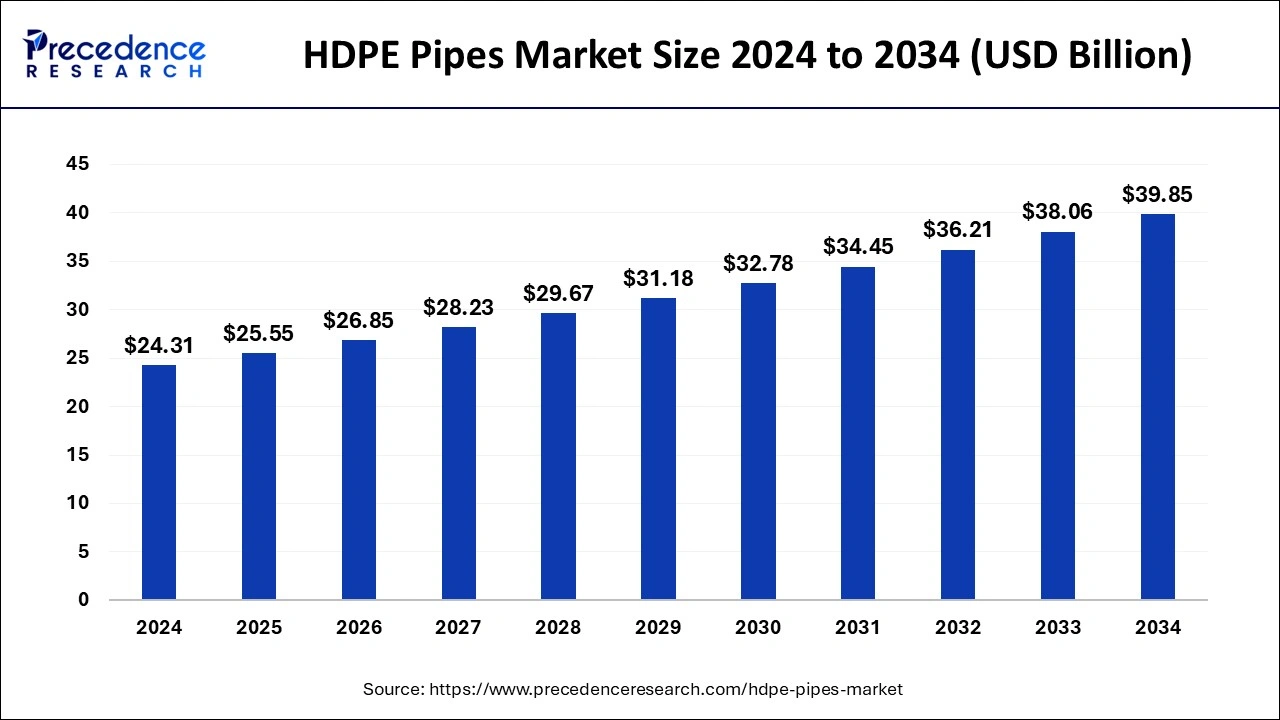

The global HDPE pipes market size is anticipated to cross around USD 38.06 billion by 2033, growing at a CAGR of 5.11% from 2024 to 2033.

Key Points

- Asia-Pacific dominated the global market in 2023.

- Europe shows a significant growth in the market during the forecast period.

- By type, the HDPE 100 segment dominated the HDPE pipes market in 2023.

- By type, the HDPE 80 segment is observed to be the fastest growing market during the forecast period.

- By application, the sewage system pipe segment dominated the HDPE pipes market in 2023.

- By application, the oil and gas pipe segment are observed to be the fastest growing market during the forecast period.

High-Density Polyethylene (HDPE) pipes are a type of thermoplastic polymer pipes known for their high strength-to-density ratio, corrosion resistance, and flexibility. These pipes find extensive applications in various sectors such as agriculture, construction, water distribution, gas transportation, and sewage systems due to their durability and cost-effectiveness.

Get a Sample: https://www.precedenceresearch.com/sample/4361

Growth Factors:

The HDPE pipes market has experienced significant growth in recent years due to several factors. One of the primary drivers is the increasing demand for efficient and durable piping systems in infrastructure development projects globally. Additionally, the shift towards HDPE pipes from traditional materials like concrete, steel, and PVC due to their superior properties such as chemical resistance, light weight, and ease of installation has fueled market growth.

Region Insights:

The HDPE pipes market exhibits regional variations influenced by factors such as infrastructure development, industrialization, and government regulations. Emerging economies in Asia-Pacific, particularly China and India, are witnessing substantial growth in demand for HDPE pipes due to rapid urbanization and industrialization. In North America and Europe, stringent regulations promoting the use of eco-friendly and sustainable piping solutions have further boosted the adoption of HDPE pipes.

HDPE Pipes Market Scope

| Report Coverage | Details |

| HDPE Pipes Market Size in 2023 | USD 23.12 Billion |

| HDPE Pipes Market Size in 2024 | USD 24.31 Billion |

| HDPE Pipes Market Size by 2033 | USD 38.06 Billion |

| HDPE Pipes Market Growth Rate | CAGR of 5.11% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

HDPE Pipes Market Dynamics

Drivers:

Several drivers propel the growth of the HDPE pipes market. The increasing investment in water infrastructure projects worldwide, driven by growing urbanization and the need for efficient water management systems, is a significant driver. Moreover, the rising awareness regarding the environmental benefits of HDPE pipes, including their recyclability and low carbon footprint, is driving their adoption across various industries.

Opportunities:

The HDPE pipes market presents lucrative opportunities for manufacturers and suppliers. The expanding applications of HDPE pipes in sectors such as agriculture, mining, and telecommunications offer significant growth potential. Furthermore, advancements in manufacturing technologies, such as extrusion processes and material enhancements, enable the development of high-performance HDPE pipes catering to specific industry requirements.

Challenges:

Despite the favorable growth prospects, the HDPE pipes market faces certain challenges. Pricing fluctuations of raw materials, particularly crude oil, impact the production costs of HDPE resins, thereby affecting the overall pricing of HDPE pipes. Moreover, competition from alternative piping materials and concerns regarding the long-term performance of HDPE pipes in extreme environmental conditions pose challenges to market growth. Additionally, issues related to proper disposal and recycling of used HDPE pipes need to be addressed to ensure environmental sustainability.

Read Also: Payment Security Market Size to Rake USD 95.35 Billion by 2033

HDPE Pipes Market Recent Developments

- In April 2024, based in Sequin, Texas, AmeriTex Pipe & items LLC is constructing a new Conroe, Texas factory to extrude corrugated pipe from virgin high-density polyethylene and polypropylene, meeting the state’s demand for infrastructure items.

- In December 2023, announcing the acquisition of Infinity Plastics, a manufacturer of manufactured high-density polyethylene (HDPE) piping products, was ISCO Industries.

- In November 2023, a definitive agreement was reached to acquire nearly all of the assets of Lee Supply Company Inc. (Lee Supply), the ability to rent HDPE fusion equipment and perform custom fabrication. Core & Main Inc. is a leader in advancing dependable infrastructure with local service across the country.

HDPE Pipes Market Companies

- Lane Enterprises, Inc

- POLY PLASTIC Group

- RADIUS System

- SCG Chemicals Public Company Limited

- JM EAGLE, INC.

- United Poly Systems

- Vectus

- Prinsco, Inc.

- WL Plastics

- Blue Diamond Industries

Segments Covered in the Report

By Type

- HDPE 63

- HDPE 80

- HDPE 100

By Application

- Oil and Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/