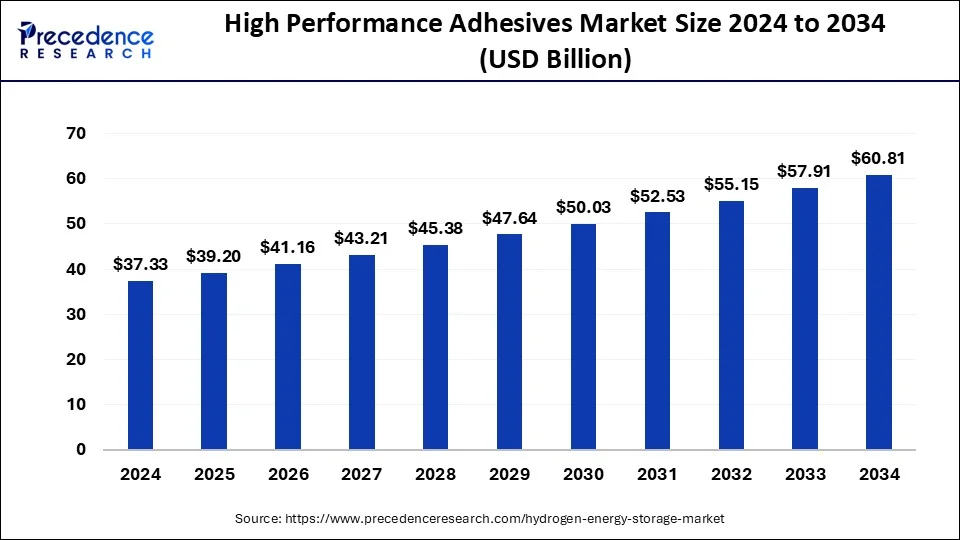

The high-performance adhesives market was valued at USD 37.33B in 2024 and is set to reach USD 60.81B by 2034, growing at a CAGR of 5%.

High-Performance Adhesives Market Key Takeaways

- Asia Pacific dominated the high-performance adhesives market in 2023, holding a 44% market share.

- Epoxy adhesives led the market by product, capturing the largest share in 2023.

- Solvent-based technology accounted for the highest revenue share in 2023.

- The medical industry is projected to experience the fastest CAGR growth among end-users during the forecast period.

The high-performance adhesives market is experiencing significant growth, driven by increasing demand across various industries such as automotive, aerospace, electronics, and medical. In 2023, the Asia Pacific region held the largest market share at 44%, reflecting its strong industrial base and expanding manufacturing sector. Among product types, epoxy adhesives dominated the market, while solvent-based technology accounted for the highest revenue share. The medical segment is expected to grow at the fastest CAGR over the forecast period, fueled by advancements in healthcare applications and the rising adoption of high-performance adhesives in medical devices and equipment.

Sample Link: https://www.precedenceresearch.com/sample/1073

Key Drivers

Opportunities

- Increasing demand for lightweight and high-strength adhesives in aerospace, automotive, and construction industries.

- Growing adoption of bio-based and eco-friendly adhesives due to rising environmental concerns and stringent regulations.

- Expanding the use of high-performance adhesives in medical applications, including wearable devices and surgical instruments.

- Rapid industrialization and infrastructure development in emerging markets, especially in Asia Pacific.

- Technological advancements leading to improved adhesive formulations with better durability and efficiency.

Challenges

- High production costs associated with advanced adhesive formulations may hinder market growth.

- Stringent environmental and safety regulations limit the use of certain chemical-based adhesives.

- Volatility in raw material prices affects overall production and profitability.

- Complex application processes requiring skilled professionals, which may limit widespread adoption.

- Competition from alternative bonding technologies such as welding, mechanical fastening, and tapes.

Regional Insights

The Asia Pacific region dominates the high-performance adhesives market, holding the largest share due to rapid industrialization, expanding manufacturing sectors, and growing infrastructure projects. North America follows closely, driven by strong demand in aerospace, automotive, and medical applications, along with ongoing R&D in adhesive technologies. Europe is witnessing steady growth, supported by stringent environmental regulations promoting eco-friendly adhesives and a well-established automotive industry. The Middle East and Africa are experiencing rising demand due to increasing construction and industrial activities. Latin America is also emerging as a potential market, supported by growth in the packaging, automotive, and healthcare sectors.

Don’t Miss Out: Aroma Chemicals Market

Market Key Players

- Anabond

- Huntsman International LLC.

- Ashland

- Henkel

- Permabond LLC

- Delo Industrial Adhesives, LLC

- WEICON GmbH & Co.KG

- Gougeon Brothers

- Royal Adhesives & Sealants, LLC

- Ashland Inc

- Hernon Manufacturing

Recent News

Recent developments in the high-performance adhesives market highlight significant growth and strategic shifts among key industry players. In October 2024, 3M Co raised its full-year profit forecast, attributing the positive outlook to robust demand for industrial adhesives, roofing materials, and electronic equipment. This optimistic projection reflects a recovery in consumer demand and strategic portfolio reviews under new leadership.

Conversely, Evonik announced plans to scale back its adhesives and healthcare units as part of a broader restructuring strategy. The company aims to focus on core assets, shedding operations such as its polyester business and certain production lines, in response to industry-wide challenges like high production costs and weak demand experienced throughout 2023.

Market Segmentation

By Technology

- Solvent-based

- Hot melt

- Water-based

- Reactive & others

By Product

- Polyurethane

- Silicone

- Epoxy

- Acrylic

- Others

By End-User

- Electrical & electronics

- Packaging

- Medical

- Transportation

- Construction

- Others