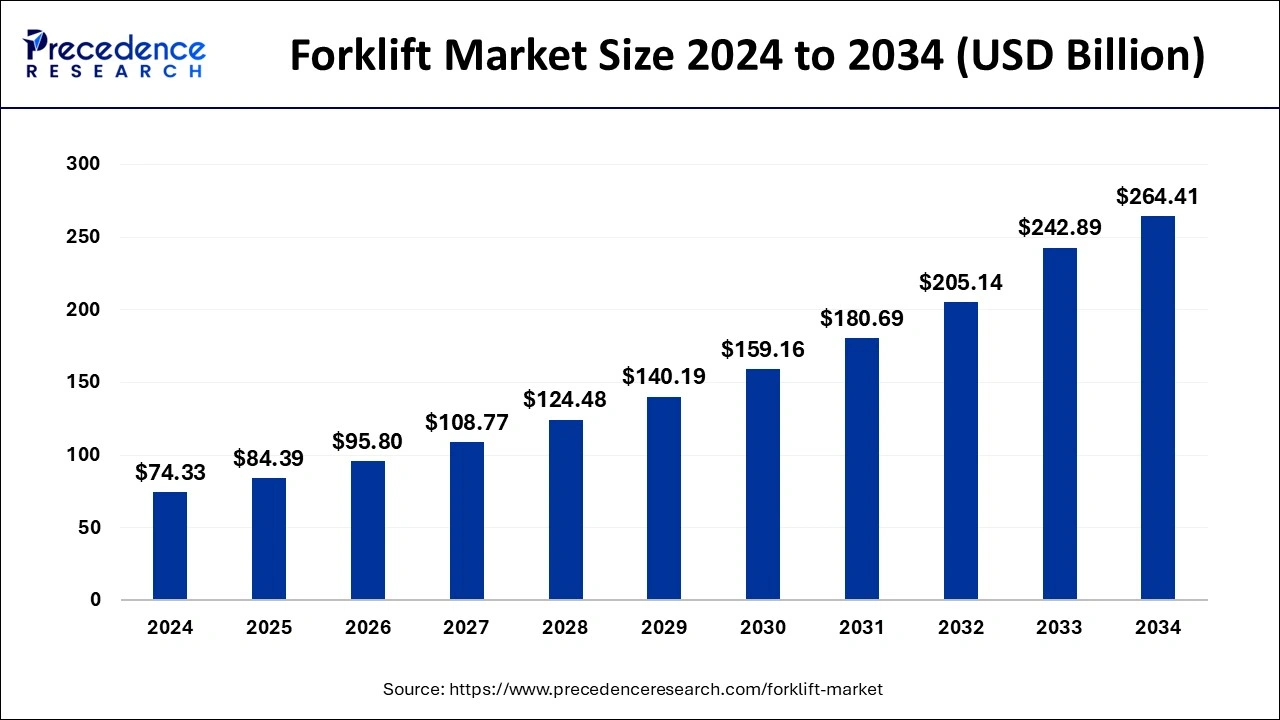

The global forklift market is valued at USD 74.33 billion in 2024 and is expected to reach USD 264.41 billion by 2034, growing at a CAGR of 13.53%.

Forklift Market Key Takeaways

- Asia-Pacific led the global forklift market with a 48% share in 2024.

- The class 3 segment accounted for 44% of the market share in 2024.

- Electric-powered forklifts dominated the market in 2024.

- Forklifts with a load capacity of 5-15 tons held the largest share in 2024.

- Lead-acid batteries contributed 67% to the electric forklift market in 2024.

- Industrial applications captured over 25% of the market in 2024.

The global forklift market is experiencing robust growth, fueled by the expanding logistics, construction, and manufacturing sectors. Asia-Pacific dominates the market due to rapid industrialization and infrastructure development. The adoption of electric forklifts is rising because of their environmental benefits and cost-efficiency. Innovations in forklift technology and automation trends are expected to drive future market expansion.

Sample Link: https://www.precedenceresearch.com/sample/1032

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 74.33 Billion |

| Market Size in 2025 | USD 84.39 Billion |

| Market Size by 2034 | USD 264.41 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.53% |

| Bae Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Class, By Power Source, By Load Capacity, By Electric Battery Type, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Drivers

The forklift market is primarily driven by the expansion of the logistics and e-commerce sectors, which require advanced material handling solutions. Rapid industrial growth in emerging economies fuels the demand for forklifts. The adoption of electric-powered forklifts is increasing due to rising environmental concerns and regulatory pressures. Automation and advancements in forklift technologies further stimulate market growth.

Opportunities

- Rising demand for electric forklifts driven by sustainability concerns

- Expansion of e-commerce and logistics sectors, requiring advanced material handling solutions

- Technological innovations, such as automation and AI, enhance forklift efficiency

- Increasing industrialization and infrastructure development in emerging markets

- Government initiatives promoting green technology and energy-efficient equipment

Challenges

- High initial investment costs for electric and automated forklifts

- Limited availability of skilled labor for operating advanced forklift systems

- Regulatory and safety standards increasing operational complexities

- Fluctuating raw material prices affect production costs

- Intense competition among market players driving price wars

Regional Insights

The forklift market shows strong regional variations, with Asia-Pacific leading the charge owing to its rapid industrial development and booming logistics sectors. North America is growing steadily, fueled by the expansion of e-commerce and the adoption of advanced material handling technologies. Europe is also contributing significantly to market growth, especially with its focus on sustainability and electric forklifts. The Middle East and Africa are expected to see growing demand driven by infrastructure projects and industrial growth. The increasing preference for electric forklifts is gaining traction in developed regions, driven by environmental concerns and regulatory standards.

Don’t Miss Out: Healthcare Metaverse Market

Market Key Players

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha

Recent News

The forklift industry is undergoing notable changes, including a lawsuit against Toyota for alleged emissions cheating in forklift engines, which could lead to significant legal and regulatory challenges. Concurrently, there’s a growing trend of manufacturers moving away from traditional forklifts in favor of safer and more efficient alternatives, such as autonomous vehicles and electric pallet jacks, contributing to a 28% decline in retail forklift orders in 2023. Additionally, the market is witnessing a surge in electric forklift sales, with combustion engine models declining, reflecting a strong shift towards sustainable material handling solutions. These developments underscore the industry’s commitment to safety, environmental responsibility, and technological advancement.

Market Segmentation

By Class

- Class 1

- Class 2

- Class 3

- Class 4/5

By Power Source

- ICE

- Electric

By Load Capacity

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

By Electric Battery Type

- Li-ion

- Lead Acid

By End Use

- Industrial

- Logistics

- Chemical

- Food & Beverage

- Retail & E-Commerce

- Others