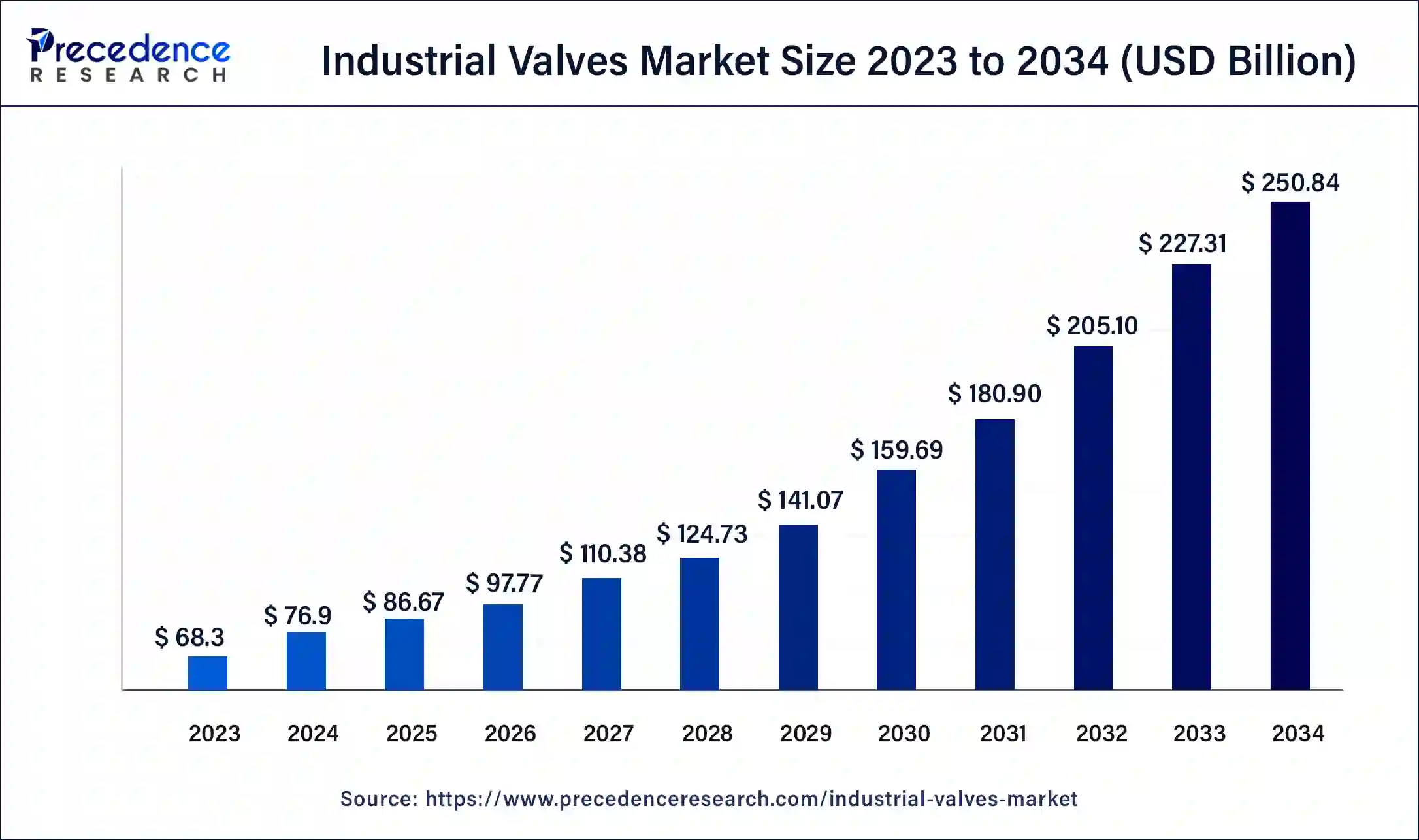

The global industrial valves market was valued at USD 76.9 billion in 2023 and is projected to reach USD 250.84 billion by 2034, growing at a 12.6% CAGR.

Industrial Valves Market Key Takeaways

- Asia Pacific dominated the industrial valves market in 2023, holding the largest market share of 36%.

- Steel industrial valves led the market by material type, securing the highest market share in 2023.

- Oil & gas remained the top application segment, contributing the largest revenue share in 2023.

- Water & wastewater applications are projected to grow at a CAGR of 6% during the forecast period.

The industrial valves market plays a crucial role in regulating the flow of liquids and gases across various industries, including oil & gas, water & wastewater, chemicals, power generation, and manufacturing. In 2023, the market was valued at USD 76.9 billion and is projected to reach USD 250.84 billion by 2034, growing at a CAGR of 12.6%. Asia Pacific emerged as the leading region, holding a 36% market share.

Among material types, steel industrial valves dominated the market, while the oil & gas segment accounted for the highest revenue. The water & wastewater segment is expected to witness significant growth, with a projected CAGR of 6% during the forecast period. The market’s expansion is driven by increasing demand for energy, water treatment solutions, and advancements in valve technology, ensuring efficiency and reliability across industrial applications.

Sample Link: https://www.precedenceresearch.com/sample/1076

Key Drivers

Opportunities

- Rising demand for smart and automated valves with IoT integration for enhanced efficiency and monitoring.

- Expansion of the oil & gas and power generation sectors, increasing the need for advanced valve solutions.

- Growing focus on water treatment and wastewater management, driving demand for industrial valves.

- Increasing investments in infrastructure development and industrial automation across emerging economies.

- Advancements in materials and manufacturing technologies, leading to more durable and high-performance valves.

Challenges

- High initial costs and maintenance expenses associated with advanced industrial valves.

- Stringent regulatory and environmental standards, requiring compliance and frequent upgrades.

- Supply chain disruptions and fluctuations in raw material prices affect production costs.

- Competition from local and unorganized players, impacts pricing and market share.

- Complex installation and operational challenges, requiring skilled labor and technical expertise.

Regional Insights

Asia Pacific dominates the industrial valves market, holding the largest share due to rapid industrialization, urbanization, and increasing investments in infrastructure, oil & gas, and water treatment projects. Countries like China and India drive market growth with expanding manufacturing and energy sectors. North America follows closely, supported by strong demand from the oil & gas industry, technological advancements, and stringent regulatory policies in water treatment and industrial automation.

Europe remains a key player, with growing adoption of smart valve technologies and a strong focus on sustainability and energy-efficient solutions, particularly in Germany, the UK, and France. The Middle East & Africa region is witnessing steady growth, driven by large-scale oil & gas exploration and water desalination projects. Meanwhile, Latin America is experiencing moderate expansion, supported by increasing industrial activities and government initiatives in infrastructure and energy development.

Don’t Miss Out: In-vehicle Infotainment Market

Market Key Players

- Metso Corporation

- Schlumberger Limited

- Flowserve Corporation

- Emerson Electric Co.

- IMI plc

- Forbes Marshall

- The Weir Group plc.

Recent News

In February 2025, Emerson Electric reported a 4% increase in sales within its final control unit, which includes valves, regulators, and actuators. This growth is attributed to heightened investments in energy and power sectors. The company achieved an adjusted profit of $1.38 per share for the quarter ending December 31, surpassing analysts’ expectations. Despite a 1% rise in quarterly revenue to $4.18 billion, it fell short of projections due to a slowdown in demand for automation technology. Emerson reaffirmed its forecast for adjusted profit per share to be in the range of $5.85 to $6.05 for 2025.

Market Segmentation

By Valve

- Butterfly Valves

- Ball Valves

- Globe Valves

- Gate Valves

- Check Valves

- Plug Valves

- Diaphragm Valves

By Material

- Cast Iron

- Alloy-Based

- Steel

- Others

By Application

- Water & Wastewater

- Oil & Power

- Food & Beverages

- Chemical

- Others