Hemophilia is a genetic disorder characterized by the inability of blood to clot properly, leading to excessive bleeding. The Hemophilia Treatment Market focuses on therapies that aim to replace or supplement the missing clotting factors in patients with hemophilia. Treatment options include clotting factor concentrates, desmopressin, and gene therapy. Advances in medical technology and increased awareness about hemophilia have significantly improved the management of this condition, leading to a robust market growth.

Get a Sample: https://www.precedenceresearch.com/sample/4567

Growth Factors

The Hemophilia Treatment Market is driven by several key factors. One of the main drivers is the increasing prevalence of hemophilia globally. Additionally, advancements in biotechnology and the development of novel therapies, such as gene therapy, are providing new treatment options that are more effective and have longer-lasting effects. Increased healthcare expenditure and supportive government initiatives for rare diseases also contribute to market growth.

Region Insights

North America dominates the Hemophilia Treatment Market due to high healthcare expenditure, well-established healthcare infrastructure, and significant research and development activities. Europe follows closely, with countries like Germany, France, and the UK being major contributors. The Asia-Pacific region is expected to witness the highest growth rate due to rising awareness, improving healthcare facilities, and increasing government support. Emerging markets in Latin America and the Middle East also show potential for significant market growth.

Hemophilia Treatment Market Scope

| Report Coverage |

Details |

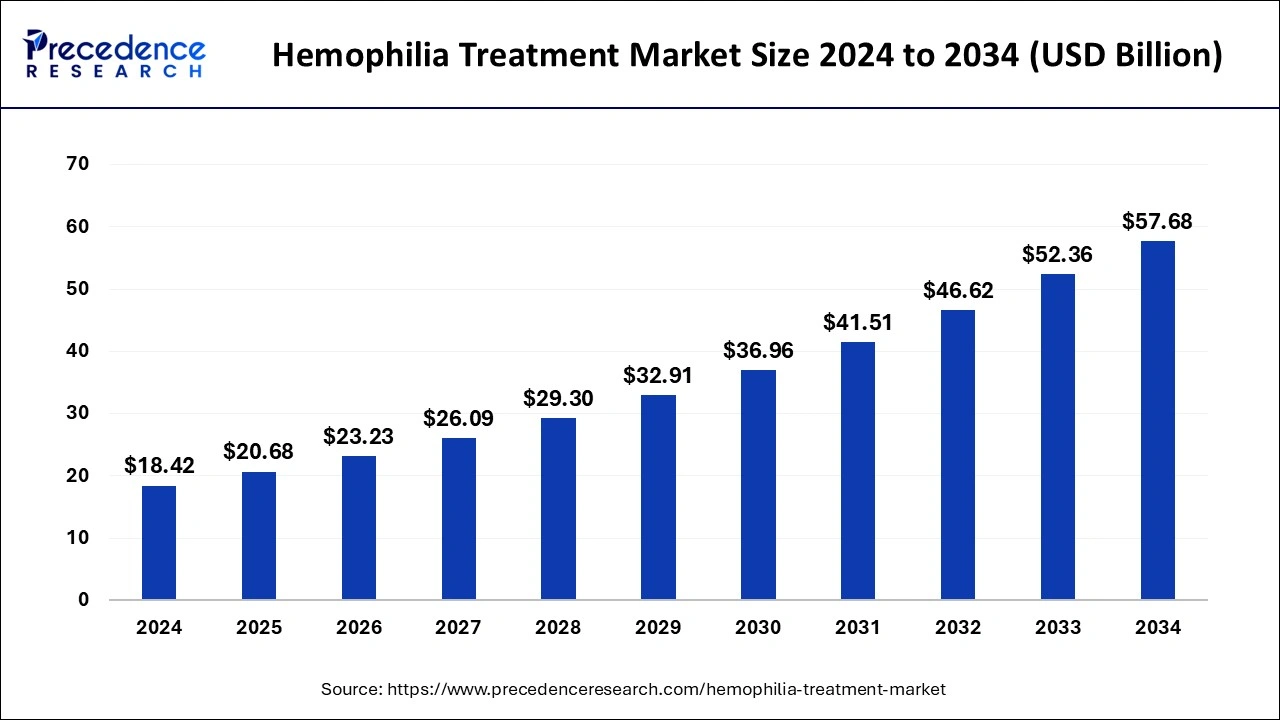

| Market Size by 2033 |

USD 52.36 Billion |

| Market Size in 2023 |

USD 16.40 Billion |

| Market Size in 2024 |

USD 18.42 Billion |

| Market Growth Rate from 2024 to 2033 |

CAGR of 12.31% |

| Largest Market |

North America |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, Drug Therapy, and Regions |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Hemophilia Treatment Market Dynamics

Drivers

Key drivers of the Hemophilia Treatment Market include the rising incidence of hemophilia, increased diagnosis rates, and the availability of advanced treatments. Innovations in gene therapy and recombinant products offer promising long-term solutions, driving the market forward. Additionally, supportive policies and funding for rare diseases and continuous efforts to raise awareness among patients and healthcare providers further boost market growth.

Opportunities

The market presents numerous opportunities, especially in the development of innovative treatments like gene therapy, which promises a potential cure for hemophilia. Expanding healthcare infrastructure in developing regions and increasing patient access to treatment offer significant growth potential. Strategic collaborations and partnerships among pharmaceutical companies for research and development are also expected to drive market expansion.

Challenges

Despite the advancements, the Hemophilia Treatment Market faces several challenges. High treatment costs and the need for regular infusions can be burdensome for patients. Additionally, the risk of developing inhibitors to clotting factors poses a significant challenge. Limited access to advanced treatments in low-income regions and the high cost of gene therapies also hinder market growth. Ensuring equitable access to care and managing treatment-related complications remain critical challenges in the market.

Read Also: AI in Project Management Market Size to Reach USD 12.75 Bn by 2033

Hemophilia Treatment Market Companies

- Pfizer Inc. (U.S.)

- Novo Nordisk A/S (Denmark)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bayer AG (Germany)

- Shire (Ireland)

- CSL Behring (Australia)

- Grifols, S.A. (Spain)

- Biogen Inc. (U.S.)

- Sanofi S.A. (France)

- BioMarin Pharmaceutical Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Octapharma AG (Switzerland)

- Sobi (Sweden)

- Pfizer Inc. (U.S.)

Recent Developments

- In November 2023, Japan approved a new Novo Nordisk hemophilia drug that will launch in 2024. Novo Nordisk itself has identified the candidate as a potential blockbuster.

- In March 2022, in its Phase 1/2 B-LIEVE dose-confirmation clinical trial of FLT180a for the treatment of hemophilia B, a crippling genetic bleeding illness brought on by a lack in the clotting factor IX protein, Freeline Therapeutics Holdings plc dosed the first patient.

- In February 2022, at the 15th Annual Virtual Congress of the European Association for Haemophilia and Allied Disorders (EAHAD), BioMarin Pharmaceutical Inc. presented encouraging findings from a two-year analysis of the Phase 3 GENEr8-1 study and an overall safety update of valoctocogene roxaparvovec, an investigational gene therapy for the treatment of adults with severe hemophilia A.

Segments Covered in the Report

By Type

- Hemophilia A

- Hemophilia B

By Drug Therapy

- Recombinant Coagulation Factor Concentrates Therapy

- Plasma-derived Coagulation Factor Concentrates Therapy

- Non-factor Replacement Therapy

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Mr. Alex