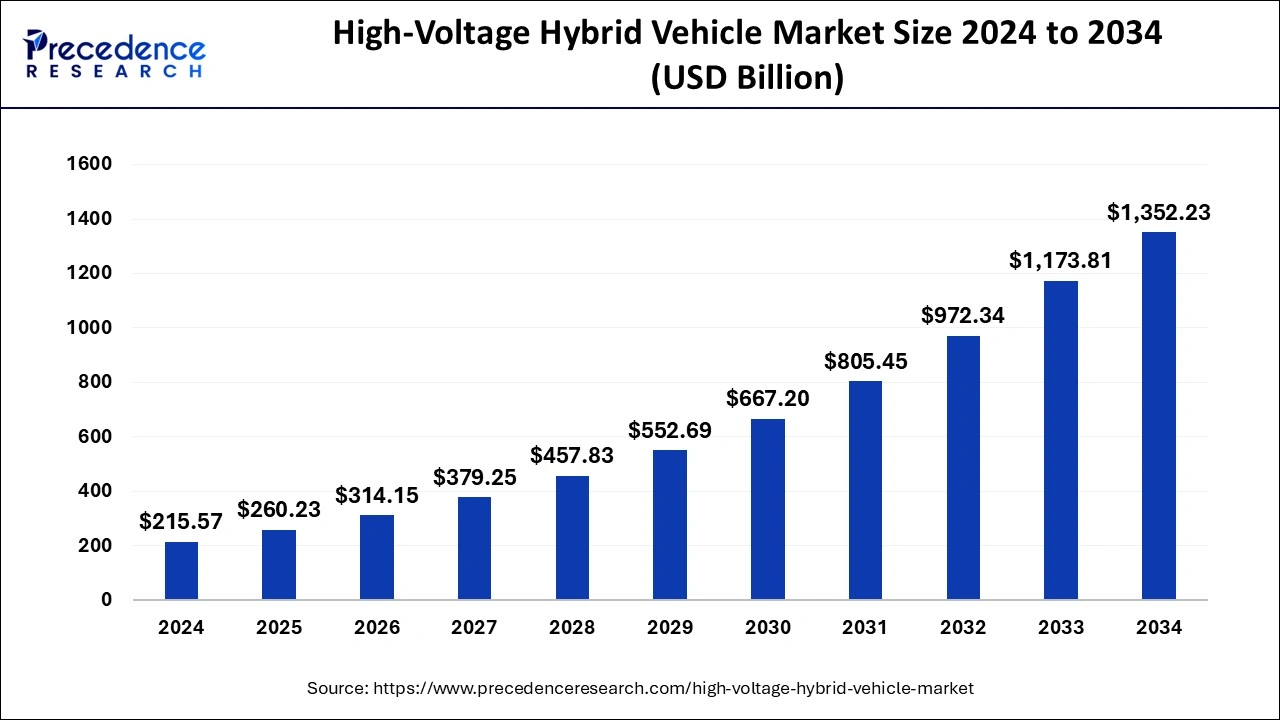

The global high-voltage hybrid vehicle market size was valued at USD 178.57 billion in 2023 and is expected to reach around USD 1,173.81 billion by 2033, expanding at a CAGR of 20.72% from 2024 to 2033.

Key Points

- Asia Pacific dominated the high-voltage hybrid vehicle market in 2023.

- North America held a considerable share of the market in 2023.

- By type, the hybrid electric vehicle segment held the largest share of the market in 2023.

- By type, the plug-in hybrid electric vehicle segment will grow rapidly in the market over the forecast period.

- By application, passenger vehicles dominated the market in 2023.

- By application, commercial vehicles segment is expected to show the fastest growth in the market during the forecast period.

The high-voltage hybrid vehicle market is a rapidly evolving segment within the automotive industry, characterized by vehicles that integrate both conventional internal combustion engines (ICE) and electric propulsion systems. These vehicles utilize high-voltage battery packs to supplement or replace traditional fuel-powered systems, offering improved fuel efficiency, reduced emissions, and enhanced performance compared to their non-hybrid counterparts. The market’s growth is driven by increasing consumer demand for eco-friendly transportation solutions amid concerns over environmental sustainability and regulatory pressures to reduce greenhouse gas emissions in the transportation sector.

Get a Sample: https://www.precedenceresearch.com/sample/4475

Growth Factors

Several key factors are driving the growth of the high-voltage hybrid vehicle market. Firstly, stringent government regulations aimed at reducing carbon emissions and promoting fuel efficiency have compelled automakers to invest heavily in hybrid and electric vehicle (EV) technologies. Additionally, advancements in battery technology, particularly the development of high-energy-density lithium-ion batteries, have significantly improved the performance and range of hybrid vehicles, making them more appealing to consumers.

Furthermore, rising consumer awareness and changing preferences towards cleaner and greener transportation options have contributed to the increasing adoption of high-voltage hybrid vehicles. These vehicles offer consumers the flexibility of using both electric and gasoline power sources, providing a practical solution for those who may have concerns about the limited charging infrastructure of pure electric vehicles.

Regional Insights

The high-voltage hybrid vehicle market exhibits varying trends and dynamics across different regions. In North America, for example, the market is driven by a combination of government incentives, stringent emission regulations, and consumer demand for fuel-efficient vehicles. The United States, in particular, has seen significant growth in hybrid vehicle sales, supported by federal tax credits and state-level incentives for electric and hybrid vehicles.

In Europe, strict emission standards imposed by the European Union (EU) have accelerated the adoption of high-voltage hybrid vehicles among consumers and fleet operators. Countries such as Norway and the Netherlands have emerged as leaders in electric and hybrid vehicle penetration, driven by generous subsidies, tax incentives, and supportive infrastructure development.

Asia-Pacific represents another lucrative market for high-voltage hybrid vehicles, primarily driven by the rapid urbanization, increasing disposable incomes, and government initiatives to curb air pollution in major cities. Countries like China and Japan have implemented ambitious targets for electric and hybrid vehicle adoption, incentivizing automakers to introduce more hybrid models to meet growing consumer demand.

Trends

Several trends are shaping the high-voltage hybrid vehicle market. One prominent trend is the development of plug-in hybrid electric vehicles (PHEVs) that allow for extended electric-only driving ranges. Automakers are increasingly focusing on improving the efficiency and performance of hybrid powertrains, enhancing battery technology, and reducing vehicle weight to optimize fuel economy and driving range.

Another trend is the integration of advanced driver-assistance systems (ADAS) and connectivity features in high-voltage hybrid vehicles. These technologies enhance vehicle safety, convenience, and user experience, appealing to tech-savvy consumers looking for innovative features in their vehicles.

Moreover, the shift towards electrification and hybridization in commercial vehicles, such as buses and trucks, is gaining momentum. Governments and fleet operators are exploring hybrid and electric alternatives to diesel-powered vehicles to reduce operating costs and comply with stringent emissions regulations.

High-Voltage Hybrid Vehicle Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 1,173.81 Billion |

| Market Size in 2023 | USD 178.57 Billion |

| Market Size in 2024 | USD 215.57 Billion |

| Market Growth Rate | CAGR of 20.72% from 2024 to 2033 |

| Largest Market | Asia- Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High-Voltage Hybrid Vehicle Market Dynamics

Drivers

The high-voltage hybrid vehicle market is driven by several factors that contribute to its growth. One of the primary drivers is the increasing consumer awareness and demand for vehicles that offer superior fuel efficiency and lower environmental impact. Hybrid vehicles are perceived as a transitional technology towards fully electric vehicles, appealing to consumers who are concerned about range anxiety and charging infrastructure limitations associated with pure electric vehicles.

Additionally, government incentives and subsidies play a crucial role in promoting the adoption of high-voltage hybrid vehicles. Incentives such as tax credits, rebates, and access to preferential parking and charging facilities encourage consumers to choose hybrid vehicles over traditional gasoline-powered vehicles, thereby accelerating market growth.

Furthermore, advancements in hybrid vehicle technology, including improvements in battery performance, regenerative braking systems, and hybrid powertrain integration, have enhanced the overall efficiency and driving experience of hybrid vehicles. These technological advancements make hybrid vehicles more attractive to a broader range of consumers, driving market expansion.

Opportunities

The high-voltage hybrid vehicle market presents numerous opportunities for automakers, suppliers, and other stakeholders. One significant opportunity lies in expanding the product offerings and diversifying the hybrid vehicle portfolio to cater to different consumer preferences and market segments. Automakers can capitalize on growing consumer demand for crossover SUVs, sedans, and compact cars by introducing hybrid variants that offer a balance of performance, fuel efficiency, and affordability.

Moreover, partnerships and collaborations between automakers, battery manufacturers, and technology providers present opportunities for innovation and cost reduction in hybrid vehicle development. By leveraging synergies and expertise across different sectors, stakeholders can accelerate the pace of technological advancements and bring competitive hybrid models to market more efficiently.

Furthermore, the electrification of commercial fleets, including taxis, delivery vehicles, and ride-sharing platforms, presents a significant growth opportunity for high-voltage hybrid vehicles. Fleet operators are increasingly looking for cost-effective and environmentally sustainable transportation solutions, driving demand for hybrid and electric alternatives in urban mobility settings.

Challenges

Despite the promising growth prospects, the high-voltage hybrid vehicle market faces several challenges that could potentially hinder its expansion. One of the primary challenges is the higher upfront cost of hybrid vehicles compared to conventional gasoline-powered vehicles. While long-term fuel savings and operational efficiencies may offset initial costs, price sensitivity among consumers remains a barrier to widespread adoption.

Moreover, concerns over battery durability, reliability, and lifecycle management continue to be significant challenges for hybrid vehicle manufacturers. Although advancements in battery technology have improved energy density and performance, issues such as battery degradation over time and the environmental impact of battery disposal remain areas of concern.

Furthermore, the availability and accessibility of charging infrastructure for plug-in hybrid electric vehicles (PHEVs) and electric vehicles (EVs) are critical factors influencing consumer adoption and market growth. Limited charging stations, especially in rural and suburban areas, contribute to range anxiety and may deter potential buyers from choosing hybrid or electric vehicles as their primary mode of transportation.

Additionally, regulatory uncertainties and policy changes related to emissions standards, fuel economy regulations, and incentives for hybrid vehicles could impact market dynamics and investment decisions within the automotive industry. Automakers must navigate evolving regulatory landscapes and anticipate future regulatory requirements to maintain compliance and competitiveness in the hybrid vehicle market.

Read Also: Produced Water Treatment Market Size to Reach USD 17.38 Bn by 2033

High-Voltage Hybrid Vehicle Market Companies

- Toyota Motor Corporation

- Honda Motor Co., Ltd

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- Kia Corporation

- Volkswagen Group

- BMW Group

Recent Developments

- In March 2024, following the phase-out of the BMW i3, the BMW Group, the forerunner of electric mobility, added another fully electric vehicle to its lineup.

- In April 2024, Chinese automaker BYD may introduce an inexpensive hybrid plug-in sedan to take on the Toyota Corolla in South Africa, as well as its first electric bakkie for the worldwide market. Using the Companies and Intellectual Properties Commission (CIPC) database, My Broadband has discovered two trademark applications submitted by BYD Company Limited in January 2024 for the names under which these cars are anticipated to be sold.

Segment Covered in the Report

By Type

- Prosthetics & Orthodontics

- Endodontics

- Restoratives

- Others

By Application

- Hospital

- Clinic

- Emergency room

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/