable growth over the forecast period.

- By material, the aluminum cans segment accounted for the largest share of the market in 2024.

- By material, the steel cans segment is anticipated to witness significant growth in the studied period.

- By application, the beverages segment contributed the largest share of the market in 2024.

- By application, the food segment is expected to show considerable growth over the forecast period.

The global food and beverage metal cans market has experienced substantial growth, driven by consumer preferences for durable and eco-friendly packaging solutions. Metal cans, typically made from aluminum or steel, offer excellent protection against light, oxygen, and contaminants, ensuring extended shelf life for various products, including carbonated drinks, alcoholic beverages, canned foods, and ready-to-eat meals. According to industry projections, the market is estimated at USD 50.42 billion in 2024 and is projected to reach USD 70.72 billion by 2029, at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2029

Sample Link: https://www.precedenceresearch.com/sample/5674

Key Drivers

Several factors drive this market expansion. A significant driver is the rising demand for ready-to-eat and convenience foods, as urban lifestyles lead consumers to seek quick meal solutions. Metal cans cater to this need by offering durability and the ability to preserve food quality over extended periods. Additionally, the focus on sustainability has propelled the popularity of metal cans due to their high recyclability. Unlike plastic, metal can be recycled indefinitely without degrading in quality, making it an attractive option for eco-conscious consumers and businesses. The convenience and portability of metal cans also play a crucial role, as they are lightweight, portable, and tamper-resistant, making them ideal for on-the-go consumption and easy transport.

Opportunities

Opportunities within the market are abundant, particularly concerning packaging innovations. Manufacturers are investing in creative can designs, including resealable lids, slim profiles, and vibrant graphics, enhancing consumer appeal and brand differentiation. Advancements in technology are enabling features like QR codes on cans, providing product details, tracking supply chains, and engaging consumers with interactive experiences. The growing demand for natural and organic products packaged in sustainable metal cans also presents significant growth prospects.

Challenges

However, the market faces challenges, notably the availability of alternative packaging options like plastic and glass. Glass is popular due to its nonreactive nature, safeguarding food quality over extended periods, while plastic packaging offers adaptable design and lightweight properties, making it competitive in the market. Additionally, fluctuations in raw material prices, such as aluminum and steel, can impact production costs, posing a challenge for manufacturers.

Regional Insights

Regional insights reveal that the Asia-Pacific (APAC) region is expected to lead growth in the food and beverage metal cans market. Factors such as a rising population, increasing urbanization, and heightened awareness of sustainability contribute to this expansion. The demand for on-the-go food and beverages is driving the need for metal cans, with consumers becoming more aware of the harmful effects of plastic. Countries like China and India, with their high population density and significant fruit and vegetable production, are major contributors to this growth.

In North America, the market continues to grow due to the steady consumption of canned foods, driven by their extended durability and convenience. Investments in research initiatives and technological improvements in packaging methods further support this growth. The United States, in particular, shows strong growth resulting from rising consumer interest and business collaborations in the sector. The trend of health-conscious consumers opting for low-calorie beverages drives the demand for canned beverages and health products.

Europe is also experiencing considerable growth in the food and beverage metal cans market. The rise of ready-to-drink products and continuous advancements in metal recycling tools establish a circular economy that minimizes the environmental impact of packaging. High-quality standards prevail in the food industry due to mandatory regulations regarding food safety and packaging requirements.

Don’t Miss Out: Paperboard Packaging Market

Market Key Players

- Canpack S.A.

- Amcor plc

- Silgan Holdings, Inc.

- CCL Container, Inc.

- Kian Joo Can Factory Berhad

- CPMC Holding Ltd

- Envases Group

Recent News

Recent developments in the industry highlight the dynamic nature of the market. For instance, Ball Corporation, a manufacturer of aluminum beverage cans, exceeded Wall Street expectations for fourth-quarter profits due to cost-cutting measures. The company faced weak demand as clients like Constellation Brands reported reduced consumer spending. In response, Ball Corp reduced operating expenses and slimmed operations by closing manufacturing facilities and selling its aerospace business to focus on the core business of aluminum cans. This shift was partially beneficial as some companies moved away from plastic packaging, increasing volume in the EMEA region by 11% in the quarter.

In another development, Orora, an Australian glass bottle and can manufacturer, announced plans to cut glass production capacity in Australia due to declining wine and beer volumes, driven by long-term domestic demand reduction and rising costs. The company will close its oldest furnace at its Gawler, South Australia plant, transitioning to a two-furnace operation and potentially affecting jobs. Some production will move to the UAE, and capacity at other sites, including France, will be reviewed. Orora also plans to modernize its Ghlin site in Belgium. Despite these challenges, Orora reported a sharp increase in profit helped by the sale of its North American packaging business and plans to resume a share buyback program. The company’s earnings were below forecasts, but it remains optimistic about growth in its Cans business and long-term prospects.

In conclusion, the global food and beverage metal cans market is poised for significant growth, driven by factors such as sustainability concerns, consumer demand for convenience, and innovative packaging solutions. While challenges like alternative packaging options and raw material price fluctuations exist, opportunities in emerging markets and advancements in can design and functionality present promising prospects for the industry.

Market Segmentation

By Type

- Two-Piece Cans

- Three-Piece Cans

By Material

- Aluminum Cans

- Steel Cans

By Application

- Beverages

- Food

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa