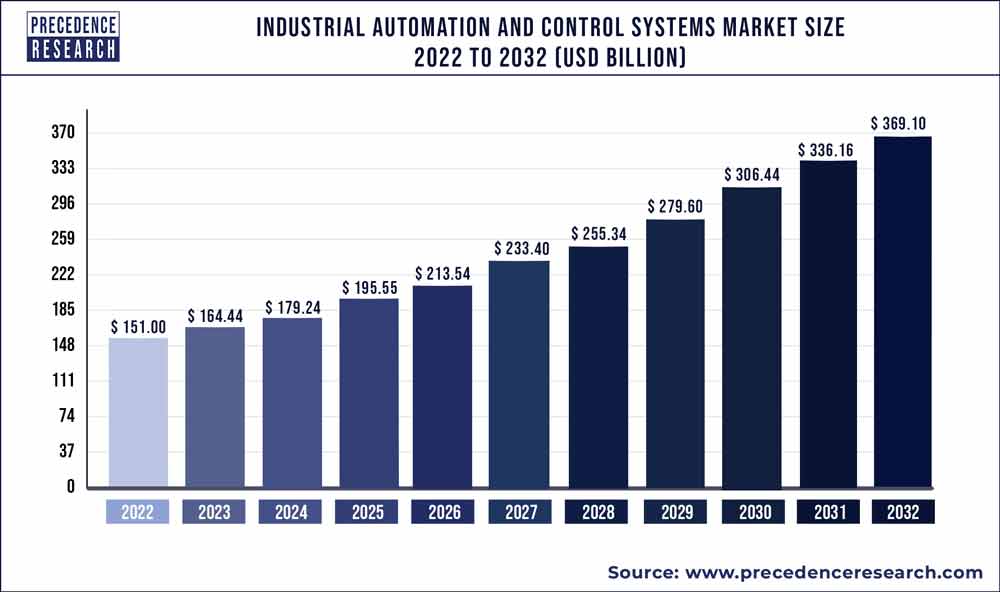

The industrial automation and control systems market recorded a notable revenue share in the market in 2021 and is set to be worth more than USD 347.9billion by the end of 2030. It is poised to grow at a healthy CAGR of 9.2% from 2021 to 2030.

The report contains 150+ pages with detailed analysis. The market report also covers the estimated market sizes and trends for different countries across major regions, globally.

The industrial automation and control systems refers to a group of people, hardware, and software that can affect or influence the safe, secure, and dependable running of an industrial process. Industrial automation is the use of control systems, such as computers or robots, and information technology to replace humans in various processes and machineries in an industry. In the context of industrialization, it is the second step beyond mechanization.

Crucial factors accountable for market growth are:

- Rapid shift of industries toward smart manufacturing.

- Investments in smart factory automation

- Increasing government spending on the automation system

- The innovation and technological advancement

- The increasing R&D expenditure of the market leaders

Download the Sample Pages of this Report for Better Understanding (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1344

Research Objective

the market revenue/volume with the help of widespread quantitative and qualitative insights, and forecasts of the market. This report presents breakdown of market into forthcoming and niche segments. Additionally, this research study gauges market revenue growth and its drift at global, regional, and country from 2017 to 2020. This research report evaluates industrial automation and control system market on a global and regional level. It offers thorough analysis of market status, growth and forecast of the global industrial automation and control system market for the period from 2017 to 2030. This research study offers historic data for years 2017 to 2020 along with a forecast from 2021 to 2030 based on value.

This report also provides detailed company profiles of the key market players. This research report also highlights the competitive landscape of the industrial automation and control system market and ranks noticeable companies as per their occurrence in diverse regions across globe and crucial developments initiated by them in the market space. This research study also tracks and evaluates competitive developments, such as collaborations, partnerships, and agreements, mergers and acquisitions; novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Scope of the Industrial Automation and Control Systems Market Report

| Report Highlights | Details |

| Market Size in 2030 | USD 347.9 Billion |

| Growth Rate | CAGR of 9.2% from 2021 to 2030 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe, North America |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Mentioned | Component, Control System, Vertical, Region |

Report Highlights

- Based on the component, the control valve segment is the most dominating in the industrial automation and control system market due to rapid growth in the technologies and it is expected to continue in the forecast period.

- The DCS is the major contributor in the industrial automation and control system market due to its advantages in the automation and control system.

- The manufacturing industry held the largest share in the industrial automation and control system market. Manufacturing industry trends are in the spotlight as the industry undergoes its most significant transformation in recent years.

Market Dynamics

Driver

Because of significant technological breakthroughs in robotics, the industrial sector has seen an increase in the incorporation of robotics engineering and technology into its production processes. Industrial robots are versatile manipulator machines that are autonomously controlled and reprogrammable. Welding, painting, ironing, assembling, pick and place, palletizing, product inspection, and testing are common uses for industrial robots, all of which are achieved with high endurance, speed, and precision. Industrial robots perform repeatable operations, reducing the need for human labor.

Furthermore, the Internet of Things (IoT) is a dominant trend, with industrial and consumer products being connected via the internet. According to the World Bank, the number of IoT-connected devices increased to 20.35 billion in 2017, up from 15.41 billion in 2015, and is predicted to reach 51.11 billion by 2023. HMIs are becoming more sophisticated in order to operate the growing number of connected devices. Furthermore, the emergence of Industry 4.0 and the Industrial Internet of Things (IIoT) has made this more accessible, since it has become easier to convert smartphones into a type of mobile HMI, and technologies like as smartwatches have made HMI wearable, boosting accessibility and convenience of use.

Restraint – Large investments

Automation necessitates significant capital expenditure because it entails the installation of hardware such as dexterous robots, sensory perception devices, and mobility wheels. This results in exorbitant start-up costs. However, as costs fall over time, automation becomes increasingly competitive with human labor.

Replacing human workers may not necessarily result in a reduction in an organization’s operational expenditures. A single collaborative robot system can range in price from USD 3,000 to $100,000. An industrial robotic system is significantly more expensive, with prices ranging from USD 15,000 to USD 150,000. The cost of industrial robots, combined with integration and peripheral costs, such as end effectors and vision systems, makes automation an expensive investment for SMEs, particularly those involved in low-volume production.

Opportunities – The increasing government investments and initiatives

The government is aiming for an investment of 12 billion USD 362 million in the first year, expanding toUSD 6 billion Baht over the next five years in Thailand. The development plan also aims to reduce the import of robotics and automation systems by USD 3.97 billion on an annual basis.Companies like Cairn, an Indian oil and gas plant has shown that through automation and digitization, they were able to keep up their production of 1.6 lakh barrels of oil every day, as against 1.8 lakh barrels with less than 1/3rd of their workforce due to the quarantine measures. These investments and initiatives taken by the government companies will lead to the spur the market growth of industrial automation and control system.

Indonesia issued two stimulus packages in response to the COVID-19 outbreak. The first bundle, worth $725 million, was introduced in February 2020, while the second package, worth $8 billion, was released in March 2020. The second stimulus package was introduced to protect the economy and small and medium-sized firms (SMEs), notably those in the manufacturing sector. To mitigate the negative impact of COVID-19 on businesses, the Singapore government will not raise the goods and services tax (GST), which will stay at 7%.

Read Also: Homeopathic Products Market Valuation To Surpass USD 19.7 Billion By 2030

Challenges – Skilled Manpower

The occupations will be mechanized are directly determined by the demand and supply of skilled and unskilled labor. Countries with higher wages, such as those in the service sector, may use automation earlier than countries with lower wages. India, being a growing country, continues to face a shortage of trained labor in the automation sector.

Regional Snapshots

The Asia Pacific is the most dominating in the industrial automation and control system market followed by North America and Europe. Asia Pacific is the market leader in industrial automation and control systems, followed by North America and Europe. According to CGTN, China’s industrial robot output increased by 29.2 percent year on year in June to 20,761 units, reaching a peak in the first half of 2020. According to National Bureau of Statistics data, the country manufactured 93,794 units of industrial robots over the past six months, up 10.3 percent from the same period last year, with growth accelerating from 16.9 percent in May.

The industrial sector in the United States continues to spend heavily in robots and automation. The United States’ automotive sector has the second highest robot density in the world, trailing only Japan. The industrial boom in North America continues unabated; assuming the global economy remains solid, robot shipments to Canada, Mexico, and the United States are expected to expand at a 5 to 10% yearly rate. Because of the high demand for industrial robots, the industrial automation and control system market will expand at a rapid pace.

Some of the major players in the industrial automation and control system market include:

- ABB

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens AG

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Yokogawa Electric Corporation

- General Electric

Segments Covered in the Report

By Component

- HMI

- Industrial Robots

- Control Valves

- Sensors

- Others

By Control System

- DCS

- PLC

- SCADA

- Others

By Vertical

- Aerospace & Défense

- Automotive

- Chemical

- Energy & Utilities

- Food & Beverage

- Healthcare

- Manufacturing

- Mining & Metal

- Oil & Gas

- Transportation

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Purchase Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1344

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com