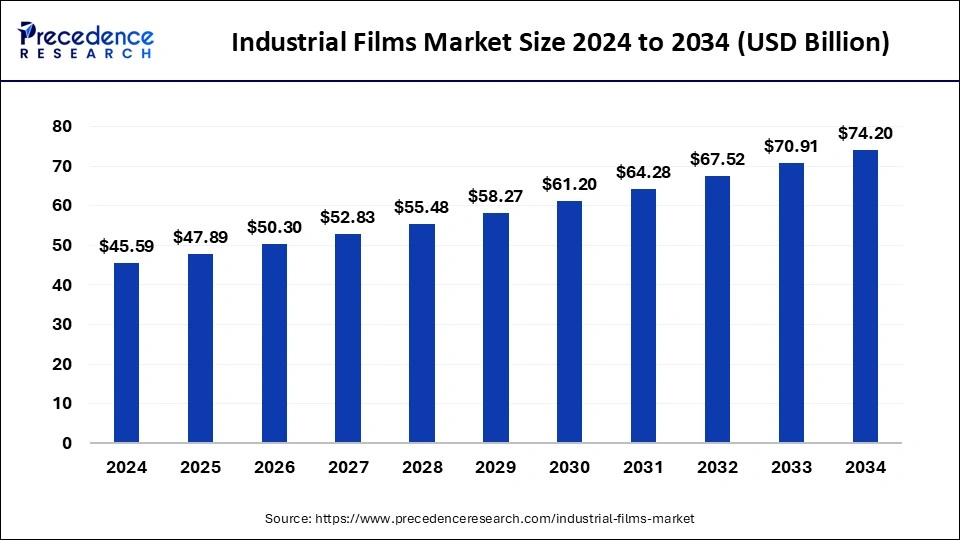

The global industrial films market size was valued at USD 43.41 billion in 2023 and is expected to reach around USD 70.91 billion by 2033. The market is expanding at a solid CAGR of 5.03% over the forecast period 2024 to 2033.

Key Points

- Asia Pacific held the dominant share of the industrial film market in 2023.

- North America is expected to expand at a rapid pace during the forecast period.

- By type, the linear low-density polyethylene (LLDPE) segment accounted for the dominating share of the market in 2023.

- By type, the low-density polyethylene (LDPE) segment is expected to witness significant growth in the market during the forecast period.

- By end user, the agriculture segment held the largest segment of the market in 2023.

- By end user, the industrial packaging segment is expected to grow significantly during the forecast period.

Industrial films are essential materials used in various industries for packaging, surface protection, agriculture, construction, and automotive applications. These films are typically made from plastic resins such as polyethylene, polypropylene, polyvinyl chloride, and polyester. The industrial films market encompasses a wide range of products tailored to meet specific industrial needs, including stretch films, shrink films, barrier films, and agricultural films, among others.

Get a Sample: https://www.precedenceresearch.com/sample/4438

Growth Factors

The industrial films market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing demand for flexible and lightweight packaging solutions across various industries. Industrial films offer superior properties such as high strength, durability, and barrier protection, making them ideal for packaging applications in food and beverage, pharmaceuticals, and consumer goods sectors.

Moreover, the rising adoption of industrial films in the agriculture sector for greenhouse covers, mulching, and silage storage is driving market growth. These films help improve crop yield, protect plants from pests and adverse weather conditions, and conserve water, thus contributing to sustainable agricultural practices.

Additionally, the construction industry is a major consumer of industrial films for applications such as moisture barriers, vapor barriers, and concrete curing. With the growing construction activities worldwide, especially in emerging economies, the demand for industrial films in this sector is expected to escalate further.

Region Insights

The industrial films market exhibits regional variations driven by factors such as economic development, industrialization, and regulatory policies. North America and Europe are mature markets with a strong presence of established players and stringent regulations regarding environmental sustainability and product quality. However, these regions continue to witness steady growth fueled by innovation in film technology and increasing demand from end-user industries.

In contrast, the Asia-Pacific region is emerging as a lucrative market for industrial films, driven by rapid industrialization, urbanization, and infrastructure development. Countries like China, India, and South Korea are experiencing robust demand for industrial films, particularly in packaging and agriculture applications. Moreover, favorable government initiatives and investments in manufacturing infrastructure are further bolstering market growth in this region.

Industrial Film Market Scope

| Report Coverage | Details |

| Industrial Film Market Size in 2023 | USD 43.41 Billion |

| Industrial Film Market Size in 2024 | USD 45.59 Billion |

| Industrial Film Market Size by 2033 | USD 70.91 Billion |

| Industrial Film Market Growth Rate | CAGR of 5.03% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial Films Market Dynamics

Drivers

Several drivers are propelling the growth of the industrial films market. Firstly, the expanding e-commerce industry is driving demand for high-performance packaging materials, including industrial films, to ensure product safety during storage, handling, and transportation. Additionally, the growing emphasis on sustainable packaging solutions is prompting manufacturers to adopt recyclable and biodegradable films, thereby driving market growth.

Furthermore, advancements in film manufacturing technologies, such as multi-layer extrusion and nano-coating, are enabling the production of films with enhanced properties such as oxygen barrier, UV resistance, and anti-static properties. These innovations are widening the application scope of industrial films across diverse industries, thereby fueling market expansion.

Opportunities

The industrial films market is ripe with opportunities for manufacturers, suppliers, and stakeholders. One significant opportunity lies in the development of bio-based and compostable films to address the growing demand for eco-friendly packaging solutions. Manufacturers can capitalize on this trend by investing in research and development to create sustainable film materials derived from renewable sources such as plant-based polymers and biodegradable additives.

Moreover, the integration of smart technologies such as RFID tags and QR codes into industrial films presents opportunities for enhanced product traceability, authentication, and anti-counterfeiting measures. These smart films can find applications in pharmaceutical packaging, food safety, and supply chain management, providing added value to customers and driving market growth.

Challenges

Despite the promising growth prospects, the industrial films market faces certain challenges that need to be addressed for sustained growth. One such challenge is the volatility in raw material prices, particularly petroleum-based resins, which significantly impact production costs and profit margins for manufacturers. Fluctuations in crude oil prices and supply chain disruptions can pose challenges in price forecasting and inventory management.

Furthermore, environmental concerns regarding plastic pollution and carbon footprint are prompting regulatory bodies and consumers to seek alternatives to traditional plastic films. Manufacturers in the industrial films market must invest in sustainable practices such as recycling, waste reduction, and the use of renewable energy to mitigate environmental impacts and meet regulatory requirements.

Read Also: Thoracic Surgery Devices Market Size to Reach USD 1,385.83 Mn by 2033

Industrial Films Market Companies

- Cosmo Films Ltd

- Dunmore

- Inteplast Group

- Jindal Poly Films

- Kolon Industries

- Berry Global Inc.

- Dupont Teijin Films

- Jindal Poly Films

- SKC Co. Ltd.

- Toray Industries Inc.

- Toyobo Co. Ltd.

- Unitika Ltd.

- Mitsui Chemicals Tohcello.Inc

- Polyplex

- Raven Industries Inc.

- Saint-Gobain Performance Plastics

- Sigma Plastics Group

- Solvay

- Toyobo Co. LTD

- Treofan Group

- Trioplast Industrier AB

Recent Developments

- In April 2022, Raven Engineered Films announced its acquisition by Industrial Opportunity Partners, enabling the company to advance technological innovations in Sioux Falls polymer film and sheeting solutions.

- In February 2024, Dhunseri Ventures opened a new polyester film manufacturing plant in eastern India, with a capacity to produce 52,000 tonnes per annum. The plant, which involved an investment of Rs 570 crores, aims to meet the increasing demands of the packaging and industrial sectors.

- In April 2023, Berry Global Group Inc. initiated a significant expansion of its key stretch film manufacturing facility in Lewisburg, Tennessee. This expansion, encompassing 25,000 square feet, is strategically aimed at accommodating the surging demand for Berry’s top-quality sustainable stretch films.

- In December 2022, Toray Industries Inc., a manufacturer of advanced materials, films, resins, chemicals, and carbon fibers, announced its development of eco-friendly PET (polyethylene terephthalate) sheets providing excellent applicability and adhesion for the water-based solvent-free coatings while eliminating the solvent derived emission of carbon dioxide.

Segments Covered in the Report

By Type

- Linear Low-density Polyethylene (LLDPE)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyamide

- Others

By End-user

- Agriculture

- Industrial Packaging

- Building & Construction

- Healthcare

- Transportation

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/